The start of 2023 has been optimistic, especially when compared to the global economic recession of the pandemic period. The digital coin market is also at a turning point after a difficult 2022. Among the most distinguished participants are the perpetual cryptocurrency leader Bitcoin, the sidechains Arbitrum and Optimism, as well as NFT-sector projects. They were largely helped by external financial support from major market participants.

The relaxation of policies on cryptocurrency assets within Hong Kong has been particularly influential. This allowed external investments to enter the promising jurisdiction. Domestic projects received publicity and a significant increase in the price of tokens.

On the other side of the ocean, regulators chose the opposite tactic. Part of the US Federal Reserve’s (Fed) tightening was due to rising inflation.

In early March, the cascading collapse of 3 US banks – Silvergate, Silicon Valley Bank and Signature Bank – led to further “tightening of the screws”. Loud liquidations caused short-term panic in the market and radical measures on the part of regulators.

In recent years, the Fed has been issuing additional money supply to maintain the level of interest rate on loans. Banks took advantage of this and bought up U.S. Treasuries during times of excess liquidity. In March 2023, the regulator raised the rate. Against the background of what happened, private financial institutions became hostages to the situation. Securities depreciated and led to a liquidity shortage.

As of March 2023, the Fed increased the interest rate by 450 basis points (+4.5%). This allowed the government to receive increased income from Treasury bonds.

5020 $

bonus for nye brukere!

ByBit gir praktiske og trygge forhold for handel med kryptovaluta, tilbyr lave provisjoner, høyt likviditetsnivå og moderne verktøy for markedsanalyse. Den støtter spot- og leveraged trading, og hjelper nybegynnere og profesjonelle tradere med et intuitivt grensesnitt og opplæringsprogrammer.

Tjen 100 $ i bonus

for nye brukere!

Den største kryptobørsen hvor du raskt og trygt kan starte reisen din i kryptovalutaverdenen. Plattformen tilbyr hundrevis av populære aktiva, lave provisjoner og avanserte verktøy for handel og investering. Enkel registrering, høy transaksjonshastighet og pålitelig beskyttelse av midler gjør Binance til et godt valg for tradere på alle nivåer!

The domestic banking crisis caused distrust among the institutions’ customers, who began taking deposits. The worsened problems led to the bankruptcy of even the largest participants in the sphere. Institutionalists accused the regulators of provocation. By the time the report was created, the macroeconomic situation had still not recovered.

Indirectly, the negative momentum from what happened in the banking sector also affected the crypto economy. Silvergate was considered the main liquidity intermediary between traditional fiat institutions and digital currencies.

The loss of Silicon Valley’s leading provider of banking services to cryptocurrencies has led to difficulties in the flow of liquidity into the digital economy.

Additionally, the collapse of Silvergate has had a negative impact on stablecoins. USDC’s collateral was deposited in this very bank, and its loss led to a temporary decoupling of the stable cryptocurrency from the dollar exchange rate. Distrust spread to all virtual coins of this type.

Bitcoin Overview

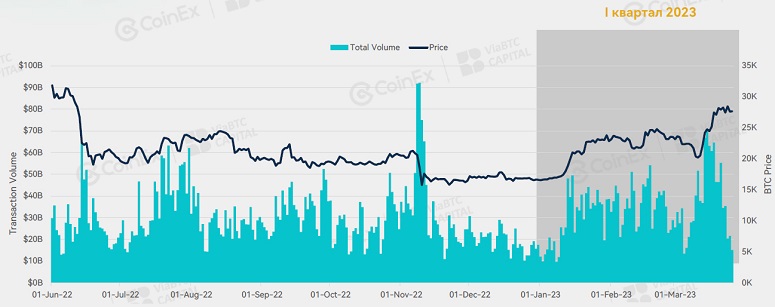

After a two-month decline in the BTC exchange rate, investors stepped up. In mid-January 2023, trading turnover increased, and the price of the coin showed significant growth. Altcoin quotes strengthened, and transaction volumes also increased.

Despite this, after the collapse of US banks, the BTC rate fell below the $20 thousand mark. The Fed’s rebuttal in response to allegations of manipulation improved the market environment. Cryptocurrency prices were able to regain lost ground.

BTCFi: Ordinals

At the beginning of the year, bitcoin chain developers realized integration with the DeFi Legos protocol. The main goal is to develop L2 solutions for the BTC network primarily to create a bridge between the blockchain and decentralized finance (DeFi) projects.

The update modernized the Taproot feature and allowed asset metadata to be embedded into Bitcoin’s operations. In other words, it became analogous to smart contracts and a major breakthrough for the first-generation peer-to-peer blockchain.

One of the bonuses of the update is the ability to create NFTs. In the bitcoin chain, they are called Ordinals, and the infrastructure of finance with the help of second-level add-ons experts have dubbed BTCFi.

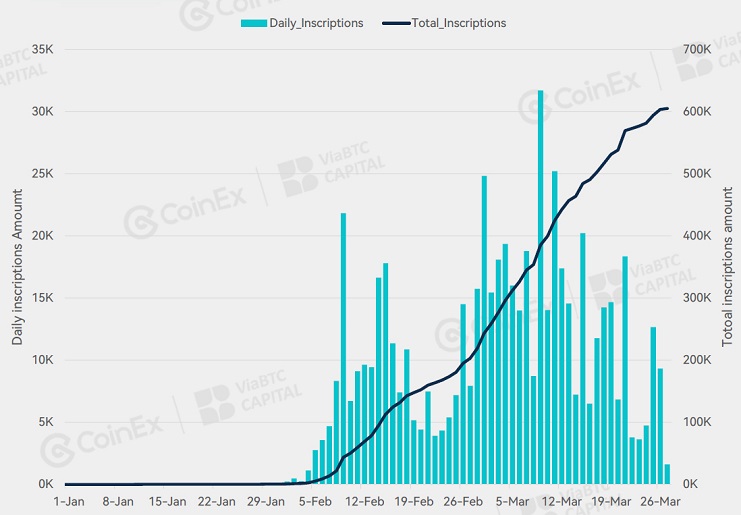

Source: Dune Analytics

At their core, Ordinals are individual satoshis recorded by users on the blockchain. Combining Taproot’s technology with Ordinals theory allows digital assets (such as JPEG files) to be included directly into the crypto network. This ensures that data is stored in the chain rather than using external storage, and also means decentralization in the classical sense. NFT tokens on Ethereum smart contracts are dependent on third-party hosting.

According to the ordinal number theory, each of the 2.1 quadrillion satoshis has a unique identifier. At the same time, inscriptions can contain arbitrary metadata – such as images, GIFs, and videos. By April 2023, BTC Punk is considered the most popular.

The first Ordinals appeared on December 17, 2022, but the surge in activity didn’t start until late January 2023. By April, the number exceeded 600k, most of them images.

A number of projects are working on the development of the BTCFi infrastructure. The most promising of them are considered:

- Solutions in the Lightning Network ecosystem – OmniLab, Lightning Labs, RGB Protocol, Portal.

- Independent sidechains – RSK, Stacks, Liquid Network.

Second-level protocols for the BTC network are at the nascent stage. It is premature to talk about competition in the DeFi segment with Ethereum. For further development of this function Bitcoin developers will need to solve several problems, including the limited block size. Nevertheless, the expansion of practical application of BTC remains an important point in the development of the network.

Ethereum Overview

The second coin in the ranking of cryptocurrencies by capitalization in the first quarter of 2023 also had an important event in the development of the network. The successful launch of the update called Shanghai had a positive impact on the Ethereum exchange rate. Trading volumes increased and fixed at a new bar. The ETH price moved around the $1800 level. This confirms the recovery after a significant drawdown between November and December last year. The daily turnover of transactions exceeded $1 billion.

Source: CoinGecko

As part of the Shanghai update, several Ethereum Improvement Proposals (EIPs) have been implemented. Among them, three key changes can be highlighted:

- EIP 4895. Modernizes the mechanics of staking – it is now possible to freely deposit and withdraw ETH after the end of the blockchain within the protocol.

- EIP 3855. Increases network throughput for transaction processing.

- EIP 3860. Allows to reduce commission for exchange transactions.

Before launching on the main blockchain, the Shanghai update module was tested on the Goerli add-on network. The changes went live on the Ethereum motherchain on April 12.

Cardinal edits to the staking procedure, like the move to PoS consensus, have split the crypto community. Skeptics are inclined to believe that the update will harm the network and reduce the motivation of participants when ETH is blocked.

The total amount of assets blocked under the staking program is 17.94 million ETH (14.9% of the total coin supply). Current characteristics of the feature usage are shown in the table (data from Dune Analytics service).

| Parameter | Indicator |

|---|---|

Another part of experts expect that the update will lead to an increase in the volume of blocked ETH in the future. It is also worth paying attention to the indicators of platforms with the possibility of liquid staking (LSD). Lido remains the leader of the segment. The top ten largest LSD platforms and key indicators are shown in the table (information from Dune Analytics).

| Project | Pool size in ETH | Number of validators | Market share, % |

|---|---|---|---|

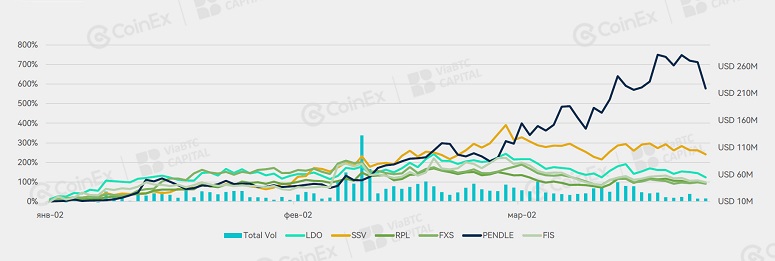

Ethereum’s staking rate remained low compared to other chains in the first quarter of 2023. The Shanghai update led to an increase in blockchain flows. This had a direct impact on the popularity of LSD protocols.

Native platform management tokens started to be purchased more frequently, which led to an average 100% increase in their value. Below is an infographic of the rates and volumes of the segment’s leading projects (data from Dune Analytics).

The industry leader token LDO recorded an increase of +250% at one point. This was followed by a minor price correction. Trading turnover also partially declined in the last month. Increased free liquidity in ETH has provided more opportunities for derivative tokens (e.g. stETH in the DeFi Legos protocol). This helps to get a better return on investment.

Among the projects, PENDLE stood out brightly. In the first quarter, its exchange rate increased by 750%.

NFT-sector thaw

In the first quarter, the direction of operations with non-replaceable tokens attracted close attention. The reason was the appearance of the cryptocurrency Blur on the market. The triumphal journey began with the launch of the NFT marketplace on October 19, 2022. At the same moment, the creators announced airdrop, which became the third for the project. A retrospective of token giveaways:

- The first airdrop was for users of the test version of the platform in Blur for 6 months before the official launch.

- The second giveaway was allocated for activity from release until November 2022.

- The third round was for bid placement. The size of the airdrop exceeded the previous ones.

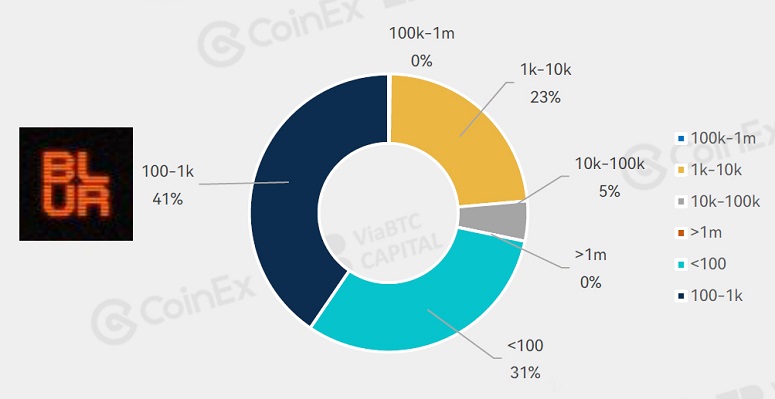

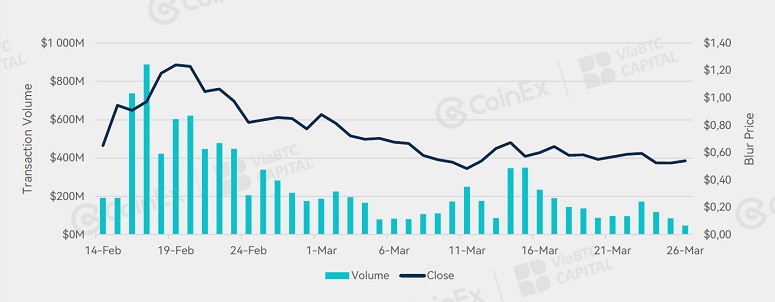

The final campaign launched on February 14, 2023 and was widely publicized. The bid rate exceeded 94% during the first week. At the end of the results, 70% of participants were rewarded with an award of 1,000 BLUR tokens or more. The largest single payout amounted to 32 million BLUR. Its holder as of the end of March continues to own the asset.

Source: Dune Analytics

The token price rose from $0.5 to $1.4, an increase of 180%. Owners of 83.3% of addresses have sold out of the asset. 15.6% of recipients continue to hold the reward. 0.9% of payees additionally invested in BLUR. As of the end of March, 41% of addresses held between 100 and 1,000 BLURs, while 31% held less than 100 tokens.

Source: Dune Analytics

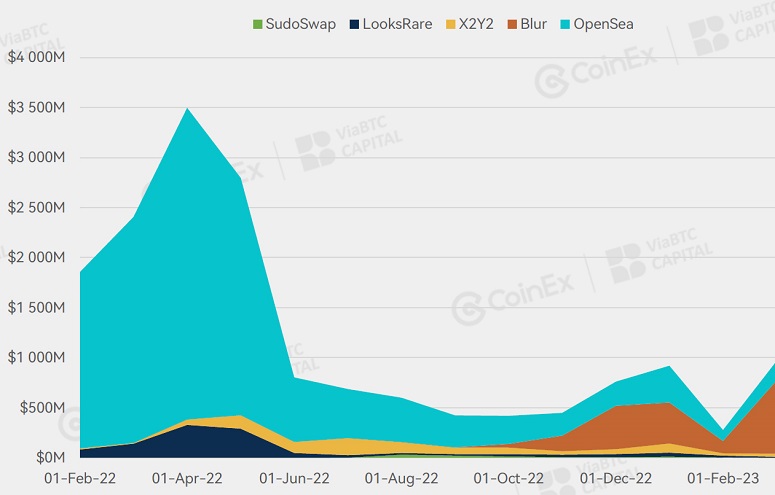

Top 5 NFT Marketplaces

The main launch of the Blur marketplace and the high-profile distribution of airdrop allowed the project to surpass OpenSea in trading turnover at the start. By February, the activity of both sites was at approximately equal levels. For the former leader, the appearance of a competitor caused a significant decrease in trading volumes.

Source: Dune Analytics

The rating of the best projects of the non-mutually exchangeable tokens segment included multidirectional marketplaces. Separate groups can be distinguished among them:

- New promising NFT marketplaces – Blur, Sudoswap.

- Themain competitors for leadership – Open DAO, LooksRare, X2Y2.

- Thebest cryptoartmarkets – SuperRare, Rarible.

- Other significant marketplaces are NFTrade, NTFb.

- Major NFT lending protocols – BendDAO, JPEG’d.

BLUR project is leading by a large margin. NFT startups are summarized in the table (source: Dune Analytics).

| Token | Capitalization (mln) | FDV | Change over the last 30 days (%) |

|---|---|---|---|

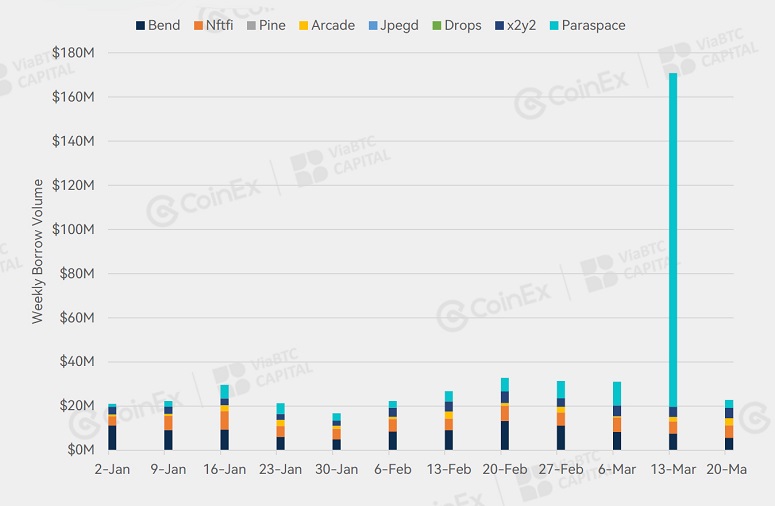

NFTFi

Decentralized NFT-based protocols have also picked up in the first quarter of 2023. The emergence of a new entrant is noteworthy. In March, the Paraspace protocol emerged as the second largest TVL among NFT lending projects. The reason was the launch of the APE coin-stacking program. Moreover, the loan volume at the end of March also significantly outperformed other participants.

Source: Dune Analytics

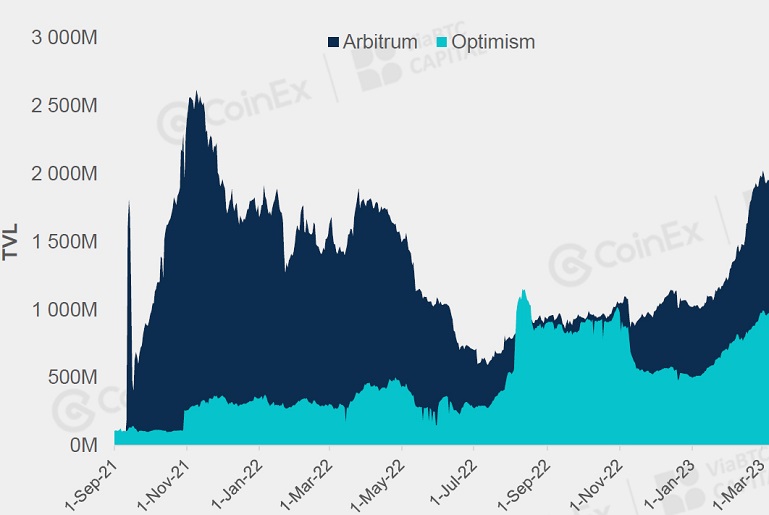

Arbitrum or Optimism, who is better

Both projects are based on the same type of transaction handling on the Ethereum network – Optimistic Rollups. They are also equally active in infrastructure development and attracting external investments.

| Project | Arbitrum | Optimism |

|---|---|---|

Nevertheless, Optimism’s limited compatibility with the Etherium Virtual Machine (EVM) at the protocol’s launch did not play in the development’s favor. Arbitrum, with its absolute combinability and ease of deployment of DeFi projects based on smart contracts, succeeded in TVL volumes and took over half of market transactions.

Sources: L2beat, Optimism.io, Arbitrum.one

Optimism’s popularity grew after the compatibility issue was resolved in December 2021. However, this was not enough. To encourage an influx of users, the developers lowered the commission rate by March 2022.

In parallel, the startup raised $150 million in private token sales from venture funds led by a16z and Paradigm.

The subsequent airdrops and infrastructure promotions that followed allowed Sidechain to briefly overtake its competitor in September of the same year. Apart from technological rivalry, ecosystems develop infrastructure along similar lines. The main participants are shown in the table below.

| Category | Network | Project name | Token | TVL | Kapitalisering | FDV | Ratio FDV/TVL |

|---|---|---|---|---|---|---|---|

Capital | |||||||

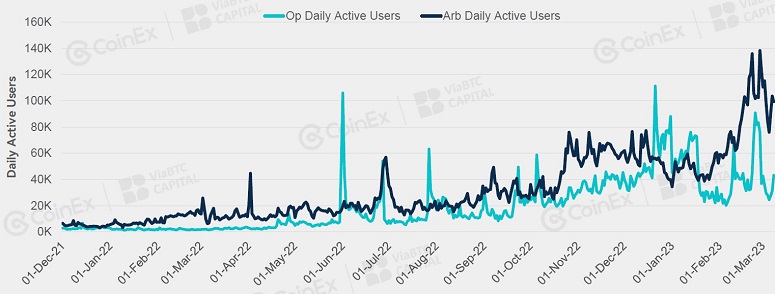

Nevertheless, by the beginning of 2023 Arbitrum had regained its leading position. By the first quarter of this year, the demand for DeFi products based on it increased. Over the last 6 months, the number of active users has steadily increased (+163%). The same indicator for the Optimism project noted a non-linear dynamics. This is due to the launch of a series of airdrops and the outflow of participants after their completion.

Source: Dune Analytics

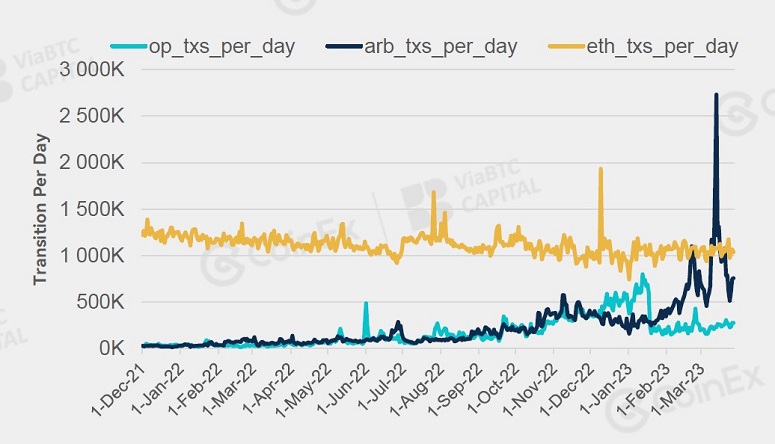

At the end of March 2023, Arbitrum developers also sent out an ABR token as part of their own Airdrop giveaway. Amid the excitement, the number of transactions on the L2 network exceeded that of the parent Ethereum blockchain for the first week after the payout. On the opening day of trading – March 23 – the daily transaction volume reached 2.73 million transactions. The figure exceeded Ethereum by 2.5 times (1.08 million).

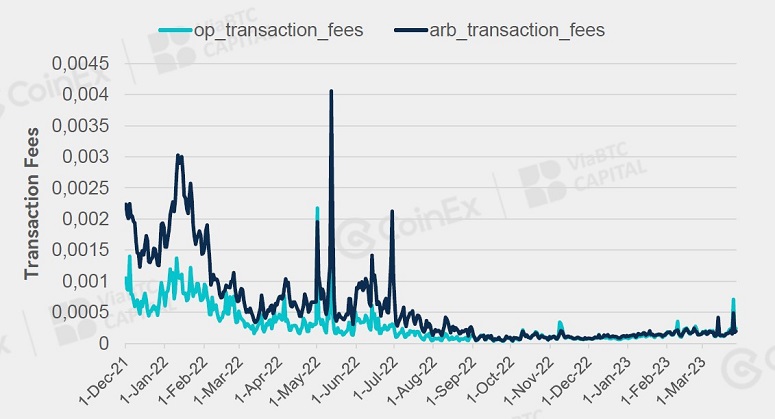

In terms of the cost of service fees, Arbitrum and Optimism chose similar scenarios. Fees were reduced by developers by upgrading networks and increasing transaction volume. The measures resulted in costs at roughly the same level.

Other L2 solutions

Opposing optimistic convolutions is the ZK-Rollup proof-of-concept system. Layer2 solutions of this type prove the truth of a transaction with zero backoff information. This allows transactions to be executed faster, with fewer steps and a high level of confidentiality. One of the first cryptocurrencies to implement ZKP technology was Zcash and Monero.

ZK-Rollup projects enable efficient scaling of Ethereum’s L1 network. In the first quarter of 2023, this segment generated a lively interest. Infrastructure solutions zkSync, Scroll, Starknet and Polygon EVM achieved breakthroughs in smart contract throughput.

Distinguished participants also include crosschain bridge development teams Succinct Labs and =nil; Foundation.

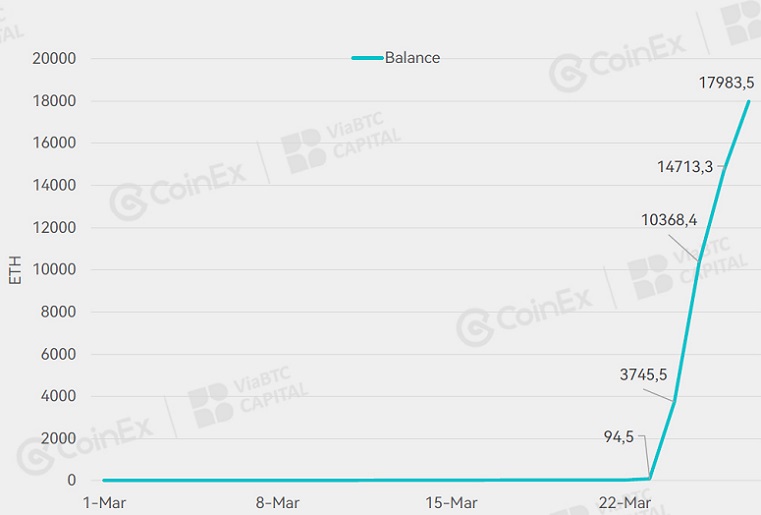

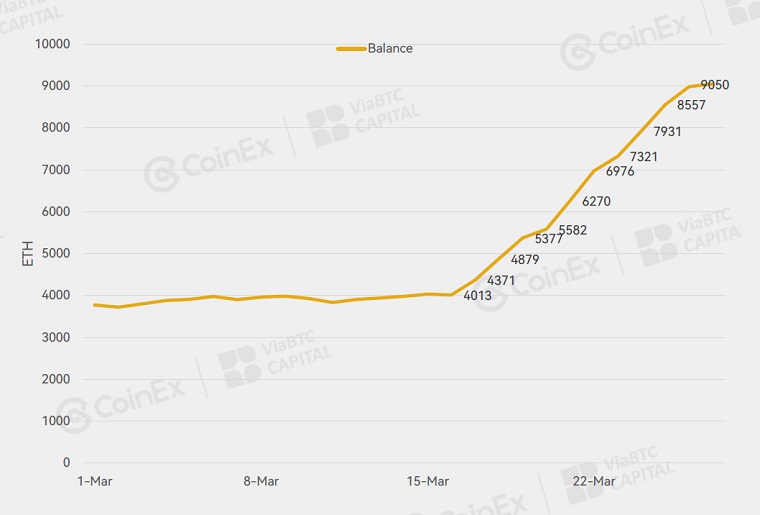

L2 protocol zkSync officially launched its Era ecosystem on March 24. The framework incorporates account abstraction and a powerful LLVM compiler. The main goal is to compress data and extend scalability. During the first 4 days, more than 120 thousand addresses were registered in the environment, and transactions with a turnover of 18 thousand ETH were conducted.

Source: Etherscan

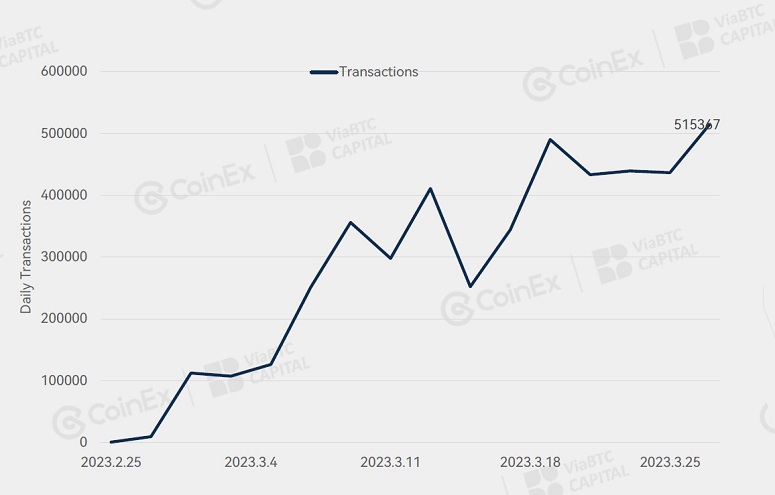

Another promising L2 project was Scroll. A press release on February 27 announced the launch of Scroll Alpha chain in the Goerli test network. In the first month, 2 million addresses were registered. The total transaction volume amounted to 8.6 million transactions, and the daily number exceeded 500k at the end of March.

Source: BlockScout.Scroll

The third interesting representative of the segment was Starknet. On February 23, the developers of the project launched a solution called Alpha v.0.11.0 in the Goerli test network. Community members will need to test the tool and leave their vote. Based on the results, a decision will be made on the deployment in the main Ethereum blockchain.

Starknet’s L2 protocol reduces computation time by 5 times. The feature of the updated version is its own Cairo 1.0 programming language. The previous version of the protocol is already integrated into the core network. During the first month Alpha v.0.10 attracted 9 thousand ETH.

Source: Etherscan

Another project, Polygon, also launched a zero-proof solution at the end of March. Ethereum founder Vitalik Buterin supported the developers and conducted the first tokenized transaction right after the beta launch.

ZK bridges

ZKP technology plays an important role in the design of crosschain bridges. The latest developments increase the speed of computation in the blockchain by reducing the number of steps. This approach simplifies the network and focuses on the conciseness of the proof-of-concept. In this perspective, crosschain bridges on ZKP are similar to Rollup solutions. Promising developments include:

- =nil; Foundation

- Succinct Labs

- Electron Labs

- zkBridge.

The developers of =nil; Foundation unveiled a circuit compiler called zkLLVM on February 2. The C++ and Rust programming languages were used to create it. It allows third parties to quickly and cost-effectively develop EVM-compatible decentralized applications – for example, protocols along the lines of zkRollup, zkBridge, and zkOracle.

The Succinct Labs team deployed the Telepathy protocol on Ethereum on March 16. The foundation of the solution replicates zkSNARK’s system development and also scales transactions on Ethereum using zero proof consensus.

Projects from Hong Kong

One of the most important developments in the first quarter of 2023 is the softening of cryptocurrency policies by Chinese regulators. The Securities and Futures Commission of Hong Kong presented an official document on February 20. According to the text, retail investors will be able to trade large-cap cryptocurrency on exchanges with an SFC license. The document will come into force on June 1. Hong Kong is also recognized as a free zone for the digital economy.

The move was triggered by the US Securities and Exchange Commission’s (SEC) strict policy on cryptocurrency platforms. In 2022, sanctions were imposed on exchange Kraken and provider Paxos (refers to subsidiaries of the Binance ecosystem). Also, the relaxation of rules by Chinese regulators has caused a stir among investors around localized blockchain startups.

By April 2023, there are about 50 crypto projects headquartered in the jurisdiction in Hong Kong. Most of the startups emphasize CeFi, CEX, GameFi and the development of their own Metaviews.

One of the brightest representatives was the Conflux project. The team announced a partnership with China Telecom, the country’s largest mobile operator. The partnership is aimed at piloting the launch of blockchain SIM cards in Hong Kong.

The price of the CFX coin recorded a significant increase. After the publication of the decision of the Hong Kong SFC commission in late February, the Conflux rate increased by 400% in 7 days. The trend spread to other local startups. The cryptocurrency of SelfKey (KEY) project added 200%. The token of the payment system Alchemy Pay (ACH) – +140%. However, with the weakening of FOMO sentiment by the end of the quarter, the quotes declined. Current indicators are reflected in the table.

| Project | Token | Kapitalisering | FDV | 30 д % |

|---|---|---|---|---|

Other trends for the first quarter of 2023

In February, ChatGPT’s neural network for texting sparked heated discussions around the world. The discussion turned users’ attention toward artificial intelligence (AI) capabilities. The popular AI project continued to gain momentum and merged with Office and Azure systems.

Technology giant Google chose to invest in the closest competitor of ChatGPT – the development of Anthropic. The investment amounted to $300 million.

AI-cryptocurrencies

Investors also started looking for solutions to integrate neural networks with blockchain technologies. The token price of the SingularityNET (AGIX) project grew by 700% in the first 3 months of 2023. However, by the end of the quarter, the AI-related development sector went through a course correction. The key trading figures are shown in the table below.

| Over 90 days (%) | Over 30 days (%) | |||

Collapses of large banks

No less important event was the crisis of financial institutions in the USA. Chronology of what happened:

- March 8. Crypto-friendly Silvergate Bank announced its liquidation.

- March 10. Silicon Valley Bank also reported bankruptcy.

- March 12. New York regulators announced the forced closure of Signature Bank due to “systemic risks.”

- March 15. First Republic Bank’s stock price fell 20%.

This was followed by a sharp drop in share prices of other U.S. financial institutions. The Fed’s decision provoked a lack of liquidity in the entire banking system of the country. On the other hand, the collapse of large CEX institutions once again showed the need for a digital economy on the foundation of decentralization.

Konklusjoner

The recession of the crypto market over the past year has brought many challenges. The decline in the BTC exchange rate occurred for most of this period. The fall in November 2022 was particularly painful, when the price fell into the corridor from $16 thousand to $18 thousand.

However, in the first quarter of this year, the crypto industry began to revive. In January, BTC quotes and trading volume grew significantly. By the end of March, the rate broke the $28 thousand mark. This was partly helped by the implementation of BTCFi within the framework of cooperation with the Lego DeFi protocol.

The exchange rate and trading volumes of ETH in early 2023 also recovered. The price has consolidated in the area of $1.8k. In terms of technological functionality of the network, the Shanghai upgrade brought significant potential for the development of cryptocurrency instruments. Especially LSD projects with the possibility of liquid steaking strengthened. Most of the segment’s developments recorded an increase in the value of native tokens.

The high-profile emergence of Blur brought popularity to a new application of non-fungible token technology – NFTFi – and in particular lending. Also, the prominence of ChatGPT has influenced interest in the use of neural networks in the crypto domain.

Equally important is the development of large L2 projects such as Arbitrum, Optimism and protocols using ZKP technology.

Foreign policy was divided in sentiment. U.S. regulators have increased pressure, the Hong Kong Securities Commission – weakened. The latter caused a significant resonance and excitement around Chinese crypto startups.

At the end of the first quarter of 2023, the cryptocurrency market has definitely started to strengthen and pave new paths for the industry. However, a full recovery requires more innovation.

Er det en feil i teksten? Marker den med musen og trykk på Ctrl + Skriv inn

Forfatter: Saifedean Ammous, en ekspert på kryptovalutaøkonomi.