The technical paper about Bitcoin is not in simple language. However, there are ways to explain the working principles of the main cryptocurrency in a simpler way than it is written in Satoshi Nakamoto’s article about Bitcoin. Therefore, even without technical knowledge, you can understand complex terms and realize the importance of Bitcoin for the global financial system.

History of the emergence of Bitcoin

The cryptocurrency Bitcoin has been in circulation since 2009. In early November 2021, the maximum price of BTC was recorded at $68,530. Anonymous holders, who have the largest number of Bitcoins on their wallets, became billionaires overnight. The BTC exchange rate is amazingly soaring, and the story of buying a pizza for 10 thousand BTC is replicated year after year as a day of lost opportunities and has been dubbed Pizza’s Day.

Despite the popularity of the major cryptocurrency, many crypto-enthusiasts don’t even know that the $1 trillion kapitalisering asset was first introduced to the world through a simple PDF document.

Satoshi Nakamoto’s article titled “Bitcoin – a peer-to-peer electronic monetary system” was published online on October 31, 2008. The paper revealed a solution against the global financial crisis – a fully decentralized and independent payment system with a limited supply of assets. The paper used mathematical concepts dating back to 1957. Knowing the key talking points contained in Bitcoin’s technical description is important. It will provide a detailed understanding of today’s investment opportunities. Users should understand why Bitcoin was created, what its developers were trying to achieve.

The essence of Satoshi Nakamoto’s article about Bitcoin

The digital transfer of fiat money requires an intermediary (i.e. a bank), which generates unfavorable consequences:

5020 $

bonus for nye brukere!

ByBit gir praktiske og trygge forhold for handel med kryptovaluta, tilbyr lave provisjoner, høyt likviditetsnivå og moderne verktøy for markedsanalyse. Den støtter spot- og leveraged trading, og hjelper nybegynnere og profesjonelle tradere med et intuitivt grensesnitt og opplæringsprogrammer.

Tjen 100 $ i bonus

for nye brukere!

Den største kryptobørsen hvor du raskt og trygt kan starte reisen din i kryptovalutaverdenen. Plattformen tilbyr hundrevis av populære aktiva, lave provisjoner og avanserte verktøy for handel og investering. Enkel registrering, høy transaksjonshastighet og pålitelig beskyttelse av midler gjør Binance til et godt valg for tradere på alle nivåer!

| Transactions | Costs increase as third parties charge for their services. |

| Data | User information is held by banks and can be shared or lost due to leakage. |

| Security | The need to make payments that neither the bank nor any party to the transaction can cancel. |

The presence of a centralized intermediary in the financial relationship means that this person can make decisions about which transactions will be processed and which will not. He can freeze the money in an account or cancel a transaction. Security for the payment system depends entirely on him.

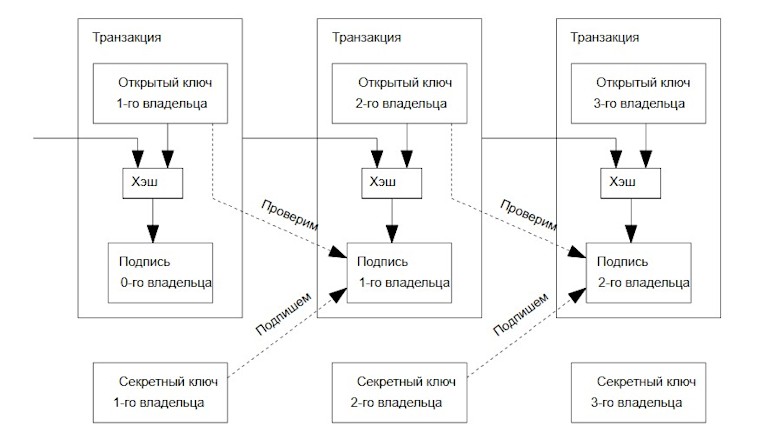

The paper proposes a model for electronic financial transactions based on proof of ownership by digital signatures. At the same time, double spending is mitigated by using a P2P network (peer-to-peer system, without intermediaries) based on PoW (proof-of-work algorithm). To understand how the Bitcoin blockchain works, Satoshi Nakamoto’s article on cryptocurrency in Russian will help.

Decentralized financial system

The purpose of the Bitcoin network was to create a model for conducting digital transactions based on trust. Bitcoin was supposed to replace the existing financial system, where the main role is played by governments and banks. The developers proposed a digital realization of money that could be used to pay for online and in-store purchases. Standardly, settlements were always made through financial institutions that approved and executed each transaction.

With digital currencies, third party services are not needed. The developers’ goal was achieved by creating Bitcoin, which allows immutable and cryptographically encrypted peer-to-peer transactions to protect users from fraud.

In the Bitcoin white paper, the developers sought to realize what people have always thought of as secure money. The main cryptocurrency was to function as a medium of exchange, a unit of account, and a way to save. By creating a reliable alternative to the existing monetary system, Satoshi also imbued the principles of durability, divisibility, portability, intrinsic value, and rarity.

Algorithm of the system

In order for Bitcoin to fulfill its functions, the blockchain was created. All transactions take place on a network that stays active by collaboratively solving problems through computing systems owned by the participants. When someone wants to transfer bitcoin to another user of the blockchain, the links in the chain verify when the sender first owned that amount (one of the previous blocks) and approve the payment they are now transferring to the counterparty (a future block). In this way, the network approves that the amount will no longer be held in the sender’s funds, but is irreversibly transferred to the recipient.

To ensure that all transactions are verified and there is no room for fraud, the Bitcoin network has made them publicly available. This allows any user to check transaction records on the Bitcoin blockchain. Each transaction is recorded with a timestamp that shows where the amount previously existed and where it is going. This is how the block chain is created.

The Bitcoin network uses asymmetric encryption to find and access coins in the blockchain. It is a cryptographic method that uses 2 different keys:

- Public – the address used to retrieve or request coins on the network.

- Private key that gives access to the wallet.

The problem of double spending emerged after digital payments with the ability to reuse the same asset became available for the first time. P2P platforms existed many years before Bitcoin: back then, users could transfer files by creating duplicates on their computers through copying. Blockchain solved this problem.

To avoid double spending, every transaction on the network is verified by all existing nodes that host and synchronize copies of the entire chain.

The power of many computers can help the blockchain validate transactions and create blocks. As each transaction becomes public, it is verified by the nodes. The more miners in the network, the lower the likelihood of double spending.

Tag server operation

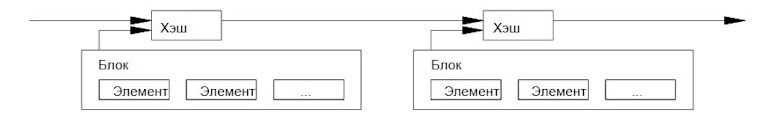

Participants in the network are encouraged to agree on a single history using a special tool. The timestamp server takes a hasj (unique number) of a transaction block and broadcasts it publicly. This identifier serves as proof that the blockchain element in which the transaction is recorded existed at a particular point in time. Timestamps allow network participants to verify the order in which transaction blocks were transmitted. Encoded information indicating when a particular event occurred in the Bitcoin blockchain includes a similar identifier for the previous block. In this way, a publicly verifiable chain of transfers is formed.

A mechanism that forms a permanent history of all blockchain transactions is not enough. An algorithm that will verify incoming transfers and compare them with previous transactions is required for the payment system to work adequately. This ensures that there are no double charges. Moreover, this mechanism should be decentralized. Such an algorithm is known as Proof-of-Work.

The rules of how the network works

A brief description of how the Bitcoin blockchain works:

- New transactions are broadcast to all nodes that collect transactions into a block.

- Each miner then tries to calculate the hash for the new block.

- Once the math problem is solved, the block is broadcast throughout the network.

- The nodes check to see if all transactions are valid (i.e. no bitcoins have been spent).

- When starting work on the next block, nodes declare that they have accepted the previous one and added it to the chain.

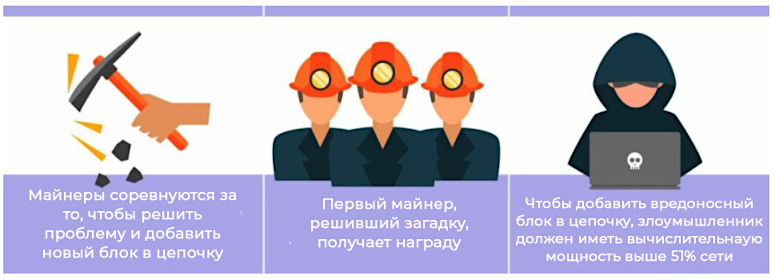

To validate the transaction, Proof-of-Work (PoW) was introduced. The proof-of-work mechanism assigns a random number to each transaction, which is attached to a small puzzle. To complete the transaction, miners solve a math problem (trying different combinations of code). The proof of work is a unique value (hash). Once a miner finds it, it sends this data to other nodes for verification. Network participants can verify the hash to see if it matches the task at hand. Once validity is confirmed, the transaction is executed and added to the blockchain. Chain elements accumulate transaction data and grow in size as new data is included.

Undoing a transfer would require enormous computational power. A minimum of 51% of Bitcoin’s total hash power is needed to undo one hour of transactions. In order to ensure that the system works properly with the PoW algorithm, the nodes that perform transactions are compensated in bitcoins according to the number of confirmed transfers. This is called BTC mining.

Other technical details

BTC mining is referred to as using the nodes of one’s computing system to process blockchain transactions. In return, compensation is paid in bitcoins. This is how new blocks of transactions are created every 10 minutes.

The process of mining is what the bitcoin creator calls an incentive. A reason for people to keep the fully decentralized network up and running while making sure that its proliferation continues to grow.

Bitcoin’s white paper also mentions a predetermined number of coins that can be mined. The maximum number of BTC available is 21 million. This feature makes the bitcoin cryptocurrency free from inflation. New coins cannot be created once the limit is reached. In addition, approximately every 4 years, the reward from a newly mined block is halved (a process called halving). This reduces the number of new coins entering circulation.

Both of these features have shown that, unlike traditional money, bitcoin’s purchasing power increases over the years. For many investors, this cryptocurrency has become one of the main means of saving. However, therein lies a small timing problem. Satoshi wanted people to spend BTC on their daily online purchases. Instead, users are investing in bitcoins for the long-term.

The Byzantine Fault solution is a potential problem the network could face if members do not agree with its strategy. The fault suggests that some members may be bribed. Such nodes will operate undemocratically, and a single point of failure will be enough to jeopardize the system.

The Bitcoin blockchain solves Byzantine failure with its Proof-of-Work algorithm, allowing new strategies to be introduced only if 51% of the network agrees to the process. As the number of miners continues to grow, the likelihood of malicious participants taking over the blockchain becomes unlikely. According to Business Insider, an insider news portal, there are about 1 million miners active in the crypto space. It would take roughly 510,000 nodes to agree on the intentional threat of blockchain to the success of the Byzantine Rift.

Security and privacy

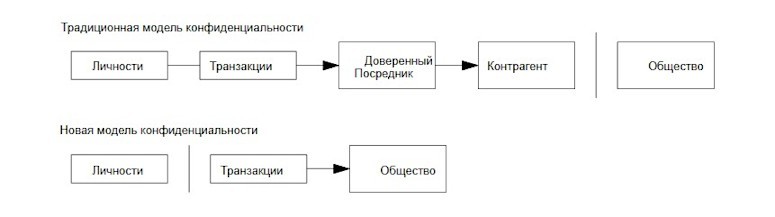

Privacy is the issue that led to the creation of Bitcoin. The ability to transfer funds on a secure network without sharing personal information with third parties was essential for people. The idea of privacy-enhancing technologies dates back to the early 1990s, when the Cypherpunk movement emerged – cryptography enthusiasts who explored ways to make digital systems more private so that they were under the exclusive control of their users.

The fundamental concepts of the movement are outlined in “The Cypherpunk Manifesto,” written by mathematician and programmer Eric Hughes.

Although traditional banking systems restrict access to information about transaction participants, the latter cannot be assured of privacy. In the Bitcoin network, account holders are identified by addresses (random sequences of 26-35 characters). To send or receive assets, a user needs an account number on the blockchain with which to interact. The public can see all bitcoin transactions on the blockchain. However, the blockchain only records addresses, without tying the transfer to identity and private information.

Satoshi Nakamoto’s article also states that it is easier to group transactions. In other words, it’s better to combine 5 BTC in one transfer instead of having 5 separate transactions for each bitcoin. Of course, provided the coins are sent to the same recipient.

Math

Calculations – a section in the white paper, laid out over 2 pages. This place considers a scenario where attackers in the system try to create an alternative chain faster than the original blockchain is created. In this situation, there is a race between the honest network and the attacker.

Assuming that the attacker can get more computing power than the honest nodes, they will be able to alter the chain. In other cases, it is impossible to affect the network because the miners will not accept an invalid transaction (such as sending money to different users twice or willful coin creation).

The only way is to change the output of recent transactions or cancel them. The longer the chain after a transaction, the more proof of work is required to keep it going. The math shows that the probability of an attacker catching up decreases exponentially with more confirmed blocks.

- P = the probability that the attacker will catch up (0.1%).

- q = the probability that the attacker will get the next block (10%, 15%,…).

- z = number of block confirmations.

z=1 z=2 z=3 z=4 z=5 z=6 z=7 z=8 z=9 z=10 | P=0,2045873 P=0,0509779 P=0,0131722 P=0,0034552 P=0,0009137 P=0,0002428 P=0,0000647 P=0,0000173 P=0,0000046 P=0,0000012 |

z=5 z=10 z=15 z=20 z=25 z=30 z=35 z=40 z=45 z=50 | P=0,1773523 P=0,0416605 P=0,0101008 P=0,0024804 P=0,0006132 P=0,0001522 P=0,0000379 P=0,0000095 P=0,0000024 P=0,0000006 |

q=0,15 q=0,2 q=0,25 q=0,3 q=0,35 q=0,4 q=0,45 | z=8 z=11 z=15 z=24 z=41 z=89 z=340 |

These numbers indicate that the higher the perpetrator’s power (q), the more confirmations need to be obtained (5, 8,…). The section calculates the mathematical probability that the attacker will catch up with an even numbered chain. The calculation results in a number

Interesting facts and speculations

For most, Satoshi Nakamoto is the most mysterious character in the cryptocurrency world. It is still unknown whether the name refers to one person or a group of people. The state of the creator of the main cryptocurrency according to various estimates – from 750 thousand to 1.1 million BTC. Also in his honor was named the smallest unit into which bitcoin is divided. Satoshi is the analog of a cent for the dollar.

The first transaction with bitcoins was conducted in January 2009. The cryptocurrency became available for open buying and trading in July 2010. Even 11 years after the first bitcoin was opened for public trading, the coin still ranks number one in terms of market capitalization.

Satoshi Nakamoto’s article opened the door for others to utilize his technology. As a result, people tried to create other forms of blockchains. When Bitcoin’s white paper was written, a proof-of-work mechanism seemed like a great idea. However, keeping track of the number of transactions was too far from a realistic calculation.

Bitcoin became popular and the number of transactions on the network increased. The blockchain was crowded, with miners unable to keep up. This led to slow confirmations. Bitcoin became too impractical for everyday use. It confirmed the fact that people viewed Bitcoin more as an investment than an alternative to traditional money. At the same time, other cryptocurrencies have emerged with different consensus mechanisms (e.g. PoS), faster transactions, more privacy and other useful features such as smartkontrakter.

Bitcoin’s value has been rising every year. Its deflationary nature and technology have made BTC one of the most profitable assets over the past decade (+10,000% ROI). No one knows what marks the value of BTC will reach in the next years.

There is mixed opinion about the future of the Bitcoin network after all the coins are mined. Many crypto-enthusiasts believe that nodes will be incentivized by transaction fees after the full volume of BTC issuance is put into circulation.

Ofte stilte spørsmål

🤷 Which is better – PoW or PoS?

In a Proof-of-Stake mechanism, large players gain power, which is theoretically impossible in Proof-of-Work. However, PoW requires a lot of power.

🔨 Can bitcoin be split into parts?

There is a decibit equal to 0.1 BTC, a centibit is 0.01 BTC , a millibit is 0.001 BTC. The smallest denomination, satoshi, is 0.00000001 BTC.

📄 Where was the bitcoin white paper published?

On metzdowd.com.

🤨 Why was bitcoin created?

To allow people to send money over the internet without intermediaries.

🤔 Why was blockchain created?

The developers wanted to realize a system where transaction timestamps could not be changed by anyone.

Feil i teksten? Marker den med musen og trykk på Ctrl + Kom inn.

Forfatter: Saifedean Ammous, en ekspert på kryptovalutaøkonomi.