The digital coin market is unpredictable. In order to profit from transactions, traders calculate actions ahead of time – create trading strategies. On Veles, these algorithms are embedded in bots. Users can choose a ready-made template or create their own robot. To test strategies on the platform launched backtesting. The tool allows you to assess the effectiveness of the trading plan without risk to capital. In the article, readers will learn how it works.

What is backtesting in cryptocurrency trading

Before opening a transaction in the digital market, traders analyze coin charts. Trading options can be seen in the changes in prices and transaction volumes.

Backtesting allows you to test an idea in different market conditions. This is done by creating a model based on historical data. Traders see how their strategies might work in the future and make more informed decisions.

Backtesting usually evaluates 2 key parameters: total return and risk level. Various indicators are used for this purpose. The tool also takes into account trading costs that can affect trading efficiency.

벨레스 - 암호화폐 시장에서 봇을 만들기 위한 플랫폼

Cryptocurrency exchanges trade assets 24/7. Regular traders cannot constantly monitor the market. In this regard, many use bots. Algorithms can be programmed to analyze rates, search for trading opportunities, open and close transactions on exchanges according to pre-designated input data.

5020 $

신규 사용자를 위한 보너스!

바이비트는 암호화폐 거래를 위한 편리하고 안전한 조건을 제공하며, 낮은 수수료, 높은 수준의 유동성, 시장 분석을 위한 최신 도구를 제공합니다. 현물 및 레버리지 거래를 지원하며 직관적인 인터페이스와 튜토리얼을 통해 초보자와 전문 트레이더를 돕습니다.

100 $ 보너스 획득

신규 사용자를 위해!

암호화폐 세계에서 빠르고 안전하게 여정을 시작할 수 있는 최대 규모의 암호화폐 거래소입니다. 이 플랫폼은 수백 개의 인기 자산, 낮은 수수료, 거래 및 투자를 위한 고급 도구를 제공합니다. 간편한 등록, 빠른 거래 속도, 안정적인 자금 보호 기능을 갖춘 바이낸스는 모든 수준의 트레이더에게 최고의 선택입니다!

Veles offers a full set of tools for creating individual bots and entire automated strategies. The platform cooperates with leading crypto exchanges and helps to quickly connect a robot to any of them. Users can also take a ready-made bot template with a strategy embedded in it – conservative, moderate or aggressive.

There is no subscription fee for connection. Developers take 20% of trading profits, but no more than $50 per month.

In 2024 Veles has a new tool to test strategies before launching. It is based on the company’s developments that help identify market inefficiencies and capitalize on them.

Backtesting allows analyzing different market scenarios based on historical performance. Users can adjust algorithm settings before running them, which greatly improves their efficiency.

How Veles backtests work

The tool allows you to test the effectiveness of trading ideas without the risk of losing money. In essence, it is a modeling of market situations on historical data. A trader checks how well a strategy may have worked in the past. If the result is positive, it is advisable to apply it in real time.

Veles users have access to various tools to manage orders, positions and reduce risks. In the backtest mode, you can customize the parameters of trades to increase profitability.

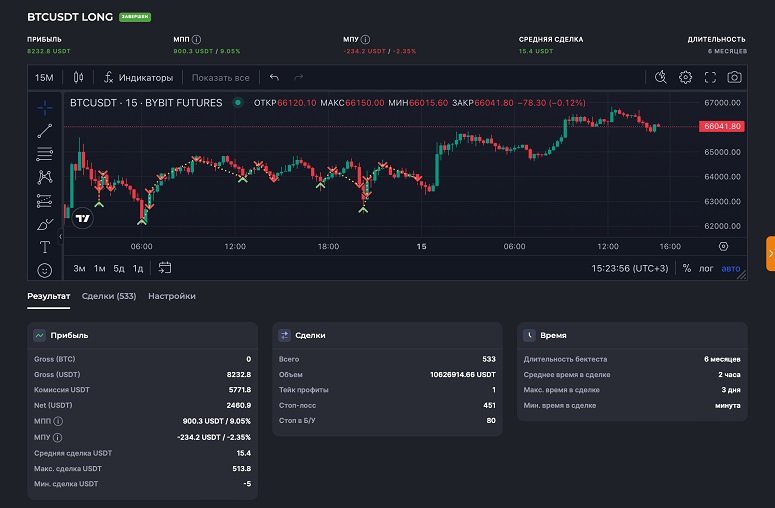

Veles offers a database of minute candles to thoroughly analyze trading ideas. The “Profit” indicator on the chart shows the profitability of the strategy for a specific period without taking into account the exchange commission. This data is duplicated in the Gross (“dirty” income) line. Net profit minus transaction costs is shown in the Net field.

The “MPP” and “MPU” indicators display the maximum possible profit and loss values on open positions. This data can be used to customize the strategy – placing Stop Loss and Take Profit orders.

Advantages of the tool

With the backtesting function, the use of trading bots becomes more efficient and safe. Now traders can thoroughly analyze strategies before starting a deal – calculate potential profit, identify weaknesses that can lead to losses. Other advantages of the tool are also worth mentioning:

- By experimenting with the settings, it is possible to find the most profitable combinations and increase the profitability of the strategy.

- The trader no longer needs to collect statistics for a long time. Veles provides an extensive trading history of 2 thousand pairs and billions of candlesticks for analysis.

- Strategies can be tested on historical performance without risking real capital.

기술적 특징

The backtesting function automates the testing of trading ideas before launch. Thanks to the clear interface, the tool can be used even by novice traders. Technical advantages of Veles backtests:

- Proprietary market database with billions of minute candles.

- It is possible to test opening positions in parts, placing several orders.

- Traders are provided with detailed statistics to evaluate and optimize strategies.

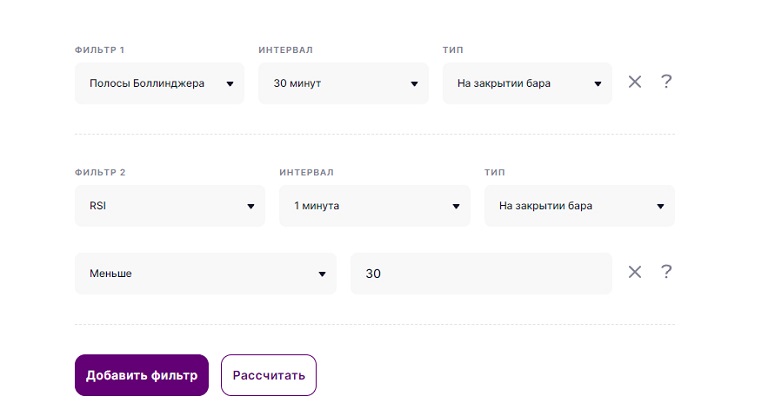

- Also available is a set of indicators for analyzing volatility, trading volumes, determining overbought or oversold cryptocurrencies.

Rates

You can create and test trading strategies on Veles for free. The Free format is available for all registered users. On the paid tariff Pro opportunities are more. The price is $25 per month. You can compare tariff plans in the table below.

| Connected options | Free | Pro |

|---|---|---|

How to start the backtest of a trade idea

To get access to the functionality, you need to create an account on the site. Veles does not collect and does not store user data, so for registration it is enough to specify e-mail. You can also authorize with a Google account.

In the personal cabinet you need to perform test tasks to get a bonus $5. After that, you can proceed to creating a bot:

- Click on the corresponding button on the control panel.

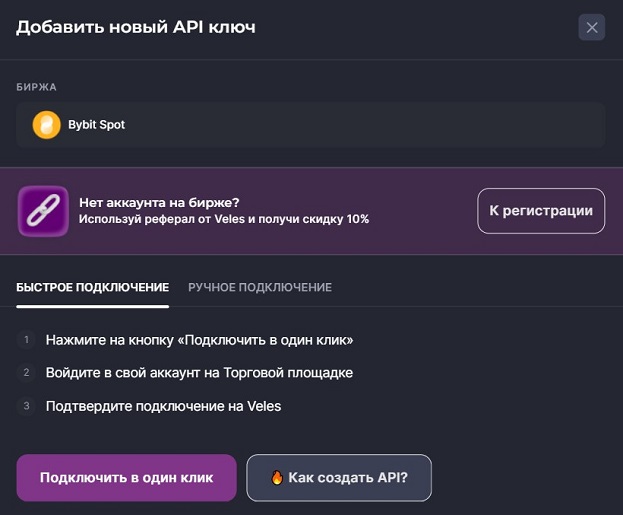

- Choose an exchange for trading and create an API key. The Veles website has step-by-step instructions for activating each platform.

- Customize trading parameters. You can manage orders, automate your strategy with indicators and filters.

- To start the backtest, click on the “Analyze” key at the bottom of the page.

A terminal model for simulating trading with bots will appear on the screen. Here you can test strategies before implementation to increase potential profits and minimize losses.

결론

Once a strategy has been tested and optimized, it can be applied in real trades. You need to realize that backtesting does not guarantee profitable trading. The tool will show how the strategy can work in different market conditions. This will allow the trader to make informed decisions, increase income and minimize risks.

텍스트에 오류가 있나요? 마우스로 강조 표시하고 Ctrl + 입력합니다.

작성자: 사이페데인 암무스암호화폐 경제학 전문가입니다.