Pump and Dump is a well-known strategy that is used by traders to make money. Pump cryptocurrency on the exchange is to manipulatively influence the price of a particular coin with the subsequent profit from the sale of the koin at the peak of the rate. As a result, experienced traders gain income, while beginners who invested in the process lose money.

Definition of a bump in the crypto market

Artificial increase in the value of an asset has been used in trading for a long time. Traders in the stock market make money on speculation with stocks, tracking the growth of their price. Such a scheme is widely used in the cryptocurrency market.

What it is

Pump – a planned and organized increase in quotations for a certain coin, the price of which was previously in sideways movement. There is an explosive growth, usually of a little-known token. Then traders-promoters actively spread fake news in open sources and social networks. Inexperienced market participants believe in the prospect of a heated asset and buy it at inflated prices.

Features

There are organic and inorganic pumps of cryptocurrencies. The first is characterized by a gradual growth with an increase in demand for several days to months with small corrections. Inorganic, on the contrary, occurs quickly. In this case, there is a jump upward by tens or even hundreds of percent in a few hours. Then there is a dump – a subsequent sharp decline in the value of the asset.

Hamsters

A dump is a classic model of interaction, in which there are leading participants and those who adjust to them. In trader’s slang, hamsters are beginners, naive participants. They do not know how to analyze the market competently, they easily succumb to mass injections of false information and react to price changes. It is hamsters, buying up the asset and pushing the upward movement, that become victims of organizers who profit from it.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Characteristic signs

Recognize which cryptocurrency will be pamped, you can by the general features of the strategy, even in conditions of high market volatility:

- Information attack by promoters, in which an abundance of messages about a particular token appears in the network.

- The cryptocurrency pair is actively traded on only one exchange.

- The appearance of a large number of orders to buy and sell koin, which are constantly changing.

- A little-known asset is in the spotlight. Organize a bitcoin dump and rock the price of the main cryptocurrency by 30%-50% is possible only for groups of traders with large capital or influential people. Significant resources and funds are also required for organizers to change the value of other famous coins.

How it happens

The scheme of the strategy is the same every time and follows the following plan:

- Organizers select a coin.

- At a convenient moment, the asset is bought up.

- Promoters disseminate information in messengers, chat rooms, websites.

- Other market participants begin to show interest.

- Ordinary traders buy up cryptocurrency en masse.

- Organizers sell their coins at the peak of the price.

- There is a massive collapse in the market.

- Hamsters either sell at a loss or are left with an unnecessary asset in their portfolio.

Differences from a dump

The task of manipulators is to make money on their coins. When the price reaches a peak, the organizers synchronously sell the heated cryptocurrency. The opposite effect occurs – dump, that is, the collapse of the market. This is the final stage, when the coin abruptly returns to the initial natural state.

Legality

Such actions are detrimental to the growing digital money industry. However, there is no legal framework for the decentralized cryptocurrency market. Therefore, it is impossible to recognize organized manipulation as illegal.

The exchanges themselves are beginning to play the role of regulator. Trading platforms monitor user activity, try to identify manipulators and limit their actions.

Examples

A well-known example of the Pump and Dump strategy was organized by Ilon Musk. It took only a few tweets for the Dogecoin coin to grow. As a result, in the spring of 2021, tens of thousands of hamsters bought the asset and drove up the price by 1000%.

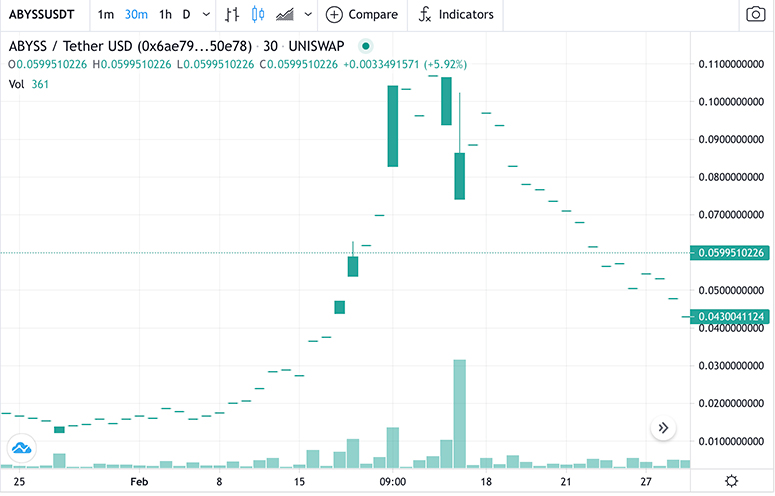

Another example, but already a short-term action. In February 2021, the Abyss token quadrupled in one day. A few days later, the asset fell significantly.

Varieties

Pumps of cryptocurrency can be divided by duration.

Short-term

The action takes place within a few hours or sometimes even minutes. The short-term strategy is more often used for cryptocurrencies with low capitalization. Organizers need less funds to manipulate the price of the token. Traders who believe in this cryptocurrency observe a sharp growth and invest money. After a few seconds of holding the peak position, a dump occurs.

Long-term

The scheme of the strategy does not change. However, cases of long-term dump are more often subject to popular currencies. Promoters spread fake news about the imminent growth of altcoin. Movement occurs in smooth waves lasting up to several days or weeks. To pump up large-scale projects, large expenditures are needed. Large groups of traders gather to organize such actions.

How to recognize the pump of cryptocurrencies

To understand that there is a manipulation of assets, you can recognize the following signs:

- A sharp increase in the volume of trading in the absence of significant events on the development of the project. For example, previously, the average number of transactions was 1,000,000 transactions per day. This is followed by a sharp increase to 10,000,000. At the same time, the value of the asset grows. Hence, it is concluded that there is a manipulation of the koin.

- The emergence of informative posts and news. An increase in social media activity related to the discussion of certain digital currencies may indicate an attempt to provoke purchases.

- Acceleration of the rate of growth in the value of the koin. If the value of the asset has been fluctuating in the corridor for a long time and suddenly there was a jump of tens of percent, most likely, the price is artificially inflated.

How to know when the next pump is

In the case of organic growth, you need to know how to work with trading tools: with levels (support, resistance) and figures (triangle, flag, head and shoulders and others). However, you should enter the transaction only after confirming the direction in which the price will go.

In the case of inorganic pump in advance to be aware of its occurrence is possible only if you participate in its organization. In other cases, it is impossible to determine the asset that manipulators have paid attention to.

Ways of earning money

Participating in a pampa can be potentially profitable for a trader, but there is a risk of losing money if you buy coins late or do not manage to discount them in time. There are 3 ways to manipulate the price:

| Method | Description |

|---|---|

| Become an organizer | Requires skills to gather a group of individuals to buy up an asset. |

| Join a group | There are groups in Telegram through which pampas are organized. You can add yourself to them to participate in such events. |

| Determine the beginning of the action in time and act independently | Suitable for experienced traders. To protect yourself from a sharp price reversal, you should definitely place stops in orders. |

Creating a group

The main earnings on the strategy are received by the organizers. Anyone with knowledge, experience and sufficient funds can create a group to provoke the growth of cryptoassets and get the highest profit. Success depends on the number of people that can be attracted. In order to move the price of even a small capitalization cryptocurrency, you need up to several thousand participants. The easiest way to do this is for well-known bloggers, owners of popular YouTube channels or closed groups in Telegram.

Participation in other people’s groups

If a user cannot organize his own community, he can join an existing one. The easiest way to find such a group is in closed Telegram channels. The main purpose of communities is to earn money for the creators. When searching and choosing a group, it is important to pay attention to the feedback of participants.

Often manipulators violate deadlines and can start the dump earlier than planned. It is worth trusting groups that have existed for a long time and have a history of success.

Independent earnings

Any trader can profit if he recognizes a stock with manipulation at the very beginning. When the price is already in growth, the risk of locking in a loss increases. But if you open a position for a short period of time, it is possible to earn at later stages.

Risks of working

Most often manipulations are short-term, so it is better to buy tokens in the first few minutes from the beginning of trading. Otherwise, you can join the ranks of hamsters and lose money.

This way of earning money is risky. To limit possible losses, you should invest no more than 3-5% of the deposit.

Active participation in price manipulation can be considered by exchanges as fraud and lead to blocking of your account on the exchange.

Frequently Asked Questions

❓ How not to become a victim of Pump and Dump?

Following simple rules will reduce the risk of becoming a hamster. The trader must remember that the hype around the coin may be artificial, so one must not give in to emotions. Assets that have already risen by 20-30% during the day or week should not be bought.

❕ What to do if a trader bought an asset at the peak?

If the value of the asset falls, the cryptocurrency can be left in the portfolio, continue to carefully study the market situation and wait for changes. Another option is to lock in a loss.

🤔 Why participate in cryptocurrency manipulation?

For users, it is a way to make money quickly. However, to get profits, the luck factor is important.

💵 Which coins to buy?

Investments in large capitalization cryptocurrencies are more stable and predictable. You can get the most movement on little-known koins, but the pumps of coins like Dogecoin are longer and stronger in terms of trend.

➕ How to maximize the chances of getting into the plus side?

Any action with money should take place according to a plan formed in advance. You should not give in to emotions and greed. Profit should be fixed immediately after reaching the set percentage and do not enter the deal again.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, expert in cryptocurrency economics.