Etherium (Ethereum) is among the top popular cryptocurrencies – in August 2021, it ranks second in kapitalisering after bitcoin. This is the name of the coins themselves and the platform for creating online services based on blockchain. The platform works on the basis of smartkontrakter (algorithms for the formation and control of digital information) and is implemented as a decentralized independent virtual machine. The history of Ethereum will familiarize you with the features and advantages of the project, its future, as well as the prospects of investing real funds in it.

The main features of Ethereum

Initially, Ethereum was created as an affordable platform for the introduction and distribution of blockchain technology in various projects. Later, a payment system of the same name emerged on the basis of the decentralized algorithm. The fast performance, reliability and multifunctionality of the network attracted the attention of global corporations IBM, Microsoft, as well as Russian companies such as VTB and Sberbank.

The history of the Efirium cryptocurrency began in 2013, when Vitalik Buterin – a Canadian-Russian programmer – created this digital currency and launched a network based on it. The coin quickly became the world’s second most capitalized currency after bitcoin. It is difficult to track the exact increase in value from the launch to the current moment (August 2021), as the exchange rate is constantly changing, but the approximate figure is 234,000%.

ETH has fundamental differences from other virtual coins and from its main competitor – BTC.

Features of ether:

- The role of cryptocurrency is not limited to payments – based on the platform, you can exchange other resources or register transactions using smart contracts.

- Ether is a publicly accessible database where you can store any digital transactions indefinitely.

- Key management systems are not needed to maintain the platform – instead, a framework in which individuals perform peer-to-peer transactions works.

- The Efirium blockchain, unlike Bitcoin, is able to rebuild itself in the current moment without the need to save data, which speeds up its operation.

- The issuance of ETH coins is not limited – this is another fundamental difference from BTC.

Efirium became the world’s first coin with infinite issuance. At one time, such a solution from the developers made a real furor and made the cryptocurrency unique.

5020 $

bonus for nye brukere!

ByBit gir praktiske og trygge forhold for handel med kryptovaluta, tilbyr lave provisjoner, høyt likviditetsnivå og moderne verktøy for markedsanalyse. Den støtter spot- og leveraged trading, og hjelper nybegynnere og profesjonelle tradere med et intuitivt grensesnitt og opplæringsprogrammer.

Tjen 100 $ i bonus

for nye brukere!

Den største kryptobørsen hvor du raskt og trygt kan starte reisen din i kryptovalutaverdenen. Plattformen tilbyr hundrevis av populære aktiva, lave provisjoner og avanserte verktøy for handel og investering. Enkel registrering, høy transaksjonshastighet og pålitelig beskyttelse av midler gjør Binance til et godt valg for tradere på alle nivåer!

Table of differences between BTC and ETH.

| Comparison criteria | Bitcoin | Eter |

|---|---|---|

| Concept | Virtual money | Platform for implementing decentralized applications |

| Transactions | Direct format | Via smart contract |

| Founders | Anonymous (Satoshi Nakamoto) | Vitaly Buterin and his team |

| Release | January 2009 | July 2015 |

| Utgave | Limited (21 mln coins) | Unlimited |

| Block formation time | 10 minutes | 15 seconds |

| Source | Gruvedrift | Mining, staking |

ETH exchange rate dynamics

Since the launch of the project, the price of ether has been constantly growing. If in December 2015 it was $0.85 per coin, then at the beginning of August 2021 it is at $2,490. The maximum value was recorded in May 2021 – it reached 4300 dollars.

Exchange token rate

What affects the growth of the price

Like all other cryptocurrencies, ETH is subject to high volatility. This property makes virtual money such a highly profitable instrument for speculators. In a day, the price can fall several times and rise again, which is what traders who play on the dynamics take advantage of.

Price changes are influenced by hundreds of factors – from publications in the media to changes in the legislation of certain countries:

- The value of bitcoin. The state of the world’s first cryptocurrency affects all other assets. If BTC goes up, most of the other altcoins grow as well. Synchrony in the change in the prices of ether and bitcoin is noted.

- Primary placement of coins. The emergence of new projects affects the interest of investors in the main cryptocurrency assets.

- Innovations. Announcements of platform hardforks also lead to a surge in exchange activity and affect the price. New tools for decentralized programs increase the value of assets.

- Changing transaction speeds. Fresh software solutions that speed up currency transactions contribute to the upside of the value.

- China’s cryptocurrencypolicy, US elections and other events of global significance.

- Participation of official banking structures in cryptocurrency transactions. In 2021, the Bank of France calculated digital bonds on the Ethereum blockchain, which was reflected in exchange quotations.

- Updates. After the Berlin softfork (making changes to the platform code), transaction fees within the system decreased – another growth factor.

- Predictions of famous analysts. Even if they do not come true, a temporary investment surge is reflected in the price dynamics.

According to cautious forecasts, no cardinal drops in exchange value are expected in the near future, but with cryptocurrencies, there is no complete certainty in the price dynamics.

It is most reliable to buy digital currency on exchanges recommended by the official Ethereum platform.

Ethereum history by years

The first 8 years of Ethereum’s existence are full of important events in the development of the project. The most significant of them are considered by year.

2013

Etherium appeared in 2013, but everything started a little earlier, when in 2011 Vitalik Buterin’s father told him about the newly created bitcoin. The future billionaire conducted a study to assess the state of affairs in the world of virtual money. At that time, crypto was such a radical idea that many were sure in the soonest possible ban of BTC at the legislative level. However, it turned out differently – the new money became incredibly popular.

Vitalik Buterin saw serious potential in cryptocurrency from the very beginning, which was the impetus for the creation of his own blockchain. According to the developer’s idea, the new network was to become a platform on which other services could be built – payment, gaming, and business.

The White Paper (a detailed description of the project) was presented in 2013. Vitalik chose the name thanks to Wikipedia. According to him, the word “ether” reflected the essence of cryptocurrency as accurately as possible – it means the medium in which light and other waves in the universe can travel. At the age of 19, Buterin dropped out of university to work closely on the new blockchain. The work was done with several co-founders.

Funds to make the idea a reality were raised through crowdfunding – people sent bitcoins in exchange for ethers. So 30,000 BTC (about 18 million dollars at the time) was collected.

2014

In this year, Ethereum Switzerland was founded in Switzerland. The country was not chosen by chance – here the most liberal laws in relation to virtual currencies and a lot of potential customers. In particular, Buterin was financially supported by a large investor Peter Tal, one of the founders of PayPal. In addition, the creator of the new blockchain won the World Technology award.

At the developers’ meeting in December, ether technologies were discussed, including new ideas in the sphere of security and scaling of the project. Many of the innovations proposed at the conference formed the basis of the system.

2015

The Ethereum network was launched in 2015 as the initial version of the Frontier platform (in March). The decentralized system for the development of multiple applications and the use of smart contracts operated at high speed, but did not provide any guarantees to users regarding security. Users began mining the first coins by gruvedrift.

By August, the first 100,000 blocks had been generated. In September, a trial version of Ethereum Wallet appeared, and later the official wallet was launched.

The developers’ conference in London discussed scientific research and social context in the use of cryptocurrency. Participants made their predictions about the future of the platform. Representatives from IBM and Microsoft were present at the event as sponsors.

2016

In March, the first stable release of the network came out. The developers officially declared it secure. However, in May, the decentralized autonomous organization had its ethers stolen in a hacker attack with a total value of $50 million. This led to a sharp collapse in the value of the coin.

During this period, the platform came under intense media pressure. The result was the separation of the unified system into two separate projects – Ether and Ether Classic. After the hardgaffel (a radical change in the algorithm of operation), the network was cleaned from the consequences of attacks. This led to a stabilization of the value.

In the same year, Vitalik Buterin came to Russia for the first time since leaving for Canada 15 years ago. He met with representatives of the Central Bank to discuss the prospects of blockchain in the global financial system.

2017

In January, the value of ETH was $8.05, and the market capitalization reached 700 million. Already by spring, the price doubled, and then reached $100. First in the test, and then in the main network produced a hardfork called Byzantium – the first part to address the issue of scalability and the introduction of private transfers. Another developer conference was held in the fall.

2018

In February, the team announced the launch of a new Go Ethereum client service called Iceberg. The modified version eliminated all the bugs of the previous development and added about 170 newest options.

The value of ether reached $1,000.

2019

Several upgrades were carried out to switch to the new protocol and cancel the previous mining scheme. The launch of Metropolis: Constantinople took place in February. It prepared for the innovative for the platform transition to the PoS-protocol “Casper”. Thus, the former mining scheme was canceled, which reduced the time of finding a block from 21 to 13 seconds – this is the minimum figure for the entire existence of the network.

The next update “Istanbul” took place in December. Among the main tasks was to work out the compatibility of the etherium blockchain with the Zcash cryptocurrency. Modifications touched on the scalability of the network and increased protection against hacker attacks.

2020

In December, the largest update took place, after which the platform entered the preparatory period of testing Ether 2.0. The PoS algorithm was tested before a large-scale transition to the new mining scheme.

2021

In February, a new hardfork was released under the codename HF1, the purpose of which was to support “light” clients of the platform, who use mostly smartphones to enter the network.

The negative dynamics of bitcoin value, caused by the ban on mining farms in China, inevitably affected the value of all global virtual currencies. The price, after a record soaring to $4,300, declined in May and June. The new growth began in the run-up to the London Fork.

Ethereum 2.0.

The protocol update took place on August 4, 2021. The London modification will ensure the transition to a fundamentally different PoS consensus. It involves abandoning mining as the source of network operation.

The driving force will be staking – storing user coins on the block. Owners will receive passive profit for this. This model makes it possible to mine new blocks without large computational costs.

According to Buterin, version 2.0 will be more environmentally friendly – it will radically reduce energy consumption and hydrocarbon emissions. The “London” hardfork will update not only the mining scheme, but will also affect the cost of transactions, as well as the processing of contracts.

Future and prospects

The platform is far from exhausting its capabilities in terms of providing smart contracts. The initial goal was precisely to automate and simplify any online transactions. In the future, intermediaries in the form of banks will be completely eliminated, as well as the influence of the human factor on financial transactions.

The founder of the project is seriously interested in the issue of life extension. Buterin donated 2.4 million dollars to a thematic research foundation dealing with the problems of overcoming aging by engineering methods.

ETH appeared only in 2013, but already has the status of a legendary project. The type of decentralized network proposed by the programmers may become the foundation for blockchain technologies of the future.

According to analysts at Fundstrat Global Advisors, in late 2021-early 2022 the value of altcoin will grow to 10.5 thousand dollars.

Ofte stilte spørsmål

❗ What is more reliable in terms of investments – bitcoin or ether?

Most analysts talk about the equivalence of these two assets. However, in the long run, some experts are leaning in favor of ETH, especially with the launch of the new version 2.0.

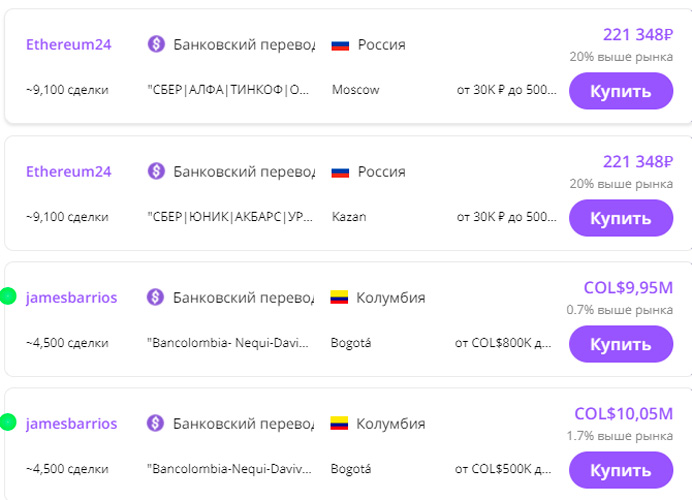

❔ How to buy Efirium?

The easiest way is to buy on exchanges like Binance and FTX. Alternatively, you can buy altcoin directly from the owners on online auctions and trading platforms. There are also exchange services where you can convert fiat (real) money and other assets into altcoins.

👛 Where to store coins?

The most affordable option is an etherium wallet on a blockchain, such as Metamask, MyEtherWallet. Such services guarantee safe storage of both the ETH currency itself and other altcoins based on it.

✅ How to choose an exchange for exchange operations?

Reliability and functionality of the platform for transactions determine the success of cryptocurrency investments. The main factors in the choice are the size of the commission for transactions, availability, reputation and user reviews.

⛔ Can I store sensitive data online?

Efirium is a public system where you can’t store passwords and other sensitive data.

🤔 What are the disadvantages of ETH?

Unlimited issuance is partly an advantage of the platform. But in the long run, it’s a serious problem. To protect assets from inflation, developers will have to take some kind of restrictive measures.

Er det en feil i teksten? Marker den med musen og trykk på Ctrl + Skriv inn

Forfatter: Saifedean Ammous, en ekspert på kryptovalutaøkonomi.