The major cryptocurrency has risen 40.71% since the beginning of the year, reaching a value of more than $73,000 in March, which has once again caught everyone’s attention. Bitcoin-related search queries are high and mining methods remain a hot topic of discussion. Owning 1 BTC is a dream for many, as in the real world a unit of this asset can be exchanged for a Cybertruck, 17 Apple Vision Pro units or 26 ounces of gold.

How to get BTC

There are currently two ways to get BTC: one is to buy on the cryptocurrency market and the other is to invest in bitcoin mining equipment. Thanks to the emergence of spot ETFs for digital gold this year, a wider range of users have been able to invest in bitcoin. Unlike directly buying BTC through cryptocurrency exchange platforms (hereafter referred to as exchanges), spot bitcoin ETFs allow you to buy and sell BTC without actually owning it.

Mining digital gold is the most “natural” way to obtain the asset. It involves using computers to solve complex mathematical problems (verifying and processing bitcoin transactions, through which new BTC can be obtained). This process is similar to mining gold in nature – miners need tools, equipment, and time to find and extract the precious metal. The miners, having obtained digital coins, can either keep them or sell them on the market.

Investing in bitcoin

Investing in a digital asset has a high profit potential, along with significant risks and relatively low barriers to entry. Right now, anyone can buy BTC on exchanges with minimal financial requirements. The biggest hurdles, aside from regulatory issues, are acquiring basic knowledge such as understanding how to deposit funds, place orders and withdraw the asset. However, most exchanges now offer tutorial programs for beginners, making it easy to buy BTC after careful study.

Bitcoin price fluctuations are the main way to profit by investing in this asset. However, wrong decisions by investors during significant changes in value can lead to substantial losses.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Investing in mining equipment

Investing in mining equipment is a form of investment that requires significant initial funds and has a relatively long payback period. To obtain BTC in this way, users need to wait patiently to recoup their costs and begin to realize a profit. The higher the hash rate of the equipment purchased and lower its power consumption, the higher the daily net income from mining.

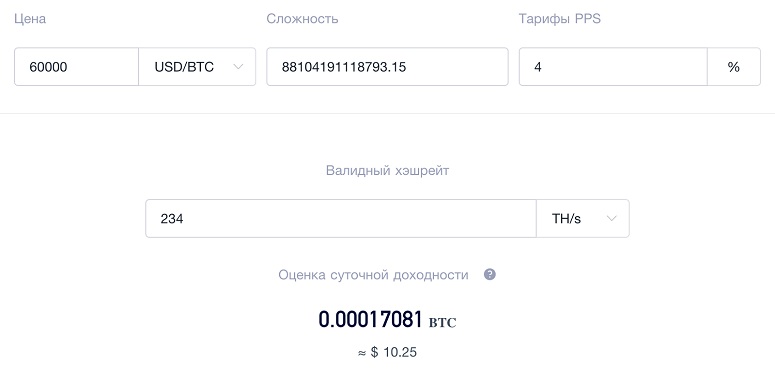

Given the factors that affect the reward (difficulty of mining, block payouts, transaction fees, hash rate, energy costs), it is difficult to accurately calculate future income. Nevertheless, estimates can still be made based on the current mining difficulty and the average commission over the last 7 days.

As an example, we should consider the latest generation Antminer S21 Pro at a price of USD 4423 on the official website. The cost of electricity is $0.05 per kilowatt-hour, the current difficulty is 88.10T, the mining pool with PPS calculation and 4% commission. The equipment can mine approximately 0.00018017 BTC per day, with a daily electricity cost of $4.21. If the price of BTC remains at $60,000, the static payback period will be approximately 409 days.

Investing in bitcoin or mining equipment: which path to choose

Buying digital gold has both advantages and potential risks. Investors should consider:

- The simplicity and convenience of the purchase. Buying BTC is relatively uncomplicated: it requires taking advantage of exchanges or platforms offering Bitcoin ETF services with low entry barriers.

- Liquidity. Holding bitcoin provides high liquidity, allowing trading on the relevant platforms at any time.

- Risk. The bitcoin market exhibits significant volatility, with prices subject to significant fluctuations. This can potentially lead to investment losses.

Investing in mining equipment also has specifics. Users are advised to consider such nuances:

- Long-term returns. Although investing in mining equipment requires initial capital and a longer payback period, once recovered, it is possible to generate continuous profits from mining, which offers long-term investment potential.

- Strong risk tolerance. Having mining equipment can diversify investment risks. You won’t have to rely solely on bitcoin price fluctuations.

- Risks. Digital gold mining is affected by local regulatory policies, including taxation and energy policies. Changes made by regulators to restrict bitcoin mining activities may affect the actions of miners.

For those who want to dive into the world of cryptocurrencies, direct bitcoin investment will be the best way to go. But if the user is consistently profitable and has the capacity (both financial and energy), investing in bitcoin mining equipment may be a higher priority for them.

Disclaimer: This article is for reference only and does not contain financial advice.

About ViaBTC

ViaBTC, established in May 2016, has provided professional, efficient, secure and stable digital coin mining services to more than one million users in 130 states/regions around the world. ViaBTC, a leading integrated mining pool, offers mining services for more than 10 major digital assets, including BTC, LTC and KAS. In addition to offerings spanning ViaBTC pool, CoinEx exchange and vault, ViaBTC aims to provide users from around the world with more additional tools, stable and efficient mining services, and guarantee the best customer experience.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.