Trading and investing have acquired a bad reputation in the Russian-speaking space. Perhaps the reason for this is the negative information background on forums and in social networks. There are hundreds of such stories, and then there is cryptocurrency, where there is a lot of scam and fraudsters.

Why become an investor in digital assets

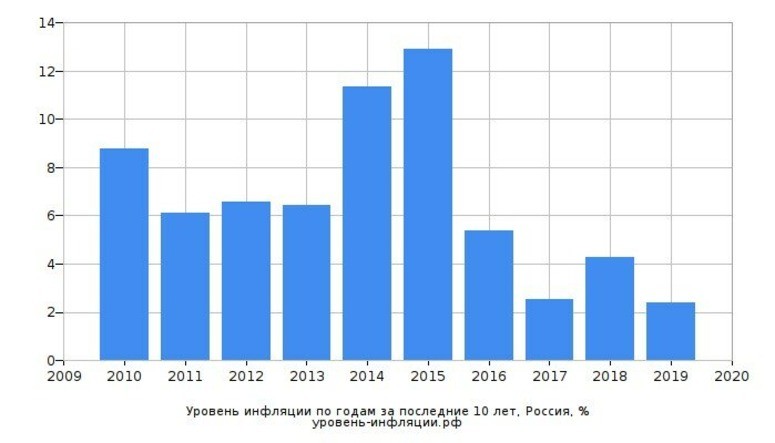

Confidence in the future gives a stable salary, but with inflation and crises in Russia, the future is vague. Investing in real estate for a rainy day is not as profitable as it seems. Long-term rent – not a bad option for downshifting, if there are several properties in a major city. Otherwise – spending 30-50 hours of personal time per week in daily maintenance of the apartment. From the cost of real estate in a year you will earn 10-12%. This is a very small percentage. Taking into account the fall in prices, as in 2008, and the costs of maintaining an aging fund, a trouble-free old age is not guaranteed.

The average person is sure that capitals are created by big finance, and there are no places in this party. But it is not so. The question is not how much we earn, but how much we spend. For example, your neighbor’s salary is 1 thousand dollars. He can buy at a time a new IPhone 12, which will lose 20% in value in the first year of use. Another option is to buy Apple stock and double the amount in a year. Investments are more profitable than tangible assets.

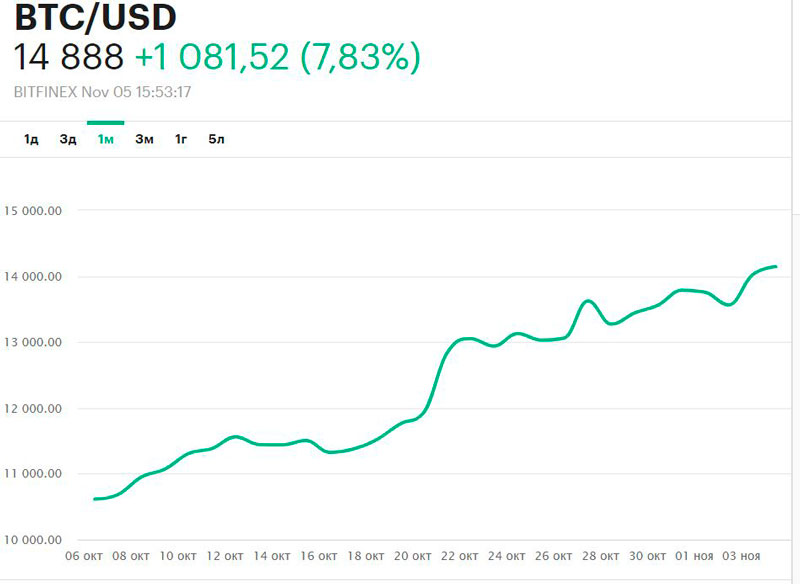

With cryptocurrency is more interesting, but the investment period here is long – volatility sometimes leads to sharp price drawdowns. The trend of any financial instrument in history is growing, so the rule “buy and hold” works well in the crypto market. An investment in bitcoin, for example, in January 2019 of the same thousand dollars would today give an increase in capital almost four times. The world’s main rich people, participants of the Forbes ratings, are now actively withdrawing money from fiat currencies into crypto-assets.

How to become an investor

First, you need to optimize your personal budget. You should not deny yourself small pleasures, but the accounting of expenses is necessary. Even with a small salary, you can become an investor. For example, with an income of 300 dollars a month, monthly expenses are only half of this amount. A small investment will yield a profit, but it will take time.

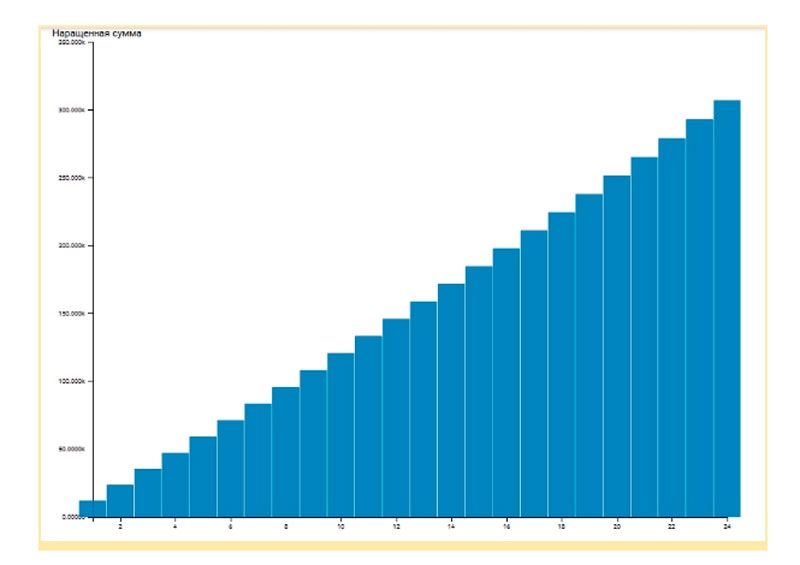

Compound interest is simple. Each month, the investor invests a fixed amount at interest. The previous month’s profit is not withdrawn, but reinvested. For two years, the free 150 dollars from the salary will bring 350 thousand rubles. To get more profit, you can increase the investment period, and make investments in dollars.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

The rule of “72” will allow you to calculate the terms of doubling the capital, if you do not make additional cash injections every month. For example, if profitability is 20% per year, then 72/20=3.6 years – the time for which investments will double.

The picture shows the calculation of compound interest with an initial deposit of 11,500 rubles ($150). The investor adds every month an amount equal to the starting amount and reinvests the income of the previous period at 10% per month. After two years, the account will have 350,000.

What to invest in

There are many financial instruments on the market, which give returns many times more than the usual bank deposits. Let’s focus on some of them:

- Cryptocurrency is sold in online exchanges or crypto exchanges. To start, you need a personal digital wallet to store the currency. You can register it on the Blockchain service;

- Tokens – an analog of blockchain project shares. The owner is provided with benefits: reduced commission for buying coins and for withdrawing money. Tokens are also traded on stock exchanges and can bring profit if the rate grows;

- Shares are traded on the stock market, access to which is provided by the broker. The company will help with registration of an IIS (Individual Investment Account). The owner of an IIS is entitled to a tax deduction of 13%. Share – a share in a company expressed in money. If you bought Gazprom securities for one thousand rubles, you own a part of the company for this amount;

- Bonds are less profitable than shares, but their income is stable. According to the results of a half-year or a year, the owner is paid a fixed percentage;

- ETF-funds are suitable for beginners. The company, issuing such securities, collects different assets in one instrument and releases it to the exchange under a single marker. For example, you can buy one ETF-fund “Enterprises of American hitech”. This approach reduces risks. If some of the securities in the fund bring a loss, it will be compensated by the profit of others.

Registration on a stock or cryptocurrency exchange does not take much time and is no more complicated than opening an account in social networks. Account replenishment by brokers and exchanges is usually free of charge.

Author: Saifedean Ammous, expert in cryptocurrency economics.