One of the best and legitimate ways to make money from bitcoins is to mine them. To do this, miners use powerful computer systems. If it’s a small system, it can be set up at home. The price and payback period of a mining farm in 2023 depends on the equipment and the cost of its maintenance. Calculators are used for calculation. Such tools give an approximate forecast of profitability.

Why it is important to calculate the payback

The complexity of mining is growing, and the price of assets is falling. To get a good income, participants in the crypto market create mining farms. On them, several pieces of equipment work simultaneously. Managing the installation is similar to mining on a single device. To create such a system, you need equipment and an Internet connection. Beginners often make mistakes, for example, they buy old video cards that fail, or choose the wrong coins. All of this increases the payback time. In addition, in 2023 it is difficult to purchase equipment and make a profit in a few months, so calculations should be made before the equipment is purchased.

Main parameters for calculation

For investors, the return on investment is in the first place. The calculation of profitability includes several parameters: the price of equipment, electricity costs, the unstable exchange rate of cryptocurrencies, rent of premises.

Basic costs

The payback of a mining farm on video cards in 2023 depends on the price of installation and related equipment. For the first time, the miner is mining cryptocurrencies to cover the cost of investment. The processing power and power consumption of the machinery is an important factor in this matter. If a GPU costs ₽30k and it brings in ₽30 per day, this means that it will take 1,000 days until the GPU pays off. This includes:

- Amortization. This item should include not only the wear and tear of the cards, but also other equipment that is susceptible to damage. For example, power supplies.

- Costs for maintaining an optimal temperature regime: built-in or conventional cooling system, sensors.

It is necessary to regularly check the system for possible errors, monitor its condition: change the thermal paste, clean from dust. This is also a cost.

5020 $

bonus voor nieuwe gebruikers!

ByBit biedt handige en veilige voorwaarden voor de handel in cryptocurrency, lage commissies, een hoog liquiditeitsniveau en moderne tools voor marktanalyse. Het ondersteunt spot en leveraged trading en helpt beginners en professionele handelaren met een intuïtieve interface en tutorials.

Verdien een bonus van 100 $

voor nieuwe gebruikers!

De grootste cryptobeurs waar je snel en veilig je reis in de wereld van cryptocurrencies kunt beginnen. Het platform biedt honderden populaire activa, lage commissies en geavanceerde tools voor handelen en beleggen. Eenvoudige registratie, hoge transactiesnelheid en betrouwbare bescherming van fondsen maken Binance een geweldige keuze voor handelaren van elk niveau!

Variable costs

Such parameters include:

- The price of electricity and a stable Internet connection.

- The exchange rate of cryptocurrencies. This factor is the most unpredictable. There is no guarantee that the investment will pay off when the market recovers.

How to calculate profitability

After Ethereum switched to the Proof-of-Stake algorithm, miners started mining other coins and the complexity of their network increased. For example, the net profit from mining Ethereum Classic on an AMD Radeon RX 6750 XT graphics card was ₽17.3 per day in August 2022, but in October it yields -₽7.7. However, users continue to mine the cryptocurrency with the prospect of a rising rate.

Special calculators allow you to calculate the profitability of GPU and ASIC mining and calculate the payback of the farm for cryptocurrency mining. They take into account several important parameters: electricity costs, hash rate, network complexity. But even such a calculation will not give an absolutely accurate result. You can not predict the most important factor – the cost of cryptocurrency. During the day, the forecast can change by tens of percent.

Examples of calculating the payback period of a mining farm

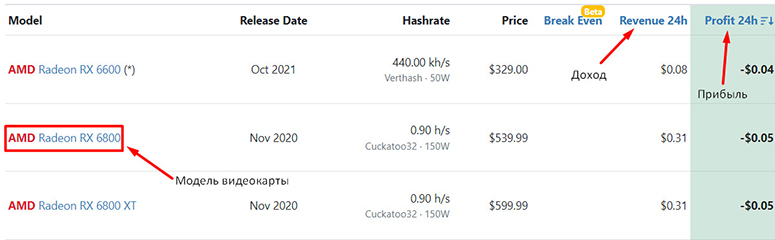

There are two main options for mining: ASIC or GPU. Usually profitability is assessed by ROI (Return on Investment), which is calculated using the formula: purchase price of the device / net monthly income = how many months are left until the return on investment. To calculate the payback of crypto mining equipment, WhatToMine resource will also help. The calculator has two available parameters: revenue per 24 hours and profit per 24 hours. By making simple calculations, you can find out the values for a year.

The tool also allows you to choose the most profitable coins. To do this, on the GPU or ASIC pages, you need to specify the equipment model and click on Calculate.

The exact payback period can only be found out after the fact. The exchange rate is constantly changing, and the complexity of mining increases.

Based on AMD graphics cards

Mining cryptocurrencies requires investment. To assemble a mining farm from video cards will cost the buyer from a few hundred thousand rubles to a million. All further calculations are approximate and based on the WhatToMine calculator.

| GPU | Farm cost (4 devices, thousand ₽) | Profit per year dirty (thousand ₽) | Profit per year net (thousand ₽) | Terugverdientijd |

|---|---|---|---|---|

| RX 6800 | ||||

| RX 6800 XT | ||||

| RX 6700 XT |

Based on Nvidia graphics cards

Some miners plug AMD together with Nvidia. But it is recommended to create a clean installation where all graphics cards are of the same brand. This will cause fewer driver support issues.

| GPU | Farm cost (4 devices, thousand ₽) | Profit per year dirty (thousand ₽) | Profit per year net (thousand ₽) | Terugverdientijd |

|---|---|---|---|---|

| GeForce RTX 3060 Ti | ||||

| GeForce RTX 3070 Ti | ||||

| GeForce RTX 3080 |

Using ASIC processor

ASIC processors are hardware specifically designed for mining. They are much more efficient than GPUs. However, ASICs have a big disadvantage – lack of flexibility (limited to a single algorithm) combined with high cost. Model Bitmain Antminer T17+ can be bought for ₽226 thousand. The characteristics are as follows: hash rate value – 58-64 TH/s, power – 3200 W, support for the SHA256 algorithm.

| Quantity | Revenue (thousand ₽) | Net profit (thousand ₽) |

|---|---|---|

| 2 | ||

| 4 |

On the other hand, you can get income on the MicroBT Whatsminer M30S++. The price of this device is ₽200k on average.The specifications are as follows: 108 TH/s, 3290W, SHA256.

| Quantity | Revenue (thousand ₽) | Net profit (thousand ₽) | Terugverdientijd |

|---|---|---|---|

| 2 | |||

| 4 |

Payback on old graphics cards

It is possible to mine on old graphics cards. However, they are not suitable for all cryptocurrencies. For example, before Ethereum switched to Proof-of-Stake, its DAG file reached 5 GB. All models with memory less than this value could no longer mine. Therefore, it is better to choose a card with memory close to this value. Of the older GPUs, users prefer AMD Radeon R9 280X, R9 380X, R9 290X, NVIDIA GeForce GTX 1050 Ti, GTX 1060 6GB.

A farm of 4 GTX 1050 Ti units as of October 2022 can be bought for ~₽60k. It will bring in about ₽17 per day, but you’ll have to pay ₽40 for electricity. There is no way to determine how long it takes to pay off a mining farm on this equipment.

The older the model, the lower its efficiency. The parameters of such equipment can be increased by overclocking the clock frequency of the core and memory.

What profitability depends on

Several factors affect the profitability:

- Network hashrate. The more miners are involved in mining, the higher this value. As it grows, the income proportionally decreases.

- Complexity. In 2023, this indicator is constantly growing and more additional computing power is required for mining.

- Block time. Helps determine how many blocks will (theoretically) be found in a specific period of time.

- Reward per block. This is the number of coins that machines will receive once they find a block. It is different for each blockchain.

- Power Payment. As the calculations above show, this is an important factor in determining profitability.

- The hash rate of the device.

- The price of bitcoin.

- Equipment. Both profitability and payback depend on the choice of equipment. Some cards are more power-hungry, others lack power.

Belastingen

If the profit from mining is not guaranteed, then quite differently things are with the payment of taxes on the reward for mining. In Russia, cryptocurrency is recognized as property. Legally, mining is not regulated, but it is taxed.

| Income | Tax | How to file |

|---|---|---|

| Up to 2.4 mln. | Via online banking or FTS application | |

| Up to 150 mln. | USN | |

| From 150 mln. | Disqualified from the simplified taxation system |

Conclusies

In 2023, mining does not bring the same profits. The average home miner with GPU has little chance to recoup the cost of equipment and electricity. ASIC users can find an option with profitability, but it requires a lot of investment.

Before mining coins, you need to calculate the payback of a crypto farm and analyze it, taking into account electricity costs, efficiency and the cryptocurrency exchange rate.

Veelgestelde vragen

📊 What is the most profitable equipment for mining in 2023?

Calculators only show profits on ASICs. GPUs are running at a loss.

❓ Is it possible to install an ASIC-powered crypto farm in an apartment?

In October 2022, this is not prohibited. But it is worth considering that ASICs are loud. On average, the noise level is 80-100 dB. This can be compared to a vacuum cleaner. It is necessary to provide noise insulation.

⛓ What are the benefits of cryptocurrency mining for the blockchain?

Miners verify transactions and add them to the blockchain’s decentralized registry. This is done by solving complex cryptographic problems.

🖥 Can mining damage a graphics card or computer?

Most GPUs rely on auxiliary fans to prevent overheating.

🔍 Is it worth it to mine bitcoin?

There is no unequivocal answer. Bitcoin is in high demand. Because of this, individual profits are decreasing. Also, over time, more and more computing power is required to mine each block, so mining and electricity costs increase.

Staat er een fout in de tekst? Markeer het met je muis en druk op Ctrl + Ga naar

Auteur: Saifedean Ammous, een expert in cryptocurrency-economie.