In 2023, there are many investment instruments in the cryptocurrency market. Among them, for example, derivatives (derivative contracts tied to underlying assets). Leveraged 토큰 (financial leverage) can also be included in the list of additional instruments. In 2023, they started gaining popularity. Such tokens mean cryptocurrency instruments, transactions with which are carried out with a fixed trading leverage. With pronounced trends in the market of digital assets, they are able to bring large profits.

Features of leveraged tokens

The main characteristic feature of short and long altcoins is the binding to the underlying assets. In this case, they are the corresponding futures (also a type of derivatives).

For example, the underlying asset of BTCUP on the Binance cryptocurrency exchange is the perpetual BTC contract on the Binance Futures platform.

The daily fee for leveraged token management on Binance is 0.01%.

Also, leveraged crypto assets have 5 other features:

- Spot market trading. Short and long altcoins are tied to derivatives. However, such assets are traded on the spot market along with traditional cryptocurrencies.

- Calculation of quotes using a special formula. It looks like this: the value of the underlying asset + (price change * coefficient). The second variable in parentheses determines the amount of leverage to decrease or increase the quotes of the digital currency at market fluctuations. It works like this: the coefficient of the crypto asset ETHBEAR (short type positions) is -3. When the price of traditional ETH decreases by $100, ETHBEAR quotes will increase by $300.

- High losses and gains. Losses and gains from derivatives trading increase due to the leverage ratios set.

- Free issue. Any cryptocurrency company or platform for trading virtual assets can issue and bind tokens to futures contracts of interest.

- The ability to generate income even when the price falls. Short tokens are used to capitalize on selected digital assets during a decline in their quotes. They are usually denoted by the suffix DOWN or BEAR.

Because of the listed features, short and long altcoins are considered a profitable trading instrument. For example, they allow traders to receive increased profits even with a downtrend in the cryptocurrency market.

5020 $

신규 사용자를 위한 보너스!

바이비트는 암호화폐 거래를 위한 편리하고 안전한 조건을 제공하며, 낮은 수수료, 높은 수준의 유동성, 시장 분석을 위한 최신 도구를 제공합니다. 현물 및 레버리지 거래를 지원하며 직관적인 인터페이스와 튜토리얼을 통해 초보자와 전문 트레이더를 돕습니다.

100 $ 보너스 획득

신규 사용자를 위해!

암호화폐 세계에서 빠르고 안전하게 여정을 시작할 수 있는 최대 규모의 암호화폐 거래소입니다. 이 플랫폼은 수백 개의 인기 자산, 낮은 수수료, 거래 및 투자를 위한 고급 도구를 제공합니다. 간편한 등록, 빠른 거래 속도, 안정적인 자금 보호 기능을 갖춘 바이낸스는 모든 수준의 트레이더에게 최고의 선택입니다!

Difference between leveraged tokens in margin and futures trading

Perpetual contracts are a type of derivatives. More specifically, such transactions are a special type of futures (Futures). They have no expiration (execution) date. Also, open-ended contracts are based on major price indices.

Leveraged token trading and futures trading have 3 main differences. They are presented in the table below.

| Difference | Brief description |

|---|---|

| Changes in token quotes are always larger than with Futures | Short and long altcoins fluctuations are more pronounced than in contracts. According to some information, token holders earn more than futures investors. For example, when buyers of contracts earn 270% of the initial amount for a conditional period, the income of investors in leveraged altcoins for the same time is 400%. |

| With stable trends, tokens bring higher profits than conventional futures | Example: a conditional investor invests $10,000 each in the ETHUSD contract and the long crypto asset ETHBULL. In one week, the price of traditional Ethereum increases by 25%. In this case, the profit from the contract will be about 75.7%, and from the long crypto asset – about 101%. The net return in dollars would be $7570 and $10,080, respectively. |

| Exchanges often fail to liquidate even heavily losing token positions due to rebalancing | This term refers to restoring the original shares of cryptoassets in an investment portfolio by buying/selling new coins. Issuers make rebalances at set periods or forced rebalances when prices drop by 11% on average. They also shift liquidation points each time shares rebalance. Because of this, issuers almost never forcibly close investors’ positions. |

Principle of trading

First, you need to understand the types of leveraged altcoins. There are only four of them:

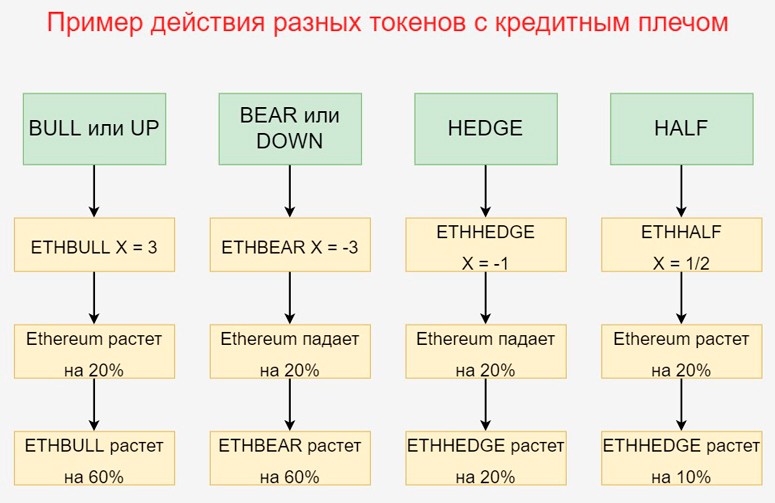

- BULL or UP. This type is called a long position. It allows traders to receive increased profit from the direct growth of quotes of cryptoassets. Usually the coefficient (X) for BULL/UP is between 2 and 4.

- BEAR or DOWN. This type is called a short position. It allows you to make money when prices are falling. Usually the coefficient for BEAR/DOWN is -2 to -4.

- HEDGE. This type is used for hedging risks (leveling losses). The coefficient for HEDGE can be 1 or -1 depending on the current trend. Buy such crypto-tokens only when X = -1, that is, when the prices of the underlying instruments decrease.

- HALF. This type allows you to minimize risks. The coefficient for HALF is always equal to 1/X, where X = 2. This type reduces not only losses, but also income.

You should choose the type of altcoin depending on your current goal and the market situation. Otherwise, you can accidentally acquire an unsuitable position and lose part of your capital or profit.

You can buy cryptotokens with leverage using 3 methods:

- Through an exchange. Cryptocurrency trading platforms offer customers easy access to the spot market. This is where short and long tokens are traded en masse.

- Via deposit. Part of the platforms offer clients a method of direct exchange of savings directly to the altcoins in question. With this method, users make deposits and request the issuance of cryptocurrencies of interest. Exchanges issue them and give them to investors.

- Through conversion. The FTX platform offers the exchange of any available assets in the account at once to tokens with leverage.

It is worth considering that investing in such assets should be done with caution. By purchasing a leveraged token, a trader can significantly increase his profit. However, there are risks.

Leveraged coins are not suitable for beginners.

When it is worth trading

Investing in leveraged altcoins is possible in 2 cases:

- The trend of cryptocurrency market movement is maintained for a long time (from 2-3 days). Digital exchanges reinvest the profits generated in the process of periodic rebalancing. This provides more profit in case of long-term trends.

- The investor follows a conservative trading strategy. The main fear of investors while using leverage is liquidation. However, for short and long altcoins, forced liquidation is almost impossible. For example, for liquidation at X = 3 the quotations of the underlying instrument must collapse by 33% in a day, and at X = 2 – by 50%.

작성자: 사이페데인 암무스암호화폐 경제학 전문가입니다.