In 2021, all major centralized marketplaces moved to mandatory verification of customer data for full access to platform capabilities. This is due to the expansion of anti-money laundering activities in the field of electronic payments. This is how KYC verification on the cryptocurrency exchange appeared. The procedure is mandatory for all users: both new and already registered. The trading platform offers to confirm the identity. Otherwise, the functionality will be limited only to the withdrawal of coins.

What is KYC

The procedure is the collection and verification of personal data of users by organizations offering financial services. Customers must provide identity documents: civil or foreign passport, driver’s license, ID-card. When conducting KYC on a cryptocurrency exchange, the administration may require utility bills to confirm the residential address. The procedure itself consists of 3 parts:

- User identification. Collection and initial control of information about the client. Comparison of account registration data and provided documents.

- Due diligence. After the initial risk assessment, the financial company may decide on an additional audit. The operator sends requests to the competent authorities to find out whether the potential user has been involved in illegal activities.

- Transaction monitoring. Monitoring of large transfers and transfer of information to terrorist financing tracking organizations. Depending on the results of the verification, the account may be suspended.

The verification process is automatic. However, it can be transferred to manual. Then the procedure will take several days.

Why KYC procedure is necessary

Verification allows financial organizations to identify customers, understand where they get their money from and what they do with it. KYC regulations are needed to combat fraud, terrorist financing, drug trafficking and other crimes.

The regulations require companies to follow an identity verification procedure and store all information. The data are bank secrets and are not available to outsiders. However, they can be requested by law enforcement agencies by court order.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Differences from AML

Anti-Money Laundering is a whole list of recommendations to prevent illegal transactions. Identification is one part of AML that complements the overall transaction risk screening. During the identity verification process, sensitive data is collected, and AML already analyzes the information and checks it against addresses in the blockchain. The effectiveness of anti-money laundering directly depends on KYC, but includes other components as well:

- CDD – collecting user identity and address data for risk assessment.

- EDD – additional verification process. Designed for at-risk customers. Users in this category are assumed to be prone to money laundering and terrorist financing.

Policy levels

Cryptocurrency exchanges offer their clients different conditions for undergoing verification. This is due to the type of trading platform and the jurisdiction in which it is located.

Lack of KYC

Platforms do not collect any personal information of customers without restricting access to features. Such conditions are offered by DEX exchanges, which do not open accounts for clients but act as intermediaries between trading participants. Centralized platforms may at any time require users to undergo verification.

Basic procedure

After tying a cell phone number, you can perform a minimum set of operations:

- Top up accounts via bank cards.

- Transfer assets to other addresses.

With basic identification, the withdrawal of fiat is often unavailable, but cryptocurrencies – not limited.

Full KYC procedure

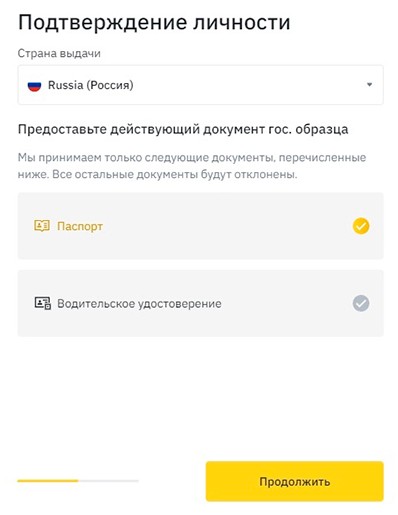

The client needs to provide identity documents (to choose from):

- Passport.

- ID card.

- Driver’s license.

Many exchanges request scanned copies of utility bills to confirm the user’s residential address. Selfies via a mobile app or live webcam are also required.

In some cases, platforms may require video selfies.

Who regulates the norms

In 1989, the FATF, an intergovernmental organization for the development of standards for combating the financing of terrorism and money laundering, was founded. Its activities resulted in 49 recommendations, which are a mandatory standard for UN members. These standards are reviewed every 5 years and updated with the changes in the types of monetary relations. Between 2000 and 2010, most of the world’s major jurisdictions passed laws governing identity verification and anti-money laundering rules.

Cryptocurrency has become increasingly important in the financial system in recent years, so AML standards have affected centralized exchanges as well.

In the summer of 2021, regulators in many EU countries and in the US initiated KYC on cryptocurrency exchanges. Clients of trading platforms were forced to confirm data or refuse to work with the services and transfer coins to other platforms.

It is assumed that all collected information is stored in accordance with AES-256 standards on third-party services. In case the platform is hacked, sensitive user data should not be affected.

How to go through the KYC procedure on cryptocurrency exchanges

Customers who have already registered on the trading platform must also undergo verification. Otherwise, access to all features and transaction limits will be limited. In 2023, the procedure is automated, its passage does not take much time. For example, on the Binance exchange to confirm the data is necessary:

- Log in to the account on the site. After that, on the toolbar, the user selects the item to start the identity confirmation procedure. This section is located in the LC on the side menu.

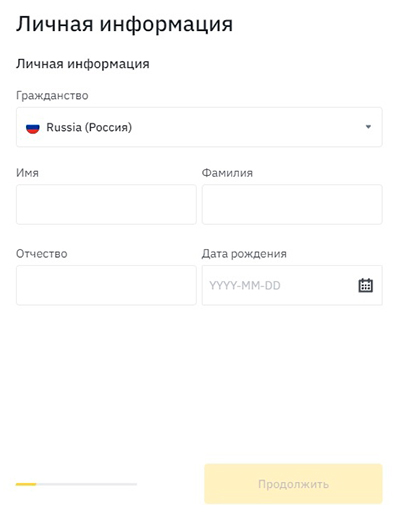

- Enter data. Specify full name, date of birth, registration address. To verify and verify the previously completed information, the client uploads a passport photo or driver’s license. The full name is indicated in English.

- Take selfies. If the computer does not have a webcam, this can be done on a smartphone.

Photos of documents must be in good quality. Otherwise, the application for verification will be rejected.

The email specified during registration will receive an email about passing the identity verification procedure. The user after KYC on the cryptocurrency exchange will have access to all functions, and the daily limits will increase from 0.06 to 100 BTC.

In case of failure, the client will have 9 more attempts.

The main advantages and disadvantages of KYC

Although identification is quick and easy, it carries risks for the client.

| Pros | Minuses |

|---|---|

| Protecting the ecosystem from fraud. Even if a participant encounters fraud, the login details of suspicious accounts will be handed over to law enforcement agencies by court order. | Privacy. It is not fully understood who collects and stores this information. There is a risk of third parties accessing users’ personal data. |

| Increased trust. Experts point out that transactions on sites where KYC is required exceed the trading volumes of anonymous transactions. | Decreased decentralization. Although verification does not directly affect transactions in the blockchain, it contradicts the principles of cryptocurrencies. |

Summary

In 2021, all centralized platforms from the top ten by capitalization switched to mandatory verification of customers’ personal data. This is due to the requirements of regulators from UN countries that have joined the anti-money laundering program. KYC on a cryptocurrency exchange is part of AML, which identifies transactions via public keys with a specific individual and holds them accountable in case of illegal activity.

The growing trust in digital assets is linked to the fight against terrorist financing and tax evasion. This leads to a decrease in the negative news background, where cryptocurrency is seen as a tool of malefactors. Participants’ confidence in the legitimacy of transactions is the reason for the increase in trading volume. Verification reduces the likelihood of fraud on exchanges.

Frequently Asked Questions

📲 What can a crypto exchange account be blocked for?

If a user’s transactions are verified as illegal activity, access to the account will be restricted.

🔑 What personal information is required for identification?

The customer needs to provide a passport or driver’s license photo, residential address, phone number and selfies.

🎥 What to do if the camera on the phone does not work?

Contact the support service of the trading floor and provide scanned copies of documents by e-mail.

💳 What transactions are subject to additional verification?

Transfers of large amounts are controlled. Exact criteria are not disclosed by exchanges.

💻 Which trading platforms work without verification?

Decentralized platforms do not oblige clients to undergo KYC procedure.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.