To trade on an exchange, you need to enter funds. Large services offer many tools for generating income from cryptocurrencies. As a result, on popular platforms, the wallet becomes a complex section with certain subtleties. In the material – about the role of different accounts, methods of replenishment and the mechanics of intra-exchange transfers. The spot wallet on Binance is the main account, but it makes up only a part of the balance. Readers will learn what operations it is used for, and will receive detailed instructions for more confident work with the site.

Definition of spot trading

This is the simplest form of cryptocurrency trading. In the spot tab, users buy or sell assets – for example, BTC. The main feature is that at the moment of payment, the client becomes the full owner of the digital coin.

Earnings can be obtained on the growth of the price of the underlying asset. In other words, first buy bitcoin cheap, and then wait for growth and sell.

Receiving income from changes in value in the financial world is called speculation.

Users who are just starting their way in trading, it is better to learn trading on the spot. Operations here are performed at the expense of a personal deposit.

Differences from other markets

Spot trading is only one of several ways to generate income on speculation. Popular trading directions, which are also represented on the platform:

5020 $

bonus for nye brukere!

ByBit gir praktiske og trygge forhold for handel med kryptovaluta, tilbyr lave provisjoner, høyt likviditetsnivå og moderne verktøy for markedsanalyse. Den støtter spot- og leveraged trading, og hjelper nybegynnere og profesjonelle tradere med et intuitivt grensesnitt og opplæringsprogrammer.

Tjen 100 $ i bonus

for nye brukere!

Den største kryptobørsen hvor du raskt og trygt kan starte reisen din i kryptovalutaverdenen. Plattformen tilbyr hundrevis av populære aktiva, lave provisjoner og avanserte verktøy for handel og investering. Enkel registrering, høy transaksjonshastighet og pålitelig beskyttelse av midler gjør Binance til et godt valg for tradere på alle nivåer!

- Margin trading. Market participants can borrow cryptocurrencies and use them in trades. The increased position size allows for greater profits to be given.

- Futures. These are contracts that in the future the trader will definitely buy or sell cryptocurrency (for example, BTC) at a certain price.

- Options. The principle of operation is similar to futures contracts. However, there is a difference – traders receive and grant the right to buy or sell.

Futures and options refer to derivative instruments. Such financial products are based not on the cryptocurrency itself, but on its value for trading. The main difference from spot is that derivatives help to generate income even on a drop in the exchange rate.

| Type of trading | Fordeler | Risikoer |

|---|---|---|

Each type of trading is designed for different investment strategies. The choice depends on experience and willingness to use financial instruments with higher risks.

Spot trades on Binance

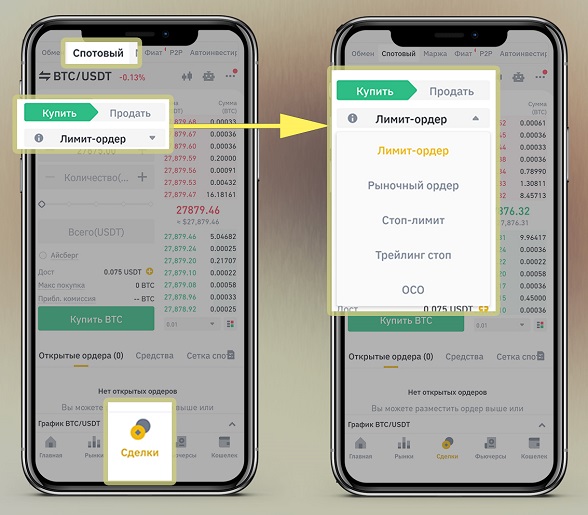

Before you start trading, you should learn to notice the differences in bids (orders). They help to buy an asset more favorably or limit risks.

Types of deals

To buy cryptocurrencies on the spot, the platform offers several options. Types of orders:

- Limit trades.

- Orders at the current market price.

- Stop orders.

- CCA trades.

The same orders are used in other trading directions – margin trading, futures trading and others. Spot trading is the foundation, and derivatives and margin option are additions to it.

Limit

In this case, the trader sets a specific price at which he wants to buy or sell assets. The application will be executed when the market rate reaches the target. With the help of limit trades, you can both buy and sell cryptocurrency at the desired price.

Such sellers create a supply in the market.

Market

When a trader is not ready to wait and wants to buy or sell assets immediately, orders at the market rate are used. In market orders, only the required volume of cryptocurrency is specified. After that, the purchase is instantly paid for and the trader receives tokens or coins on the spot balance.

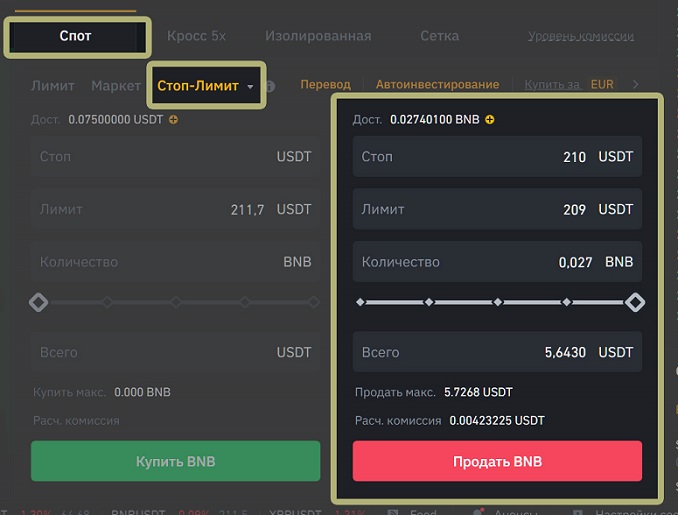

Stop limit

The first 2 types of orders are used for buying. To get earnings, one has to wait for the moment of selling. If the price falls, the trader is at a loss.

Stop orders allow you to close the position in the “minus”, which the trader specifies himself. For example, a loss of no more than 5%. Such orders are always deferred in time.

A slightly universal variant of such an order is used on Binance. It is called a stop limit. The principle of operation consists of two indicators:

- Stop target (trigger) – the level when the order is activated. If the market rate reaches this mark, the next action will be triggered – for example, selling at the current level.

- Limit price – the mark at which the order should be closed.

We can give an example: the underlying asset is bought for 100 USDT. A trader can set a stop limit according to one of four trading scenarios:

- Stop Loss or Stop Market. If the rate falls to 95 USDT, the order is closed at the current price.

- Take Profit. In case the cost grows to 110 USDT, also exit the transaction at the market bar.

- Stop Limit. If the cost decreases to 95 USDT, the next action is to place a limit order (for example, at 90 USDT). It will trigger when the market rate reaches the target.

- Take Profit Limit. If the price rises to 110 USDT, the next step is to place a limit order (e.g. 115 USDT).

To get a stop mark, users can specify the limit and stop target at the same level. The order will close immediately when the trigger is reached.

Stop limit is needed for both loss control and income extraction.

CCA trades

This type of deals allows placing 2 orders for one underlying asset – limit and stop-limit. When one of the trades is executed, the other one is automatically canceled. CCA trades are chosen by traders who want to set profit and loss levels.

Fiat and Spot section on Binance

Having studied the basic applications, you can start trading. First of all, you need to fund your fiat and spot account. The exchange profile is a multi-purse for storing cryptocurrencies and fiat money. After registration and verification, the balance can be replenished with any digital assets available for trading and some traditional currencies.

Initially, cryptocurrencies had a single account and only one type of trading (spot). Later, other tools appeared, among them – the use of margin, derivatives transactions, copy-trading. The vault’s interface changed. There was a division into sub-accounts: separate spot, futures, options and others.

In this case, these are additional balances. The closest analogy: a user opens several accounts in a bank. For example, to pay for a loan, for ordinary purchases in stores, or to receive money from other countries.

“Spot wallet” on Binance means the same thing as a current account in a bank. On the website and in the app, the translation of the names is not standardized and differs slightly. Full information about the sections is in the table.

| By default, all deposited funds are reflected here | |||

| Depending on the cryptocurrency for settlement (underlying asset or stablecoin), different accounts should be funded in transactions | |||

| You can only enter funds from the tab “Fiat and spot”, “USDⓈ-M futures” or “Deposits” | |||

| When receiving credit funds, you can add an automatic increase in collateral to avoid liquidation. Available only from the “Cross Margin” balance. | |||

| The account can be used to use the Binance Pay payment system | |||

| In October 2023, the section is blocked for traders from Russia | |||

| The account is needed to control funds in the platform’s investment instruments. Cryptocurrencies cannot be transferred from it. Money can be invested in Earn products only from the balance of a spot wallet on Binance. | |||

From Fiat and Spot, you can replenish all other sections. The account has four functions:

- Crypto Asset Storage.

- Spot trading on the site.

- Receiving and sending fiat and cryptocurrencies to external storages.

- Replenishment of any accounts on the exchange.

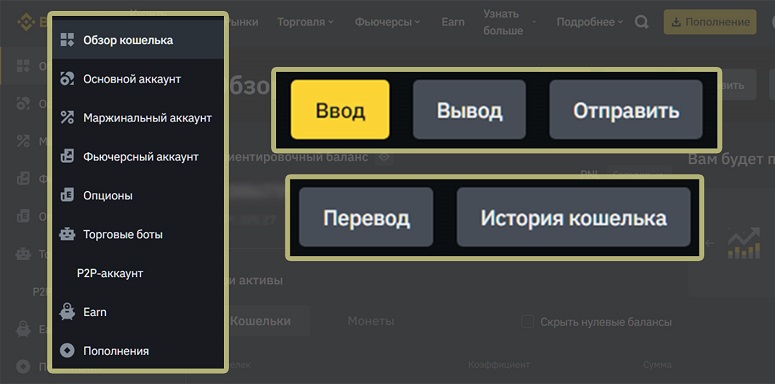

Managing a spot wallet on Binance

Several actions are available for users. At the top of the site there is a button “Replenishment”. With its help, you can quickly get fiat and cryptocurrencies to the balance of the exchange. Other actions are available in the “Wallet Overview” menu:

- “Deposit”. With the help of this option, you can credit digital tokens and coins to your address. Also in the window there is a button “Enter in fiat” to transfer traditional currencies.

- “Withdraw”. After clicking, a form will open to send cryptoassets to an external storage. Here you can also transfer funds to another user inside the service by phone number, e-mail or Pay ID.

- “Send”. A separate button to transfer cryptoassets between users of the exchange. The possibilities are the same as in the “Withdraw” option. You can transfer using a phone number, email address, Pay ID, and by specifying a Binance ID (a short identifier on the platform).

- “Transfer”. The action helps you move assets within your profile – for example, from a primary vault to a futures or margin account.

Using the “Wallet History” page, you can get information about the movement of funds. Separate lists of blockchain transactions, fiat currency inputs, and transfers between different sections of the profile are available.

Opening a wallet

Blockchain addresses are generated automatically after registration on the exchange. However, financial actions on the platform are available only after full verification by documents. You also need to bind an e-mail or cell phone.

The exchange checks new profiles for up to 24 hours.

Deposit

After identity verification, financial transactions on the platform become available. Exceptions for traders from the Russian Federation:

- You cannot deposit currencies from Russian bank cards.

- Exchange on the Binance P2P market is not available.

A unique blockchain address is created for each token or coin. It is also worth taking into account the type of crypto network over which the digital assets will be sent.

Instructions for obtaining an address to deposit funds to a spot wallet on Binance:

- You should click on the “Deposit” button on the main page of the site.

- Select the item “Deposit cryptocurrencies”.

- In the “Search for coins” find an asset – for example, ETH.

- In the item “Select network” in the list of available blockchains, mark the desired option. It is necessary to carefully study the messages of the service about the features of operations. As a rule, they relate to the time of transaction confirmation.

- The address is created automatically in item 3. The data can be copied in text form or scanned as a QR code. Sometimes it is necessary to additionally click on “Get address” to make the details appear.

There is one more way. On the site, you can go to the wallet tab “Fiat and spot on Binance” and click on “Enter”. Then steps 3 through 5 of the instructions above are followed.

By default, input from external services is made to the spot balance. In the transaction, the section to receive can be changed to “Deposit Wallet”.

Kryptovaluta

Digital coins and tokens from external storages – for example, from MetaMask – are entered to the address. You can also receive cryptocurrency from another sender.

To receive digital funds (for example, BNB) to a spot account on the Binance exchange, you should perform several actions:

- You will need to go to an external storage.

- Select a blockchain – for example, the BNB Smart Chain (BEP-20).

- Check the BNB cryptocurrency.

- Next, click on “Send” or “Withdraw”.

- Insert your receiving address.

- Mark the amount of cryptocurrency to send.

- Click on “Confirm” or “Send.”

In some networks, cryptocurrencies are transferred in a few seconds – for example, in BNB Smart Chain. In other blockchains – up to 1 day. This is due to the number of confirmations on the networks. When they are created, the cryptocurrency will appear in the “Fiat and Spot” wallet (“Primary Account”) of the exchange.

Users need to enter the details carefully before sending money. It is not possible to cancel an erroneously executed transaction on the blockchain.

Fiat

Traditional money is also sent to the exchange. However, there are several restrictions. You can’t deposit rubles from bank cards. You can transfer other currencies (for example, euros) from foreign accounts.

In October 2023 rubles are transferred only through electronic payment systems. Their balance can be replenished from a card, including Russian banks.

Binance does not charge fees for depositing fiat money. External services retain a commission. In Advcash you have to pay 3.5% for replenishment from a card, in Payeer – from 3.99%.

Commission may be withheld when withdrawing money from the payment service. Instructions on how to transfer fiat currencies from Advcash to the exchange:

- Go to the spot wallet on Binance.

- Click on the “Enter” button and then on “Enter in fiat”.

- Mark ruble in the “Currency” field.

- Select the method of depositing funds “Advcash account balance”.

- Specify the amount to send in the “Amount” field. The minimum deposit is from 100 rubles.

- After that, the Advcash page will open. On it you need to authorize and complete the operation by clicking on the “Continue” button.

You can also send money through payment systems using the “Replenishment” key. It redirects to the page of depositing fiat.

Transfers take up to 5 minutes.

P2P

In this section in October 2023, you can not use rubles. However, P2P transactions are a convenient way to deposit other traditional currencies. For example, you can deposit hryvnias or tenge.

Binance presents its own P2P marketplace. On it, you can select another user’s cryptocurrency exchange offer. It is worth paying attention to the selling price, the amount of assets for conversion and the method of sending money (bank cards or payment services).

Instructions for buying USDT on Binance P2P:

- Select an ad.

- Click on the “Buy” button.

- Then the seller should provide the details, which will need to transfer the payment in fiat currency.

- Confirm the sending of money in the application form.

- Next, the seller needs to send USDT to the specified address.

Transfer from a Binance spot wallet

The main balance holds fiat and cryptocurrencies. Only digital assets can be transferred between accounts on the exchange.

If funds are entered in fiat, it will be necessary to buy cryptocurrency using the “Conversion” tool.

On P2P

On this market, you can conduct transactions to buy and sell digital assets for traditional currency. Trading pairs with the ruble are not available. There are no restrictions for operations in UAH, BYN and KZN pairs. To participate in P2P-exchange, you need to transfer money from your main wallet to a separate balance:

- Log in to the “Main Account” tab.

- Click on the “Transfer” button.

- In the “To” field specify “P2P account”

- In the “Coin” field, select fiat or cryptocurrency from the list.

- In the “Amount” column, specify the amount of funds.

- Complete the operation by clicking on the “Confirm” button.

To the futures market

Assets for transactions with derivatives should also be allocated to an independent balance. Instructions for transferring funds to the “Futures” account:

- Select “Primary Account”.

- Click on “Transfer”.

- In the “To” column specify “Futures account” (“Futures USDⓈ-M”).

- In the “Coin” field, mark the cryptocurrency.

- Specify the amount of coins or tokens to be transferred, then click on “Confirm”.

After that, you can open positions. In some cases, an additional transfer to the “Cross-Margin” account will be needed.

Determining the spot balance

You can find out the total amount of your funds in the “Wallet Overview” tab. This page summarizes the data of all sections.

If you go to each tab, you can get information about deposit transactions in the form of the PnL (“Profit and Loss”) indicator. It is used to evaluate the change for the last day, month and throughout the whole time. Values are provided as a percentage and in a specified fiat currency – for example, in rubles.

Ofte stilte spørsmål

⚡ Do they charge a commission for transfers between accounts of the service?

No. Transactions within the exchange are free of charge.

📌 What is the “Isolated Margin” section for?

When dealing in futures, the service takes a portion of the trader’s money to lend out cryptocurrencies. Margin always acts as collateral. Isolated is collateral without the ability to automatically increase. Crossed (cross margin) allows collateral to be added if a futures order is approaching liquidation.

🔔 What is the best network to fund a USDT spot wallet through?

Stablecoins can be transferred in all popular blockchains. It is more profitable to send to the site through the BNB Smart Chain network – the transaction will cost about $0.1.

💳 How else to replenish the main balance on the platform?

You can use external P2P services to exchange traditional money for cryptocurrencies. The principle of operation is the same as when converting on Binance.

📢 How to get a private key in a spot account?

It is impossible. Private keys are obtained only in non-custodial external repositories. Profiles on exchanges do not belong to them. Apart from the owner, the money is managed and can even be locked by the trading service.

Er det en feil i teksten? Marker den med musen og trykk på Ctrl + Skriv inn

Forfatter: Saifedean Ammous, en ekspert på kryptovalutaøkonomi.