The amount of profit from trading digital assets can be dozens of times higher than the amount of the initial investment. Investors buy penningen at the pre-sale stage of the project. If the product is successfully launched and listing begins, coin holders can make tokens in cryptocurrency. There are restrictions, when not all purchased tokens are realistically sold at once at the moment of the start of public trading. Some projects set a phased unfreezing of funds of the first depositors to reduce the pressure on the exchange rate.

What does it mean to “make ics” in cryptocurrency

High fluctuations in quotations and rapid growth of asset prices have led to the emergence of specific terminology for measuring profits from trading operations. When the increase in an investment portfolio over a day or a few days began to amount to hundreds of percent, such a colloquial concept appeared.

Ix in cryptocurrency is an indicator that shows how many times the investment in the asset has grown. For example, making x10 means getting a tenfold return to the initial investment.

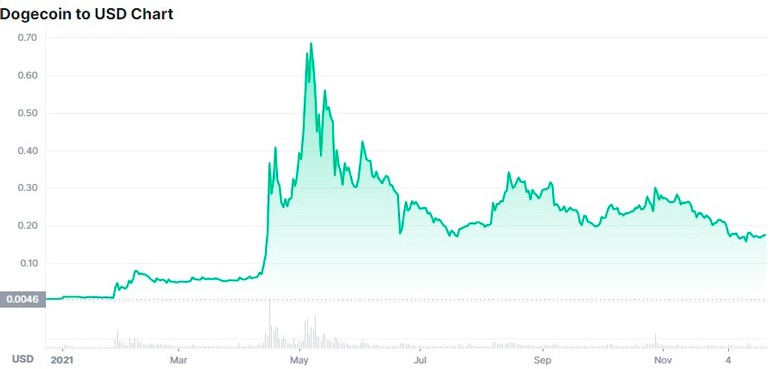

This also applies to measuring the price performance of a cryptocurrency, which shows how many times the value of a token has increased since the start of trading or other reporting period. For example, the Dogecoin meme coin has made a x182 turnover between January and May 2021, going from $0.004 to $0.73.

Pros and cons of tokens for investing

The decline of the ICO era has not destroyed the initial public offering market, with about $450 million raised through pre-sale in 2021 alone. After many fraudulent projects, new tools have emerged to protect the interests of investors through the placement on the exchange (IEO).

5020 $

bonus voor nieuwe gebruikers!

ByBit biedt handige en veilige voorwaarden voor de handel in cryptocurrency, lage commissies, een hoog liquiditeitsniveau en moderne tools voor marktanalyse. Het ondersteunt spot en leveraged trading en helpt beginners en professionele handelaren met een intuïtieve interface en tutorials.

Verdien een bonus van 100 $

voor nieuwe gebruikers!

De grootste cryptobeurs waar je snel en veilig je reis in de wereld van cryptocurrencies kunt beginnen. Het platform biedt honderden populaire activa, lage commissies en geavanceerde tools voor handelen en beleggen. Eenvoudige registratie, hoge transactiesnelheid en betrouwbare bescherming van fondsen maken Binance een geweldige keuze voor handelaren van elk niveau!

| Voordelen | Nadelen |

|---|---|

| Absence of fraud. Before listing, the trading platform conducts a detailed audit of the project. | High risk. About half of the companies that raise money do not have a finished product or its prototype. There are no guarantees that developers will succeed in bringing ideas to life. |

| Simple purchase procedure. No different from a standard cryptocurrency exchange. | Low confidentiality. To participate in the pre-sale, you need to be a registered user on the exchange, verify the account and fulfill special conditions (keep a minimum amount on the account or make a certain volume of trades). |

| Big profits. A successful project can bring iks at the level of x10-x30 after the listing starts. | Limited supply. There are maximum purchase limits, usually up to several thousand dollars for one participant. |

ICO

This form of investing became popular after the success of Ethereum in 2014. Then the development team managed to raise more than $18 million. 6 years later, each invested dollar brought $14 thousand in profit. The ICO boom was observed in 2017, but 3 quarters of the projects fell in price after listing against bitcoin by more than 90%, and only 11 companies brought investors a profit of more than 1000%. The negative result is due to the lack of pre-screening of the product and the development team, which was exploited by scammers, creating a fictitious image of a cryptocurrency project without the intention of its final realization.

IEO

The appearance in 2019 of a new method of primary placement of tokens through the exchange is designed to protect investors from scam, increase the attractiveness and convenience of investments. The trading platform undertakes to provide a convenient and transparent system for buying coins, as well as to verify the technical documentation of the project and the development team. The distribution of tokens takes place on a competitive basis, when investors apply for participation in the pre-sale and in case of victory get into the white list.

To ensure equality among buyers, exchanges introduce mandatory identity verification (KYC) and prohibit the creation of multi-accounts.

IDO

This is a funding method where a decentralized exchange (DEX) acts as an intermediary. With the help of liquidity pools, traders can quickly transact to buy an asset. The IDO mechanism lacks the disadvantages typical of IEO:

- Dependence on centralized exchanges.

- High listing costs.

- Non-transparent criteria for project selection.

With this method of pre-sale, the entire advertising campaign falls on the developers’ shoulders. They themselves create promotion channels and attract attention to their product. However, this often becomes a stumbling block for a successful launch with IDO.

How to choose a project for investment

A few important factors to analyze before buying a new cryptocurrency:

- Community size. A large number of active participants indicates high attention to the product.

- White paper and Road Map. Studying the company’s development plan and technical documentation helps to understand the growth prospect of the token once the listing starts.

- Scalability. The ability to handle a large influx of users without delays increases the appeal of the product.

Flipping Strategy

The main goal of any cryptocurrency trader is to buy it at the lowest price, sell it at the highest price and as soon as possible. High volatility in listing and low liquidity do not always allow to realize coins at the best rate. To secure investments, there is a scheme of phased sale of tokens – flipping. When certain price levels are reached, the trader reduces the volume of digital assets owned by him. For example, at x2 – 25% of the portfolio, x4 – 50%, x10 – the remaining 25%. This allows to reduce the risk, when the already fixed profit covers possible future losses. Each participant determines how many tokens to sell and at what rate.

It is advantageous to sell in installments, because on a low-liquid market an order of a small volume will be executed faster.

Is it worth investing directly in coins

In addition to directly holding cryptocurrency in order to resell it at a higher price, there are other ways to profit in the market of digital assets:

- Mijnbouw. Mining new blocks and confirming transactions is suitable for coins that use the Proof-of-Work (PoW) consensus method. As of 2021 has a very high threshold of entry, amounting to thousands of dollars to buy equipment.

- Inzetten. Freezing a certain amount of cryptocurrency in an account to qualify to be a validator in networks with the Proof-of-Stake algorithm. As payment, such a node takes commissions for including the transfer in the data chain.

- Uitlenen. Lending to large trading platforms to maintain their liquidity for certain currency pairs.

- Exchange trading. A highly profitable but risky activity that requires a highly skilled user.

Depending on the chosen strategy and the amount of investment, the investor chooses between conservative ways of earning money (mining, staking, lending) with an expected annual profit of 10-20% and high-risk investments. These include buying tokens during the initial offering and trading, which can bring hundreds of percent if the circumstances are right.

Conclusies

There is now a lot of competition to get on the white list in the initial public offering market. Some investors use many accounts, registering them with relatives, friends and acquaintances to increase the probability of getting a place in the tokensale. A project that is launched on a centralized exchange has a better chance of increasing in value in the first minutes of listing. This is influenced by promotion from the trading platform, where advertising becomes available to all registered users.

However, it is not only possible to get Xs in cryptocurrency on the listing of new tokens. Some projects a long time after the start of sales can become popular, their price grows many times. One of the famous cases occurred with SHIBA INU, when in 6 months from the launch of the coin its value increased almost 6000 times.

This happens quite rarely, new tokens are much more likely to make X when listed, but there are still highly undervalued projects circulating on the market.

Veelgestelde vragen

❔ What is the purpose of the buy limit for pre-listing?

This ensures equal opportunities among participants at pre-sale and cuts off price manipulation when a large number of tokens are concentrated in one hand.

📊 What parameters should I pay attention to when choosing a project?

The size of the community indicates the interest of users in the future product. And studying the whitelist will allow you to understand what technologies are used by the development team and assess how much demand there is for the tasks to be solved.

❌ Does participation in a tokensale on centralized exchanges guarantee success?

Despite a preliminary audit by the trading platform, it is impossible to fully assess the potential of the final product. IEO reduces the risk of fraud but cannot guarantee future growth.

❗ Why do developers conduct tokensales?

The project receives money to launch the product from a large number of participants, while not being influenced by investors on the company’s development path, as is the case with the venture funding model.

✅ What to choose between ICO, IEO and IDO?

Placement through centralized exchanges offers high investor protection. But ICOs and IDOs can be profitable when invested in a promising startup.

Een fout in de tekst? Markeer het met je muis en druk op Ctrl + Ga naar

Auteur: Saifedean Ammous, een expert in cryptocurrency-economie.