Many factors influence the rate of digital assets, from news to the emergence of new technologies. In some cases, a rally can end in a complete collapse, while in others, temporary price declines represent a correction of cryptocurrencies. Such periods end either with users losing their savings or becoming an entry point into digital assets.

What is a cryptocurrency correction

Before the advent of digital assets, the term was used for stocks, bonds, and traditional currencies. A correction in the cryptocurrency market refers to a sustained drop in the price of a coin of up to 10% on average compared to the last, highest value. This phenomenon is short-term, as a rule, it is not followed by a phase of decline. But sometimes it can be a signal of a real collapse. The regularity of pullbacks depends on the type of asset. It happens that it affects all or one cryptocurrency.

Redenen

A cryptocurrency correction is most often a reaction to an overvaluation of assets. Sometimes it’s an external crisis, such as the March 2020 pandemic. Other times, a specific industry or sector of the economy falls and causes fluctuations across the market. Important events, like the launch of Segwit, which led to faster transactions on the BTC network, can also change the exchange rate in a short period of time.

Cryptocurrency exchange rates depend on news and external factors. This increases the hype and there is a realization that the market is “overheated”. This means that the value of a stock or coin has become too high.

When large investors withdraw large volumes, panic arises among small participants and they “dump” their coins en masse.

Investor sentiment, economic indicators, global politics, and recent news all play a role in determining whether or not a pullback will occur.

How it develops

A correction on a cryptocurrency exchange begins when the value of a coin rises for a long time and becomes overvalued. During an uptrend, several pullbacks can occur when there is a decrease in demand and an increase in supply. Traders and investors sell their assets at a fixed profit. The increase in volume causes other participants to start trading their coins as well. The price falls. The decline is sustained by sales until a level is reached where demand matches their volume. As a rule, pullbacks are followed by recovery and growth.

5020 $

bonus voor nieuwe gebruikers!

ByBit biedt handige en veilige voorwaarden voor de handel in cryptocurrency, lage commissies, een hoog liquiditeitsniveau en moderne tools voor marktanalyse. Het ondersteunt spot en leveraged trading en helpt beginners en professionele handelaren met een intuïtieve interface en tutorials.

Verdien een bonus van 100 $

voor nieuwe gebruikers!

De grootste cryptobeurs waar je snel en veilig je reis in de wereld van cryptocurrencies kunt beginnen. Het platform biedt honderden populaire activa, lage commissies en geavanceerde tools voor handelen en beleggen. Eenvoudige registratie, hoge transactiesnelheid en betrouwbare bescherming van fondsen maken Binance een geweldige keuze voor handelaren van elk niveau!

Duration

According to the elongation theory, the cycle looks like this: accumulation – growth – explosive peak – major correction – decline. After each price peak and subsequent pullback, the period of time until the next bull market increases.

It has been noted that bitcoin enters a growth phase after the halving of new block mining, which occurs every 4 years. After the last halvering in 2020, the BTC accumulation period remained in effect for several months.

Implications

Cryptocurrency correction is a common phenomenon. It brings an asset closer to its real value. Reliable assets will not be affected by a large decline in the rate, for less stable coins a trend reversal is possible. A collapse of the rate will occur only in the case of good reasons. If the decline does not occur, the further growth is more active than the previous one. Therefore, it is necessary not to be afraid of a pullback, but to understand its features for further action.

Differences between the usual market and the cryptocurrency market

Digital assets have such features:

- Volatility. Cryptocurrencies are volatile compared to the traditional stock market. Virtual money has no real value. The exceptions are stablecoins, which are tied to fiat currencies and precious metals. Digital assets are easily manipulated, leading to fluctuations.

- Duration of operation. Cryptoasset exchanges are open 24 hours a day, seven days a week. One can access all exchange sites at any time without restrictions. You can not work with them only when there is an update or technical problems.

- Lack of regulation. Stock exchanges are under control. Most cryptocurrencies are decentralized with no governing body.

- Price manipulation. Due to the lack of regulation, many things are allowed on the crypto market that are prohibited on a stock exchange. Often “fake news” is spread by large investors or organizations they are affiliated with. This can influence prices.

- Vulnerable assets. Cryptocurrency trading requires investors to hold the coins themselves. Sometimes these assets are truly vulnerable because new traders don’t know how to secure their savings.

Differences from price manipulation

Despite the complex nature of the cryptocurrency market, it can be managed. It takes a lot of money to do so. One method is known as Spoofing. It is not the only method, but it is the easiest. The more low trading volumes, the easier it is to manage. Even if bitcoin is the cryptocurrency with the highest value of exchanges, it is easier to manage its price compared to the traditional financial market. When there is a large amount of assets, large players withdraw them and then wait for participants to sell their savings due to panic.

Differences from a bear market

A crash is a sharp drop, often caused by the bursting of a bubble. It is more abrupt and volatile than a simple pullback and also often tends to last longer. A collapse is often accompanied by the entry into a decline phase of the asset in question.

Evaluating a price reversal allows you to protect your profit. To determine the market direction, technical and fundamentele analyse tools are used.

Moving averages. The indicator allows to smooth the price movement, i.e. to make them readable. It helps to detect the current or emerging trend in which the coin is developing. When the closing price is above (below) the moving average, the trend is bullish (bearish). If the price crosses the line upwards, it indicates a reversal, which is a buy signal. On the contrary, a price that is below or “breaks” the line indicates a sell.

Overbought (oversold) zones. Indicates two directions. A buy signal occurs when the price moves out of the oversold zone, a sell signal occurs when the price moves out of the overbought zone. The RSI indicator gives a signal to evaluate the reversal.

Dodgy candles are candles with a small body compared to the total size.

The table summarizes the possible actions of a trader.

| Candlestick character | Possible market behavior |

|---|---|

| In case of bullish movement candlestick with a high wick upwards | Probability of transition to bearish market behavior |

| In a downtrend, a candlestick with a large lower wick. | Prerequisites for a bullish reversal |

| Dodge in the middle in a bullish or bearish trend | Possible market reversal |

Pi Cycle Top indicator is a tool that identifies bitcoin highs, correction and market reversal.

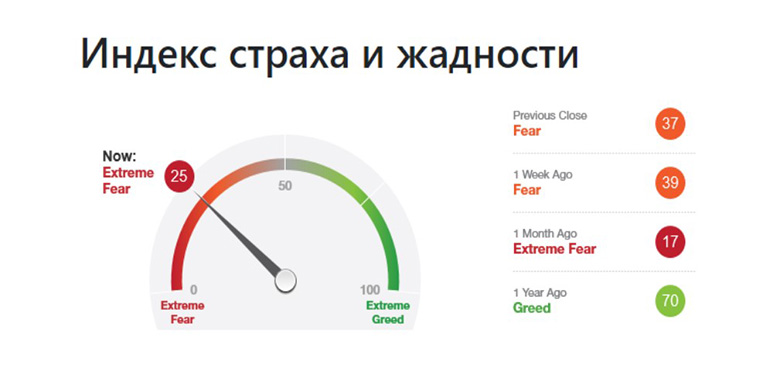

Greed and Fear Index. It shows investors’ expectations and their willingness to take risks. If the mark is in the red zone at 10, 15 points, it means strong fear. From here you can predict how market participants will act. They buy assets on fear and sell on greed.

Fundamental analysis. It is necessary to study the news, as well as information that affects the behavior of players.

How to determine the correction

An important advance in the development of technical analysis that can help predict a correction is the Dow Theory. The principles of price action presented in it are as follows:

- Prijs takes everything into account.

- Demarket has 3 types of behavior.

- A trend has 3 phases of formation.

The theses underlying the definition of a pullback are controversial. Nevertheless, these principles can be characteristic of cryptocurrency markets as well.

Technical and graphical analysis is widely used, including various indicators. For example, support and resistance levels are used to predict when consolidation or price reversal may lead to a pullback.

Stock-to-Flow models (stock-to-growth ratio) show the change of up and down cycles and whether the trend remains bullish.

Bitcoin Correction

Bitcoin was worth over $64k in April 2021 due to events surrounding Tesla and Coinbase. Ilon Musk’s announcement of a US$1.5 billion purchase of the digital coin, as well as the IPO of the largest cryptocurrency US exchange, sparked massive interest. The market reversal was further influenced by other important events:

- The ban in England of Binance, the largest crypto platform.

- Restriction of mijnbouw in the territory of China.

- Statements by influential individuals.

The restriction of mining in China reduced the speed of transactions as the network adapted to the new processing power. It was also accompanied by a drop in prices. Bitcoin lost 13% of its value in just one day on May 19. China’s position may be adopted by other countries.

Also in recent months, Ilon Musk has repeatedly influenced the rates of major cryptocurrencies with statements. Due to his frequent changes of strategy, he has lost credibility. Nevertheless, his statements are still influential.

Among the more positive news is the granting of bitcoin the status of official currency in El Salvador.

The correction process on the exchange

In theory, assume a 10% change in the price of an asset during a pullback. In practice, since the volatility of the cryptocurrency market is significant, it can reach 50%. Therefore, when determining corrections, you need to take into account the changes in the coin’s exchange rate and its behavior.

What to do in case of correction

Actions that can be taken when a pullback occurs:

- Analyze the situation.

- Estimate the duration of the pullback.

- Use technical analysis with its tools.

The strategy of market behavior may depend on the amount of savings, the type of assets, the trends taking place, the forecasts and the character of the investor.

A clear understanding of the actions according to the plan is necessary:

- Earning on a correction or waiting for a reversal.

- Selling coins at a specific price.

One can try to sell assets at the right time and buy back at low prices. Large investors can allocate a significant percentage of their cryptocurrency portfolio to this.

If the investment plan is to consolidate positions (buying assets), there is an opportunity to enter the market in the short term. This technique will become risky as the end of the bullish trend approaches.

When a participant decides to invest, they should not chase only short term results, you need to consider the long term perspective. Returns are not linear, so short-term downturns should not be a selling factor.

Behavior of traders and investors

Trading strategies of market participants differ and depend on the situation. Investors catch the price peak before the correction and its end to enter a position. Traders seek profit from risky trading in the short term. The source of income in this case is the volatility of the exchange rate.

Investors often sell their digital assets after a strong correction, but sometimes this means that they have hit a bad moment because they miss the opportunity to recover.

The difficulty of a trader’s work during a pullback is related to calculating entry points. It is often evaluated as an intermediate ground, higher than the price of the subsequent fall. Strategies are reduced to buying an asset at a low price and selling it at a high price. When using high leverage, sharp movements in an “unplanned” direction lead to loss of savings.

Investing during the correction period of cryptocurrency

If you look at the profitability of Bitcoin, you can see that it averaged over 200% for the year. Experts believe that BTC is in a growth phase. It is important to remember the main rule of investing: the higher the yield, the higher the risk.

Cryptocurrency market today

After the total kapitalisatie van digital currencies fell to $1.16 trillion in mid-June 2021, this figure returned to over $2 trillion in August. This is the first time cryptocurrencies have traded above that level since May 2021. Bitcoin remains the most expensive digital coin. By the end of August 2021, the cost of 1 coin crossed the mark of 47 thousand dollars. Thus, the capitalization of BTC alone exceeded $931 billion.

It is difficult to accurately predict the behavior of cryptocurrencies. However, there is an increase in the purchase of “safe” coins by investment funds. There is also a growing number of retail holders who hold assets for a year or more and continue to make regular savings.

Veelgestelde vragen

❓ How do you know when a correction is over?

It can be determined using volume. For example, there was a downward movement, a slowdown and volumes for selling are falling and volumes for buying are starting to rise.

❔ Does a correction mean that it is a bearish trend?

A downtrend is defined as a 20% decline in several indices over an extended period.

⚖ Is it possible to trade during a pullback?

This is a good time for traders to enter, however, you need to analyze to determine the correct action.

🧿 How to anticipate a correction?

There are different ways to predict it: charts, technical analysis, studying information from publications and news.

📈 What does the trend of rising price lows mean?

Over the entire period of bitcoin’s existence, the low price of one BTC after each correction is constantly increasing.

Staat er een fout in de tekst? Markeer het met je muis en druk op Ctrl + Ga naar

Auteur: Saifedean Ammous, een expert in cryptocurrency-economie.