The easiest way to make money from tokens and coins is to buy and store assets for the long term. But this methodology brings profit only if the price of bitcoin and other digital currencies will grow. Trading on crypto exchanges gives you the opportunity to earn both on the rise in the price of assets, and on the decrease in their price. But the profitability of this method depends on the user’s ability to predict the dynamics of tokens and koins. For this purpose, different strategies for trading cryptocurrency on the exchange are used. Beginners need to study all the ways of analyzing and forecasting and choose the most convenient and effective.

Fundamentals of trading

The main principle of speculative trading: buy cheaper, sell more expensive. Regardless of the specific strategy, users on crypto exchanges work according to this general algorithm:

- Choose a trading pair or a specific asset.

- Estimate the probability of continuation or reversal of the trend.

- Determine the moment to open a transaction.

- Create a buy or sell order (in stock exchange slang it is called a long or short position).

- Wait for quotes to change in the desired direction.

- Close the transaction after they receive the desired income or if the operation brings unacceptable loss for the client.

The result of such actions depends on the accuracy of market analysis. The trader needs to understand in what direction the rate of cryptoasset will change in an hour, a day or a month. For this purpose, different techniques are used.

The best exchanges for trading

The profitability of cryptotrading depends on the choice of platform. The more assets available on it and lower commissions, the easier it is for the client to receive income from operations. CryptoProGuide.com published a rating of crypto exchanges by daily transaction volume, number of trading pairs and user reviews. Beginners should register on platforms from the top of the list.

Technical analysis

A forecasting method based on the study of past quotes of an asset. It is believed that the dynamics of the cryptocurrency exchange rate is cyclical. The rise and fall in demand for bitcoins and altcoins follow the same patterns. To identify these recurring situations, users:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- Look for patterns (graphical shapes that signal a reversal or continuation of a trend) on the chart of a trading pair.

- Identify support and resistance zones.

- Try to predict reversal points using Elliott waves or Fibonacci levels.

Fundamental analysis

Based on the study of economic, political and news preconditions for changes in quotes. To trade using this methodology users:

- Follow the news, speeches of major investors and politicians.

- Evaluate the prospects of cryptocurrencies, compare their technical characteristics.

- Analyze the economic situation and sentiment in other markets (stock, commodity, currency).

Time horizon

Holders can store tokens and coins for an unlimited time (from a second to several years). It all depends only on the plans and skills of the user. Time horizon is an approach to investing and crypto trading based on the expected duration of transactions. The user determines what financial result they need on a daily basis and how long they are willing to wait for profits. There are these types of time horizons:

| Type | Characteristic |

|---|---|

| High Frequency Trading | The duration of a trade does not exceed a few seconds. The emphasis is not on market analysis, but on searching for arbitrage situations – the difference between the rates of buying and selling an asset. Usually such operations are carried out with the help of robots and computer programs. |

| Scalping | Focused on earning from conducting many short-term transactions. A cryptotrader holds a position for several hours (sometimes – minutes). His goal is daily stable earnings. |

| Medium-term trading | Trades are conducted less frequently than in scalping. A deal can remain open for up to several weeks. In this case, the user expects a high income from each transaction. |

| Long-term investing | Provides for a gradual increase in capital. In some cases, the user keeps cryptoassets for several years, expecting their multiple appreciation. |

Use of indicators

For the convenience of cryptotraders, there are special mathematical formulas that help to predict the dynamics of quotes. Usually, thechanalysis indicators are calculated:

- Probable trend reversal points.

- Resistance or support levels.

- Zones of overbought (overvalued) or oversold (too low price).

- Trend direction and strength.

- Trading volume (number of transactions per second or hour).

Indicators are available on most crypto exchanges in both desktop and mobile versions of terminals (trading applications). They are usually applied to the chart of a digital currency or placed below it.

The first indicators were created in the era of the emergence of stock and commodity exchanges. Back then, speculators had to make calculations manually. Today, most indicators have a convenient interface. The client only needs to set the timeframe (time interval) and other options, and the application itself will display the necessary levels and zones.

Factors affecting the cryptocurrency rate

The price of tokens and coins depends on the ratio of buyers and sellers. If the demand is higher than the supply, the rate rises. But this ratio is influenced by many factors:

| Positive | Negative |

|---|---|

| High interest of ordinary people in digital payment systems | Legal bans and restrictions |

| Emergence of new cryptocurrency startups | Slowdown of blockchain technology adoption in other spheres of activity |

| Increase in investments from institutional investors | Capital outflow to stock and commodity markets |

| Legalization of digital money at the state level | Disruptions in the work of major crypto exchanges and blockchain projects |

Best cryptocurrency trading strategies

Users apply different systems for analyzing and opening trades. Some crypto traders rely on indicators, support levels and graphical figures. Others analyze the prospects of projects and invest in the most interesting startups. On crypto exchanges there are also clients who earn on the difference of quotes of several platforms. This type of activity is called arbitrage.

Each client tries to trade on the exchange according to his own methodology. But in general, it is possible to distinguish such common systems.

Margin trading

On many cryptoplatforms there is an opportunity to open transactions with leverage (leverage). These are borrowed funds that the exchange provides to the client for transactions. The strategy of earning on cryptocurrency using leverage allows you to get more income, because the capital increases in proportion to the borrowed assets. But in case of a failed transaction, losses also increase.

Margin trading requires accurate market analysis and the use of stop-loss type orders. This type of transactions allows you to limit the maximum loss: if quotes move in the opposite direction to the expected, the exchange will stop the operation, preventing the loss of the deposit.

Scalping

The second way to quickly increase capital, popular among beginners. Scalpers open a lot of transactions and fix the profit immediately after the chart moves in the desired direction. Usually the profitability of one transaction does not exceed several percent. But due to a large number of transactions, a trader can make a profit every day.

Usually scalping is combined with margin trading. In this case, the client has enough capital to open several orders in parallel.

Long-term trading

Cryptotrading strategy based on the expected growth of the price of the asset in a few months or years. Usually, the analysis is carried out in this sequence:

- The trader studies the most promising cryptocurrency projects. The professionalism of the development team, technical documentation (white paper), and practical utility of the blockchain network are evaluated.

- Based on fundamental techniques, the level that the asset price can reach in the future is calculated. In long-term trading, a margin of error of a few percent is allowed.

- The user buys cryptocurrency and stores it on an exchange or personal wallet. In some cases, tokens and coins are transferred to investment projects to increase profits. These can be lending, staking or farming programs.

- Once the price has reached the desired mark or the prospect of a further uptrend has deteriorated, the transaction is closed. Cryptoassets are exchanged for fiat or other digital currencies.

Trend Trading

English-speaking crypto traders often use the saying: The trend is your friend. Translated into Russian, this means “The trend is your friend.” It is believed that trades against the dominant direction are more dangerous. The user hopes for a reversal, but a strong price movement can nullify his deposit. Therefore, experienced crypto traders try to trade on the trend. Usually, indicators are used in such strategies:

- Relative Strength Index (RSI). Allows you to assess how fast the rate of a digital asset is growing or declining.

- Trend lines and Andrews Pitchfork. Indicates the range of quotes, within which there is a prospect of further growth or decline of the rate.

- Moving Average (Moving Average, or MA). These mathematical formulas compare the current price of cryptocurrency with past data.

A common mistake made by beginners is trading on a trend determined only visually. The user sees that the price of a token or coin is rising and opens a position, expecting that this sentiment will continue.

This expectation often turns out to be wrong. Cryptocurrency cannot continuously go up or down in price. If the exact reversal zones are not identified, there is a risk of entering a trade before the current trend changes.

Breakdown of the resistance level

On the chart of a cryptocurrency, you can find lines near which volatility (rate of change in the exchange rate) decreases. Such zones are called support levels (in a downtrend) and resistance levels (during the growth of quotes). If the chart continues to move in the same direction near these marks, we speak about a breakdown. The opposite situation is a rebound from the level with further correction or reversal.

Breakout techniques are more often used by scalpers. The cryptotrader waits for the volatility of the asset to increase. After breaking through an important price level, an order to buy or sell the currency is sent. Usually, the operation is completed when the chart reaches the next significant zone, near which volatility slows down again.

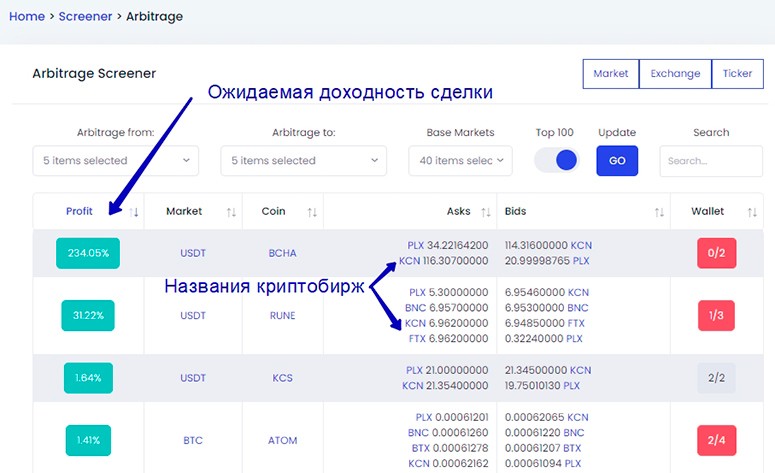

Arbitrage

The quotes of tokens and koins differ on different crypto platforms. This feature can be used to make money. Usually, arbitrage is conducted according to the following algorithm:

- A visitor creates accounts on several crypto exchanges.

- If the exchange rates on them differ, the client buys the asset where its value is the lowest.

- The purchased tokens or coins are transferred to the deposit of another exchange.

- The client sells the cryptocurrency, receiving more fiat for it than was invested at the beginning.

Arbitrage attracts beginners with the possibility of earning money without studying the principles of fundamental and technical analysis. But in this case, there is a risk of losing money if there is a sharp collapse of quotes during the operation. Besides, the difference of exchange rates usually does not exceed a fraction of a percent.

The costs of making a deposit and transferring cryptocurrency in the blockchain can exceed the profit from the sale. Therefore, arbitrage should be treated in the same way as other methods of earning money on exchanges. It is important to remember the risks and competently distribute the capital used in the work.

Strategy on MACD

Trend trading system based on technical analysis. MACD is an indicator consisting of 2 moving averages with different periods.

If the histogram (bars) of the indicator crosses the signal line from bottom to top, the crypto trader opens a long position. In the opposite situation, the possibility of selling the asset should be considered.

Cryptostrategies on MACD attract beginners by the ease of setting up and searching for signals. But such recommendations are often inaccurate. Therefore, in addition to the indicator, you should use other methods of fundamental and technical analysis.

BTER

A trading strategy for a cryptocurrency exchange based on the daily volatility of digital money. In 2020-2021, the rate of Bitcoin and altcoins changed by 3-5% on average per day. This feature can be applied by buying cryptocurrency and simultaneously placing a pending order to sell the asset with a markup of 5%. The authors of the methodology promise to double the starting capital for 20 operations.

In practice, a trader risks opening a position on the eve of a sharp collapse and losing the entire deposit. Therefore, even using the BTER strategy, one should analyze it thoroughly and, if possible, avoid trading on days of increased volatility.

Alligator

A trading system developed by the stock market analyst Bill Williams. The Alligator indicator consists of 3 smoothed MAs. Usually the fast moving average is colored in green, the average – in red, and the slow moving average – in blue.

The simplest instruction provides for opening long positions if there is a crossing of the indicator lines. In this case, the fast MA should be above the others. If the green line crossed the red one from top to bottom, a sell order should be placed.

Inverse Stochastic

A strategy for trading on the cryptocurrency exchange based on the Stochastic indicator. This oscillator helps to identify powerful trend movements. As soon as the market began another upward impulse, a buy order is created. The disadvantages of the methodology include poor efficiency during the flat period – a period of reduced volatility.

Trading on MAs

A simple way to make money with the Moving Average indicator is to add one moving average to the chart. If the MA line is below the last candle, a long position is opened. This type of signals is characterized by low accuracy.

A more complex variant of cryptotrading is the addition of several moving averages. Depending on their configuration, the strength and probability of trend continuation is evaluated.

Heiken Trader

A system based on analyzing the sequence of candlesticks on the chart. Heiken Ashi means “average bar” in Japanese. The chart of this indicator differs from the classic candlesticks by the equal size of bars. In addition to bars, the strategy provides for filtering signals based on the duration and severity of the trend.

CCI, Dema and RSX

Indicator system that includes such tools as Momentum and RSI. It belongs to the number of trending techniques. The signal to open a position is received if the price breaks through a significant level determined by indicators and moving averages.

Thriller

Trading system with author’s Trillion indicators. It is actually a modification of such tools as MA and MACD with unique period settings. Gives the user a signal to open a position after confirming the start of a new trend.

WPR + volatility

One of the popular stochastic oscillators is the Wiiliams Percent Range. This tool helps to find overbought zones. The combination of WPR + volatility provides for filtering the signals of the Wiiliams Percent Range depending on the volatility level. Unlike the usual Wiiliams Percent Range, the indicators are displayed in the form of a histogram. This allows you to determine the moment of entering a trade by the ratio of the indicator bars.

Daily Chart 3-Candle

The system of searching for patterns on the chart. One of the formations characteristic for the cryptocurrency market is 3 candles of the same color, located sequentially. This signal indicates a possible trend reversal.

The disadvantages of candlestick patterns include their low accuracy. The formation of the bar is tied to a certain time interval. Therefore, traders living in different time zones, candlestick patterns on daily or weekly timeframes may differ.

Beat the Market

A system that involves searching for reversal points on the chart. According to the authors, the market is flat most of the time. In such a situation, the price returns to the previous levels. If you correctly find the pivot point, you can open positions even against the established trend.

Using bots

Manual trading has a significant disadvantage – psychological pressure on the trader. The user risks losing investments, which causes stress. In such a situation, beginners often make mistakes: they close profitable deals too early or hold positions during the collapse of quotes.

Trading robots (applications for automated trading) are devoid of these disadvantages. The user specifies the conditions under which the program places orders. In the future, the owner of the robot only needs to control its work, without interfering in market operations. But good applications for automated trading are not distributed for free. To create your own robot, you need not only to understand techanalysis, but also to be able to write the code of computer programs. Therefore, this strategy is not suitable for beginners.

On the Internet, you can find ads for the sale of robots that bring guaranteed profits. Developers promise a quick increase in deposit in exchange for an inexpensive subscription. Most often such ads are placed by scammers, offering bots that trade according to the simplest algorithms.

High profitability can be provided by averaging – repeated opening of repeated trades against the current trend. This system creates an illusion of profitability, as it allows you to close even erroneous operations with profit. But at any moment a strong trend movement may start in the market, as a result of which the trader will lose his deposit.

Investments in the index

On trading platforms, you can buy not only digital currency, but also derivatives: futures, volatility tokens, swaps. One way to make money is to invest in bitcoin and other cryptoasset indices. These instruments display the change in the price of several digital currencies or contracts. In particular, the rate of the altcoin index depends on the dynamics of Ethereum, Solana and other popular coins.

This method allows you to make a profit even if the quotes of one of the assets included in the set fall. But investments in indices are usually categorized as long-term investments. These instruments have low volatility, and most crypto exchanges do not have the option of margin trading with such instruments. In addition, when buying a basket of assets, you need to analyze the prospect of growth or fall in the price of each of them.

How to choose a cryptocurrency exchange

When compiling the rating, such criteria are taken into account:

- The reputation of the project and feedback from other customers. In the network there are many fraudulent platforms that block visitors after making a deposit. Therefore, the rating takes into account the reviews of real cryptotraders and the reliability of the exchange.

- The number of available tokens and coins. The wider the list of trading pairs, the easier it is for the client to pick up the asset.

- The average daily volume of transactions. On crypto exchanges, all transactions are conducted through the orderbook – a book of orders. The greater the volume of transactions, the faster the exchange will be made.

- The possibility of depositing fiat. Beginners may not have a cryptocurrency wallet. In this case, you need to deposit fiat currency and then exchange it for tokens and koins. To do this, you should create accounts on exchanges that accept payments through electronic systems and from bank cards.

Tips for beginner traders

There are many ready-made trading systems on the Internet. Beginners often make the mistake of opening trades using unproven indicators and analysis methods. The exchange rate of the token or coin changes to the disadvantage of the user, and the investment is burned.

To earn cryptocurrency trading strategy, you need to understand the basic principles of speculative operations. For this purpose, there are training materials, articles, expert forecasts.

The next stage is to test the methodology of cryptanalysis on a demo account or by performing transactions for a small amount. Proceed to large transactions should be after a complete test of the trading system.

Summary

The main goal of crypto trading is to buy an asset and then sell it at the best price. To do this, you need to conduct fundamental or technical analysis, determining how the value of a token or coin will change. Different cryptocurrency trading strategies are used on exchanges and trading platforms:

- Indicator trading.

- Analyzing support and resistance levels.

- Studying news, expert opinions and technical characteristics of cryptoassets.

- Arbitrage.

Each technique has advantages and disadvantages, so beginners should test different ways of working on crypto platforms.

Frequently Asked Questions

📐 How do cryptostrategies differ from techniques for analyzing the stock market and forex?

Tokens and coins are characterized by high volatility. Therefore, competent traders try to use trend indicators. But the general sense of analysis does not change significantly.

💡 Does the choice of cryptocurrency affect the result of trading?

Most strategies are suitable for any digital assets. For beginners, it is better to train on Bitcoin and Ethereum, because these currencies are more liquid.

✅ What is better – standard or author’s indicators?

There is no exact answer. The effectiveness depends on the methods and settings. No indicator gives 100% accuracy of signals.

🔎 Which methods of analysis are easier for beginners to master?

Usually beginner traders use the most common indicators: MA, MACD, Stochastic. It is recommended to learn the basic patterns and trading on support and resistance levels.

💰 Is it possible to make money on cryptocurrency without getting into trading methods?

Yes. Lending, staking, and liquidity pools are available to token and coin owners. These offerings involve transferring crypto assets to the platform or others in return for a certain percentage.

Error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.