Decentralized finance has given the cryptocurrency world new tools to create passive income. DeFi-stacking has become a trend in 2020-2021. This concept has gained more recognition as it allows users to earn stable profits by contributing cryptocurrencies to decentralized finance protocols. The tool does not require transactions or trades. The profitability depends on the conditions of the platform and the type of cryptocurrencies invested.

What is DeFi-staking

The concept of contributing your digital coins to the protocol has been around for several years. It is a way to encourage users to accumulate cryptocurrencies. In return, coin and token holders will be rewarded with a percentage of the deposit. Compared to the returns of a regular savings account, the payouts for staking are more attractive. The concept is pretty much the same as traditional finance: users hold a certain amount of altcoins while earning passive income. DeFi platforms manage the reserved assets, thereby encouraging the industry to operate at full capacity.

How it differs from conventional staking

In 작업 증명 blockchains, a lot of energy-intensive computation is required to ensure the validity of a transaction. And 지분 증명 mechanisms require validators and their nested cryptoassets. Nodes in Proof-of-Stake chains are entitled to be rewarded for creating and validating blocks. This incentivizes desired behavior in the network. In the narrowest sense, staking is the blocking of crypto-assets in exchange for becoming a validator in a Tier 1 blockchain and receiving rewards for performing node duties.

In a broader sense, DeFi-staking is often used as a collective term for all transactions that require the temporary investment and retention of digital coins in the protocol.

While variations exist, the purest form of steaking involves the blockchain blocking altcoins for their owner to become a validator in a network with a Proof-of-Stake (PoS) algorithm.

5020 $

신규 사용자를 위한 보너스!

바이비트는 암호화폐 거래를 위한 편리하고 안전한 조건을 제공하며, 낮은 수수료, 높은 수준의 유동성, 시장 분석을 위한 최신 도구를 제공합니다. 현물 및 레버리지 거래를 지원하며 직관적인 인터페이스와 튜토리얼을 통해 초보자와 전문 트레이더를 돕습니다.

100 $ 보너스 획득

신규 사용자를 위해!

암호화폐 세계에서 빠르고 안전하게 여정을 시작할 수 있는 최대 규모의 암호화폐 거래소입니다. 이 플랫폼은 수백 개의 인기 자산, 낮은 수수료, 거래 및 투자를 위한 고급 도구를 제공합니다. 간편한 등록, 빠른 거래 속도, 안정적인 자금 보호 기능을 갖춘 바이낸스는 모든 수준의 트레이더에게 최고의 선택입니다!

In DeFi, a common blockchain is Ethereum. It is the first blockchain to start deploying 스마트 컨트랙트. Ethereum runs on a Proof-of-Work consensus mechanism where transactions are validated by miners. There is no staking here. However, during 2020-2022, Ethereum is scheduled to move from the outdated Proof-of-Work to the Proof-of-Stake algorithm as part of the Ethereum 2.0 project.

The problem with this direct approach to staking is that the staking requirements are often quite high. For example, to become a validator in Ethereum 2.0, you need to place 32 ETH (about $40k as of June 2022).

However, the switch to Proof-of-Stake will make a 51% attack impossible.

Service providers have emerged in the market that allow ordinary people to bypass the high financial requirements. They assemble pools to bring together different crypto investors to participate in the management of the network and receive rewards. The system allows people to deposit any number of digital units and earn passive income depending on how much of the total pool their deposit accounts for. Most major centralized and decentralized exchanges already have a staking feature.

Differences from lending

Both concepts allow users to earn cryptocurrencies, but the risks and returns are different for the instruments. In staking, investors agree to contribute money to the network (protocol) to help it validate transactions. In lending, users lend their cryptocurrencies in exchange for interest payments.

Investment risks

Despite its appeal, DeFi-staking has some drawbacks:

- Loss of liquidity. If a user puts a coin with very low volumes on the exchange, it will be difficult for them to sell their asset or convert their profits into any stable coin. Choosing a liquid cryptocurrency with high trading volume on an exchange for steaking will help reduce this risk.

- Asset loss. This can happen due to the negligence of the users themselves, hacker attacks or fraud. To avoid losses, you should choose a platform with the best security features.

- Gas prices. This drawback is due to the limited scalability of the current generation of Tier 1 blockchains, especially Ethereum, which is most applicable in DeFi. Complexity often leads to spikes in gas prices, making transactions expensive. To remedy the problem, Ethereum programmers are developing a viable solution, the Ethereum 2.0 network.

- Volatility risk. Coins and tokens can lose or gain value in a short period of time. The bitcoin exchange rate is also a driving factor for the rise or fall in value of the entire crypto market. In the event of a sharp drop in the price of a coin or token sent to a staking, the user runs the risk of selling their assets at a loss.

- Blockchain periods. These are times when an investor cannot use their cryptocurrencies. If prices drop, there is no way to sell assets quickly. As a result, there could be losses. The best option is to bet coins without a lockup period to avoid risk.

DeFi-staking platforms

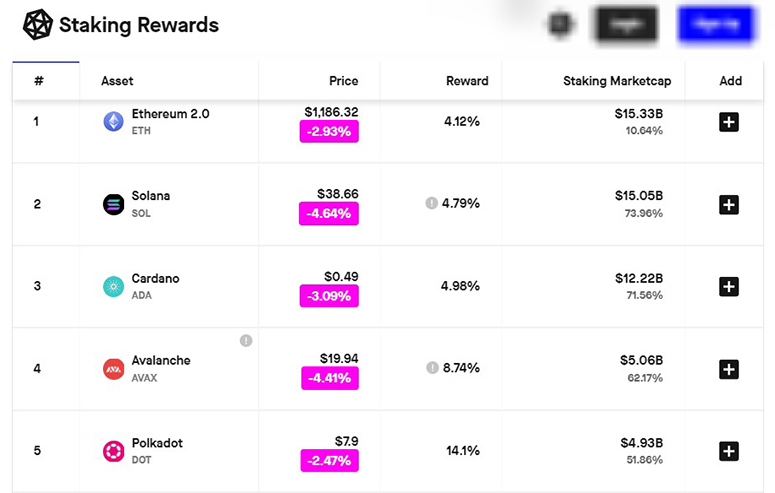

Staking Rewards is a leading data provider for decentralized finance tools. The platform tracks around 210 assets with an average interest rate of 9.7%. All these cryptocurrencies participate in Staking Rewards on various platforms.

바이낸스

The world’s largest crypto exchange by trading volume and one of the most popular cryptocurrency platforms for passive income. Binance allows you to send assets that the user holds on their internal wallet to Staking Rewards. There are 2 types of participation available on the platform:

- Fixed Staking. Allows you to lock crypto assets for a predetermined period of time. The freezing period can range from 1 week to 3 months. Users keep these assets in their cryptocurrency wallet, thereby improving blockchain performance. It is possible to withdraw assets from the program at any time, but interest is only accrued when the conditions are met.

- DeFi-staking. Allows you to contribute stakes in decentralized finance projects. However, these investments carry higher risks. The yield depends on the digital asset that the user sends to the steaking. However, there is a trend: new coins and tokens yield a higher percentage than well-known cryptocurrency brands such as BNB and ETH. The Binance exchange supports the most popular altcoins, so you can lock in up to 100 different digital assets.

In terms of security, Binance is one of the safest platforms for staking as it is centralized. User funds are stored on the platform’s balances and are protected by the SAFU fund, which provides insurance coverage in case of a serious hack.

| 장점 | 마이너스 |

|---|---|

| Large pool of invested funds | Large difference in interest rates on cryptocurrencies: yields are constantly changing, which complicates the calculation of risks |

| Many opportunities to create passive income with different interest rates | |

| Secure site | |

| Insurance of users’ funds |

PancakeSwap

This is a decentralized exchange on the Binance Smart Chain. PancakeSwap competes with the main DEX on Ethereum Uniswap. CAKE is the platform’s own token. PancakeSwap operates under the AMM model. The term refers to an automated market maker, a decentralized exchange protocol that does not require an order stack, but relies on a mathematical formula to set asset prices.

Trading on PancakeSwap occurs through liquidity pools filled with user funds. PancakeSwap allows investors to farm their own management token. One can contribute their own cryptocurrencies to the liquidity pool and earn CAKEs as rewards.

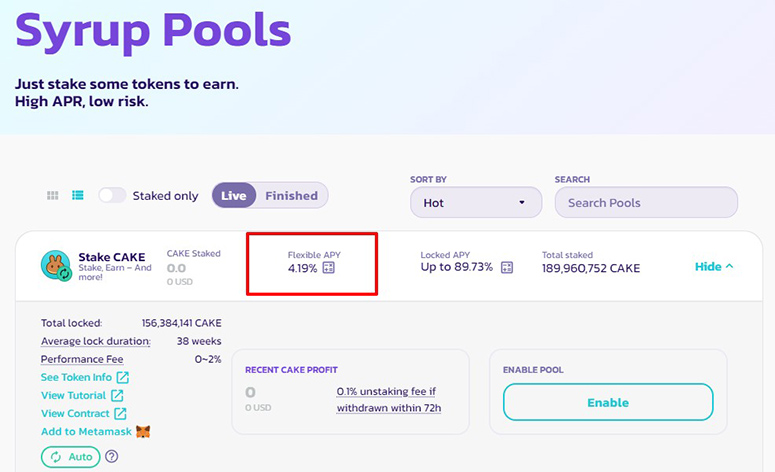

Only PancakeSwap management tokens can be sent to staking on the platform. The feature is available in the Syrop Pool section. The annual percentage yield (APY) on the PancakeSwap platform was as high as about 75% in December 2021. By June 2022, it had dropped to 4%.

In order to transfer CAKE tokens into a smart contract, you must first set up a MetaMask or Trust Wallet and fund it with some BNB to pay fees. Transaction fees on the Binance Smart Chain blockchain are significantly lower than Ethereum.

Venus.io.

This is a decentralized lending platform on the Binance Smart Chain. Venus also runs on the AMM system, accordingly, it needs liquidity providers. Users can send in staking tokens available on the platform (e.g. BNB) and mine the XVS provided for network members while receiving incentives. To become a liquidity provider on the Venus platform, you need to launch Metamask and connect it to the Binance Smart Chain. You will also need to top up your wallet with BNB tokens to pay the network’s fees.

For steaking the native XVS token, the platform offers the highest yield percentage.

SushiSwap

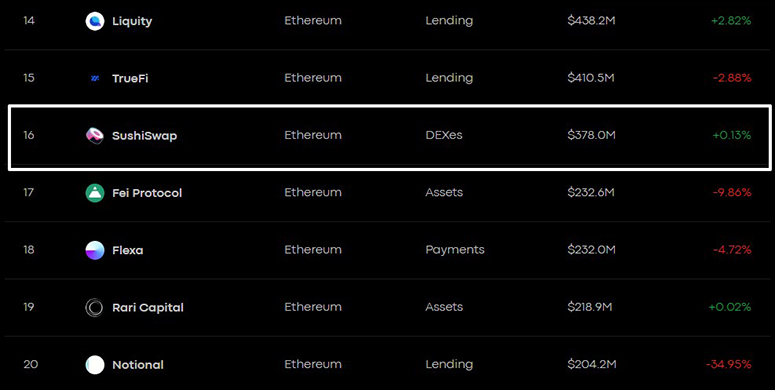

This is a decentralized exchange for exchanging tokens and earning with the help of AMM system. The Ethereum-based platform is an extended fork of the Uniswap protocol. SushiSwap incentivizes liquidity providers to deposit tokens on the platform, rewarding them with commissions generated from user transactions. As of June 2022, SushiSwap is ranked #16 on DeFi Pulse (a decentralized finance protocol analytics and tracking site) and has deployed a total of about $380 million in secured assets. By comparison, competitor Uniswap is ranked #2 with a $7 billion market share.

All SushiBar pool participants share 0.05% of SushiSwap’s total trading volume. SUSHI is an exchange token issued by liquidity providers. The main purpose of this cryptocurrency is for community management. The token can be obtained for providing liquidity to pools on SushiSwap. SUSHI digital units are transferred in exchange for xSUSHI tokens. To transact with the exchange’s digital units, a MetaMask wallet and ETH coins to pay commissions will be required.

For steaking SUSHI, the platform offers an annual percentage yield (APY) of around 11%. Users can withdraw SUSHI steaking rewards or withdraw their tokens from the platform at any time. The only drawback of SushiSwap is the gas cost for interacting with the Ethereum platform.

Compound

This is a decentralized funding protocol that allows anyone to lend or borrow cryptocurrency assets. Compound was the first to allow and popularize the use of cryptocurrency-backed loans.

COMP is the proprietary management token at the heart of the Compound Finance protocol. The platform’s digital unit is used to vote on updates to the protocol, including paying fees and changing interest rates.

The moment an Ethereum block is mined, 0.50 COMP is distributed to the ETH, DAI, USDC, USDT, BAT, REP, WBTC and ZRX liquidity markets. On each direction, half of the Compound Finance tokens received are distributed to providers and the other half to borrowers. COMP accrues automatically as assets are provided or borrowed through the protocol. The yield percentage of the management tokens depends on the market. For example, depositing USDT into Compound yields 2.23% per year.

How much you can earn

DeFi-stacking is the process of locking cryptocurrencies into the smart contract of a decentralized finance project in exchange for management tokens. By placing digital assets, users essentially become validators of the network (protocol). Each smart contract or blockchain relies on participants because it needs to ensure its own security. For handing over cryptocurrency to the staking, people support and protect the ecosystem and are rewarded in return.

For example, if an ETH holder locks their coins into a smart contract, they will receive Ethereum 2.0 protocol tokens for their role in creating a secure environment. In addition to direct rewards for hosting these digital units, investors can also earn a percentage of revenue from products and services offered by the platform. For example, participants in liquidity pools can expect to earn a share of commissions from swaps (exchange transactions). This percentage changes daily and depends on the cryptocurrency markets that users add to the pools

자주 묻는 질문

💰 How much money do I need to make money from staking?

The amount of capital depends on your investment strategy.

🔧 What should I pay attention to when choosing a platform?

When evaluating the profitability of a DeFi tool, you should consider 2 factors: the cryptocurrency that the investor plans to send to steaking and the APY (APR) that the platform offers.

💲 What are PoS coins?

These are cryptocurrencies that give you the opportunity to participate in the governance of a blockchain or protocol.

❓ What types of steaking platforms are there?

DeFi – marketplaces (e.g. Aave, Compound, Yearn Finance), centralized exchanges and DEXs (Binance, Coinbase, Hotbit, dYdX), cryptocurrency wallets (e.g. MathWallet, Huobi Wallet and others).

💲 When will Etherium move to PoS?

Ethereum 2.0 was scheduled to launch in late 2021, but the exact dates are unknown.

텍스트에 오류가 있나요? 마우스로 강조 표시하고 Ctrl + 입력

작성자: 사이페데인 암무스암호화폐 경제학 전문가입니다.