The safest strategy in the market is “buy and hold”. It implies betting on long-term growth of assets. This approach allows earning with minimal time expenditures. But in sideways markets the investor receives “paper” losses, and the correction can drag on for several months or years. Opening long and short positions on Binance on bitcoin or altcoins, the trader gets profit on any movements. The main thing is to conduct a preliminary analysis of the chart and observe risk management. On longing trends, most users bet on the increase in price, on falling trends – vice versa. On the exchange’s website you can view information on open positions and apply it in trading. The sentiment analysis factor will allow you to predict reversals.

What is long and short on Binance

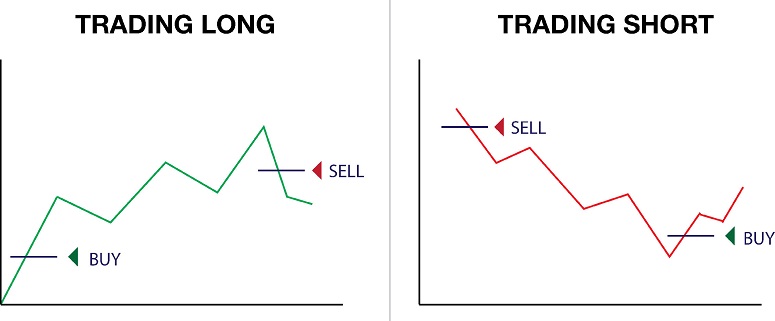

Traders can earn income on any market movements. Long is a bet on the growth of an asset, while short is a bet on the fall. You can buy coins on the spot, margin and futures markets. When trading with leverage, risks and potential profits increase.

Binance provides assets in exchange for a fee. In trades with open-ended contracts, customers pay no interest for the use of the loan. All futures traders are charged a funding fee every 8 hours. The amount can be positive or negative depending on the market situation.

In the margin market, a loan utilization fee is charged. The commission is charged once an hour. It is always a loss for the trader. Actual rates can be viewed in the trading terminal (top right). It is necessary to take into account additional costs when opening an order.

There are no commissions to pay on the spot market, that is why long positions are called long (from the English long). Trading without leverage, investors can hold coins for years. When opening short positions (from the English short), traders count on quick profits. They sell coins or contracts that they borrow from the exchange.

If the forecast turns out to be correct, crypto traders buy assets cheaper, repay the liabilities, and take the difference for themselves. Any short positions are a loan, so they should only be opened on the margin and futures markets. The direction, time and level of closing should be calculated. If the position is held too long, Binance interest will exceed the potential profit.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

What does longing mean

In the long term, quality assets are rising. In the moment, price spikes are possible for various reasons, but once the external background improves, the coin rewrites the highs. Therefore, opening long positions and holding them for a long time is considered the safest strategy.

How to open on the exchange

Binance customers buy coins with the use of exchange funds and without them. Transactions on different markets have peculiarities:

- Spot. The client can buy cryptocurrency only with his own money. When creating a request, the amount on the account is blocked, so you can not place many orders far from the current price “for luck”. After the purchase, the coins will be transferred to the spot wallet. They can be withdrawn to another platform, placed in deposits or kept on the balance.

- Margin. Binance provides leverage on some assets. You need to enter the ticker of the coin in the search. There is near the name there is an icon “3x” or “5x”, the cryptocurrency is allowed to buy with margin.

- Futures. More than 200 contracts can be traded on the exchange with leverage up to 125. The size depends on the market situation and the underlying coin. The lower the price and popularity of the digital asset, the smaller the maximum position. To access the option, one must pass a knowledge test on the basics. During the first two months you cannot open transactions with leverage above 20, further – without restrictions.

Explanation of the concept of “short”

The cryptocurrency market is not always rising. During a downtrend, lows are constantly rewritten, coins fall almost without rebounds. Long trades bring losses, so traders act on the downside. This is done by borrowing assets from the exchange or opening a short trade in the futures market. A fee is charged for holding positions, which is why they are called short trades.

How to short

To access margin trading on Binance, you need to activate two-factor authentication. Instructions for opening a trade:

- Go to the “Wallet” tab and then “Balance”.

- Select the item “Open a margin account”.

- Confirm the action.

- Open the “Futures account” tab.

- Correctly answer 5 questions about open-ended contracts. You can take the test an unlimited number of times up to 100% result.

After that, the user is authorized to transfer funds between markets. When making a deposit, the balance is displayed in the “Deposit Wallet” tab. To open short positions, it is required to transfer money to a margin or futures account.

Profit taking

The client analyzes the chart of the cryptoasset and comes to the conclusion that the price will decline. You can open a transaction on the spot market (margin account) or on futures. Need to determine:

- The level of cancelation of the idea.

- The acceptable risk.

- Time to hold the position.

- Lot size.

Taking into account these data, the cryptotrader chooses a market for trading. Then the order of actions is as follows:

- Go to the “Markets” tab.

- Select the item – “Spot/margin” or “Futures”.

- Find the desired asset in the table or via search.

- Click on the coin and go to the trading terminal.

- Select the leverage, order type (pending, market or stop order) and specify the order size.

- If necessary, enter the price (you can click on the glass).

- Click on the “Sell” button.

Risk Management

When opening a long trade on the spot market, the loss is limited to the price of the coin. When buying 1 BTC for $25k, the trader will lose the deposit if the digital asset depreciates. Theoretically, the value of cryptocurrency is not limited by anything, so in a short position, the potential costs are infinite.

Acting on the downside, it is necessary to follow the rules of risk management. It is necessary to set small stop losses or take a loss when approaching the level. Beginners try to avoid liquidation and add funds to the account. This leads to large losses.

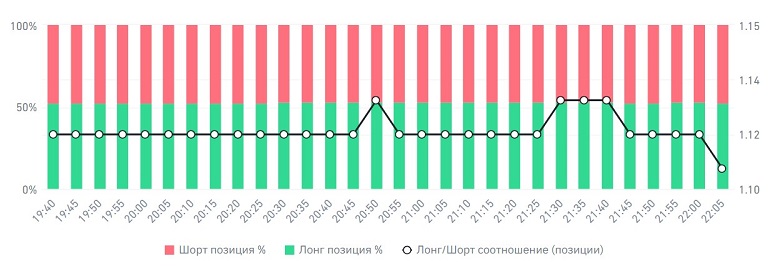

Ratio of longs and shorts on Binance

This is a market sentiment indicator that can be used in trading. To calculate the long and short ratios on Binance, you need to divide the number of some positions by the number of others. For example, if there are 50 longs and 25 shorts open on an asset, the ratio will be 2 (50/25).

Where to watch

Analytical information is posted on the exchange’s website in the Binance Futures section. On the page you can see the ratio of longs and shorts on Binance, open interest and market buy (sell) volumes for the last month.

The information is presented in a graphical form. Only the positions of top traders – 20% of accounts with the largest balance – are taken into account. You can view five-minute, hourly and daily bars.

How to use it in trading on the stock exchange

Data on traders’ positions helps you to understand the market sentiment and make informed decisions. Usually, most participants stand in the direction of the main trend. But when there are too many short positions, it may indicate an imminent reversal.

If a major participant appears on the market, which will set the growth momentum, users will have to close short trades on the market. To do this, they will need to buy the coin, which will further accelerate the price.

Explanation of the PNL indicator on Binance

Cryptocurrency trading on the exchange is a high-risk business. To make money, you need to stick to a strategy and regularly analyze profitability. The PNL (Profit and Loss) parameter is used to evaluate the performance of an account. You can generate a report on any data:

- Transactions on a particular strategy for the entire period of work.

- One position (open or closed).

- A series of executed orders (5, 50, 100 or more).

- All transactions on the account for a certain period. They can be opened by one strategy or by different strategies.

You can select only the necessary indicators or order general statistics. Often traders analyze several reports at once – for the quarter for the futures market, spot market or for individual strategies. It is possible to use different sub-accounts or trade on one.

How to check on the exchange

Statistics of long and short on Binance for the required period can be viewed in the user profile. Reports are uploaded by account or separately by market for a month, quarter or year. The page displays a graph and daily histograms. They are used to evaluate the overall result or analyze the most profitable (loss-making) periods.

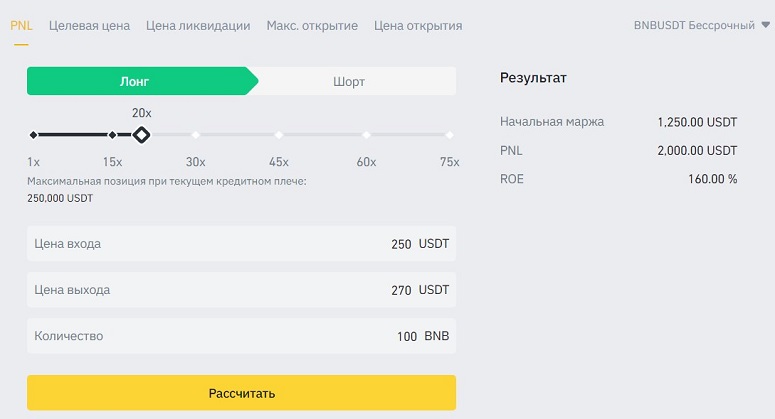

PNL is calculated by the formula – the difference between the opening and closing prices is multiplied by the order size. This parameter can be viewed in Binance reports and current positions. Until the transaction is closed, PNL is called unrealized, and instead of the cost of fixing take the market (markdowns). Exchange commission, possible slippage and spread are not taken into account.

How to calculate on a spot

Leverage is not used here, so the PNL principle is the easiest to understand. Example – a client buys 1 BTC at a price of $25 thousand and sells it for $30 thousand. The commission on the spot is 0.1%. Calculation is required for all positions for the period.

| Parameter | Value |

|---|---|

Calculation at margin trading

In such trades clients buy assets for the amount exceeding the balance. For example, with own deposit of $100, leverage of 10x is used. As a result, $1 thousand can be invested in a deal. Therefore, in the formula for calculating profit/loss, the PNL value for a spot should be multiplied by the leverage size.

It is also necessary to take into account the fee for holding a position. On a margin account, it is charged every hour. On Binance for bitcoin the commission is 1.46% per annum, and for altcoins – 7.3%. An example of calculation is in the table. Initial data: a user buys 10 LTC at the price of $100, sells it for $110, transaction time – 1 day.

| Parameter | Value |

|---|---|

Performance on futures

In trading perpetual contracts, it is possible to open orders that are 100 times or more the size of the deposit. High marginality of the market creates additional risks – price squeezes and manipulation of quotes. That is why instead of the market rate an index is used. It is used to calculate the marking price – the average value on all exchanges.

The index is used to calculate the unrealized PNL on Binance. When opening a transaction on futures, the client can choose which price to take into account for take profit and stops – the last or marking price. The rest of the calculations are similar to PNL for margin trading, with one exception. Futures traders do not pay interest for the use of borrowed funds. Instead, a funding fee is calculated every 8 hours.

This is the name given to the periodic payments that some traders make to other traders. If the futures price is above the spot in the reporting hour, the longs pay the shorts. If it is lower, vice versa. The actual value is placed in the terminal in the upper right corner of the screen. The funding fee on Binance changes every 8 hours. During peak volatility, more frequent adjustments are possible.

Frequently Asked Questions

✨ Why do traders open short trades, since the risks are higher?

Usually the price rises slower than it falls. Sometimes it happens that the growth of several months is lost in 1-2 weeks. But the client is able to reduce the risks – acting on the downside, the trader is on the market for less time, and earns the same or more. It is worth following the rules of the strategy and putting stops. Otherwise, you can lose your deposit.

📌 How to simplify the calculation of PNL and initial margin?

On Binance, you can open the calculator – click on the corresponding icon in the terminal. You need to enter transaction parameters to get the potential PNL, maximum lot size and margin call level at a given deposit.

🔔 Why is it recommended for beginners to buy coins on spot?

In margin trading it is important to calculate the correct entry point, otherwise there is a risk of position liquidation. On the spot, it does not matter much. When buying quality assets, quotes will still return to the entry point and rewrite the extremes. You can increase your profit by using the averaging strategy.

⚡ Why analyze your PNL reports?

Beginners are not always able to adequately evaluate trading results if there have been many deposits and withdrawals on the account. It may seem that there are profits. The report shows that the result of trading is zero or minus. In this case, it is better to change the strategy.

📢 How to choose the optimal leverage in margin trading?

On Binance on perpetual contracts, you can open a trade exceeding the deposit by 125 times. Such leverages are taken by beginners with a very small deposit (up to $10). Experienced traders with medium-sized capital trade at 10-20x. To calculate the size of the position you need to determine the risk (% of the deposit), entry price, stop and enter the data into the calculator. The maximum leverage will be determined automatically.

Error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.