The cryptocurrency market operates 24 hours a day, seven days a week, but traders cannot stay at the terminal all the time. In order not to miss trading opportunities, exchange clients use bots. These programs connect to the terminal via API, can open and close orders, rearrange take profit and stop losses. Usually traders purchase ready-made strategies or order an algorithm to be written for their needs. Bybit trading bots are available free of charge to all clients and work on the futures and spot markets. With their help, users can schedule regular purchases or open orders in a “grid” using Martingale.

What is a trading robot

Most of the time traders perform routine actions – entering the market on a signal, placing stop and take, closing trades. To simplify the work, these tasks are delegated to robots. The programs connect to the trading terminal via API and perform operations according to the algorithm.

Robots are used by both professional traders in crypto funds and ordinary users. With the help of free programs on Bybit, you can automate the opening and closing of orders.

Customization

There are 3 market phases – sideways, long and short trends. The trend also depends on the timeframe. On the daily chart there can be a strong growth, and on the minute chart – a clear dantrend. Experts recommend opening trades on the younger periods only in the direction of the older one. But there are examples of successful application of countertrend strategies. We can distinguish such ways of trading:

- Scalping. The trader works on a minute or tick chart. Often margin lending or futures are used. The goal is to make a lot of positive transactions with minimal profit. It is enough to take 2-5 points of the price.

- Daytrading. The participant analyzes the mood of the market and enters a deal in the direction of the trend. On average, traders open 2-3 orders per day. Stop and Take are set. On successful days, the user earns 5-15% of the deposit. Otherwise, the user receives a loss of 2-3% or trades at zero. At the end of the day all operations are closed.

- Swing. The trader analyzes large timeframes (4 hours, daily). Movements on charts below the hourly timeframe are noise. The goal is to take 15-50% profit from one instrument. Such a user never enters the entire deposit. The deal is fixed for several days or weeks.

- Investering. The user plans to hold positions for a year or more. The buying strategy can differ – some take coins in equal parts once a week, others wagering ideas and do not average positions.

Depending on the method of trading, traders customize the parameters. A few basic ones are taken into account:

5020 $

bonus voor nieuwe gebruikers!

ByBit biedt handige en veilige voorwaarden voor de handel in cryptocurrency, lage commissies, een hoog liquiditeitsniveau en moderne tools voor marktanalyse. Het ondersteunt spot en leveraged trading en helpt beginners en professionele handelaren met een intuïtieve interface en tutorials.

Verdien een bonus van 100 $

voor nieuwe gebruikers!

De grootste cryptobeurs waar je snel en veilig je reis in de wereld van cryptocurrencies kunt beginnen. Het platform biedt honderden populaire activa, lage commissies en geavanceerde tools voor handelen en beleggen. Eenvoudige registratie, hoge transactiesnelheid en betrouwbare bescherming van fondsen maken Binance een geweldige keuze voor handelaren van elk niveau!

- Market – futures or spot.

- Cryptocurrency – you can choose any coin. It is better to invest in new low-liquid assets, and scalp on top ones.

- Digital currency of purchase – USDT or USDC.

- Lot size – depends on the deposit and risk profile.

- Timeframe for trading.

Given the type of robot, other parameters may be available. The setting also depends on the trend. On strong trends it is better to work only in the direction of movement, and in sideways – in both directions.

Rassen

The program scans the market according to a pre-defined strategy. After a signal appears, the robot can:

- Send a notification to Telegram chat. The message will contain the stop, take and recommended lot size. The trader makes a decision and enters the trade independently.

- Automatically open an order. The robot connects to the terminal via API and takes over the transaction management. It places orders if it is stipulated by the strategy. In some cases, they prescribe closing a position not by level, but by a combination of indicators.

Bots provide a flexible and automated approach to trading on cryptocurrency markets. This will help to increase income and save the trader’s time.

What the income depends on

There is no strategy that makes profits on all instruments in every phase of the market. Traders will receive losses if the robot opens trades against a strong trend and does not put stops. But in sideways markets such tactics are profitable.

Trading success depends on how accurately a trader analyzes charts, determines the market phase and knows how to admit mistakes. There are situations when it is better to accept losses and stop the robot.

To compensate for strategy drawdowns, a portfolio of bots is used. The joint work of algorithms will smooth out the equity (common P/E graph) – when a trending robot drains, a flat robot will earn.

Can bots be used on Bybit

The exchanges do not prohibit algorithmic trading. On Bybit, the use of your own bots is available. To do this, you need to connect via API. Beginners are offered to copy the deals of successful traders or take templates of the Bybit platform to create a trading plan. Settings can be left by default or repeat the parameters of the top 3 clients from the leaderboard.

Are there free trading robots

Bybit does not charge a commission for using bots and provides templates for creating custom strategies. Clients can also download algorithms from forums and themed blogs. Usually, old strategies and Expert Advisors (for order opening and management) are publicly available. But you should not expect that a free Bybit bot will earn autonomously. The program needs to be adjusted to the current market.

Best Bybit trading bots

The crypto exchange offers its clients to take advantage of algo-trading. Bots for popular strategies are collected and run on Bybit’s servers. Traders do not need to customize anything, the algorithms are embedded in the trading platform interface. To connect a strategy you will need:

- Authorize on the platform under your login and password.

- Go to the “Trade” section. Select the market type – “Spot”, “Margin” or “Futures”.

- Open the “Trading Bots” tab.

- Select an offer and click on the “Create” button.

- Specify a coin.

- If necessary, you can limit the maximum amount for trading. If the field is not filled in, the entire deposit will be used.

- Click on the “Create Bot” button.

Spot

The trading robot for Bybit is programmed to trade using a “grid” strategy. The algorithm buys on a price decline and sells after a pullback. There are no stops – if a trade goes into a minus, the robot averages out. Here is how Bybit bots work on the spot:

- You need to select an instrument and trading range. For example, at the current ETHUSDT price of $1500, the algorithm will offer a corridor of $1100-1900. It can be changed.

- It is necessary to specify the number of marks. The algorithm will divide the range into equal parts. For example, with the width of $1100-1900, the current price of $1500 and 6 levels, the following orders will be placed: $1400, $1300, $1400 – to buy, $1600, $1700, $1800 – to sell. If the quotes rise above the current (at the time of launch), the robot will open a short, if they fall below – a long.

- The robot will buy and sell at each level. If the price leaves the corridor, it will stop.

The strategy can bring good income on a sideways trend. The trader trades in large ranges ($1-2 thousand) or chooses the intraday variant – $40-50.

It is necessary to properly assess the risks and limit the deposit size for the robot. Otherwise, on a strong trend without bounces the program will drain all the capital.

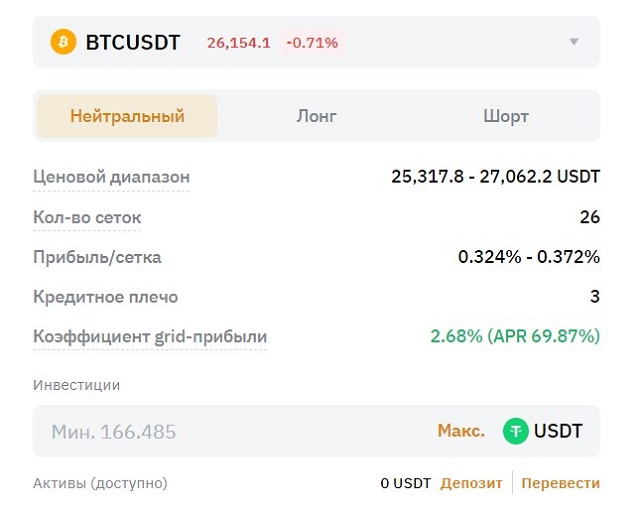

Futures

The robot uses a similar strategy for open-ended contracts. The trader can choose the option:

- Neutral. The bot acts in both directions – it buys on the decline and sells on the growth.

- Long. The strategy is used in strong growing trends. The bot trades only long – buys on pullbacks and fixes profit.

- Short. The strategy is used to earn on corrections. The robot opens only down trades.

Users can set manual settings. This mode is recommended for experienced traders. Beginners are better to choose the default parameters (calculated by artificial intelligence) or copy from the leaderboard.

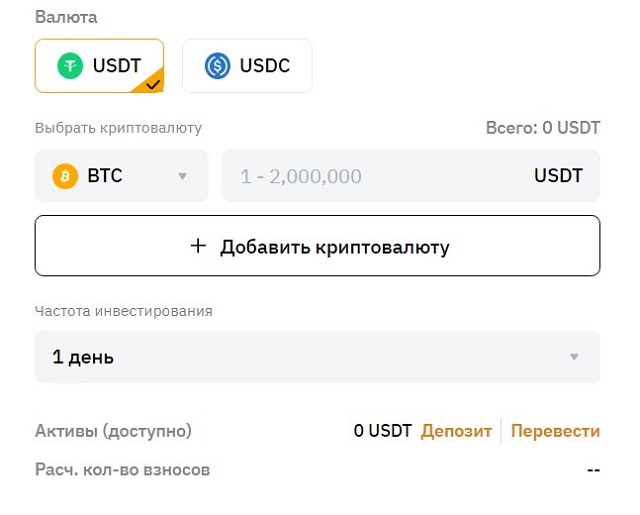

DCA-bot

In this strategy, investors buy reliable assets at equal intervals for the same amount. If the quotes fall, the user can buy more cryptocurrency. This lowers the average of the position. The DCA robot automates routine operations. To start it, you need to specify the parameters:

- Digital payment currency (USDT/USDC).

- The coin to be purchased.

- Transaction amount (in stablecoins).

- Frequency of investment (10 minutes, hour, day, week or month).

- Maximum purchase amount. You can leave the field empty, then the program will conduct transactions until the money runs out.

To include several coins in the plan at once (up to 5), you need to click on the “Add cryptocurrency” button. Different investment parameters are specified for each asset.

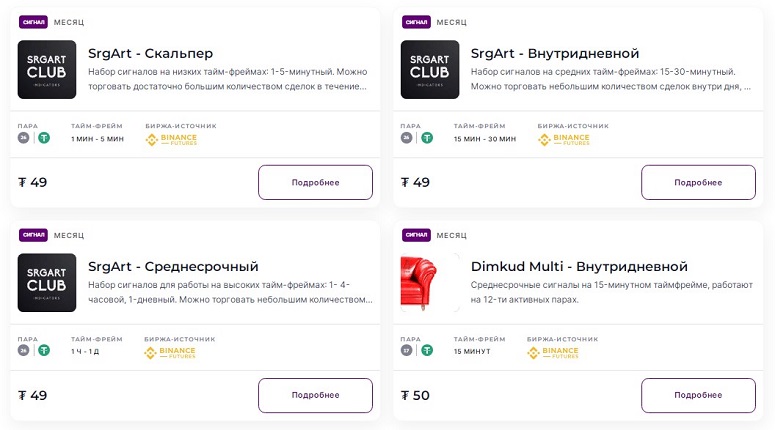

Top trading robots for Bybit

Customers can connect their own algorithms to the exchange. To do this, an API key should be obtained. Ordering a robot from scratch from a specialist is expensive, so you can use ready-made software. For example, algotrading platforms provide convenient tools for strategy development. To use them, you do not need to know how to program – customization is carried out in a convenient interface.

Algorithm testing is free, but you will need a subscription to launch it. On average, they charge $10-50 per month. Discounts are available if you buy a one-year subscription.

Veles Finance

A platform for creating robots launched in 2020. Here they offer to develop programs in a visual constructor. The site supports Russian and has a simple interface.

No special knowledge is required to create an algorithm. Users are offered to read the instructions in text form and watch video tutorials. Features of the platform:

- Users are only charged a commission from profitable trades – 20%, but no more than $50 per month.

- You can buy a template with tested parameters.

- There is partial profit taking, stop loss and trailing orders.

- Work on spot, margin and futures markets is available.

- They offer to use 20 popular indicators in the trading terminal. If this is not enough, you should switch to TradingView charts.

3Commas

The bot supports trading on Bybit, Binance and 13 other popular platforms. The algorithm can work with more than 100 coins. You can use the built-in indicators or switch the chart to the TradingView interface. Other features of 3Commas:

- Built-in strategies (arbitrage, marketmaking and others) are available.

- The robot can be customized according to individual parameters.

- Demo mode is available (7 days free of charge).

- There are 3 tariffs – payment for access for a month or a year with a discount (from $174 for 365 days).

- Includes additional trading functions – profit taking strategies, stop-loss.

- Trading on futures and spot markets (with and without margin). Options are available.

- There is a three-level trading program.

- You can download a bot for Bybit in mobile format.

- There is a training course for beginners.

RevenueBot

Cloud bot for Bybit, EXMO and other popular platforms supports simultaneous work with different pairs by individual settings on separate accounts. The RevenueBot interface is translated into Russian and English. There are other features as well:

- No upfront payment required. The developers take 20% of the profit (no more than $50 per month).

- You can use pre-installed indicators or integrate the service with TradingView terminal.

- Backtest of bots is available (for the previous 60 days).

- Automatic selection of cryptocurrencies by volatility (dump/dump filters) works.

- Among the additional settings – delay before creating a new grid, indentation of the first order, profit calculation, trailing stop and others.

- You can stop algorithm execution, close trades and transfer control to another bot (change the direction from long to short and vice versa).

WunderTrading

The trading automation platform was launched in 2018 by the Estonian company WunderBit. Users are offered to manage positions on Bybit, Binance and 11 other popular CEX. There is no verification required to work, it is enough to register on the site by e-mail.

New clients can test WunderTrading in the demo version. Full functionality is provided for 7 days. Beginners can continue to use the platform for free in a limited mode.

The Free tariff includes the launch of 2 bots, no more than 5 open positions, operations on one exchange.

The paid version includes more tools for stop and profit taking (partial take profit, trailing stop, DCA). Users can buy a subscription for 3, 6 or 12 months to get a discount of up to 25%. Different subscription options are available.

| Rate | Monthly fee ($) | Number of bots | Number of exchanges | Maximum number of open orders |

|---|---|---|---|---|

HaasOnline

On the platform, you can create a robot based on your own strategy. Beginners often use the visual builder, while experienced users write programs in HaasScript. The service has the following features:

- Provides 3 days of free access.

- Traders use a demo account to practice strategies.

- 4 paid tariffs are available ($9-149 per month). A 16% discount is available if you purchase a one-year subscription.

- You can trade spot, margin and futures markets.

- The referral program pays up to 25% of referred clients’ profits.

- There is a mobile application for Android and iOS.

- The developers have created robot design instructions for beginners.

Bitsgap

The platform supports 18 leading crypto exchanges, including Bybit, KuCoin. It is possible to work in Russian. In 2023, the service is used by more than 500 thousand traders on the futures and spot markets. Clients have access to all popular indicators in a native interface. Working conditions:

- Demo mode is provided – 7 days of free access.

- Minimum tariff is $29 per month and $276 per year (20% discount).

- Smart orders are available – users can place orders that are not supported on the platform (Stop Loss, Take Profit, Trailing Take Profit and OCO).

- There is a mobile application (for Android and iOS devices).

- There is a detailed tutorial in English (in Russian – a brief instruction).

ProfitTrailer

The platform has existed since 2017 and is still popular. ProfitTrailer clients conduct transactions with futures on 16 crypto exchanges (Bybit, Binance, BitMEX and others), as well as on the fiat currency market (Forex). Traders can use 40 indicators, work simultaneously with 2 bots, customize receiving trading signals from 5 more templates and TradingView terminal.

The investment bot is available only from PC (Windows, Lunix, macOS), there is no mobile application. You can access your personal cabinet and view the history of trades through your browser.

Cryptohopper

The platform is suitable for beginners and advanced algo traders. In 2023 Cryptohopper is used by more than 700 thousand clients from different countries. Clients can trade on several exchanges in one terminal for free. Subscription is needed to connect robots (3 days of demo mode is provided). The minimum tariff plan is $19 per month. If you buy an annual subscription you get a 16% discount.

Cryptohopper supports arbitrage (domestic and inter-exchange), classic trading on spot, futures market. Other features:

- 15 popular exchanges are available.

- Offer paid and open training courses.

- On the native trading platform you can connect copytrading, buy templates and signals.

- The referral program pays up to 15% of the profit of referred users.

Stacked

The service offers automation tools for long-term trading only. Stacked is a convenient portfolio manager. Clients can view positions on all exchanges in one interface. Bybit, Binance, KuCoin and other popular platforms are supported.

In Stacked, you can track changes and invest with one button. Demo access is provided for users to test features. A one-month subscription costs $8.95.

With the help of Stacked tools, it is possible to set up automatic balancing of coins in the portfolio according to the set risk profile.

Kaktana

This trading automation platform supports Binance, Bitmex, Bittrex, Bitfinex, Kraken, Coinbase Pro and Bybit. You can conduct transactions on the spot and futures markets. More than 100 indicators are available on Kaktana. Users use them to develop and test strategies.

You can sell robots on the internal marketplace. To do this, you need to write a description and attach results for at least six months. There is a demo mode (free of charge) for practicing strategies. It is allowed to use 10 years of history for backtests.

Subscription costs $20-80 per month. The following tools are available to algo traders:

- Trailing Stop.

- Opening a deal after quotes change by a specified percentage.

- Simultaneous stop loss and take profit. When one order is triggered, the second one is deleted.

- Averaging according to the set plan (with or without Martingale).

- Analyzing the chart simultaneously on several timeframes.

Tips for using bots

Traders develop trading algorithms to simplify routine operations. A bot can work around the clock, does not get tired and does not violate the rules of the strategy. But the program is not able to replace a real investor. Periodically you should change the settings to suit the current market, stop the robots or replace them with others. No strategy, except investment strategy, can function permanently. Also, the following factors are taken into account when using trading algorithms:

- All robots take losses. You should not evaluate the performance of an algorithm based on one unsuccessful week.

- Before launching on a real account, you should test the bot on historical data for at least 4 years. It is necessary to check how the algorithm behaves in bullish and bearish trends, in sideways.

- Bots show different results depending on the crypto coin. It is worth trying to conduct operations with popular assets.

- Slippage and exchange commission should be taken into account. This can distort the results.

How to stop the bot

When connecting an external algorithm to Bybit, users can choose permissions for actions. The robot opens and closes transactions, withdrawal of funds should be prohibited. If the bot began to drain, it will be necessary to go to the API panel and remove the key associated with it. It is also worth changing the password. To remove the built-in Bybit programs (Grid, DCA), you should:

- Go to the Bybit Bot section, select the “Active” tab.

- Click on the “More” button to expand the “My Bots” list.

- Select the unwanted algorithm and click on “Delete”.

- If there are 2 or more coins in the account, it is required to specify the method of transfer to the bot wallet. You can leave the default settings or convert to one at the current exchange rate (marking price).

- Click on the “Confirm” button.

How to create a robot yourself

To perform simple operations (regular buying, placing stop and take, rebalancing), you can use a ready-made free Bybit solution or templates of popular algo-trading platforms. Programming a complex strategy based on multiple indicators is a time-consuming task. Traders can use popular platforms to create bots and backtests of the strategy. It is necessary to test the work on different coins and timeframes.

Veelgestelde vragen

🔔 Is trading with robots a passive income?

Programs simplify the trader’s work, but do not replace it. The user still has to control the process. Algorithmic trading cannot be called passive income.

✨ What is more profitable – fixed-fee tariffs or a percentage of profits?

It depends on the size of the trader’s deposit. For small accounts, the second option is more profitable.

🔔 Is it safe to trade with a bot on Baybit?

The trader transfers control over the funds to the program. Therefore, you should not use products of untested developers. They may have viruses embedded in them. Using reliable platforms for constructing trading algorithms is safe. Services value their reputation and will not take risks.

⚡ What security measures should be taken when using trading algorithms?

It is necessary to set complex passwords and connect two-factor authentication. It is recommended to change the code every six months. You should also allow trading on the account only with IPs from the white list and block withdrawal of funds (the option can be disabled if necessary).

📌 How much do people earn on Bybit’s “grid” bot?

In a flat market, with the right settings, you can get up to 30% per month. But when the trend changes, the risk of losing your deposit is high. Therefore, you should follow the trends and disable the program in time.

Fout in de tekst? Markeer het met je muis en druk op Ctrl + Enter.

Auteur: Saifedean Ammous, een expert in cryptocurrency-economie.