Perpetual contracts can be held indefinitely. At the same time, futures prices can deviate significantly from spot market prices. Binance has developed a mechanism to reduce this effect. It is called “funding.” Funding rate on Binance Futures is a periodic charge to traders. Depending on the market situation, longs pay shorts and vice versa. The accrual/discharge on Binance takes place three times a day.

The difference between the spot market and open-ended futures

Binance users can buy coins on an immediate delivery basis. The holder becomes the owner of the cryptocurrency. Coins can be transferred to other wallets, placed in staking or used as collateral for a loan.

Unlike the spot market, in the futures market, holders do not have rights to the underlying asset.

They make a commitment to buy or sell the coin at a future date. Perpetual contracts have other differences from spot:

- Leverage. On Binance, a user can buy an asset without having the entire amount of the transaction. It is enough to freeze a deposit – 0.8-2% of the dollar equivalent.

- Short and long speculation. Users can act on the downside with or without leverage. On the spot market traders earn only on price growth.

- High margins. Whales with multi-million dollar accounts can also take high leverage. That’s why value squeezes are not uncommon on futures – a minute level breakout and a rate return.

- Price. Rates on the futures and spot markets are formed by supply and demand. Due to high margins, the price of a perpetual contract for a coin may differ from the spot. If it is higher, the futures premium is positive, if it is lower, it is negative.

What is the funding rate on Binance

It is a mechanism for regulating the price of a futures contract. Depending on the direction of the position, traders receive payments (positive funding) or incur periodic costs (negative funding rate on Binance). The amount depends on the size of the position and the cryptocurrency traded. Money is credited or debited every 8 hours.

5020 $

신규 사용자를 위한 보너스!

바이비트는 암호화폐 거래를 위한 편리하고 안전한 조건을 제공하며, 낮은 수수료, 높은 수준의 유동성, 시장 분석을 위한 최신 도구를 제공합니다. 현물 및 레버리지 거래를 지원하며 직관적인 인터페이스와 튜토리얼을 통해 초보자와 전문 트레이더를 돕습니다.

100 $ 보너스 획득

신규 사용자를 위해!

암호화폐 세계에서 빠르고 안전하게 여정을 시작할 수 있는 최대 규모의 암호화폐 거래소입니다. 이 플랫폼은 수백 개의 인기 자산, 낮은 수수료, 거래 및 투자를 위한 고급 도구를 제공합니다. 간편한 등록, 빠른 거래 속도, 안정적인 자금 보호 기능을 갖춘 바이낸스는 모든 수준의 트레이더에게 최고의 선택입니다!

The funding rate is calculated by an algorithm based on the sentiment of market participants. The program transfers cryptocurrency from one user to another. If the futures price is higher than the spot, it pays to hold longs and shorts make a profit. Funds are transferred directly between clients, so there are no additional trading fees.

What it consists of

The holding period of contracts on Binance is not limited. The user can stay in the position until liquidation. It takes 1-5% of the face value to buy/sell a futures contract, so the market is highly marginal. During strong movements, the demand for perpetual contracts is higher than for the underlying asset.

Funding system on Binance is launched to reduce the rascorrelation of instruments. The funding rate includes 2 components. You can compare them in the table.

| Component | 설명 |

|---|---|

| Consists of 0.3% per day (0.1% every 8 hours). This rule applies to all crypto pairs except ETH/BTC, BNB/USDT, BNB/BUSD. For them, the fixed part is equal to zero. | |

| The algorithm calculates the indicator in real time. The premium depends on the influence of leverage on the cryptocurrency rate, the average price on the main exchanges and the spread. |

Current value and rate history

Binance customers can analyze the change in the funding rate. Traders use this data to determine pivot points. If the funding rate on Binance is greater than zero, it indicates that many participants do not see growth prospects. If it does occur, it will lead to mass liquidation – “short-squeeze”. You can get the history of changes in the indicator as follows:

- Go to the futures terminal and select a cryptocurrency pair.

- Click on the current fanding value in the upper right corner.

- Select the item “History”.

Funding system on Binance

Due to high margins, futures prices can deviate significantly from the spot. In standard derivatives market instruments, the rate is positioned closer to the underlying coin by the time of expiration.

Perpetual contracts have no expiration time. The trader can hold them for as long as he wants.

To reduce price discordance, a mechanism of fundraising – transfer of money from one user to another – is implemented. It works like this:

- The algorithm calculates the rate. The current value can be viewed at the top of the “Futures” page.

- Funds are debited 3 times a day – at 0:00, 8:00 and 16:00.

- If the futures rate is higher than the spot, fundings are positive. Funds are debited from users with long positions and transferred to participants with open shorts. If the futures quotes are lower than the spot – vice versa.

How to Calculate the Funding Rate on Binance Futures

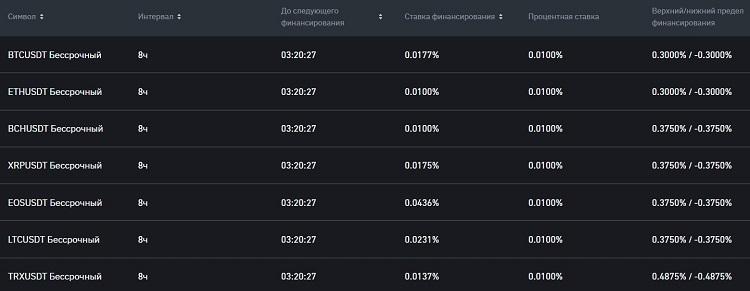

On the exchange, periodic payments are made every 8 hours. Funding calculates the algorithm based on trader sentiment, volatility and other parameters. The values differ for cryptocurrencies. On Binance, you can see real-time data for all pairs. To do this, you need to select the “Contract Information” tab in the “Futures” section.

You can find out the current value in the futures terminal. This allows you to track the change during trading. The algorithm is as follows:

- Authorize in the Binance profile on the website or in the application.

- Go to the futures market terminal.

- Select a cryptocurrency.

The value of fanding and the time until the write-off are displayed in the upper right corner. To calculate the exact amount, multiply the contract size in USDT by the rate. The marking price is used in this process. In a fast market, the quotes deviate a lot, which leads to an increase in fanding.

Technical analysis of the bet

This method of predicting quotes in the cryptocurrency market is based on historical data. Users can upload the rate change information in CSV format and pour it into any trading application. The chart is examined with the help of technical analysis tools. The most popular tactics are:

- Divergences. It is believed that in trends, the probability of continuation of movement is higher than reversal. The longer the quotes grow, the more users want to buy the coin. Therefore, when the price increases, fanding is in the minus zone. Deviations from this rule can be used in trading.

- Extreme values of the rate. The rate can be used as an indicator of the mood of participants. At market reversals, investors do not want to buy (shorting trend) or sell (longing trend). Therefore, the rate sharply changes its direction. Such moments can be tracked by the value of the funding rate.

- Elliot Wave Theory. The method is based on the behavior of market participants and can be applied to any chart. Channels and trend lines are drawn on the chart, markings are made. This allows you to predict the reversal point.

Developing a trading strategy

Traders use data on the funding rate to predict the quotes of crypto coins. The indicator changes once every 8 hours, so it is included only in long-term strategies. The deal is held for a minimum of 5-10 days. When developing a trading system, you need to take into account such factors:

- The strength of the trend. Analyzing the rate helps to track market reversals. If the coin is in a prolonged flat, there will be a lot of false signals.

- The size of the bet. Indicators differ for coins. It is profitable to trade on assets with a high value.

- The use of robots. The trader needs to analyze a lot of data. Therefore, it is better to entrust routine tasks to bots.

- Risk management system. In the crypto market, there is always a possibility of error. Therefore, it is necessary to provide conditions for exiting a position. The user should not lose more than 10% of capital per day.

How to earn on a bet in trading

When dealing with open-ended contracts, you need to keep an eye on the time of the transaction. On the Binance exchange, fanding is carried out three times a day. If the rate is less than zero and there are 15-30 minutes left before the settlement hour, you should wait for the period to close.

If the user does not have time to fix the profit before the automatic debit, the commissions will increase.

If the value is greater than zero, it is worth opening a position before the calculation. This approach will reduce commissions. The funding rate can be used in several strategies:

- Swing trading. A trader holds a position until a reversal signal appears. On average, the period ranges from several days to a year. The size of the funding rate is only one of the parameters that signal a change of trend.

- Arbitrage. Users buy an asset with positive funding on the spot and open shorts for the same volume on open-ended contracts. This allows avoiding the risk of changes in quotes. The position is held until the value of fanding goes into the minus zone.

자주 묻는 질문

📢 How can I set up notifications about fundings changes?

Receiving SMS messages or push notifications can be set up in the “USDⓈ-M Futures” section. You will need to select a rate value. A message will come if it is exceeded.

📌 What is hedging on Binance?

On futures, users can open longs and shorts at the same time. Funding will be deducted/accrued from both parts of the position. This allows you to hedge the risks of the trades.

🔔 Is the value of fundings the same on all exchanges?

No. Each platform performs a different calculation. Investors can compare the values in aggregators.

⚡ What are the risks of using a fundings arbitrage strategy?

In a low-volatility market, the value does not exceed 0.005%, so you can work on the entire available margin. However, in case of a mistake, there is a risk of losing a significant part of the capital.

🔎 Is the funding period on Binance subject to change?

Normally, debits are made three times a day at set time intervals. However, during peak volatility, unscheduled payments are possible.

텍스트에 오류가 있나요? 마우스로 강조 표시하고 Ctrl + 입력합니다.

작성자: 사이페데인 암무스암호화폐 경제학 전문가입니다.