In many countries, digital currencies are not considered a means of payment. This limits their use in retail settlements. But the growth dynamics of certain assets attracts the attention of traders from the point of view of earnings. You can make profit in different ways. Short-term trading stands out. Traders often apply indicators for scalping cryptocurrencies, but this type is multifaceted. The strategy came to the sphere of digital assets from traditional finance. The idea is that all markets are the same because they are influenced by the law of supply and demand. Hence, what works with contingent stocks is also applicable in the realm of digital assets.

What cryptocurrency scalping means

The idea behind the approach is to make profits on short-term price fluctuations. Traders open many trades in a short period of time. With the cumulative result of all trading operations, the final profit can be high.

The work is conducted on short intervals, and technical analysis is often used to obtain signals. Important economic events occur infrequently. Therefore, fundamental analysis is ineffective when scalping on cryptocurrency. The idea behind short-term trading is to find limited opportunities and use them to make money.

Scalping is often confused with pipsing. But these are different approaches. Pipsing is based on earning a limited profit, which is a few pips. Scalper is aimed at maximizing the short-term but pronounced movement.

The effectiveness of the method depends on several factors:

5020 $

bonus voor nieuwe gebruikers!

ByBit biedt handige en veilige voorwaarden voor de handel in cryptocurrency, lage commissies, een hoog liquiditeitsniveau en moderne tools voor marktanalyse. Het ondersteunt spot en leveraged trading en helpt beginners en professionele handelaren met een intuïtieve interface en tutorials.

Verdien een bonus van 100 $

voor nieuwe gebruikers!

De grootste cryptobeurs waar je snel en veilig je reis in de wereld van cryptocurrencies kunt beginnen. Het platform biedt honderden populaire activa, lage commissies en geavanceerde tools voor handelen en beleggen. Eenvoudige registratie, hoge transactiesnelheid en betrouwbare bescherming van fondsen maken Binance een geweldige keuze voor handelaren van elk niveau!

- Risk to profit ratio.

- The percentage of profitable and losing trades.

- Number of trades.

There are many factors, and all of them affect the performance. Consequently, the results of different traders will differ.

Methods of earning on scalping

Strategies based on technical analysis are popular. That is, the trader focuses only on the price chart, identifying trading signals. Both indicators and elements of candlestick analysis are used.

The method appeared in the XVII century, when rice traders from Japan revealed regularities in price dynamics.

The interest to such analysis in the CIS was aroused by Steve Neeson’s book “Beyond Japanese Candlesticks”, which became a bestseller.

In 2005, a topic created by user James16 appeared on Forexfactory. The expert published Price Action approach, which became a refined version of traditional analysis. The method attracted traders’ attention and proved to be popular on Forex. However, it is also used in the field of cryptocurrencies.

Traders also use Volume Spread Analysis, which is based on the study of the dynamics of trading volumes. The developer of this approach was Richard Faycoff. The specialist identified 4 market phases:

- Accumulation

- Impulse

- Distribution

- Correction

The market is driven by 3 laws: supply and demand, cause and effect, and effort versus result. This idea was developed by Tom Williams. He wrote the book “Masters of Markets”, which became a success among traders.

Learning to scalping cryptocurrencies on the exchange with the help of technical analysis is a complicated process. It is necessary to study a lot of information and consolidate everything in practice. But technology is developing, and automatic strategies have begun to be used more often. They contain an algorithm that works mechanically. For this purpose, suitable conditions in the market are required. There are high-frequency bots that work on tick charts. Such strategies for scalping cryptocurrencies will not be effectively implemented by a person, because he will not be able to analyze a lot of information in a short time.

Different tools for scalping cryptocurrencies

There are 2 types of traders – system traders and discretionary traders. The former adhere to a clear strategy of entering, exiting the transaction. This type of trader works only in optimal conditions for their method. Discretionary traders make decisions here and now. It cannot be said that they trade without a strategy, but these market participants do not set strict conditions for opening transactions. Traders use different tools to achieve their goals.

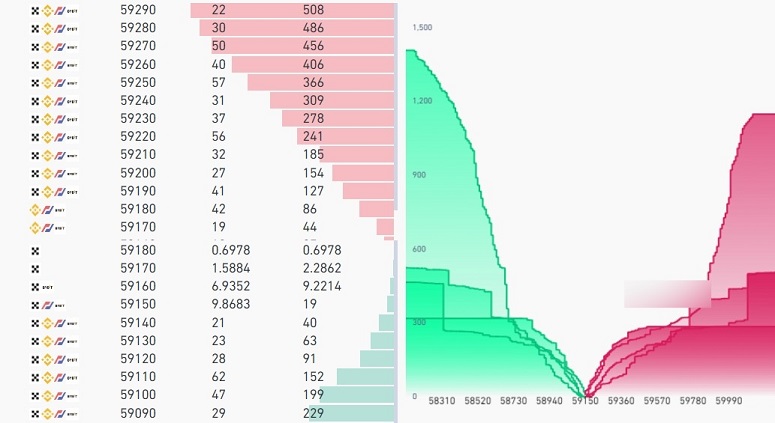

Cluster chart

The idea is to divide the market structure into systemic units. The trader gets a clearer understanding of what is happening on the chart.

A candlestick chart is shown on the left and a cluster chart on the right. In the second case, it is possible to study in detail in which range of the candlestick high and low volumes were observed. The user has information about the activity of traders, getting an opportunity to open a good deal.

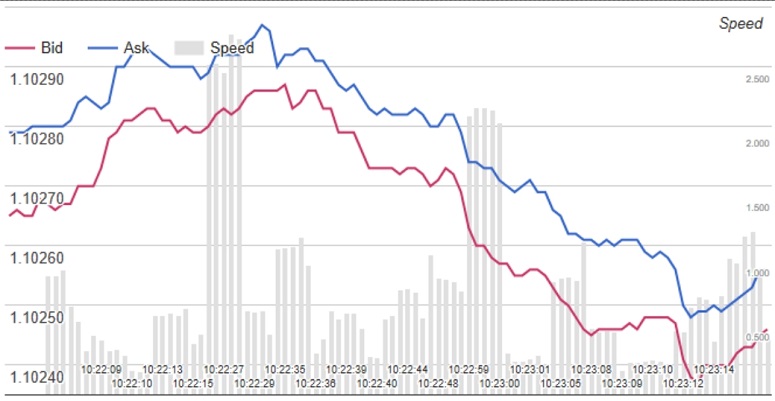

Tick chart

It is used infrequently because market dynamics change too quickly. Consequently, it will be difficult to realize the elements of technical analysis.

Such scalping of cryptocurrencies is focused on high-frequency bots. The average trader will not be able to apply it.

Exchange stack and transaction feed

These tools are related to the market depth metric. Traders use them in conjunction with each other. The Exchange Stack (order book) allows you to evaluate at what levels buy and sell volumes are formed. Market depth provides insight into the balance of supply and demand.

These tools are often used by traders. But they do not work well in isolation from assessing the market context. Traders also need to consider the overall trend and strong levels.

Using different types of orders

When buying a digital currency, a trader places an order that is executed by the market. He chooses an asset and specifies the volume of the transaction. There are 4 types of orders for this purpose:

- Limit order. Execution at a specific price.

- Market order. Execution of the order at the current price.

- Stop Loss. The price at which the deal will be closed at a loss.

- Stop-limit order. The trader specifies the level of stop-loss and limit order. This gives a guarantee that the purchased asset will be sold at a specific price.

All types of orders are used depending on the trading strategy and trader’s preferences. But stop loss is the base as it allows to limit losses effectively.

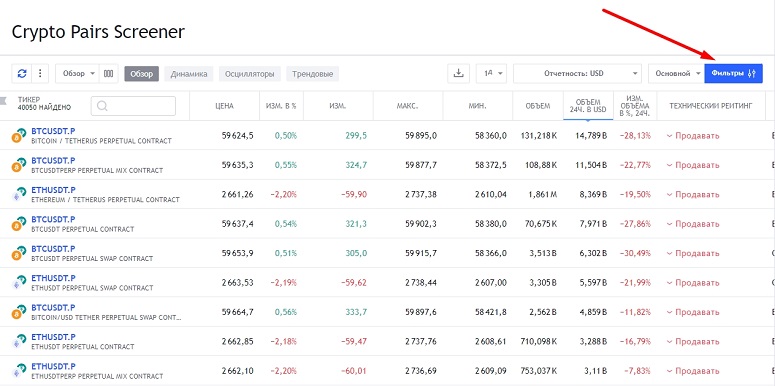

Services and robots

Traders when scalping on the cryptocurrency exchange often engage auxiliary tools – for example, screeners are popular. They online track dozens of cryptocurrencies and compare them on various factors. The TradigView screener stands out as an example. It helps the trader to select a cryptocurrency for trading according to specified variables.

In the context of trading robots, solutions with AI are becoming popular – for example, Octobot. It uses ChatGPT to analyze market conditions and open positions.

API tools

This is an application programming system that helps applications exchange data. In the cryptocurrency industry, it has become an important tool for creators of dApps.

Scalping on a chart from an exchange is difficult as timeliness is important here.

API makes it possible to link the user’s account with a third-party terminal (for example, Tigerer Trade) and receive a stream of data to work with.

Indicators for scalping cryptocurrencies

This tool refers to technical analysis, and it is popular among novice traders. Users on their basis form strategies and make trading decisions. Experienced scalpers also use them, but as a supplement.

Moving averages

This is a classic tool of technical analysis. It reflects the price dynamics for a certain time. This tool is trending, so it works well in directional price movement and gives weak signals in consolidation.

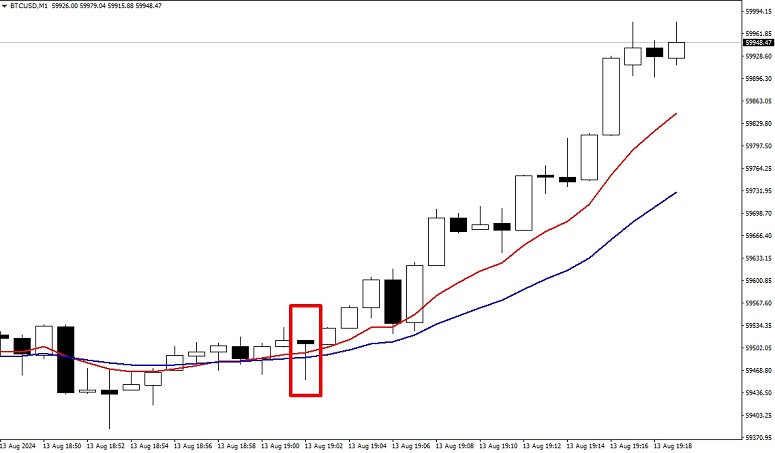

There was a crossing of two muwings. Further – their retest, on which a pin-bar was formed. Thus, there was a signal that worked out.

Relative Strength Index

The tool belongs to the class of oscillators and is especially effective in the period of consolidation. But in trend conditions, the indicator can be in the overbought or oversold area for a long time. However, RSI can also indicate divergence.

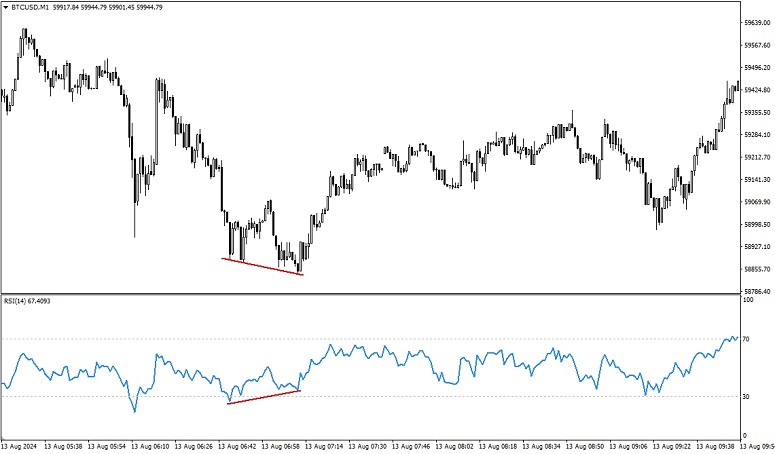

The price updated the minimum, while the Relative Strength Index was moving in the opposite direction. A bullish divergence was formed and bitcoin quotes moved upwards.

Support and resistance levels

This is one working tool of technical analysis. To build a level, it is necessary to find the point from which a pronounced price movement was formed. There is a probability that when the level is tested, the price will react to it.

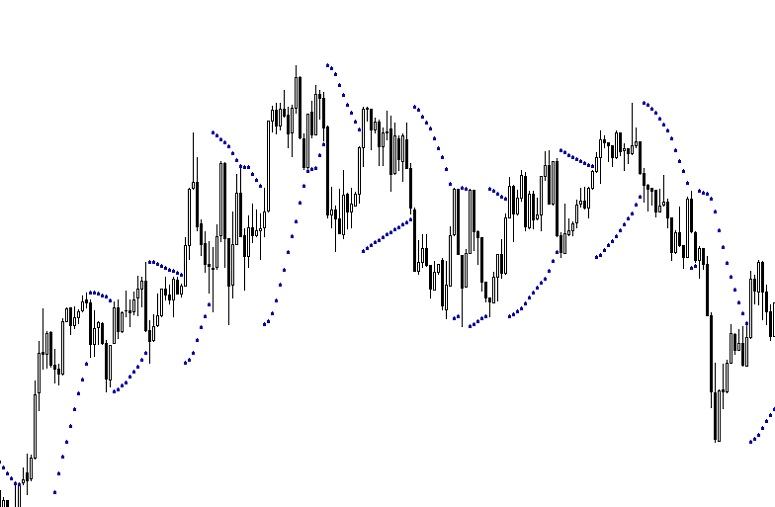

A point has been formed, in which the quotes correction has started. When retesting the level, the price moved down again. However, levels are effective together with additional factors. The trader should take into account the general trend of the market and find patterns that are formed on the areas of support and resistance.

Stochastic Oscillator

The idea of using the tool is similar to the relative strength index. Stochastic Oscillator sets signals while in the overbought or oversold zone. This works in consolidation conditions. But in a trend, false signals are formed. Also this indicator can warn about divergences.

Parabolic SAR system

The indicator was developed by Wells Wilder in 1978. It is a trend instrument with characteristic advantages and disadvantages. It signals well during the period of directional market movement, but it is ineffective in flat.

The chart shows a short-term flat. Therefore, the indicator often gave false signals.

Popular scalper terminals

Scalping on the cryptocurrency exchange is difficult, because the chart does not have the necessary tools for the trader. So traders use third-party terminals and link the exchange account to them via API. There are many such programs, but Tiger Trade should be noted. It is free and provides users with many tools for detailed market analysis.

The strong point of Tiger Trade is the simplicity of the interface. In this aspect, it outperforms competitors like CScalp or QScalp.

Varieties of strategies for scalping cryptocurrencies

Methods of active trading on the digital money market are many. The trader develops a strategy taking into account preferences, risks and market expectations.

According to the number of assets

A trading participant can focus on 1-2 cryptocurrencies. This is preferred by users who work with technical analysis. If we talk about arbitrage speculation, the trader evaluates hundreds of assets.

His task is to find profitable forks that allow him to capitalize on price differences.

For example, in “triangular arbitrage” involving three coins, one is exchanged for the 2nd, it is exchanged for the 3rd, which is overvalued relative to the 1st. At the end, the 3rd cryptocurrency is exchanged for the 1st and the user gets more assets than they had.

By volatility levels

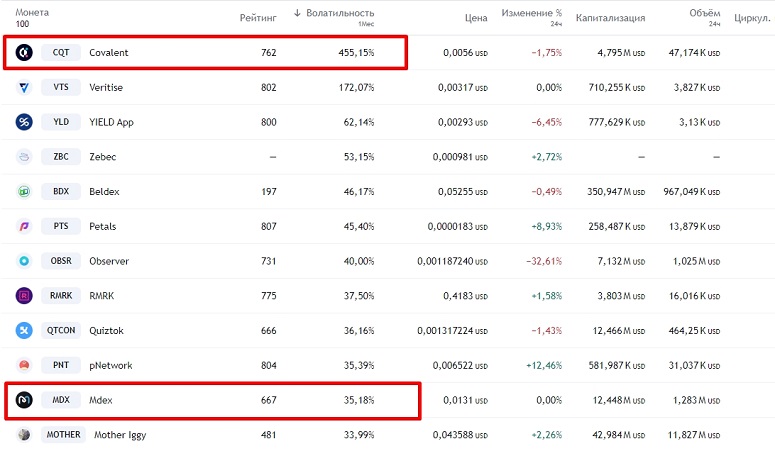

This factor signals the changes in the value of an asset over a certain period of time. Different cryptocurrencies differ in terms of volatility.

Fluctuations in the value of Covalent for a month reached 455.15%, while the Mdex – 35.18%. A speculative trader will surely choose the 1st coin.

On trend

The main idea is to capitalize on a steady price movement. Profile indicators can be used for this purpose. It is also advisable to consider levels. There is a basic property: in a trend, support becomes resistance and vice versa. An effective strategy can be built on this.

Intuitive

This is a discretionary approach in trading. Intuitive does not mean that a trader guesses at coffee grounds when making decisions. It is simply not tied to timings and can work according to the situation.

On indicators

Such strategies are popular among beginner scalpers. A trader takes several indicators that are clear to him. And on their basis forms a trading approach.

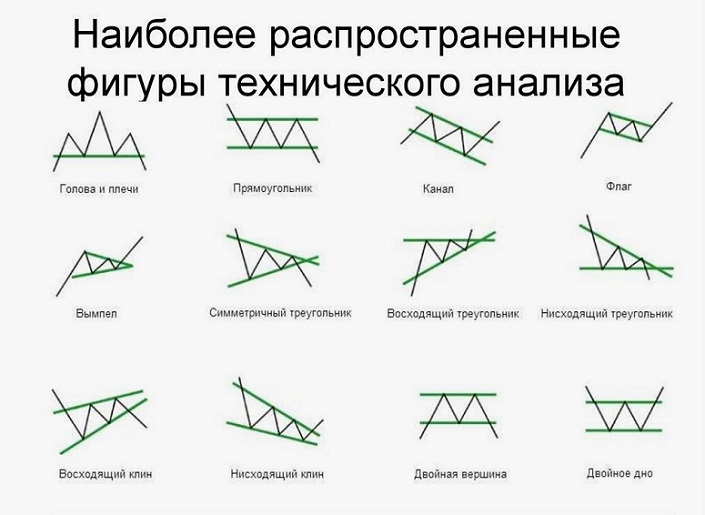

On figures

This refers to technical analysis, and is based on patterns. Price figures are many, they can be effectively realized.

The strategy works well on large intervals. It can also be used on low timeframes, but the quality of signals will decrease.

Linear strategy

This approach is based on placing orders with systematically rising and falling prices in a selected range. Let’s say a trader places buy and sell orders every $1000.

| Order | Prijs |

|---|---|

The bidder does not analyze the market. The idea behind this strategy is that the price stays in a range. The best cryptocurrencies for scalping according to this principle should have low volatility.

Exchange strategy

This is a cumulative term. A strategy that works on one exchange can be applied on another. It will also work on other markets.

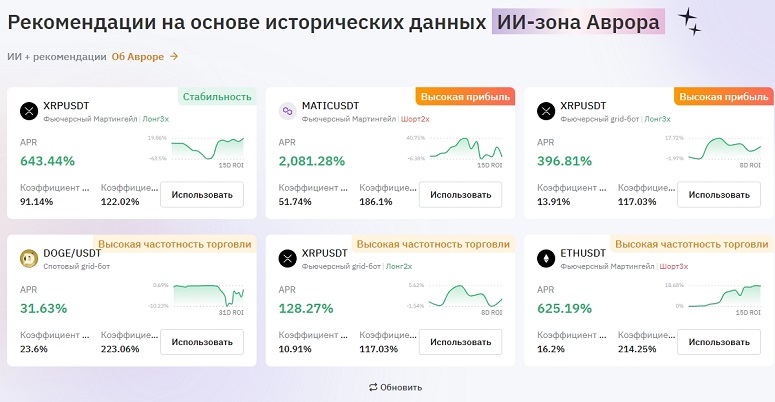

Automatic scalping

The methodology involves the use of algorithmic systems. In them, a mechanism is laid down, which is automatically activated under suitable market conditions. Many cryptocurrency exchanges offer clients such solutions in the trading tools section.

Such scalping strategies for bitcoin and other cryptocurrencies will suit novice traders. They will not need to interfere with the trading mechanism.

Top exchanges for scalping

Here it is recommended to evaluate a number of factors. For example, the speed of order processing is important for the trader. In the case of active trading, a delay of a few seconds can turn a profitable trade into a losing one. Commissions should also be evaluated, as they are a source of constant expenses. Exchanges with fast execution and low fees are optimal. These criteria are suitable:

These exchanges have high liquidity and have many tools needed by the scalper. They are also characterized by high speed of order processing with low transaction fees.

The best cryptocurrencies for scalping

Every trader is in search of something better: an indicator, a strategy, an exchange. But this is incorrect, because traders have their own views and expectations. They look at the same chart, but interpret it differently. In the context of active trading, meme tokens will work well.

For example, Shiba Inu, Bonk, Floki Inu, Pepe. These assets have a low price with high liquidity. Dogecoin should not be forgotten. This is the flagship of this segment. However, to choose a cryptocurrency for scalping, you need to consider your goals, experience and opportunities.

In which markets can scalpers trade

This approach is unrealizable except on bonds due to the specifics of the instrument. A scalper is able to work with stocks, futures, indices, commodities, options and cryptocurrencies. The market is subject to the law of supply and demand. Therefore, this approach can be applied everywhere.

Risk Management in Scalping

Effective trading is based on three variables: strategy, money management and discipline. These are links in a chain that are closely related. Risk management is important in scalping cryptocurrencies, because with an effective strategy and discipline, in the absence of money management, the trader will lose money. Initially, it is recommended to pick a type of margin:

- Cross. The entire deposit is used as collateral for the transaction.

- Isolated. The trader risks the initially set percentage of the capital.

It is necessary to remember about stop-loss, as it has proved to be an effective tool for risk limitation. It is worth considering the ratio of threats and profits. If a trader risks 1% of the deposit in each transaction to earn 4%, then in the long run he will profit in difficult market conditions.

Tips for users

This is a working strategy. But it is difficult to implement. In the context of tips, we can emphasize the following:

- The work of a scalper requires diligence.

- Strategy, money management, and discipline are the way to effective trading.

- At first, you should focus not on money, but on gaining experience and honing skills.

- You should avoid important news, as the market becomes volatile during these periods.

- You should always set a stop loss.

- No confidence in the deal – no entry.

- You should not be in a hurry.

Scalping is a complex methodology that requires experience, skills and knowledge. It can take a lot of time to acquire them.

FAQ

❓ Is it realistic to learn this approach in a month?

It is possible to work out the theoretical basics. But you need knowledge that is backed up by practice. This comes only with time and experience.

⚖ Which candlestick formations are preferable?

They all work under certain conditions. But the pin bar and the engulfment pattern are considered the strongest.

💰 How much money do I need to start?

There is no limit. Profits and losses will be commensurate with the starting capital.

🤖 Is P2P arbitrage related to scalping?

To a certain extent. But it is based on analyzing the price chart.

🏛 Does it make sense to use Martingale?

There are no restrictions. However, this approach excessively increases risks.

Fout in de tekst? Markeer het met je muis en druk op Ctrl + Enter.

Auteur: Saifedean Ammous, een expert in cryptocurrency-economie.