Starting from 2017, queries like “ICO in simple words” or “What is a crowdsale” are often found in references to search services. Such excitement is caused by the popularity of the topic of cryptocurrency, its impact on the financial world and the desire to make a profit. One of the main concepts in the sphere of digital assets is Initial Coin Offering, or initial coin offering.

Definition of ICO

An ICO is a way to raise money for projects based on blockchain technology. Stable, large-capitalization assets are often used as investment vehicles. Initially it was bitcoin, and then etherium gained popularity.

Hvordan det skjer

Describing the initial asset allocation in a simplified form, it can be presented as follows:

- Project Launch. The initial stage, at which the startup team (programmers, administrators, financiers and advertisers) is assembled. A presentation of the main idea is held on forums and special platforms. At this time, seed rounds are held with initial fundraising for the development of the project.

- Presale. Closed token sale for anchor investors and business angels. At this stage, seed capital is raised for product development.

- Advertising preparation. It consists in the free distribution of coins in the form of bounties and drops for performing simple actions in social networks, websites and messengers.

- The actual stage of crowdsale. Coins are sold to all willing users.

Reasons for holding

If you study the prerequisites of the ICO of cryptocurrencies, the reason for launching the primary distribution of coins is only one – raising money for a project that uses blockchain technology. The other reasons only explain and supplement the main one. There are cases of illegal initiation of fundraising, when people initially do not plan to develop, implement and promote anything. The goal of such fake projects is only money and profit by deceiving users.

Differences from IPOs and IEOs

For a layman, the concepts of IPO, ICO and IEO seem close to each other in their meaning. However, they have only one thing in common – they are needed to raise money for the development of the project.

| IPO | IEO | ICO | |

|---|---|---|---|

Regulering

Many experts and financial market specialists have long expressed opinions about the need for legislative support of all processes related to the issuance of cryptocurrency, ICO or token trading. Two points of view are popular:

5020 $

bonus for nye brukere!

ByBit gir praktiske og trygge forhold for handel med kryptovaluta, tilbyr lave provisjoner, høyt likviditetsnivå og moderne verktøy for markedsanalyse. Den støtter spot- og leveraged trading, og hjelper nybegynnere og profesjonelle tradere med et intuitivt grensesnitt og opplæringsprogrammer.

Tjen 100 $ i bonus

for nye brukere!

Den største kryptobørsen hvor du raskt og trygt kan starte reisen din i kryptovalutaverdenen. Plattformen tilbyr hundrevis av populære aktiva, lave provisjoner og avanserte verktøy for handel og investering. Enkel registrering, høy transaksjonshastighet og pålitelig beskyttelse av midler gjør Binance til et godt valg for tradere på alle nivåer!

- No governmental structure is allowed to interfere in the processes on the market of digital coins. Cryptocurrencies became so popular because the principles of anonymity and decentralization were observed.

- With legislative acts regulating the ICO procedure, digital money will be more quickly integrated into the global financial system as an equivalent means of payment. Mechanisms will prevent acts of fraud, the number of which is constantly growing.

In most countries, the solution to these issues has not been realized in any way. Some states are making attempts to establish a legislative framework for the organization of trading in digital assets:

- Switzerland. The action of the laws on securities trading does not apply to tokens, although the latter are equated to them. Companies engaged in cryptocurrency projects do not require registration and licensing.

- US. In 2017, the SEC said that some tokens participating in Initial Coin Offering may be equated to shares. They should be subject to similar laws, with little or no control over token trading.

- China. Conducting ICOs, trading in digital assets is categorically prohibited by the state.

Historien om fremveksten

The first time Initial Coin Offering was held in the summer of 2013. The main ideas and principles were formulated by American developer Jay Willett. He offered interested investors to purchase a certain number of his coins for bitcoin. The project was called Mastercoin (later renamed Omni Layer). His goal was to develop a special “superstructure” over the bitcoin blockchain. Such a platform would enable complex financial transactions.

In 1 month, the tokensale raised 4,700 bitcoins. Taking into account the exchange rate at the time, this amounted to about half a million dollars.

However, already in November, the price of BTC coins increased significantly, and the collected amount turned into $5 million. A year later, the capitalization of Mastercoin cryptocurrency exceeded $35 million, and it was ranked 7th in the rating by this criterion.

The next event that significantly influenced the popularity of the concepts of digital coins and ICOs was the Ethereum crowdsale, which was organized by Vitalik Buterin in July 2014. It managed to collect 31.6 thousand bitcoins, which was equivalent to $18.5 million.

Stages of the event

Initial coin offering takes place in several rounds. Depending on the specific project, there may be slight differences, but in general, the sequence of actions remains the same.

Private Sale

First comes the preparation phase. At this time, a White Paper and a roadmap for the project are created and then published. A platform for presentations is set up (its own website or a special Internet platform). During the private sale, the organizers seek to attract “reference” investors. These are specialists whose opinion is valued in the cryptocurrency community. They are called business angels and anchor investors.

The price of tokens at this stage is minimal, which potentially makes it possible to count on high profits when the coin enters the exchanges.

However, not everyone can get to the Private Sale. Most access is granted to institutional investors.

Pre-Sale

This stage can be called a promotional one. In addition to the issuance of tokens itself, the main events at this time take place in the information field. Demand is actively studied and promotional campaigns are held. The price of tokens offered at the pre-sale stage, although higher than during the private round, is lower than at the public crowdsale.

CrowdSale

The main stage of the ICO. It is characterized by great activity on social media, maximum coverage of the event, and the sale of a large volume of digital coins. If the issue was limited, all of them are sold.

With the start of the tokensale, bonus projects, including airdrops, are closed. Only bounties (distributions for writing reviews, comments on forums) remain, as the only purpose of this program is to spread information in public sources.

Coins redeemed are usually transferred to participants’ wallets immediately. Assets received as a result of a free giveaway (airdrop) or bounty will be distributed only after the completion of the placement on the exchange.

Earnings on ICO

With the variety of cryptoprojects conducting initial token offerings, there are not many options for making a profit on this process. The same schemes, developments are used. Among themselves, ways to make a profit on cryptocurrencies differ in the amount of money invested, time frames and different degrees of risk of remaining without capital. The list includes:

- Participation in the early stages of the offer of coins (Private Sale and Pre-Sale stages). This is the most profitable way. Discounts sometimes reach 70% or more compared to the main rounds. Participants can lock in profits immediately after the ICO when going public.

- AirDrop. The essence is that the startup team distributes part of the tokens for free. The money is small, but there is no risk. At the same time, there is no need to perform complex actions.

- Staking. This type of profit generation refers to passive. It will only work if the cryptocurrency uses the PoS (Proof-of-Stake) protocol. You can periodically receive interest if you buy a certain number of tokens on the platform and store them in the official wallet.

- Creating your own project. The most complicated way to earn money on Initial Coin Offering. You can’t do it alone. You need a team of like-minded people and professionals. Besides, you will need money for preliminary expenses. Most importantly, you need a viable idea that people will like so that they will want to become investors in the startup.

Benefits of investment

There are many real-life examples of people who have gotten a 1000% or more increase after the price hikes of etherium and bitcoin. Many successful crowdsales have been held. People who took part in them received decent money.

If you look for how to increase profits on investment projects, you can see that cryptocurrencies and ICOs are a good opportunity to earn, despite the high risks. The main problem is collecting information and analyzing it. It is not enough to have the necessary amount to invest in cryptocurrency. You need to accurately imagine at what stage and in which project you can deposit money.

Risks of investing

Considering investments in cryptocurrency, financial risks can be grouped as follows:

- Related to insufficient or incorrect analytics. Due to inexperience, poor knowledge of the cryptocurrency market, investors can make incorrect conclusions about the possible prospects of a particular startup. Only 30% of such projects were completed and brought profit to their clients.

- Market risks. Due to the high volatility of cryptocurrencies, it is difficult to predict how their rate will change over time.

- Fraudulent activities. This risk group can include both the actions of ICO organizers (who initially conceived the scam for the sake of luring money) and attacks by hackers who break into the project’s software and steal financial assets.

Even if a startup was not planned as a scam, but failed due to force majeure, investors rarely get their money back (including minimal compensation).

Token sales models

Methods of distribution of virtual coins:

- Fixed token sale. The most frequent variant in which the number of assets and their price is a known and constant value. The specifics of coin distribution among insiders are specified in the white paper. If at the end of the tokensale the softcap (the minimum amount for the project) is not reached, all finances will be returned to the investors.

- Non-fixed token sale. This model has no limits on both the number of buyers and the final amount. The price of 1 coin in the distribution process is unknown and is assigned only at the end of the crowdsale.

- Fixed auction. The method involves a prescribed funding limit. Investors themselves determine the price of one token (market mechanism). The number of realized coins depends on the hardcap. This means that if people start buying them at a high price, less will be sold when the limit is reached than if the market value of the token is lower.

- Unfixed auction. The main difference from the previous point is that the number of tokens to distribute is limited. There is no limit on the amount collected. The order of buyers is determined by the highest price offered.

- Hybrid model. The common name of token distribution options that combine various qualities of the main methods.

How to choose a successful project

Before looking for an ICO to invest money, you need to clearly realize that no one is insured against the loss of invested funds. There is no special questionnaire for cryptocurrencies, having filled in which you can determine with 100% certainty the probability of failure or success. However, you should not act at random.

There are not so many criteria by which crowdsale is selected. It is a task for a specialist to assess their importance and priority:

- Relevance of the main idea.

- Study of the main documents: roadmap and white paper.

- Choosing a platform for the project.

- Checking the reputation of the organizers.

- Studying the reviews of the opponents.

Platforms to look for

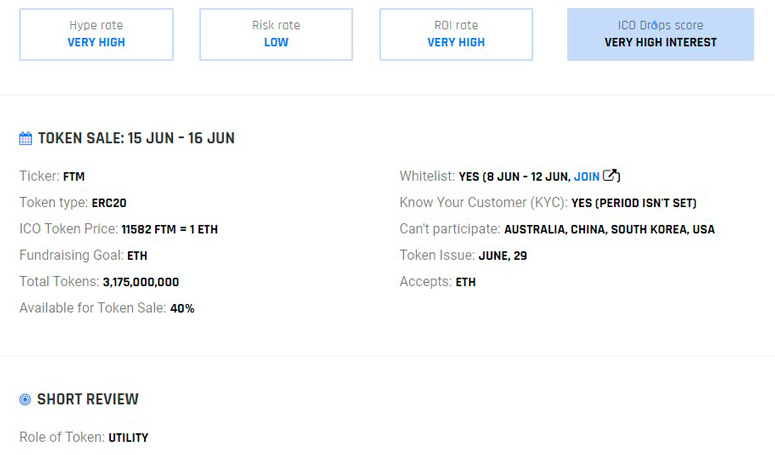

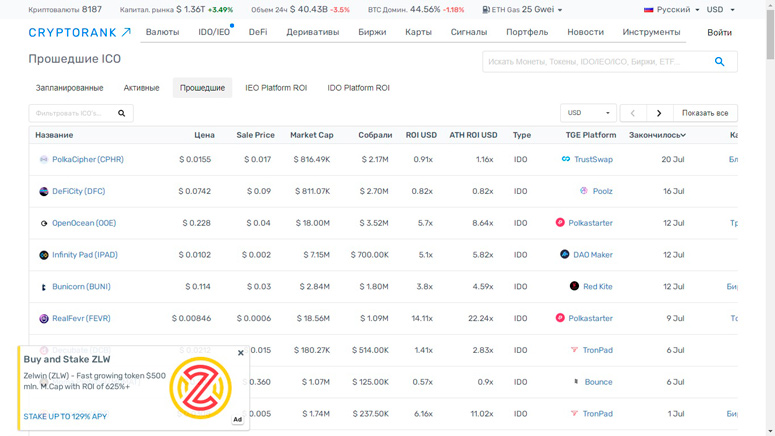

To help with the choice of a promising crowdsale can separate Internet services, which collect full information about the ongoing ICO. In addition to information, some sites provide an analytical assessment of tokensales and the probability of high profits.

Successful and failed examples of popular projects

For 11 years of the existence of the initial coin offering, several thousand startups were launched. Some of them were successfully completed, while others went bust. There were some that initially showed good results (brought investors large dividends), but later the pace of development fell – the projects languished.

| Profitable | Unprofitable |

|---|---|

| ETH (Ethereum) is an open software platform for creating decentralized applications. In 1.5 months, $18 million was raised. The price of the coin at the time of the ICO – $0.31 (2014), in the fall of 2024 – $2379. The maximum all-time high value (ATH) is $4631.42. | Dragon (DRG) – $320 million was raised during the crowdsale. The price of the coin in April 2018 is $1.14, in 2024 – $0. |

| IOTA is a platform focused on the Internet of Things industry. In 2015, an ICO was held, and the project was among the market leaders. The price of the coin during the ICO was $0.14 (2017), in 2024 – $0.12. However, ATH was $5.69. | Envion (EVN) – $100 million was raised during the initial sale. The coin’s price in April 2018 was $0.5, in 2024 was $0.000648. |

| Solana (SOL) – a high-speed blockchain platform for running decentralized applications. The price of the coin during the tokensale in 2021 is $0.22. The exchange rate in 2024 is $128. | Status (SNT) – $95 million was raised during the ICO. The price of the coin during the January 2018 tokenization is $0.6. The rate in 2024 is $0.022. |

| TRON (TRX) – the platform is created for decentralized exchange of content, mainly of entertainment nature (games, social networks, messengers). The price of the coin during the ICO – $0.00109 (2017), in September 2024 – $0.15. ATH – $0.3. | COMSA [ETH] (CMS) – $95 million was raised during the initial sale. The price of the coin is $0.33 in June 2018, $0.03 in 2024. |

How to run your ICO

Each case of launching an icio is an independent action. However, if you highlight only the mandatory elements, there are not so many:

- Formulation and justification of the main idea, calculation of the budget and formation of the project team. The initial coin offering can be launched for a business of any orientation. It is required to outline the range of tasks that the project will solve. It is necessary to define the function of the token (encouragement, payment for actions, payment for goods and services).

- Writing the main document of the company – a white paper (whitepaper). This stage should be approached responsibly, it will be studied by investors. The decision to invest money in the project depends on the quality of the document.

- Selecting a platform and developing a token. To issue a coin, you can create a blockchain platform from scratch. True, it is difficult and quite costly. However, if the goal is simply tokenization of internal settlements and attracting investors, you can use existing protocols for creating smart contracts, which is what more than 90% of companies do. No advice is needed here. It depends only on the project what will work best.

- Registration of the company. To register a company, it is preferable to choose a country in which the legislation is most loyal to cryptotechnology based on blockchain (Japan, Switzerland, Singapore, Estonia). States with offshore jurisdiction are suitable for the initial public offering.

- ICO and PR. Direct description is given above.

- Listing and access to exchanges.

Ofte stilte spørsmål

✅ Is it possible to organize an ICO in an offshore zone and not worry about legal risks?

The choice of such a jurisdiction does not guarantee exemption from liability. This is because the distributed tokens may end up with citizens of a country with a very strict position on cryptocurrencies.

❓ What is an escrow?

It is a temporary account between the founders of the distribution and investors. Its function is to guarantee the return of money to investors in case of a failed fundraising campaign.

❔ How to distinguish a promising crowdsale from a failed one and how to avoid fraud in ICO?

A full guarantee of high profits is impossible. It is necessary to study the trends of the crypto market, technical documentation provided by the organizers, or get information from professionals. To avoid becoming a victim of fraudsters, you need to independently collect information about the project, its owners and team members.

📃 Do I have to study the white paper and roadmaps before participating in an ICO?

No one can force a user to do so. However, without having information about the essence of the startup, it is difficult to seriously expect to increase your investment.

En feil i teksten? Marker den med musen og trykk på Ctrl + Skriv inn

Forfatter: Saifedean Ammous, en ekspert på kryptovalutaøkonomi.