Many factors influence the rates of digital coins. Most of them are unpredictable: news, project popularity, correlation with the bitcoin price. But there are constant ones – you can keep them in mind when choosing an asset to invest in. For example, the current issue of cryptocurrency and its relation to the planned issue of coins allow you to understand at what stage the project is, and assess its prospects. If you buy an asset at an early stage, you can get a significant profit in the future. When most of the cryptocurrency has already been mined, investors are waiting for its rapid growth due to the anticipated shortage.

How a new cryptocurrency emerges

Blockchain allows transactions to be stored in a distributed ledger as a sequential chain of blocks. From there, they are fed to miners – members of the network – who validate the transactions. To do this, a hash – an encrypted number containing information about the amount and time of each transaction, sender and receiver addresses, and other parameters – must be selected.

There is a random component in this set of numbers. To determine it, miners search through millions of variants. When the hash is found, the transaction block is automatically closed. New coins appear at the moment the transaction is confirmed. Whoever is the first to find a hash with the specified parameters is rewarded.

For example, a Bitcoin block is formed every 10 minutes. In 2021, the reward for it is 6.25 BTC. Every 4 years, the amount is halved(the process is called halving). Once it reaches 0, the mining of the first digital asset will stop.

Cryptocurrency issuance is the continuous generation of new coins in one or another network. The process is not controlled by a single authority, only users’ computers are involved. But there are also centralized cryptocurrencies, for which mining is not provided, and the current and total issuance is set and controlled by the developer (Ripple, NEM, Cardano):

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

| Asset | Total issuance | Number of crypto coins in circulation in November 2021 |

|---|---|---|

| Bitcoin (BTC) | 21 million | 18.86 million |

| Ethereum (ETH) | Unrestricted | 118.28 billion |

| Binance Coin (BNB) | 166.8 million | 166.8 million (Coin volume is decreasing due to quarterly coin burns; the process will continue until 100 million BNB remain) |

| Cardano (ADA) | 45 billion | 33.3 billion |

| Solana (SOL) | Unlimited | 302.64 billion. |

Difference between cryptocurrency and fiat money issues

The position of governments regarding digital coins is ambiguous. The main problem for governments is the lack of ability to control the issue of cryptocurrencies. In the classical sense, this ability can be vested exclusively in central banks and agencies under their control.

But in the cryptocurrency environment, most assets are issued in a decentralized manner. Hundreds of thousands of individual users can mine coins. Some cryptocurrencies have a primary issue – a one-time issuance of the asset by the developer in a planned volume. States, on the other hand, conduct such operations on a regular basis.

Other differences between the issue of digital currency and the issue of fiat:

- National money is periodically renewed. Old banknotes go out of circulation, new ones appear. There is no such phenomenon in the cryptocurrency market. A coin issued in 2010 is equivalent to one created in 2021.

- The issuance of fiat money is at the discretion of government agencies. Central banks can accelerate or stop the issuance of banknotes. In a digital environment, new blocks are generated at a set interval. Miners receive a fixed reward, which decreases according to a predetermined algorithm.

Both types of currencies are similar in that current issues never meet the intended volume. Paper money deteriorates, while crypto coins can be lost if the user forgets the digital wallet password or fails to keep a thumb drive with the private key.

How cryptocurrency issuance occurs

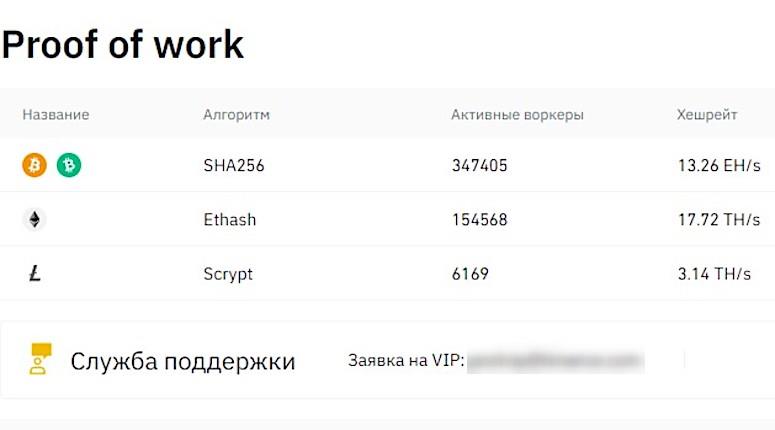

According to CryptoProGuide, there are 14,002 digital coins on the market in November 2021. Most of them are issued in a decentralized manner: miners perform computational operations, create new blocks and receive a reward – a certain amount of cryptocurrency. The search for a hash is governed by the rules established by the PoW (Proof-of-Work) algorithm. This is how Bitcoin, Ethereum (before the transition to the steaking model), Litecoin and other projects work.

Some coins are issued into circulation centrally. Cryptocurrency is issued by a team of developers, and randomly selected users(validators) stake their assets (staking) to validate new blocks on the network. Validators are rewarded from the koins that are already in circulation. Cardano, Solana, Tezos, Algorand, and other cryptoassets work this way.

Proof-of-Work

In 2021, PoW still dominates cryptocurrency mining. The essence of the algorithm is simple: a miner solves a mathematical problem with the help of a computer and sends the result to the network, which checks it against a template. If the values match, the user receives a reward.

Solving PoW problems requires a lot of computing power. It takes much less resources and time to check the results. Extraction of crypto coins is complicated by the ever-increasing complexity of decrypting blocks, so miners join pools, summarizing computing power. In this case, the reward is divided among all participants in proportion to the resources involved.

Proof-of-Work protects the blockchain from DDOS attacks and the influence of low-powered miners. To attack the network, you need to have 51% of the network hashrate, which is economically unfavorable in most cases.

The disadvantages of PoW mining include:

- High electricity costs. Experts estimate that by the end of 2021, it will take up to 91 TWh of electricity to mine cryptocurrency. This is 157% more than in 2020 (67 TWh).

- The risk of attack is 51%. The algorithm only provides security in large blockchains where miners compete for a block. In smaller networks, a hacker can gain a decisive percentage of computing power and reorganize the chains. In 2018, several projects were attacked 51% at once: MonaCoin, Zencash, Verge, Litecoin Cash, Aurum Coin. The total losses amounted to $2.8 million.

Proof-of-Stake

The PoS consensus algorithm was created as an alternative to the costly PoW. Proof-of-Stake is a mechanism that determines the right of users to confirm transactions based on the amount of digital currency in the wallet. PoS mining does not require special hardware. The work of the blockchain is supported by validators – holders of crypto coins that provide their assets to the system (this is called staking). The algorithm randomly selects a user, giving him the right to form a block. The validator is rewarded in native currency.

PoS-mining solves the main problems of PoW: it does not require power consumption and eliminates the risk of a 51% attack. For an exploit, the hacker must buy back 51% of all coins in circulation. In this case, he himself will suffer an attack that will disrupt the stability of the cryptocurrency. The algorithm is faster than PoW and creates a more scalable block chain with high throughput.

Disadvantages of PoS mining:

- Additional motivation to accumulate assets in single hands, which negatively affects the decentralization of the network.

- Nothing-at-Stake problem. An attacker may try to create a blockchain fork – an alternative chain with fake blocks to use it to perform double spending.

Types of issuance

Every year, hundreds of digital coins appear on the market. There are 3 types of cryptocurrency issuance:

- Limited with a one-time issue of coins – without the possibility of mining.

- Limited controlled – the number of coins in circulation is gradually increased by mining up to a set limit.

- Unlimited – constantly increases through mining.

The maximum supply of a particular asset and the current number of coins in circulation can be found on the monitoring sites CoinMarketCap, CoinGecko.

Limited one-time

Cryptocurrency is issued at once in full volume. It is impossible to mine such coins, but it is profitable to invest in them at the early stages of development. Under other favorable conditions (in-demand product, strong team), the asset will grow in value. In addition, crypto coins with a one-time limited issue are practically immune to inflation caused by the excess of supply over demand.

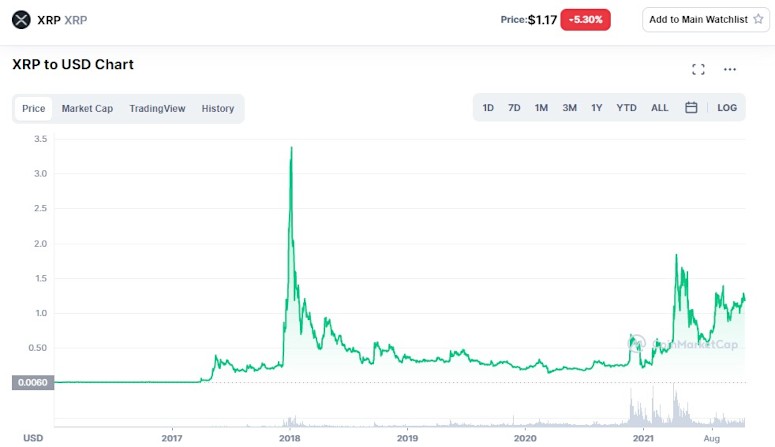

Examples of such currencies are Ripple, Cardano, NEM and others. The creators of XRP initially “froze” 53.6 billion coins out of the total number (100 billion), and then gradually brought them to the market. This approach allowed to create an artificial shortage of cryptoasset, and the developers received a reserve of time for the development and popularization of the project.

Limited controlled

Most popular digital currencies (Bitcoin, Litecoin, Dash) work according to this principle. The limited controlled issuance of bitcoin is due to mining. New coins appear on the market gradually. The rate of mining is predetermined by the PoW algorithm. The total number of coins cannot exceed the set limit. This mechanism keeps supply and demand at approximately the same level, or the former exceeds the latter. As a result, the value of BTC increases, and its exchange rate rises.

The shortage of crypto coins is also ensured by regularly reducing the reward that miners receive for each block found. The commission is halved approximately every 4 years (during the halving process).

Unlimited controlled

In some networks, the issuance of new koins can continue indefinitely. Digital currency is created by miners, and developers control its circulation. Such a mechanism is implemented in Ethereum, Dogecoin, Solana and other projects. The main advantage of these crypto coins is the speed of transactions. However, experts fear that unlimited issuance may lead to the depreciation of assets in the future. Therefore, developers gradually increase the difficulty of mining or burn koins to create an artificial scarcity.

Principles for regulating the issuance of new coins

The more money supply governments and central banks pour into the economy of an individual country, the more inflation swings. But cryptocurrencies are issued according to a certain plan, which is regulated by pre-approved algorithms:

- Blocking a part of coins and gradually bringing them to the market. The method is used in projects with a one-time issue. Developers create an artificial deficit of the asset and get a reserve to attract new investors.

- Increasing the complexity of mining. New crypto coins in the network are created with a certain time interval. For Bitcoin it is 10 minutes, for Ethereum – 14.2 seconds. The time remains unchanged regardless of the number of miners and attracted capacity. The difficulty of mining crypto coins gradually increases: in the Bitcoin network – every 2016 blocks (approximately every 2 weeks), Etherium – 1000.

- Decrease in the reward for mining. In the BTC network, the payment for finding new blocks is halved every 4 years. At the same time, the release of new coins slows down and creates a moderate deficit of the asset on the market. The same processes occur in other projects.

How to know the real number of coins in circulation

It is impossible to determine the value of cryptocurrency without knowing how many units are on the market, and what volume will be released in the future. Theoretically, the number of coins in circulation should be equal to the current issue. In practice, this is not the case.

According to CoinMarketCap monitoring data, there are 18,870,343 BTC in circulation in November 2021. These crypto coins are stored on 38,890,675 wallets. According to Blockhain.com, the Bitcoin network processes an average of about 300,000 transactions between 500,000 addresses per day. Another 28.4 million wallets have zero balance. Thus most of the holders of the asset do not use it in any way. They only accumulate digital currency.

Some users may have lost or forgotten their wallet key – these crypto-coins can no longer be recovered. When estimating the number of koins in circulation, you need to take all these factors into account. The real numbers will be much smaller than the statistical ones.

Frequently Asked Questions

🤔 What does the cryptocurrency issue affect?

This is one of the factors that determine the value and exchange rate of a koin.

🔢 What are the most popular consensus algorithms in 2021?

Proof-of-Work continues to dominate. PoS (Proof-of-Stake) and PoC (Proof-of-Capacity) are also used in many networks.

❓ How many Ethereum crypto coins are in circulation?

In November 2021, there are 118,301,459,31 ETH.

🙄 How does the issuance of Dash take place?

The crypto coin runs on the Proof-of-Activity algorithm. It is a combination of PoS and PoW functions. In the Dash network, miners generate blocks and hodlers (holders) confirm transactions.

👨💻 What is hidden mining?

It is the unauthorized use of computing devices to mine digital assets. Another name for it is cryptojacking. Usually hidden miners are installed in programs or applications. According to Recorded Future, cryptojacking infects one in four computers in the world.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.