The US is actively exploring the opportunities and risks of blockchains and is outpacing other countries, including Russia. However, they have not been able to fully define the areas of responsibility of several regulators. This complicates the development of the industry and limits the use of US cryptocurrencies. Moreover, each state can introduce its own rules – for example, New York has banned the creation of new mining companies.

Peculiarities of cryptocurrency regulation in the USA

In the United States there are several federal agencies involved in controlling the circulation of tokens. Trading in digital assets is regulated:

- FinCEN – an agency for combating economic crimes. Its task is to prevent money laundering and terrorist financing.

- SEC – Securities and Exchange Commission. Tracks the issuance and trading of cryptocurrencies, as well as NFT, which are not yet related to money.

- CFTC – organization that controls the circulation of futures. Regulates the purchase, sale of assets if they are part of a group of commodities or derivatives.

Areas of responsibility are divided taking into account the categories of cryptocurrency tokens. Often the organization is controlled by two agencies at once. If a company is involved in cryptocurrency futures, it must report to FinCEN and the CFTC. This increases the bureaucratic burden on organizations, making it difficult to launch startups.

To combat money laundering and other suspicious activities, the US authorities have issued a new version of the Bank Secrecy Act (BSA). It obliges financial companies, including exchangers, exchanges, and payment systems, to pass on secret information about customers and their accounts.

Cryptocurrencies cannot be used confidentially in America. All purchases in stores, transactions on exchanges are strictly recorded. The USA has taken a strict approach to the regulation of digital coins, but has not restricted their use, as in Russia. People even have cards linked to their wallets and buy food and real estate with coins.

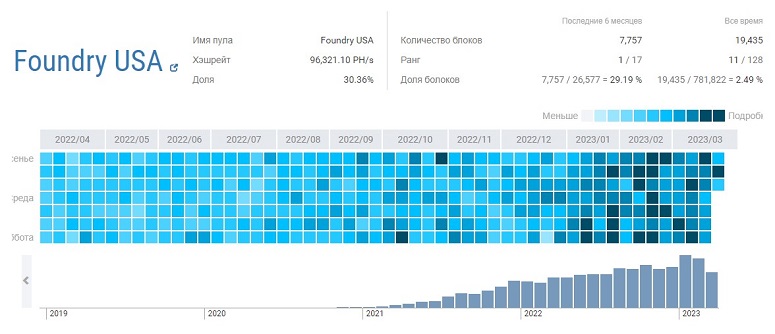

Separately, it is worth noting that the US authorities have a positive attitude to the mining of cryptocurrencies. Because of this, some industrial miners build farms in America. Here also appeared Foundry USA Pool – a pool with the highest hashrate in the Bitcoin blockchain.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

However, the governors of some states (for example, New York) see mining as a threat to the environment. They legally limit the access to electricity for companies mining cryptocurrencies. The decisions are due to the high energy consumption of asics and video cards, which causes irreparable damage to the environment due to pollution from the stations.

The exception is replenishable sources of electricity. Solar panels, hydroelectric power plants do not fall under the ban, so miners can freely use them to mine coins.

The most popular cryptocurrencies in America

In the United States, interest in digital assets is growing. Not only miners and traders, but also ordinary people are keen on them. According to SatoshiLabs statistics, 46% of Americans own koins. The most popular coins in the US are presented in the table below.

| Name | Value in March 2023 | Circulating supply | Capitalization |

|---|---|---|---|

Bitcoin

The coin was the first digital asset. It is still referred to when it comes to cryptocurrencies. The value of Bitcoin directly affects the overall state of the global market.

The United States has become the center of BTC mining thanks to Foundry Digital. It is a closed pool for institutional miners that owns 110.05 Eh/s in the blockchain. Its closest competitor AntPool is almost 2 times inferior and has 66.60 Eh/s.

Although Bitcoin is characterized by its slowness, the coin remains popular because of its underlying characteristics:

- Security.

- Listing on all exchanges.

- High liquidity.

Coin is also suitable for buying goods directly. In the U.S., Bitcoin is accepted by Amazon, eBay, KFC, and more than 50 other major companies.

Ethereum

A cryptocurrency with more potential than Bitcoin because developers have implemented the ability to create smart contracts in the blockchain. These simplify and automate the transfer of digital assets. Because of this, Ethereum is leading in the number of organizations in the US that have implemented it.

The coin is used not only as a financial instrument, but also as a base for non-fungible tokens (NFT). Ethereum is suitable for the development of digital objects that function like regular koins. Previously, NFTs have already been issued by Gucci, Burberry, and Adidas.

In 2022, the blockchain moved to a Proof-of-Stake consensus. Now you can not mine coins, but you can earn rewards for validating blocks.

Tether

This is the most popular American cryptocurrency pegged to the dollar. It functions as a stablecoin – a coin with minimal volatility. The volatility control is provided by the fiat peg. This has made Tether a convenient asset for capturing proceeds from the sale of other coins, purchases with a cryptocurrency card.

Binance Coin

Coin was issued by the crypto exchange of the same name. Initially, it functioned as an ERC-20 token, but later the developers created their own BSC blockchain. After the update, the coin became universal. It is actively used for such purposes:

- Reducing costs when trading on Binance.

- Development of dApps.

- Launching deFi projects.

- Creation of smart contracts.

- Paying for services with a card.

USD Coin

Another stablecoin similar to Tether. The cryptocurrency is suitable for settlements via blockchains. Companies use it to hedge risks due to low volatility.

The peculiarity of USDC is a transparent and rigid system of token issuance. Issuers report monthly on reserves, and coins are purchased only through smart contracts. This protects the assets from inflation and the system from fraudulent transactions.

USD Coin does not have its own blockchain. Coins are issued on multiple networks:

- Ethereum

- TRON

- Solana

- Algorand

- Stellar.

The future of the crypto industry in the US

According to MiQ research, 6% of the American population is involved in the crypto sector. Experts conducted the analysis at the end of 2021, so they counted on the rapid spread of digital assets in a bull cycle. However, the cryptozyme has arrived. Nevertheless, it did not affect the interest of developers and institutional miners in the industry.

Companies are looking for green energy sources and ways to popularize coins among ordinary people. For example, TeraWulf connected 8,000 miners to a nuclear power plant in March. Exchanges are issuing cryptocurrency cards so that users can pay with koins in stores.

The SatoshiLabs team determined: 95% of Americans surveyed believe that tokens and exchanges are an interesting solution to modernize the country’s economic system. MarketsandMarkets forecasts the growth of the digital asset market in the United States to $2.2 billion.

At the same time, the country’s authorities allow citizens to use coins even to pay taxes. So far, this is working in several states, including Ohio. Oklahoma passed a bill excluding cryptocurrencies from the list of securities. It simplifies the circulation of coins and reduces the burden on financial organizations.

However, in the US, everything is not as free and easy as it seems. In November 2022, the development of ways to regulate stablecoins began. In America, there are concerns about the lack of transparency of reserves and insufficient collateral. An expert group under the president plans to compile a list of companies that will have the right to issue stablecoins.

Summary

In 2023, the regulatory framework for cryptocurrencies in the United States has not yet been formed. The government is actively studying the industry and looking for ways to regulate it. However, it is definitely known that organizations will be forced to de-anonymize customers and adhere to the BSA. This cannot be called a disadvantage. Without a transparent control system, the government will simply not allow the use of tokens due to the threat of fraud and sponsoring terrorism.

Frequently Asked Questions

📌 Are there any exchanges in the US without KYC?

No. All cryptocurrency exchanges are required to verify customers.

🔔 Which exchanges are popular in America?

Coinbase, Gemini, Kraken, Bittrex, and Gate.io top the ranking in terms of the number of active users in the USA.

✨ How do regulators treat ICOs?

The SEC keeps a close eye on fundraisers because they see them as a high threat of fraud. Because of this, many projects, such as REcoin Centra Tech, are subject to charges due to minimal investor misinformation.

⚡ How does the SEC define securities?

A token is considered a valuable asset if it meets the term from the Howey test, “it is an investment of money with the expectation of a return that will be provided by other people (developers)”.

📢 Do US banks accept cryptocurrency?

No. However, a number of organizations have their own stablecoins (e.g. USDF).

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.