Bitcoin is the strongest and most independent asset in the crypto market. It is noticeable that BTC is not backed by anything and is not tied to any national economy (unlike fiat currencies). The lack of centralized control gives the right to believe that the bitcoin rate depends only on supply and demand. However, the factors affecting the first cryptocurrency are significantly more.

What the bitcoin rate depends on

To make money on the bitcoin rate, you need to understand what events lead to changes in its value. Not all economic models are relevant when it comes to cryptocurrency. The price of bitcoin depends on many different factors:

- Recognition of digital money at the state level.

- The activity of large financial organizations.

- Information background.

- The economic and political situation in the world.

- Emergence of new ways and tools of calculation (altcoins, DeFi).

Demand

The global rate of cryptocurrencies depends on the value of BTC. Therefore, it is important to be able to assess the features that affect its value. The following factors determine the demand for bitcoin as a means of payment or investment:

- Financial efficiency – commission on transfers and their speed. The ability to make transactions from anywhere in the world.

- The number of services where BTC is accepted as a means of payment or as a resource for exchange.

- Privacy – no personal information remains in the blockchain during a transaction, only anonymous addresses.

- The ability to convert bitcoin into fiat money.

Supply

An important factor that determines the amount of BTC in circulation is the volume of issue. This indicator in bitcoin is fixed: 21 million coins will be issued.

New koins appear thanks to the work of miners. Their activity is also necessary to confirm transactions.

Over time, the rate of appearance of new blocks decreases. In addition, every 4 years there is a halving – a decrease in remuneration to miners in 2 times. The last time this happened was in 2020. Since the time to determine each block is equal to about 10 minutes, the emission of coins decreases. It is also believed that about 30% of the total bitcoin pool is stored in lost wallets.

5020 $

bonus for nye brukere!

ByBit gir praktiske og trygge forhold for handel med kryptovaluta, tilbyr lave provisjoner, høyt likviditetsnivå og moderne verktøy for markedsanalyse. Den støtter spot- og leveraged trading, og hjelper nybegynnere og profesjonelle tradere med et intuitivt grensesnitt og opplæringsprogrammer.

Tjen 100 $ i bonus

for nye brukere!

Den største kryptobørsen hvor du raskt og trygt kan starte reisen din i kryptovalutaverdenen. Plattformen tilbyr hundrevis av populære aktiva, lave provisjoner og avanserte verktøy for handel og investering. Enkel registrering, høy transaksjonshastighet og pålitelig beskyttelse av midler gjør Binance til et godt valg for tradere på alle nivåer!

As of August 27, 2021, 89% (18,791,625 BTC) has been released into circulation. The last coin will be mined in 2140.

Consequently, the supply of BTC on the markets is formed by holders of already issued coins, and the inflow of new coins is insignificant.

This situation avoids strong inflation, which could arise as a result of over-issuance of cryptocurrency.

Cost of production

Bitcoin is a virtual asset, but each new coin requires investment.

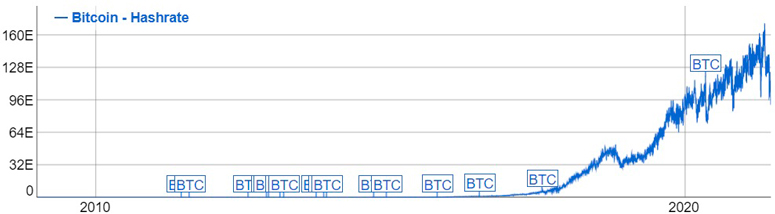

The main expense in BTC gruvedrift is the high energy costs, as the very essence of mining is solving a complex problem. The more people involved, the higher the total power of the network, but the complexity of the calculations also increases.

Depending on the price of electricity, the cost of BTC mining is in the range of 12-21 thousand dollars (as of August 2021). If we are talking about mass mining (on mining farms), it is worth considering the cost of equipment and setting up the infrastructure.

Competition with altcoins

Bitcoin holds the first place in the cryptocurrency market as the most popular and most secure asset, and this will not change in the near future.

However, the entire digital asset industry is in its infancy. New technologies and types of symboler are emerging. Therefore, in time, it is possible that altcoins will be able to compete in the market with Bitcoin.

Already now analysts claim that BTC is not the best tool in terms of blockchain technology, and some altcoins are more suitable for the role of “digital gold”.

The “Market Dominance” index is useful in this matter. It refers to a coin’s share of the total mass of cryptocurrencies.

As of August 22, 2021, bitcoin’s market dominance is 43.94%. The same figure for ETH (2nd place in kapitalisering) is 18.21%.

A factor that may affect the competition process is the introduction of DeFi, which utilizes the Ethereum blockchain. Consequently, altcoins will be in higher demand, which may affect the price of BTC.

Government regulation

One of the main aspects of cryptocurrency is its anonymity and lack of governance. Any attempt by the government to control the distribution, use or circulation of bitcoin will affect its price.

There is no general consensus on this issue in the world. Some countries recognize Bitcoin as a means of settlement in financial transactions, while others prohibit it:

| Countries where Bitcoin is allowed | Countries that have banned BTC |

|---|---|

| Switzerland | China |

| Belarus | Vietnam |

| Canada | Ecuador |

| Japan | Bolivia |

| Germany | Iceland (only mining is allowed) |

Some states do not yet have clear legislation regarding cryptocurrency. In the US, for example, there is a noticeable conflict between jurisdictions. The SEC classifies bitcoin and other cryptocurrencies as securities, while the CFTC treats digital currency as a commodity. In Australia, BTC is officially considered property, and transactions involving it are barter.

Availability of BTC on exchanges

Transactions taking place on trading platforms (Coinbase, GDAX) differ little from similar actions on securities exchanges.

The availability of bitcoin on such platforms is related to the growth of prices. The less supply, the greater the scarcity, and thus the higher the rate.

Pumping

Artificial increase in the rate of BTC. The name is taken from the English pump – “to inflate a bubble”. The bitcoin rate is affected by the fact that when buying coins in large volumes, the price of bitcoin increases sharply. After reaching the planned peak, dumping follows: pampers sell assets at the maximum price, making a profit.

Since this action is expensive, it is started by collusion of several large traders. Influential investors who have a lot of coins are called “whales”.

This is not a new technology on the stock exchange. A similar strategy was already used in the U.S. market for stocks of small-capitalization companies in the early 2000s.

Futures

A relatively new financial instrument for the cryptocurrency market. It represents a contract to buy bitcoin in the future at a fixed (at the time of the transaction) price.

It was first used on December 10, 2017. CME Group (the largest financial derivatives market in the US) launched bitcoin futures trading. Analysts believe that this event brought large investors to the market, thus raising the index of confidence in virtual currencies.

A distinction is made between delivery and settlement contracts. In the first case, the seller sends the cryptocurrency to the buyer on the completion date of the transaction at an agreed price. Settlement bitcoin futures are closed without transferring the subject of the transaction. There is a monetary settlement in the amount of the difference between the contract price and the value of the asset on the date of execution.

Traders use “leverage” during transactions. This mechanism allows you to work with borrowed funds.

Bitcoin futures transactions are often used as a hedging tool (insurance against financial risks). A variant of speculation on volatility is also possible. Experienced traders who are skilled in technical analysis and are able to predict changes in the exchange rate of the coin can earn in this way.

Hard Fork

The rise and fall of bitcoin depends on the stability of the source software. Situations arise when changes need to be added to the blockchain code. In such cases, the users of the network must come to a common decision. If part of the miners do not agree with such a correction – they continue to support (mine coins, confirm transactions) the original chain. And on the basis of the modified blockchain, a new cryptocurrency is formed. Such a process is called a hardgaffel.

Such events affect the value of the cryptocurrency:

- Holders of coins of the basic chain after the hardfork receive the same number of new tokens, and the miner with software will be able to use 2 addresses for mining. This leads to an increase in capitals. Therefore, investors who know about the upcoming blockchain change start buying up the original cryptocurrency en masse, which leads to an increase in price.

- The community is divided. As a result, the number of users, and thus the support of the network decreases, which also affects the fluctuation of the BTC exchange rate.

Bitcoin, as the first cryptocurrency, went through hardforks more than others. Most of the coins that appeared turned out to be unsuccessful solutions (SBTC, BTU and others), although there were exceptions:

- Bitcoin Cash. The hardfork took place after the SegWit protocol update. Some users stayed on the old version of the blockchain, changing the block size to 8 MB.

- Bitcoin Gold. To increase the decentralization of the network, the coin was moved from the SHA-256 algorithm to Equilash.

- Bitcoin Diamond. The project uses the X13 algorithm. The emission was raised 10 times and retained support for SegWit and the 8 MB block.

These coins could not compete with the main currency, but the projects turned out to be promising. According to the website CoinMarketCap, they are ranked 12th, 84th and 124th, respectively, on August 22, 2021.

Information hype

The growth of the BTC rate is influenced by the news background. Reports about hacking crypto exchanges, banning mining in a particular country, even a simple opinion expressed by a recognized expert can significantly shift the price bar of the cryptocurrency.

The peculiarity of this volatility factor is that it cannot be predicted. It is impossible to predict which news or statement of a famous person will change the BTC rate.

For example, the statement of Ilon Musk (in May 2021) that Tesla will not accept bitcoin as payment for its cars led to a 10% drop in the rate. At the same time, the news that El Salvador recognized BTC as a means of payment (a month later) had almost no effect on the price of the main cryptocurrency.

Speculation

Making money with bitcoin is based on 2 main strategies:

- Investment. A person invests in a cryptocurrency asset, expecting that in the future it will rise in price. Such actions do not imply much activity.

- Speculation. Buy as cheaply as possible, and sell expensively. Since decentralized currency is not limited by regulations, and its market is relatively small, traders have a chance to use BTC price spikes to enrich themselves.

According to analysts, speculators are one of the main reasons for the volatility of the main cryptocurrency’s exchange rate.

Halving

In the blockchain was originally laid down a condition that halves the reward for miners after mining 210,000 blocks (approximately every 4 years). Such an event was called halving, and it has happened 3 times in bitcoin’s history. The last one was on May 11, 2020, when the payment dropped to 6.25 coins per block.

The decrease in issuance should curb inflation of the digital currency.

Studying the change in the bitcoin exchange rate after the halving, it can be seen that there is a significant increase in the price of the coin within 18 months.

At the same time, experts in economics and technical analysis observe a pattern in the fluctuation of the BTC price depending on the time that has passed after the halving or the time left until the next “halving”.

What bitcoin is secured by

The main crypto has no guarantees in the form of physical assets. No government affects the liquidity of virtual currency. BTC are lines of code that people exchange with each other. This is the opinion formed by people who do not trust blockchain money.

All these statements are true, only the conclusions are incorrect:

- Due to limited issuance, the coin is not subject to inflation.

- Cryptocurrency cannot be counterfeited.

- The demand for bitcoin is growing. As of October 2020, its audience exceeded 101 million people (data from the University of Cambridge).

- The financial efficiency of BTC is often higher than that of fiat money.

- Since 2011, it has been the most profitable asset in the last 10 years.

Therefore, the real security of the koin is the willingness of people to use the cryptocurrency and accept payment in it.

When evaluating digital money as a financial instrument, it can be seen that it is secured by the demand for the technology itself and the credibility of the coin.

Why the value differs on different exchanges

The price of bitcoin, presented on any cryptocurrency exchange, is formed from the ratio of supply and demand at a particular moment. If a small number of BTC coins are put up for trading – the price begins to rise until market saturation. Then comes the “correction” and the rate goes down until it reaches the balance point. But within a small period of time, the cost of bitcoin on a particular exchange will differ from the average.

Such factors also play a role:

- The exchange’s place of registration. The rules of some platforms have restrictions on serving traders from certain countries. For example, Binance does not verify accounts from Belarus.

- Sometimes you can observe a divergence in the price of BTC depending on the currency to which it is traded. Example – ETH/BTC $48,112.32 and LUNA/BTC $48,079.31 (price from 25.08.2021 Binance exchange).

The method of trading, where the difference in rates on exchanges is used – “Arbitrage”.

How to predict the price change

The cryptocurrency market is relatively new and is subject to large fluctuations. Many economic laws used for fiat money do not work well or are not applicable in this sphere at all. It is very difficult to confidently predict the change in the BTC rate.

There is no reliable algorithm, there are only general recommendations:

- Keep an eye on the activity of pampers. Large players stimulate the growth of the rate of digital currency to create favorable conditions for themselves. If you identify the stage of the pampa in time, you can sell your own assets at the maximum price.

- Tracking economic and political news. For example, the factors affecting the Bitcoin to dollar exchange rate depend on the laws passed in the US or China. Publications about supporting or banning the cryptocurrency can affect the price.

- Technical analysis plus working with resistance and support charts. One of the most challenging as it requires a lot of experience and specialized knowledge.

- Technical information and blockchain news. Knowing how the coin’s exchange rate behaved during past halwings, you can try to determine its development. The same applies to information about upcoming forks.

The future of Bitcoin

Since the very beginning of 2021, bitcoin’s popularity has peaked. Thousands of forecasts from experts about the further development of BTC have appeared.

As usual, the opinions of experts and analysts differ greatly. Someone predicts the imminent demise of the project, in place of which will come new, more perfect altcoins. Other experts point out that traditional venture capital companies and large hedge funds have started to invest in the electronic currency.

This is an indicator of reliability and stability, which means that BTC will retain its status as the main cryptocurrency.

Ofte stilte spørsmål

✅ Will long-term investment in bitcoin help avoid inflation?

According to analysts, BTC as a means of saving is the most reliable instrument compared to the dollar or euro. Using it, you can not only protect your money from inflation, but also count on profit.

❓ Is it possible to mine bitcoin on your own?

In 2021, the profitability of mining has changed a lot. To get even a small result requires a substantial investment in equipment. Therefore, bitcoin mining is now practically inaccessible to ordinary users.

💵 How to convert bitcoins into regular money?

You can sell cryptocurrency for fiat and transfer to a card with the help of crypto exchanges or exchange sites.

❓ What is TXID?

It is a unique transaction number in the blockchain. For example, if you make a transfer from one wallet to another, then, knowing the number, you can get all the data about this transfer.

⛔ What should I do if I sent BTC to the wrong wallet address?

Transactions in the network are irreversible, so bitcoins will be lost. You can get the coins only if the owner of the wallet is known.

Er det en feil i teksten? Marker den med musen og trykk på Ctrl + Kom inn.

Forfatter: Saifedean Ammous, en ekspert på kryptovalutaøkonomi.