A few years ago, trading in penningen and coins started on the global financial market. At first, many people did not believe that new assets could bring profit. But cryptocurrencies rose significantly in price and began to be used as a tool for earning money. Investors and traders are actively interested in bitcoin and altcoins, shifting the focus of attention from stock platforms to electronic ones. Structurally, the cryptocurrency exchange is similar to the usual commodity and currency organizations. But there are several differences between classic and digital platforms.

Definition of a cryptocurrency exchange

Digital coins can be stored on electronic wallets, exchanged and sold to other users. Cryptocurrency is traded on exchanges. These are multi-functional systems where fiat money is converted into digital money. Tokens and koins can also be exchanged between each other. Buying coins is considered the second way to obtain them after mijnbouw.

Along with trading tools, exchanges offer a large number of options for financial analysis and risk assessment of investing in assets.

Cryptocurrency market

The main advantage of exchanges over financial brokers is the ability to buy assets not only for fiat money, but also to exchange one token for another at the current exchange rate. This is called a trading pair. For example, bitcoins can be directly converted to Ethereum. This approach allows traders to monitor the market situation and earn on promising digital projects.

History of the emergence of exchanges

Bitcoin Market is the first cryptocurrency marketplace, which was founded a year after the creation of Bitcoin. Since the project was experimental, its functionality allowed only to sell or purchase an asset. In June 2010, American programmer Jed McCaleb opened a technologically advanced exchange – Mt.Gox.

5020 $

bonus voor nieuwe gebruikers!

ByBit biedt handige en veilige voorwaarden voor de handel in cryptocurrency, lage commissies, een hoog liquiditeitsniveau en moderne tools voor marktanalyse. Het ondersteunt spot en leveraged trading en helpt beginners en professionele handelaren met een intuïtieve interface en tutorials.

Verdien een bonus van 100 $

voor nieuwe gebruikers!

De grootste cryptobeurs waar je snel en veilig je reis in de wereld van cryptocurrencies kunt beginnen. Het platform biedt honderden populaire activa, lage commissies en geavanceerde tools voor handelen en beleggen. Eenvoudige registratie, hoge transactiesnelheid en betrouwbare bescherming van fondsen maken Binance een geweldige keuze voor handelaren van elk niveau!

The cryptocurrency continued to gain momentum and attracted investors. Every day new clients came to Mt.Gox, who were ready to buy electronic assets. On the first day of trading, the platform’s total turnover amounted to 20 BTC. At that time, the main cryptocurrency was worth less than $1. The site grew, trading volumes increased. A year after opening, the Mt.Gox crypto exchange reached a turnover of more than 30 thousand BTC.

McCaleb left the project in the spring of 2011, changing activities. The platform went to Mark Karpeles. In 2014, Mt.Gox went bankrupt, and this collapse was the largest in the short history of bitcoin.

Differences from a currency exchange

Digital coin trading follows the principles used in traditional financial transactions. But there are differences:

- Cryptocurrency is characterized by high volatility. For traders, large rate fluctuations are an opportunity to earn money by applying the tools of technical and fundamental analysis.

- The price of electronic currency is formed by supply and demand, while traditional markets use a combination of factors (forecasts, financial statements, statistical indicators of companies, news background and others).

- Due to high volatility, investment portfolios of crypto coins cannot be insured, as operators simply do not have enough funds to fully cover depositors’ losses. In currency markets, risk insurance is practiced frequently, and it is even considered that this approach is beneficial to both operators and users who resort to their services.

Cryptocurrency exchanges work without breaks and weekends, which allows you to buy and sell coins without being tied to a time zone or personal schedule. But you need to know when the bulk of traders and investors are activated, as volatility increases during periods of intensive trading.

Principle of operation and peculiarities

Exchange platforms are organized almost identically. They work according to a common algorithm:

- Registration.

- Replenishment of the account with fiat money or cryptocurrency.

- Making an order to buy or sell an asset.

- Withdrawing fiat to bank accounts or electronic systems, sending digital coins to cryptocurrency wallets.

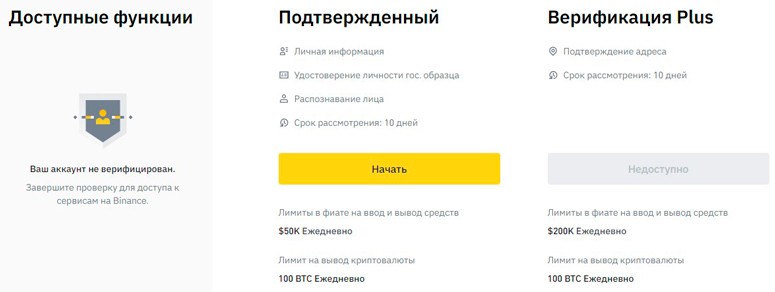

To increase the limit of available operations, traders are offered to pass verification and connect two-factor account authentication. Authorized users can customize the interface and change the chart view.

Commissions and limits

Traders earn from trading cryptocurrencies, and exchanges receive a percentage of transactions. The size of the commission depends on the amount of transactions and their number:

- If the client deposits fiat into the account, the service will take a small percentage. And replenishment of the balance with cryptocurrency is usually not subject to commission.

- The withdrawal fee is up to 10% for fiat, digital coins are charged less – on average about 1%.

- The fee for a trading operation is provided when a trader opens a new order to buy or sell an asset. The average commission per transaction is 0.1-0.2%.

- Currency conversion is also paid, the percentage is determined by each exchange individually.

On some services, commissions are not applied or are minimized. Such sites should be treated with caution. Exchanges cannot exist without interest payments from traders. At the expense of commissions, they pay money to marketers, developers, financial department and other employees.

Regulated companies limit the maximum deposit taking into account the current legislation of the country in which they are registered. There are also limits on the input and transfer of assets, storage within the exchange and some others. Verification allows you to expand the ranges.

Rassen

In 2024, crypto traders have a wide range of platforms to trade virtual currency. Some exchanges cover a wide audience, others focus on a specific market segment, and still others have only certain instruments available.

Decentralized and centralized

In 2021, trading services that store customer data in a distributed registry are popular. They use their servers only to receive and process orders for actions with assets. Access keys to tokens remain with clients. A decentralized exchange for cryptocurrency trading does not control the deposit of transaction participants. This protocol only automatically collects and processes orders.

| Uitwisseling | Trading volume in 24 hours in October 2021 ($) | Market Share (%) | Number of trading pairs in October 2021 (pcs.) |

|---|---|---|---|

| dYdX | 28.7 bln | 30,3 | 13 |

| PancakeSwap v2 | 1.53 billion | 16,1 | 33 |

| Uniswap v3 | 1.16 billion | 12,2 | 638 |

| SushiSwap | 550 million | 5,8 | 391 |

| 1inch Liquidity Protocol | 513 million | 5,4 | 26 |

Centralized exchanges are managed by companies or a group of individuals. These platforms generate revenue from transaction fees and in return offer tools and analytics for trading, security and transparency of transactions.

Regulated and unregulated

States are trying to control the growing market of digital currencies by adopting laws and rules for crypto exchanges. To this end, restrictions are imposed on deposits, withdrawals and account balance of coins.

Service requirements vary from country to country, but most jurisdictions have 2 important procedures in place:

- KYC (Know Your Customer). To verify the personal data of traders, exchanges ask for identity documents. Usually these are passport, receipts with home address, utility bills, insurance policy and others.

- AML (Anti-Money Laundry). These are the regulations and laws that guide the service in dealing with clients. Crypto platforms verify the source of the trader’s income.

To stay on the market, regulated exchanges are obliged to provide information about users when requested by the authorities.

Such rules are not to the liking of all traders. Many do not want the regulator to have access to personal data. However, cooperation with the authorities guarantees the stable operation of the site and the safety of visitors’ money.

As cryptocurrencies develop, control methods are improving. There are fewer unregulated platforms, and those that work have low demand or are located in countries that do not yet have the relevant laws.

For spot and derivatives trading

Buying and selling cryptocurrency on exchanges can be done in different ways. The most common is spot trading. These are transactions that involve the instantaneous purchase or sale of a coin. Almost every cryptocurrency exchange provides tools for spot trading. The rate of tokens and coins is also calculated based on transactions with immediate delivery of assets.

In spot transactions, you can quickly earn money if you observe risk management. The main danger is to go into a big disadvantage by making a mistake in the forecast.

Derivative is a derivative instrument. Its price is affected by the underlying cryptocurrency. The transaction is accompanied by a contract that regulates the actions carried out with the asset in the future, as well as setting the rate at which tokens and coins are purchased.

Several types of derivatives are used on cryptocurrency exchanges:

- Opties – provide privileged terms to the buyer. It is possible to get the asset at a predetermined price or to refuse the transaction by paying a small fee.

- Futures – obliges the parties to conduct an exchange in the future at a value fixed in the contract.

- Swaps – allow participants to buy assets to reduce the risks of other transactions.

Users of crypto exchanges can enter into hundreds of different contracts – for example, agree on actions when the BTC exchange rate changes. If the price drops, one will pay the other, and vice versa.

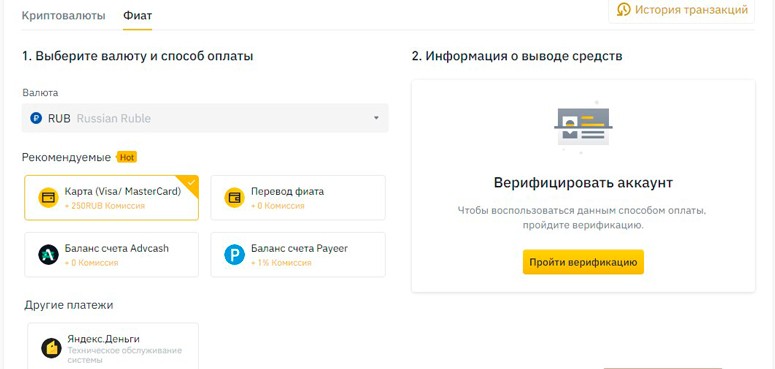

With or without fiat

Clients of large exchanges (Binance, CEX.IO) can deposit rubles, dollars and other traditional currencies, as well as tokens. There are platforms that do not accept fiat. Users have to convert national currency units into bitcoins, paying additional commissions.

On many cryptocurrency exchanges, there is no direct pairing of Bitcoin with the dollar. To trade on the spot market, you first need to convert money into USDT stablecoin.

With KYC or without KYC

The legislation of most states provides for verification of clients of crypto exchanges. The identity verification (KYC) procedure guarantees the company that it works with a real person who is not a member of a terrorist organization and does not launder funds. The method also helps to protect users’ assets from attackers.

Trading platforms independently determine the package of documents for identification, but some data are requested necessarily:

- FULL NAME.

- Identity document (passport or driver’s license).

- Contact information (e-mail, phone number).

- Address of residence.

Just specifying the data is not enough, you need to confirm their authenticity with documents. The larger the user’s account, the more checks the exchange requests. Therefore, without KYC you will not be able to trade without KYC, and problems will arise at the stage of making a deposit.

P2P uitwisselingen

Some investors want to buy cryptocurrency directly from the owners of coins. Peer-to-peer platforms provide such an opportunity. P2P exchanges can be managed and decentralized. They have a similar principle of operation, but there is a difference – the former acts as a guarantor of transactions and charges a fee. The second ensure the integrity of transactions by programs, so there are no commissions at all, or they are minimal.

How to choose an exchange for a beginner

The search for a trading platform is better to start with the definition of specific goals. Cryptocurrency exchanges provide various opportunities. For example, PancakeSwap does not have the usual exchange interface. Customers only need to connect a wallet to the platform and make an application. A convenient and simple interface combined with good functionality is an advantage for beginners.

For trading

Each cryptocurrency exchange offers tools for trading assets. Many sites have a demo account, which allows beginners to practice without risking real money. For example, on Binance, you can get 10,000 virtual units when you sign up to test the platform.

The main disadvantage of demo accounts is that they give beginners overconfidence in their abilities. If everything works out in training mode, it does not guarantee the same with real money.

For investments

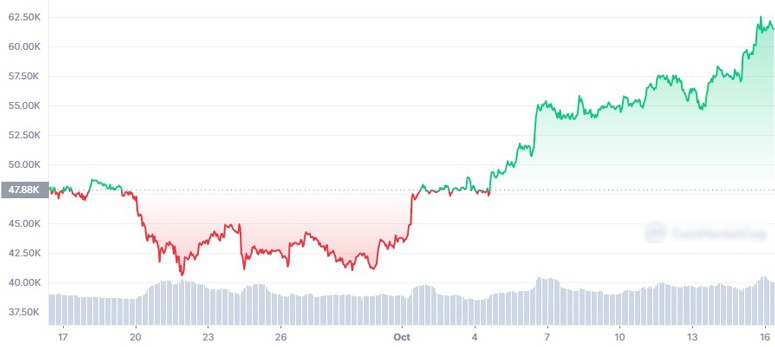

In the securities markets, traders determine the return on an asset based on its history. Cryptocurrencies are still young, so it is not possible to analyze them over a long period of time. But in general, long-term holding of digital assets can bring high returns. For example, the TWT token was worth less than $0.01 at launch, and at its peak in October 2021, its price was $1.65.

De beste cryptocurrency-beurzen

Dekapitalisatie van digital assets exceeded $2.37 trillion in October 2021. There were 308 crypto exchanges operating in the market at that time. The best of them offer dozens of tools for analyzing and trading, low commissions and different ways to deposit and withdraw fiat currencies.

CEX.IO

The trading platform with support for digital and fiat currencies has been operating since 2015. CEX.IO serves more than 1 million users worldwide and provides the ability to conduct transactions via bank cards.

Currency

A regulated platform for investing in cryptocurrencies, stocks, ETFs, and commodities. Currency offers over 2,000 tokenized assets with an average daily trading volume of over $160.84 million in November 2021.

Binance

One of the largest cryptocurrency platforms for digital and fiat money transactions in 393 pairs. The average daily transaction volume on Binance in October 2021 was $29.7 billion.

Coinbase

The popular American platform combines a trading terminal with the functions of a cryptocurrency wallet. In 2021, Coinbase stored users’ assets for more than $90 billion. The total volume of transactions conducted in the history of the project exceeded $460 billion.

FTX

The Hong Kong-based crypto platform supports spot trading, digital asset exchanges, margin trading and futures contracts. In November 2021, there are 292 trading pairs available on FTX with a daily volume of $3.44 billion.

Key components of the exchanges

Cryptocurrency services are arranged so that a trader gets information in one place and can see the pair he is working with, bids to buy and sell, and the chart. At the bottom there is usually a panel through which you can perform actions.

Chart

The cryptocurrency exchange allows you to track the dynamics of price changes visually. This opportunity is realized in charts:

- Line chart. Needed for simple monitoring of price changes for a given time.

- Color bar chart. Linearly shows the rate, and the intervals of a certain time are separated by a small distance and color. Red – the rate fell, green – rose.

- Japanese candles. Demonstrate the lowest and highest trading prices. They are usually used for professional market analysis.

By default, platforms show candlesticks on charts. This is the most convenient way to track market dynamics. For correct analysis, you need to set up a chart for a certain period (for example, 1 candlestick – every 15 minutes).

Buy and sell orders

You can buy digital currency in several ways:

- Wait for the desired price on the spot market and send a “Market” type order.

- Place a pending order. It will trigger when the rate of the asset reaches the specified mark.

Pending orders are more complicated, as they require you to understand the functionality of the site. But they allow to perform operations at a more favorable rate for the trader.

Quotes stack

The list of registered orders is usually displayed near the chart. The Quotes Stack shows the number of orders to sell an asset in real time – they are highlighted in red. Orders to buy tokens and coins are highlighted in green.

Transaction History

The cryptocurrency exchange is set up to help traders buy and sell assets profitably. Most sites display the history of transactions in real time: the transaction price, the difference with the current rate and the number of coins.

Based on this data, you can track the dynamics of currency quotes. For example, if a coin fell in price a few days ago, but now it is growing – this is a favorable situation for buying against the change of trend.

Trading volume

Any market depends on the interest of traders and investors. You can assess the demand for the coin by analyzing the trading volume. In the interface of cryptoplatforms can be present such indicators:

- Cluster. Displays the trading volume for a specified time in the form of Japanese candles.

- Horizontal. Shows the ratio of bids at each price level.

- Vertical. Displays the total number of orders for a certain period.

These indicators help to understand the mood of other crypto traders.

Tools

For stable earnings on cryptocurrency, it is necessary to analyze and monitor the rates of digital money and events happening in the world. Traders track price changes in order to add coins and tokens to the portfolio in time and look for new options for investment. Exchanges offer trading and analytical tools that help users make profitable transactions. For example, charts allow you to track the growth dynamics of the coin rate or a trend (trend).

Analytical

Large portals help to follow the news in the crypto industry and economy. But in addition to important events, it is useful to know the opinions and forecasts of other users, to test trading strategies. Analytical services, such as TradingView, are used for this purpose.

Handel

In recent years, many services have been created to help investors buy digital assets into a portfolio and diversify investments. One of the most famous is CoinMarketCap. It is a tool for trading on crypto exchanges, allowing you to track the dynamics of the exchange rate of an unlimited number of currencies and pairs. It also helps you find a broker that has a particular coin.

Another function of CoinMarketCap is to monitor a given currency pair on several markets simultaneously. This feature is interesting for those who are involved in cryptocurrency arbitrage.

Principle of trading

To earn on the growth or fall of cryptoassets, you need a free budget and basic knowledge. If the main goal is investment, it is worthwhile to distribute money so that in case one currency falls, others can compensate for losses.

The basic principle of trading digital assets is to buy cheaper to sell more expensive.

The probability of loss can be reduced by diversifying the portfolio of assets and choosing promising coins with a low level of risk.

Step-by-step algorithm

Work with the trading platform begins with account registration. You will need to fill out a contact form, create a password and activate your profile.

The next step is to verify your identity. To do this, you need to find the appropriate tab in the profile settings and, following the instructions, upload documents. Usually, the crypto exchange requires selfies and a passport photo. The service can consider the application for up to 10 days.

After verification, you can buy and sell cryptocurrency. First, you need to replenish the account. Fiat can be deposited via card or payment system. To buy cryptocurrency, you need to go to the spot trading section and place an order.

To sell an asset, you need to select it in the portfolio, specify the price and number of coins. To withdraw money, you should make an application in the “Wallet” section.

Advantages and disadvantages of cryptocurrency exchanges

Trading digital coins requires basic market knowledge, skills in technical and fundamental analysis. Exchange platforms provide such an opportunity, allowing you to monitor changes in rates online. Other advantages of the services include:

- Fast transactions.

- Low commissions on deposits and transactions.

- A large number of trading pairs.

- Support for many fiat currencies.

- Multilingual interface.

In addition to the fact that not every service withdraws fiat, among the disadvantages should be noted:

- Mandatory verification.

- Many restrictions for novice users.

Even with small inconveniences, cryptocurrency exchanges allow the industry to develop, and new tokens to go to the masses. This is a convenient way to safely exchange coins and earn on the difference in rates.

Tips and advice for beginners

Mastering the cryptocurrency market is not easy. But you can speed up the process by listening to the recommendations of experienced traders:

- Do not be afraid of losses, because this is the only way to gain experience.

- It is better to start working with small amounts of money, which are not too bad to lose.

- Do not buy coins that have skyrocketed in value – most likely, such growth will be followed by a correctie.

- The pursuit of high returns entails great risks.

Investors can make money in the long term. It is necessary to assess risks and not to panic during unsuccessful transactions.

Veelgestelde vragen

💳 How can I withdraw money from the exchange to my card?

Not all platforms offer such an opportunity. Where it is available, you need to make an application for withdrawal, specifying the details of the card. In other cases, you can use exchange services.

❓ Which cryptocurrency is better to buy?

You can use analysis tools, such as TradingView, to evaluate coins. But there is a pattern: usually when bitcoin falls, other altcoins also become cheaper. Many investors advise to keep a part of funds in BTC.

💸 Do I have to pay taxes on trading income?

Yes. In Russia, cryptocurrency trading is subject to personal income tax. When withdrawing in fiat, you will have to calculate the profit and pay tax yourself.

📉 What to do if the asset has fallen in price?

It is necessary to sell cryptocurrency, which brings a loss. If the rate falls deep down, you can lose your entire deposit.

✅ Will it be possible to trade on several exchanges at once?

Yes. This is beneficial for both sites and users, as you can find a service with the desired rate.

Een fout in de tekst? Markeer het met je muis en druk op Ctrl + Enter.

Auteur: Saifedean Ammous, een expert in cryptocurrency-economie.