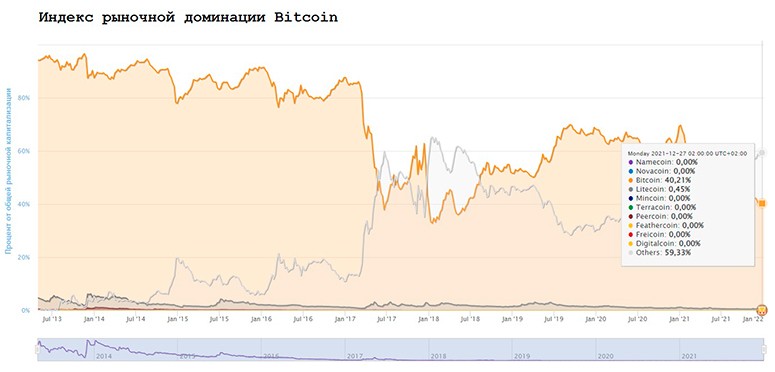

The first cryptocurrency Bitcoin started the entire digital coin industry. Bitcoin is the market leader, and as of 2021, its dominance index is 40%. But the situation is changing, with many projects taking the first generation of cryptocurrencies as a reference point and creating a new application of blockchain technology. This is the difference between bitcoin and altcoins. The coins that came after had to solve problems that were not available to BTC. For example, Litecoin, the first alternative cryptocurrency, was based on Bitcoin but with an improved algorithm. This change allowed to raise transaction throughput and increase issuance. Now bitcoin maintains an advantage over other projects, but it is rapidly shrinking.

Types of altcoins and their purpose

Development teams offer solutions to a variety of problems using blockchain technology. At the end of 2021, there were more than 7 thousand cryptocurrencies, which can be conditionally divided into several types.

| Type | Description |

|---|---|

| Exchange coins | Solve the issue of free movement of value with high speed, security and low fees |

| Exchange | Trading platforms issue their digital assets to incentivize activity, participate in tokensales, and manage the community through voting |

| Stablecoins | Backed by fiat and gold, have a stable exchange rate |

| DeFi | These tokens are traded in a decentralized finance marketplace |

Differences between bitcoin and altcoins

First and foremost is the technical side. Bitcoin was launched more than 10 years ago, it does not have a scaling function. When it gained popularity and the number of transactions grew, it turned out that the existing algorithm could not cope with such a volume of transactions. Transfers started piling up in queues and fees skyrocketed.

The first coins solved this problem by increasing the block size in the chain, but after the launch of the Ethereum network, the difference between Bitcoin and altcoins grew dramatically. This was influenced by innovations in the Ethereum protocol:

- Smart Contracts. Contracts with automatic fulfillment according to pre-determined conditions.

- ERC-20. The standard allowed any developer to run their tokens on the Ethereum network.

For mining

Bitcoin was the first to present an effective solution to the problem of double-spending thanks to the Proof-of-Work consensus method. It consists of the computation of cryptographic tasks by the nodes of the network to validate transactions and form new blocks into the chain. The miners check if a coin has been spent twice and keep the network running for a fee. The problem is that as the power involved in cryptocurrency mining grows, the complexity of the solutions increases. Today, the bitcoin network consumes terawatt hours of electricity, which is bad for the environment.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Modern coins are abandoning mining and moving to new types of transaction validation by validators.

For trading

About ¾ of all currency pairs on the exchange consists of altcoins and BTC. Trading platforms hold bitcoin as a reserve. The liquidity of such instruments is higher than in the altcoin/altcoin pair. The main cryptocurrency takes the first place in investment strategies in terms of investment volumes. This is due to the role of the leader (the main driving force) in the market and the strong correlation between the rate of BTC and other coins.

Several factors determine bitcoin’s profitability:

- Greater liquidity.

- Confidence on the part of participants.

- Good predictability by technical analysis tools.

- High volatility.

In contrast, altcoins are not as attractive to trade due to their strong correlation with BTC and less liquidity.

For investing

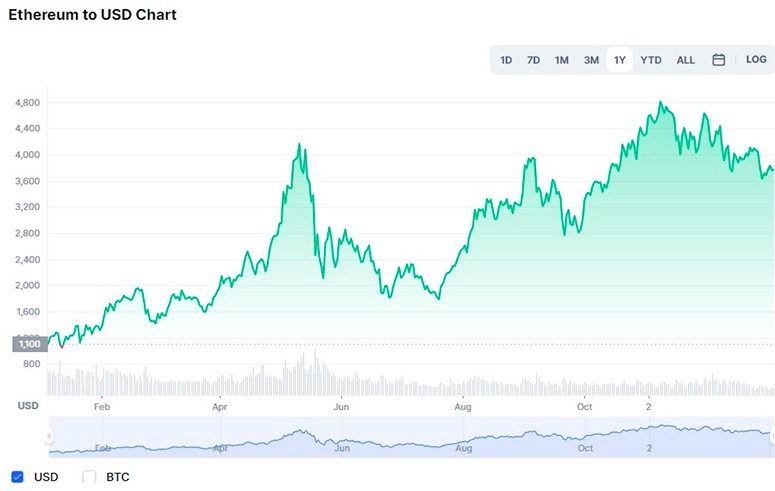

Investing in Bitcoin does not show the highest growth rates in the market. For example, it’s up 65% in 2021 compared to Ethereum’s over 400%.

This is partly due to psychological levels, where participants consider the current price of BTC high (around $50k), and increased capitalization ($1 trillion as of December 2021).

Investing in altcoins, the user can increase the capital several times, since many of them have not yet passed the phase of active growth and stabilization of the rate.

New projects show high profitability, allowing to earn on pre-purchases of koins before the launch of the product.

Efirium’s uptrend for 2021

The most popular altcoins

- Ethereum. Ecosystem for launching new projects using smart contracts. Capitalization: $440 billion.

- Solana. Blockchain processes 60 thousand operations per second and uses a new consensus method – Proof-of-History. Capitalization: $89 billion.

- Binance Coin. The cryptocurrency of the exchange of the same name, offers coin holders low trading commissions, the right to vote on the platform and participate in tokensales on the site. Capitalization: $88 billion.

- Ripple. The platform is a direct competitor to banking systems like SWIFT. Fast confirmation and low transfer fees have made the coin a popular medium of exchange. Capitalization: $85 billion.

- Tether. A leader among stablecoins, pegged to the US dollar. Works in 2 networks: Ethereum and TRON. Commissions in the second one are lower than Ethereum. Capitalization: $78 billion.

What to choose for an investor

A well-balanced portfolio consists of investments in bitcoin and altcoins. Factors that affect the attractiveness of the coin:

- What task the project solves. Cryptocurrency without clearly defined functions will not be able to become a profitable investment object and show steady growth. Such coins are called “pacifiers”, they take off quickly on the hype and fall rapidly.

- Development team. Analyze whether there is a previous successful experience of launching projects. How active is communication with community members and fixing detected bugs.

- Liquidity. Analyzing the trading volume allows you to understand how fast an asset can be traded. For example, if there are not enough buyers on the market, then by placing a large sell order, an investor may face the fact that it will not be executed instantly and the risk of currency price changes increases.

- Availability. The more trading platforms the altcoin is represented on, the better.

Summary

The difference between BTC and altcoins is not only in algorithms. Over the years of crypto market development, projects have offered the community new applications of blockchain technology. Much credit for this goes to the developers of Ethereum, who changed the approach to digital assets and expanded their circulation. Smart contracts, ERC-20, NFT – this is a partial list of innovations that changed the entire market. This laid a solid foundation for the development of decentralized finance, non-mutualizable tokens, and the emergence of new projects on the Etherium network.

Cryptocurrencies are in a constant process of improvement. Every month there are projects that offer some new approaches to the existing infrastructure.

Their developers reduce commissions, increase bandwidth, offer cross-platform solutions for integrating blockchains of different types. Some altcoins are already popular, while others are not yet fully appreciated by the market and are waiting for their time.

Frequently Asked Questions

🍴 What does a cryptocurrency fork mean?

It is a change in the network’s algorithm to improve performance or prevent vulnerability.

💡 What is the difference between tokens and coins?

The former type is a unit of value in an existing blockchain, while the latter operate on their own registry.

❗ How to understand what functions a coin performs?

You need to familiarize yourself with the project roadmap and white paper. These documents explain what will happen in the future with the product and what technical means are available for this.

🔑 What is the capitalization of a cryptocurrency?

The total value of all coins traded on the market at the current price.

🔎 How does a deflationary mechanism work?

Limiting the future supply of a coin to increase the overall value. It can be built into the algorithm (bitcoin has an issuance limit of 21 million BTC) or acquired during an update (Ethereum has introduced coin burning when sending a transaction).

A mistake in the text? Highlight it with mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.