In April 2023, the Russian State Duma passed a law on the introduction of a third form of national currency in the country. The project had been under development for several years, and as early as May, real transactions with the digital ruble were planned. So far in a narrow circle – for a small focus group. Testing will last until the end of 2023. The integration of the digital ruble into the economy is a large-scale project, so the exact timing is not reported. However, it is known that after the completion of the tests, budget payments will be transferred to tokenized money. In the article we will tell you about CDBC technology. We will explain the difference between the digital ruble and cryptocurrency. Like bitcoin, it is based on blockchain technology, but the rules of use are set by the Central Bank.

Explanation of the digital ruble

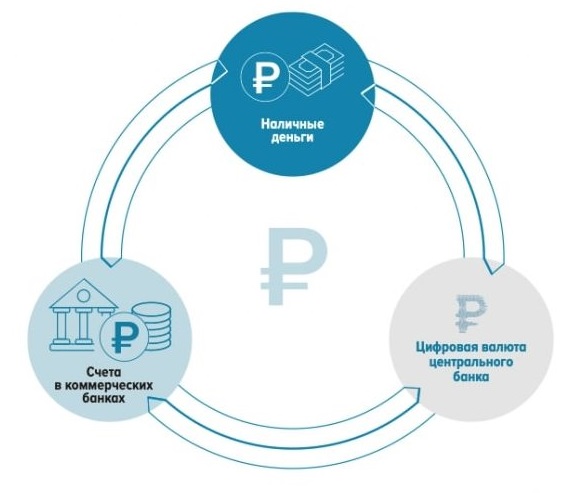

The state is concerned about the growing popularity of cryptocurrencies. Every day, Russian users make transactions worth more than 10.9 billion RUB. The blockchain technology underlying the coins is definitely useful for businesses, citizens and the state as a whole. Therefore, starting from 2020, the Bank of Russia is developing an additional form of national monetary unit – the digital ruble. It will exist in parallel with cash and non-cash versions.

The Central Bank said that it will not force the population to use the digital ruble. Each citizen will be able to choose in what form to receive a salary and pay for purchases.

Tokenized RUB has the following features:

- To access the platform, you need to be a client of one of the partner banks and have a smartphone with an application installed on the phone.

- Individuals and companies will be able to use digital rubles.

- Ordinary users will transfer money for free, companies – for a small commission (no higher than 0.6-0.9%).

- It is possible to pay for purchases with a QR code.

- No interest is charged for storing the digital ruble.

- Loans will be issued as before – in cash or non-cash money. Citizens will be able to convert them independently in the application of the bank. The official exchange rate is 1 to 1.

When will appear in Russia

After the launch of the development in 2020, top banks joined the project, which created and tested compatible software. In April 2023, the law on digital currency was ratified and amendments were made to the Civil Code of the Russian Federation. The legitimate status allowed to start testing the project in real conditions.

Under the guidance of the Central Bank, a focus group of enterprising citizens – clients of partner banks – was created. The participants check more than 40 different transactions with CBDC. For widespread use, it is necessary to develop the most convenient interface and eliminate vulnerabilities.

5020 $

bonus voor nieuwe gebruikers!

ByBit biedt handige en veilige voorwaarden voor de handel in cryptocurrency, lage commissies, een hoog liquiditeitsniveau en moderne tools voor marktanalyse. Het ondersteunt spot en leveraged trading en helpt beginners en professionele handelaren met een intuïtieve interface en tutorials.

Verdien een bonus van 100 $

voor nieuwe gebruikers!

De grootste cryptobeurs waar je snel en veilig je reis in de wereld van cryptocurrencies kunt beginnen. Het platform biedt honderden populaire activa, lage commissies en geavanceerde tools voor handelen en beleggen. Eenvoudige registratie, hoge transactiesnelheid en betrouwbare bescherming van fondsen maken Binance een geweldige keuze voor handelaren van elk niveau!

When will there be mass implementation

The government has instructed the Bank of Russia to create a secure platform with correct display of user balances. Since the issuance of tokenized RUBs is centralized, a successful hacker attack can cause significant damage. Therefore, the product must be finalized and tested for mass implementation.

Also, banks fear that a quick launch of the digital rouble will create a liquidity crisis. Therefore, the project will be implemented in stages. According to preliminary forecasts, mass implementation will take 5-10 years.

What is the difference between the digital ruble and cryptocurrency?

From a technical point of view, the new format of cryptoassets is identical to bitcoin, ether and other coins. The basis is blockchain technology – a chain of blocks containing all transaction information (or other data). Unlike other bases, records in a decentralized chain cannot be deleted or altered.

In cryptocurrencies, a copy of the distributed ledger is kept by all users involved in maintaining the security of the network. For example, Efirium has more than 500 thousand nodes. The rules of issuance are strictly prescribed in the code, it is impossible to change them unilaterally. This would require a vote involving all holders of the asset.

Coins are a digital record in the blockchain of the balance on the balance sheet. It requires a password to access it, which is only stored by the user. No one can block a non-custodial cryptocurrency wallet.

The digital ruble differs from cryptocurrency in that it is decentralized. It is a virtual monetary unit managed by the state. Only the Bank of Russia has access to the chain. He can make any changes to the code, if he considers them appropriate:

- Additionally issue and burn tokens.

- Change the commission.

- Block the coins at the address.

- Establish targeted spending of funds.

Why digital money is needed

Tokenized RUB is a more convenient, secure form of money. Each unit can be tagged, so theft is easy to track. All transactions are recorded in a single database, thanks to cryptographic protection they cannot be faked.

The platform is being developed by the best specialists from scratch, using the latest cybersecurity technologies. The project is controlled by the Bank of Russia.

The introduction of a digital settlement unit is useful for citizens, companies and the state:

- Instant and cheap transfers. Users will be able to save substantial sums on bank commissions. On the scale of the state, this is billions of rubles per year. With similar platforms in other countries, direct international payments can be made without the need for the SWIFT system.

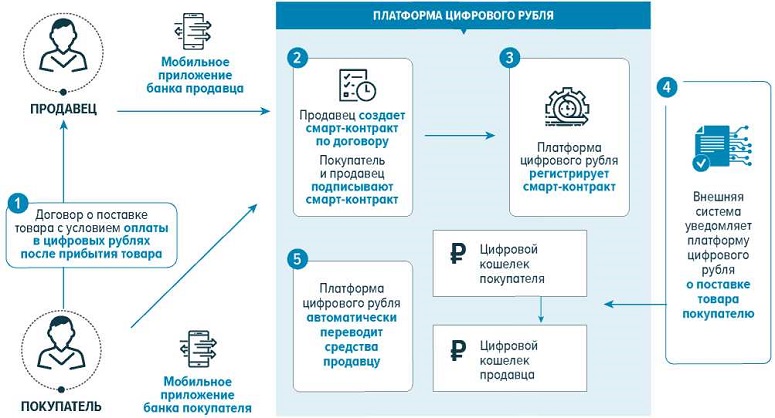

- Secure transactions. Businesses can use smart contracts. Money from the transaction is blocked until the terms are met and then transferred to the recipient. If the arrangements are broken – the funds are returned to the seller’s account.

- The single account is under the control of the Bank of Russia. Users do not depend on commercial organizations. Money is safe as long as the Central Bank is functioning.

- Increased competitiveness. Creating similar projects in other countries is a matter of time. Own digital settlement platform is a prerequisite for working in the international market.

How to use

The main task of the CB is to create a convenient product for which there will be a high demand. Therefore, the use of CBDC practically does not differ from the usual operations in the bank’s application.

The algorithm is as follows:

- The user (a client of a financial institution connected to the program) installs a mobile application. Now the service is not available on PCs.

- Goes to the Central Bank platform and opens a wallet. All personal data are already in the system, they do not need to be entered again. To enter, you will need to enter a login and password. They need to be kept safe. In case of loss, you will have to visit the offline office of the bank to reset the password.

- Return to the mobile application of the bank and send RUB to the virtual account. There is no commission for the operation.

- Goes to the Central Bank platform. You can send money to another user or pay for purchases in online stores. To do this, you need to scan a QR code.

Which countries are issuing digital currencies

Governments can no longer ignore the growing popularity of crypto coins. The creation of their own digital asset under the CBDC will allow states to maintain control over the circulation of money. In addition, the introduction of CBDC will give an impetus to the development of innovative products and economic development.

In China, the digital yuan has been tested since 2020. In 2023, the U.S. Federal Reserve published a report on the advantages of a new type of national money. According to the IMF, at least 100 countries are developing similar projects. However, most of them are still far from mass implementation.

State-controlled virtual money has been launched in the Bahamas, Nigeria, Jamaica and the Eastern Caribbean.

Difference between digital ruble and cashless money

Ordinary users will not notice any differences in the use of these two types of national currency. To make the transition as easy as possible for the population, the usual applications of banks will be used to transfer digital rubles. However, there are some differences. More details – in the table.

| Kenmerken | Digital ruble | Cashless money |

|---|---|---|

| Executed instantly, free of charge for individuals. Legal entities are charged a small set commission. | Some transactions are free of charge (intra-bank transfers, SBP). In other cases the commission is 1-5%. Most often the operation is performed instantly, but some payments are processed up to 5 working days. | |

| Money is kept by the Central Bank, so they are not affected by the liquidation of institutions. You can enter the Central Bank platform using your login and password in the mobile application of another bank. | The Central Bank initiates bankruptcy proceedings of the organization, individuals are returned no more than 1.4 million RUB, legal entities – after the sale of the company’s property (third turn). | |

| Data on all clients are stored in a single database and are protected by the law on banking secrecy. Disclosure is possible at the request of law enforcers. | The history is in the registry of the financial institution. These structures send data on open accounts to a single database. Statements are sometimes not provided even on official requests. | |

| You can customize the purchase of specific categories of goods | Can be used in any retail outlets that accept non-cash payments | |

| You need a modern smartphone. You can switch to the Central Bank platform in any banking application. Only the account holder can transfer money. | You can use Internet Bank in a smartphone application, transfer money in offline offices. In the latter case, an increased commission will be taken (payment for the operator’s work). |

Pros and cons of using the digital ruble

The integration of an additional type of national money modernizes today’s financial system. Experts are concerned that under the new device, commercial structures may disappear. To prevent this, the Central Bank does not add an investment function to CBDC.

Users can store tokenized RUB, but to receive income they need to open a deposit in a bank.

This is another difference between digital RUB and cryptocurrency. After mass integration of CBDC, retailers and the government will be able to save billions of RUB per year on commissions. This will tangibly reduce the profits of financial institutions. In the table you can evaluate the advantages and disadvantages of CBDC for business and population.

| Voordelen | Minpunten |

|---|---|

Veelgestelde vragen

🔔 Where will digital currency be traded?

Users will not be able to replenish their wallet on official exchanges (MICEX, SPBB). The exchange will only take place in partner banking apps.

📌 Can I refuse to use additional currency?

Allowances and salaries to budgetary employees will be paid to e-wallets. However, citizens will be able to instantly transfer funds to bank accounts.

📢 What are the requirements for a user to create a wallet?

Customers of partner banks with Russian residency will be able to open accounts. Credit potential and availability of income do not play a role.

✨ Can I earn on the CBDC exchange rate difference?

Directly – no. Banking applications will transfer RUB into other forms without commission. However, private exchangers will be able to set their own rates.

⚡ How to withdraw cash from a virtual wallet?

You need to exchange digital rubles for non-cash money. RUB can be withdrawn using an ATM.

Staat er een fout in de tekst? Markeer het met je muis en druk op Ctrl + Ga naar

Auteur: Saifedean Ammous, een expert in cryptocurrency-economie.