Cryptocurrency is attracting attention: the bitcoin rate is growing, and investors are investing millions of dollars in crypto-assets. In this article, let’s talk about how to trade cryptocurrency safely and take trades to the plus side.

Choosing a cryptocurrency exchange

To start, it is necessary to replenish the trading deposit with money. The choice of trading platform should be treated carefully:

- Itis good if the exchange has been operating for at least a year. This is enough time to build up capital and get feedback. There is more trust in such platforms. There are veterans in the industry: Binance, Huobi, Bittrex or EXPO, known in the runet. It is worth studying the history of the exchange for hacker attacks and theft of personal information of users;

- The commission for a trade operation (sale or purchase) should not be high. If Binance charges 0.1% for a transaction, young projects provide even better conditions. On Bibox, the owner of internal tokens will pay 0.05%;

- Trading volume – an indicator of popularity among traders, and therefore the liquidity of transactions. CoinMarketCap service will help in choosing a trading platform;

- 30% of crypto exchanges do not require verification – convenient if you want to trade anonymously, but reduces the level of security. Account identification will allow you to quickly restore access to your personal account and makes the relationship between the exchange and the client transparent. It is worth clarifying about the company’s representation in Russia. This will speed up the resolution of problems.

| Exchange | Average trading commission | Additional data |

|---|---|---|

| Binance | 0.1% | Russian interface, more than a hundred cryptocurrency pairs |

| Coinbase Pro | 0.1-0.2% | Deposit insurance up to $250k for US residents |

| Huobi Global | 0.1-0.2% | Russian interface and cashback program. User deposits over $10 bln |

| Bitfinex | 0.1-0.2% | Russian interface, no withdrawal limit |

| Kraken | 0 to 0.26% depends on trader activity | Leverage for margin trading 1:5 |

Examples of crypto exchanges from the list of top 10 according to Coinmarketcap

The problem with crypto exchanges is the centralized storage of user funds on several shared wallets, access to which is open to company employees.

On decentralized exchanges (DEX), where clients store currency on separate, segregated accounts, access to finances from the outside is closed. Such platforms are just gaining popularity and are not characterized by trading activity. Among them: Poloni DEX, Atomex, Binance DEX, Nash and others.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

The main rules of trading

A few profitable trades in a row will give confidence, but it is not enough for stable earnings. The “risk-return” model will help to constantly maintain profits. A trader on the stock exchange cannot predict the price movement 100% and trades probability. Income is formed due to the prevalence of profitable transactions over unprofitable ones. For example, when the risk/profit ratio is 1:1, there is no room for error – we lose one dollar for one conditionally earned dollar. If the ratio is 1:3, it is already better – the profit exceeds the risks three times. The market will give an opportunity to earn. It is worth opening a position if the predicted income will be greater than losses.

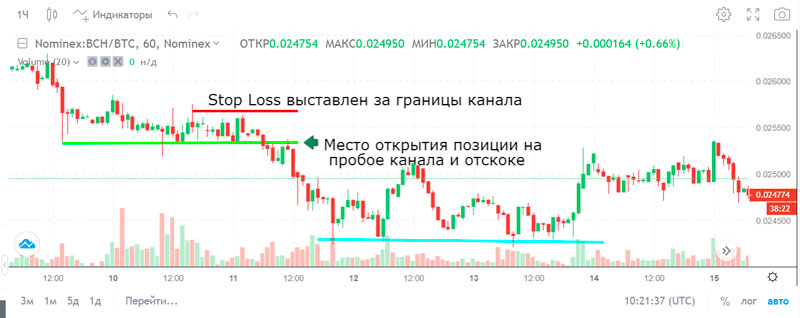

BitcoinCash rate was in a narrow channel. Having broken through a strong support level (green line), the cryptocurrency is going down, where nothing prevents further decline. The risk (limited by Stop Loss outside the channel boundary)-profit ratio is 1:3.

There are several trades during a trading session. Taking into account the percentage of profitable trades optimizes the trading strategy. Let’s assume that we made ten trades. Only 20% of them turned out to be plus, but all of them were opened with the risk-profit ratio of 1:2. The result is zero:

- 8 trades * $1 = $8, where the received sum is the loss received on Stop Loss for eight trades;

- 2 trades * $4 = $8, where eight dollars is the profit for two trades, which in each of them amounted to $2;

- $8 – $8 = 0.

The exchange will pick up the trading commission and spread – the difference between the buy and sell price, and the real return will be less. Choosing in favor of trades with a ratio of 1:3 will allow you to come out in the plus.

Author: Saifedean Ammous, expert in cryptocurrency economics.