Users are looking for different ways to identify promising digital currencies. The desire is understandable – in this case, it is possible to multiply the deposit and get a significant income. However, analyzing projects is multifaceted and complicated. Popular exchanges help users learn about new startups. Launchpad on Binance is one way to get acquainted with a budding and potentially promising cryptocurrency, as well as to earn on investments in it. In the material – about the principles of the platform and the way to calculate profitability. A list of the most successful participating projects is also given.

Definition of what is a lunchepad on Binance

To earn on the program, you need to understand 2 aspects. The first is how Launchpad is structured. The second is how to evaluate the prospects of cryptocurrency and potential income.

How Launchpad works

The program is launched for new tokens that are not traded on the exchange. At the last stage, the digital asset is listed on the platform. To participate, the startup team allocates a share of the issue (the total number of possible tokens or coins). A fixed selling price is set for them. The realization takes place before listing in the framework of OTC trading.

Launchpad on Binance is a pre-sale (presale, pre-sale) and the last opportunity to buy an asset at the developers’ rate. Once listed on the exchange, the price will be shaped by the market, i.e. supply and demand between traders.

The concept of IEO

There are alternative names for this procedure. One of them is crowdfunding (crowdfounding, literally translated as “gathering among the crowd”). This is any funding from private investors.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Another financial term is ICO (Initial Coin Offering). This is a pre-sale of cryptocurrency before listing on trading platforms. ICOs are also differentiated by the venue (organizer):

We can say that a lunchepad on Binance is both crowdfunding, ICO and IEO at the same time. Similar programs are also launched on other major exchanges – Gate.io, MEXC, etc.

How the distribution of tokens takes place

If we simplify the essence, cryptocurrencies at the developers’ price are sold to willing traders from among Binance users. Each of the Launchpad platform programs receives active coverage and success. Therefore, there are more buyers (demand) than sellers (supply).

In a normal economy, in such a situation, the price goes up.

However, on Launchpad, the rate is fixed. Therefore, exchanges, including Binance, use certain mechanics of fair token accrual.

It is most convenient to give an example. You can invest $1 in a $100 fund. The deposit will then amount to 1% or a share of 1/100 of the pool. This principle is involved in the distribution of rewards at the end of Launchpad.

For example, an investor has deposited 1 BNB. During the whole time of the program, participants have invested a total of 20 thousand BNB. In this case, the user’s deposit with 1 BNB will be 1/20 thousand (or 0.00005%). At the end of Launchpad, the investor will receive tokens based on the calculation of this share.

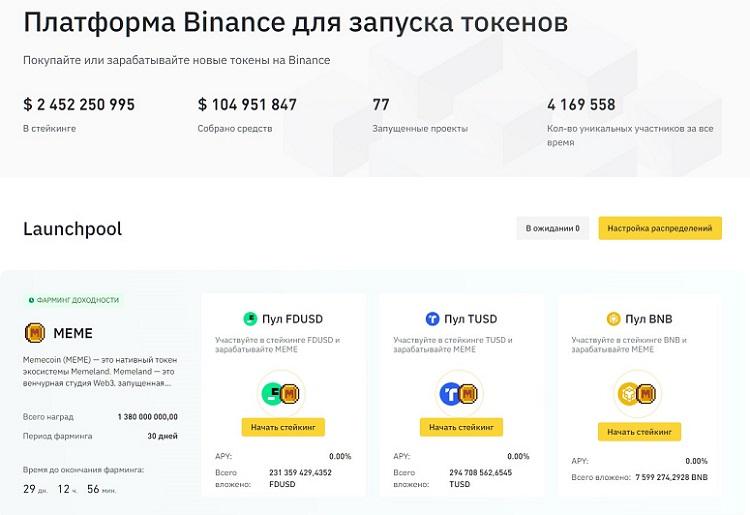

Differences from Launchpad

The Binance exchange presents another financial opportunity with a consonant name – Launchpool. Like Launchpad, the tool is designed to support new projects and their tokens that were not previously available on the exchange.

Otherwise, the programs differ in several important factors. See the table for details.

| Parameter | Launchpad | Launchpool |

|---|---|---|

| Through the platform, new startups receive funding and an opportunity for future development | The exchange collects digital assets for temporary use | |

| It is performed after the end of the campaign and the distribution of rewards in the project tokens. On Binance, the listing of these digital assets usually takes place 3-6 hours after completion. | Occurs at any point during the campaign (at the beginning or in the middle), but before the end of the campaign. The date is set for projects separately and is communicated in the announcement of the launchpool. | |

| The exchange rate for buying a new token or coin is fixed in advance | Cryptocurrencies are not purchased on Launchpool, but are received as a reward for investment deposits. Deposits made will also be returned to the participant in full. | |

| The volume of tokens is calculated and credited after the end of the promotion, taking into account the participation share | Income is accrued at the end of each hour of blocking assets (BNB or other) |

Risks and how much you can earn

Launchpad is literally buying cryptocurrencies. Therefore, users need to consider the risks of traditional investments:

- The project may fail and not achieve a significant price increase – for example, due to a lame technology. In such a case, listing a native cryptocurrency will not be effective. The exchange rate will fall below the selling level – the investment will become unprofitable.

- Indirect losses can be incurred because of the token in which the payment was made. Only Binance Coin (BNB) is deposited in Launchpad. This is a volatile asset, its rate is not tied to the dollar or other fiat currency. Therefore, the price of BNB is volatile.

For example, a deposit of 1 BNB (worth $1.9 thousand) is available for the program. At the time of token distribution, the digital asset may already cost $1.8 thousand.

Thus, the volatility of the cryptocurrency to buy (BNB) becomes a risk. Predicting the exact yield of Launchpad is almost impossible.

However, this is not the only variable indicator that cannot be predicted. Participants in Launchpad programs make a deposit, but not all of it is used for purchases.

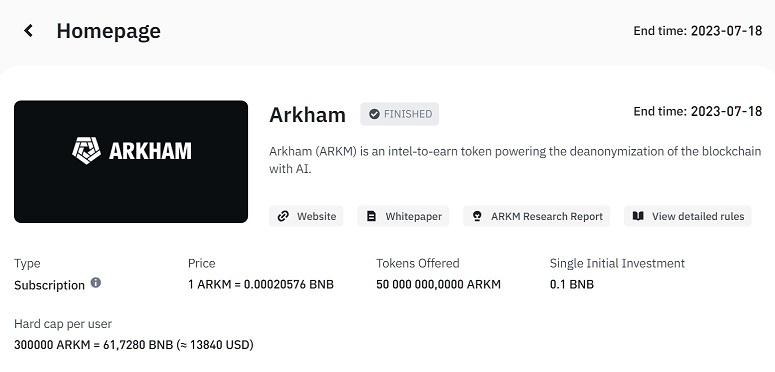

To calculate the exact yield, you need to wait until the end of the campaign. Therefore, the data from the last completed Launchpad of Arkham cryptocurrency (ARKM) is used for the example. In the table – input data for future calculations.

| Parameter | Value |

|---|---|

On the selling rate, a clarification should be made. The price of $0.05 is the payment that the cryptocurrency developers want to receive. However, the platform introduces its own condition. The payment needs to be made in native BNB tokens. Therefore, before the Launchpad starts, the exact price in BNB is unknown, as the exchange rate is volatile. Later (on the Launchpad launch day), the final purchase price was fixed at 0.00020576 BNB per 1 ARKM.

Further detailed calculations can be done. The mechanics and results of the potential returns are in the table.

| Indicator | Formula | Example | Final values |

|---|---|---|---|

Several conclusions can be drawn based on the data obtained. However, it is worth considering the subtleties:

- The increment of profitability is really significant – 1302%, but only in relation to a small part involved in the purchase of the deposit. According to the results of calculations, less than $1 was invested.

- It should be remembered that initially 4 BNB (approximately $903) was blocked. If we start calculations from this figure, the growth is small – only 1.41%.

The calculations above are given for a detailed understanding of the mechanics of distribution and profitability. When participating in projects, one should remember 2 principles. The first one is that a large share of the deposit will not be used and will be returned after the end of Launchpad. The second – the yield of the remaining part can be calculated using a simplified formula:

Price at the time of listing x 100 / selling rate x reward in startup tokens.

What gives VIP status

Users can participate in the program on general rights. VIP status on Binance Launchpad does not grant privileges.

Advantages and disadvantages of the platform

As a rule, cryptocurrencies from the Launchpad and Launchpad programs become the cause of a trading frenzy. Transaction volumes instantly skyrocket to the top of the lists. This is an advantage for spot and futures traders. However, from the point of view of investors and program participants, such projects do not bring significant income.

Where to find information about new IEOs

About new shares, the exchange publishes blog posts. They are replicated by other social and news media. The announcement on Binance immediately publishes basic information:

- Project website address.

- White Paper.

- An analytical report describing the tokenomics, collateral and principles of the technology.

- The total volume of cryptocurrencies allocated to the program.

- The purchase price in dollars.

- The timing of the event.

The refined rate in terms of BNB is published before the start of the campaign. This data allows you to independently conduct a fundamental analysis of the startup and assess the prospects for investment.

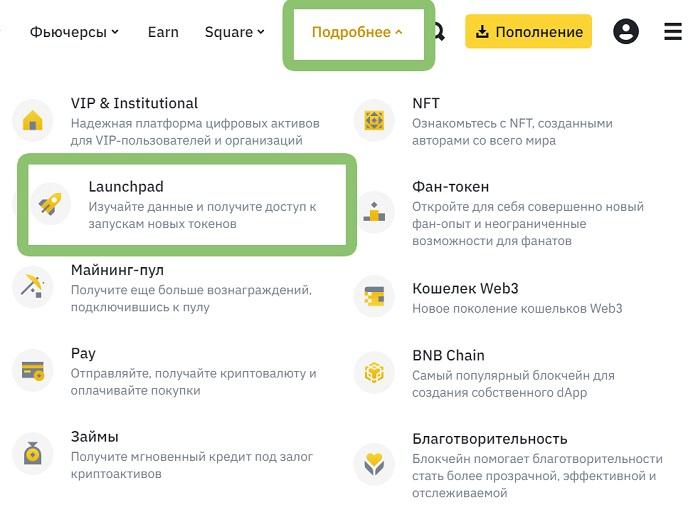

How to participate in Binance Launchpad

The platform is available only to users verified on the exchange. To participate in Binance Launchpad, you need to go to the “More details” section.

At the time of the campaign launch, you only need to keep BNB assets on your balance. The full procedure consists of 5 stages:

- Preparation period. As a rule, it lasts for 1 week. During this time, the investor needs to keep BNB on the wallet. It is not necessary to steak the digital asset. The exchange makes an automatic balance check (snapshot) every day.

- Subscription Start. This period is used to deposit assets into the steaking pool. The duration depends on the conditions of the campaign. Subscription can be held for 3 hours or longer – for example 1 day. The exact interval is also specified in the Launchpad announcement.

- Calculation period. It occurs immediately after the subscription ends. At this point, BNBs are released and the platform summarizes the final calculations. The process takes 1 hour.

- Final token distribution. This is the moment when the reward is transferred to the wallet. It takes place immediately after the end of the calculation period.

- Cryptocurrency listing. Listing begins within the first minutes after the award distribution.

Purchase of tokens before listing

One week after the program starts and the first period ends, the option to subscribe will appear. This means that assets from the balance sheet are available to invest in the pool (zastake). Step-by-step instructions:

- Go to the Launchpad section on the specified date.

- Click on the “I want to participate” button.

- Specify the number of steaking tokens in the subscription.

- Click on “Withhold BNB.”

After the subscription period is over, the token calculation for each participant will take place. The result data can be found in two sections:

- Launchpad tab.

- Trading History menu.

After the token calculation, the reward and unused BNBs will return to the spot wallet. From that point on, the assets can be used in trading.

Requirements for platform members

Any transactions on the exchange are available after full verification by document snapshots (passport photo or driver’s license). To participate, you need to hold BNB in a spot account and/or Launchpool wallet. If assets are found in other accounts (e.g., Futures, Earn, Funding), the cryptocurrency will not be counted in the automatic balance snapshot.

The exchange also imposes restrictions. Participation in the lunchepad on Binance is not available to users from Crimea, Belarus, Iran, North Korea.

There are no restrictions for Russian, Kazakh and Ukrainian investors.

What are fan tokens

Binance has launched an independent platform for users who are passionate about cryptocurrencies and fandom. Communities of fans of sports teams and entertainment brands get the opportunity to purchase NFT.

For example, fans of soccer clubs (FC Barselona, Lazio, Shakhtar, etc.) can buy Binance Fan Token and digital passports.

Holders get the ability to vote within the community and bet on the outcomes of sporting events. To explore the information and purchase assets, you need to go to the “More Info” section (Fan Token tab).

Top successful projects on the Binance lunchpad

Since the launch of the platform, programs for 32 cryptocurrencies have been conducted. The best coins can be evaluated by the return on investment (Return on Investment, ROI). The second option is a similar indicator calculated from the maximum token price (All Time High Return on Investment, ATH ROI).

The first coefficient more accurately reflects the profitability immediately after the completion of Launchpad. The top five projects by ROI are:

- Polygon (MATIC).

- Axie Infinity (AXS).

- MultiversX (EGLD).

- The Sandbox (SAND).

- Injective (INJ).

Polygon

The startup originally launched in April 2019 under a different name – Matic Network. The developers later renamed the blockchain to Polygon. The native coin has not changed – the cryptocurrency MATIC. In 2023, the Polygon network is one of the most well-known and scalable platforms for decentralized applications (dApps) on the Ethereum blockchain.

The project’s success story began with a successful Launchpad on the Binance platform. The campaign was launched on April 24, 2019 and yielded the following results:

- ROI at the time of listing – an increase of 23,430% (234.3 times).

- MATIC’s capitalization in 2023 is $5.6 billion (13th place).

Axie Infinity

This is a gaming startup that has become one of the most exciting and successful in the cryptocurrency segment. In 2023, Axie Infinity is listed as one of the major GameFi platforms. The functionality allows gamers to interact with unique fantasy creatures called Axies. The game mechanics utilize non-fungible tokens (NFT) and cryptocurrencies.

To develop the project, the Axie Infinity team raised some funding in partnership with Binance. For this purpose, a successful Launchpad program took place in October 2020. Private investors purchased the AXS native digital currency. Axie Infinity’s campaign is considered one of the most successful among Launchpad programs:

- ROI at the time of AXS listing – an increase of 4715% (47.15x).

- The capitalization of the project in October 2023 is $619 million (57th place).

MultiversX

This is a promising blockchain protocol that provides fast transactions using sharding technology. The project is focused on fintech, DeFi and the Internet of Things.

EGLD is a native token that is used for payment and blockchain management.

The main network is launched in July 2020. It succeeded in realizing this also with the help of funds raised on the Binance Launchpad. Already in the collection phase, the network achieved success:

- ROI at the time of EGLDlisting – an increase of 4398% (43.98 times).

- The capitalization of the project in October 2023 – $746 million (52nd place).

The Sandbox

The project team came from the Web2 segment. The game studio was born in 2011. In 2020, the sensational Launchpad of the SAND cryptocurrency took place. The received funding and attention went in favor of the project. The Sandbox launched a blockchain-based virtual meta-universe where investors create, collect, buy and sell digital assets.

The startup combines decentralized autonomous organization (DAO) and non-fungible token (NFT) technologies.

SAND’s digital asset facilitates transactions on the platform and participation in governance. The token’s price soared tenfold after the launchpad ended:

- ROI at the time of listing – an increase of 3862% (38.62 times).

- The capitalization of the project in October 2023 – $667 million (55th place).

Injective

This is a blockchain solution for creating fully decentralized exchanges and financial protocols. The main product is the Injective Chain network. The main goal is to include all users in the management and trading of various assets. Traders can influence changes and have equal rights regardless of the size of the investment. INJ is the native coin of the network. Injective Protocol participated in Launchpad on Binance in October 2020:

- ROI at the time of INJ listing – an increase of 3367% (33.67 times).

- The capitalization of the project in October 2023 – $1.13 billion (44th place).

Reasons for the growth of prices for tokens from Launchpad

The support of the Binance exchange and its community provides a set of advantages. Among the most significant factors affecting the further growth of cryptocurrency quotes with the participation of the platform:

- Extensive social media coverage. Support from an exchange such as Binance is usually accompanied by an active advertising campaign, communication in the media and among influencers. This attracts the attention of the audience and raises awareness of the project due to the authority of the exchange.

- Easy listing on other trading platforms. Appearing on a top exchange can facilitate partnerships with other services.

- Fundraising. Teams use the funds received as a result of Launchpad to implement development plans and achieve technological successes faster.

- Trading native digital currency. Active token turnover becomes an additional and regular source of attracting funding. This also has a positive impact on the project development and cryptocurrency price growth after participation in Launchpad.

FAQ

📌 Which projects have shown the worst results on Binance Launchpad?

The most unsuccessful was the launch of FC Barcelona soccer team fancoin in April 2021. The ROI amounted to 8%. The ATH ROI is also low, at just 1.79 times the Launchpad sale.

🔔 Does the exchange support projects after the end of the campaign?

Yes. Some of the startups received special attention. For example, WazirX and Tokocrypto exchanges are now considered elements of the Binance ecosystem and are under its indirect management.

📢 What is the vesting period for tokens?

It is a period of time during which cryptocurrencies cannot be used – transferred, sold or staked. If the No lockup status is specified, the assets are not locked and are immediately available for any financial actions.

💳 How to enter rubles on the exchange?

In October 2023, you can deposit common currencies, including Russian money, via Payeer and AdvCash payment systems.

⚡ What do Launchpad and Binance Labs have in common and are they different?

The exchange does not invest its own funds in Launchpad programs. Binance Labs is primarily a venture capital fund. It supports startup projects financially and helps to implement ideas with the help of development programs (gas pedals).

Error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.