In January 2021, Bitcoin set a new all-time high of $34 thousand and continued to update records in the following months. Investors traditionally waited for the start of a new “altcoin season”, but something went wrong. During the year, coins from the top ten (ETH, Dogecoin, Solana) were rapidly becoming more expensive. The rates of other promising currencies increased unusually evenly. Experts explain: altcoins are not growing because of the focus on BTC. In 2021, the first cryptocurrency strengthened its positions, and so far there are no preconditions for a global change of trend. But the “altcoin season” will still be there – after Bitcoin reaches a six-figure price.

Bitcoin’s impact on other cryptocurrencies

In December 2021, the market capitalization of digital coins is $2.23 trillion, of which 41.5% is concentrated in BTC and the remaining 58.5% in 15,546 different altcoins. Obviously, all market movements are determined by the first cryptocurrency. If bitcoin is rising, other coins move after it. When the price of the flagship falls, the rates of alternative currencies also fall. Analysts highlight several reasons for this dependence:

- Bitcoin is the first digital coin that made similar currencies mainstream. The asset proved to be a reliable store of value, and its popularity grew to astronomical levels. Along with the demand, BTC’s influence on the rest of the market has increased.

- Most coins are traded in tandem with bitcoin. At the same time, many cryptocurrencies cannot be bought for fiat. To invest in a promising coin, an investor will have to first purchase bitcoin. If the user wants to exit the market, they will sell the asset for Bitcoin and convert it to traditional currency.

- BTC is the reserve coin on all major cryptocurrency exchanges similar to the role the USD plays in the global stock markets. This gives additional stability to the coin. According to the Decrypt website, 2.3 million BTC remained on exchanges in March 2021.

A study by analysts Towards Data Science in 2018 showed that top coins are tightly correlated with Bitcoin. But by 2021, the market had visually changed. Many projects (ADA, MATIC, SOL) present actual technologies that allow them to increase their share in the industry and depend less on the main cryptocurrency.

Reasons why altcoin is not growing behind bitcoin

BTC remains the main market driver in 2021. The first cryptocurrency has updated historical highs 11 times. Investors rushed into Bitcoin and the asset’s dominance increased. This is the main reason why altcoins are not growing behind Bitcoin. The dominance of the main cryptocurrency has a reason:

- Investors see the asset as a tool for risk hedging and profitable investments.

- The first exchange-traded funds(ETFs) trading Bitcoin futures have appeared.

- The volatility of the asset has decreased (in November, it was 2.7%, approaching the lowest value since the beginning of the year).

If we look at the historical movement of the market as a whole, we can see that after the rise in Bitcoin, a period of consolidation begins. At this time, investors turn their attention to altcoins. The dominance of the main cryptocurrency falls, other coins begin to grow.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

So far, there are no such prerequisites. In December, the price of Bitcoin fell below $47 thousand. But analysts say that the coin will continue its growth. The nearest forecast is $100 thousand within 1-3 months. It is shared by Nikita Zubarev (Bestchange), Gleb Kostarev (Binance) and Mikhail Karkhalev (Currency). According to experts, the “altcoin season” will begin only after bitcoin updates its historical maximum and starts consolidating at this level.

Factors affecting the rate of altcoins

Most cryptocurrencies have a strong correlation with BTC. However, there are other factors that influence altcoin prices. There are constants (issuance, applicability) that need to be considered when building an investment portfolio. Some factors are unpredictable (news background, popularity). But if you control them, you can make money on rapid changes in rates. Cryptocurrency monitors (CoinMarketCap, Coingecko) are used for this purpose.

Capitalization

Digital coins have no physical collateral. Therefore, their value is determined by the ratio of supply and demand, and market capitalization is calculated by multiplying the price of the asset by the number of units issued. However, such an assessment of cryptocurrency is not objective enough, and it is illogical to base an investment strategy on it:

- Developers often “freeze” a certain share of coins, releasing only a part of them to the market. For example, the creators of Ripple initially blocked 53.6 billion XRP out of the total issue of $100 billion, and then gradually brought them into the public domain.

- The mechanism of creating digital currencies assumes that most of the coins will not be traded on exchanges, but will remain with investors as a long-term investment. Holders of STEEM coins use them to vote for the best content, and ASAP holders participate in the management of the protocol.

To estimate the real capitalization of an altcoin, you need to consider the number of users on the network and the number of transactions. Tracking these indicators, you can determine the growth or fall of interest in digital currency.

Features of the digital asset

Another factor that stimulates the increase in demand for cryptocurrency is the possibilities of its application. In 2021, Shiba Inu (77909077%), Terra (15491%), Solana (11879%), Polygon (10742%), and Ethereum (550%) coins showed the highest growth.

The ETH blockchain is home to the most profitable sectors DeFi and NFT in 2021. Users buy etherium to participate in transactions involving decentralized assets and non-mutually exchangeable tokens. Between January and December, the main altcoin team launched 2 major updates (Berlin and London), which are part of a plan to transition the network from Proof-of-Work to Proof-of-Stake. After the activation of the next hardfork in August 2021, Ethereum has another feature. The platform regularly burns coins, reducing issuance and increasing the value of the asset.

Other altcoins on the leaderboard are also pushing breakthrough technologies:

- Shiba Inu is a decentralized ecosystem with a cryptocurrency exchange and NFT, fully community-driven.

- Terra conducts fast, secure, and cheap payments using stablecoins.

- Solana builds a scalable and fully secure platform for the next generation of decentralized applications (dApps).

- Polygon increases bandwidth on the Ethereum network.

| Cryptocurrency | Price in December 2021 ($) | Capitalization in December 2021 ($) | Average daily trading volume in December 2021 ($) |

|---|---|---|---|

| Ethereum (ETH) | 3.78k | 450.4 billion | 25.17 bln |

| Solana (SOL) | 158,05 | 48.8 billion | 2.71 billion |

| Dogecoin (Doge) | 0,19 | 25.23 billion | 6.14 billion |

| Terra (LUNA) | 59,33 | 22.62 billion | 2.46 bln |

| Shiba Inu (SHIB) | 0,00003361 | 18.59 billion | 1.65 bln |

| Polygon (MATIC) | 1,86 | 13.15 billion | 2.47 bln |

Notoriety

Most private investors follow the quotations of the popular koins and invest in them. The popularity of BTC, ETH, BNB, SOL and other top projects reduces the risk that a coin may suddenly depreciate. This strategy is suitable for beginners, but limits investors in decision-making. Often, little-known altcoins remain undervalued. If there is a serious team behind the project, which is developing a potentially in-demand product, there is a chance that the asset will rise significantly in price.

Information field

According to Yale University (USA), the correlation between positive tweets about bitcoin and the cryptocurrency market is 80%. Analysts say that a 1% increase in the number of posts with the word Bitcoin is accompanied by a 2.5% increase in the price of the asset in the week following their publication. The loud news can rapidly change the course of the main cryptocurrency and, accordingly, affect the entire market.

In 2021, Ilon Musk gained a reputation as a manipulator who is able to collapse or raise the rate of koins with his tweets. In January, the entrepreneur and developer added the hashtag #Bitcoin to his profile. Within hours, the price of the asset increased by 19% (from $32.3k to $38.1k). In May, Musk said that Tesla was stopping the sale of cars for BTC due to the unecological nature of the cryptocurrency. The market reacted with a 10% decline in the asset’s rate (from $53.1k to $47.8k).

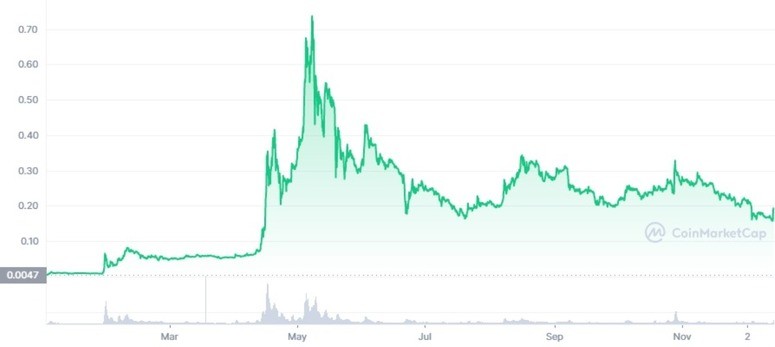

The rapid growth of Dogecoin in 2021 began after the head of Tesla and SpaceX mentioned it several times in his tweets. From January to December, the asset grew by 5771% (from $0.0049 to $0.19).

Positive investor expectations

According to Glassnode monitoring data, investors continue to increase BTC volumes at the end of 2021, despite a 30% correction of the asset after reaching an all-time high of $69 thousand. Nikita Soshnikov, head of the Alfacash exchange service, says that this indicates high growth expectations for the digital currency. According to the expert, many market participants expect to increase investments 5-10 times at the level of $20-30 thousand. Investors will start fixing their profits at $120 thousand. Many BTC holders believe in an increase to $1 million.

Conclusions

In 2021, investors’ money is concentrated in Bitcoin. The dominance of the main market asset is stably held above 40%, so altcoins are not growing. Despite the current correction of BTC, analysts forecast the rate to rise to $100 thousand in the coming months. And only after updating the next historical maximum will the long-awaited “altcoin season” come.

Frequently Asked Questions

🔍 How much BTC has already been mined?

In December 2021, miners generated a block of 714,000. This means that 18.9 million BTC has been mined – 90% of the total issue (21 million).

📝 How to mine Solana?

SOL runs on the Proof-of-Stake algorithm. Therefore, it cannot be mined with hardware, but you can participate in staking.

📊 How many BNB crypto coins are in circulation?

The altcoin has an issuance of 166.801 million units. In December 2021, 100% of the issued BNBs are in circulation. Binance burns coins on a quarterly basis and will do so until the issuance drops to 100 million.

📌 Where to buy Dogecoin?

The popular cryptocurrency is traded on all major exchanges (Currency, Cex.io, Binance and others).

🔗 How much does the Ethereum blockchain weigh?

In December 2021, the size of the ETH network is 325.60 Gb.

Is there a mistake in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.