Data on the profitability of digital mining is changing rapidly. This is due to two main factors – the bitcoin exchange rate and the cost of equipment. In the spring of 2023, the prices of miners decreased, the reduction amounted to an average of 15 to 35%. At the same time, the value of BTC began to strengthen: in the first half of the year, quotes rose from $ 16.6 thousand to $ 26.9 thousand. The material calculates the profitability and payback of the most popular models of equipment for mining cryptocurrencies in June 2023. It also tells what is important to consider when choosing a seller of equipment.

Profitability analysis

In 2022, the profitability of mining in the moment decreased. The slowdown in payback occurs at the bottom of every bear cycle. This has affected both crypto mining using graphics cards and ASIC hardware. On the one hand, the demand for miners at times like these decreases. Nevertheless, this period is traditionally considered the best time to upgrade equipment. The main reason is that ASIC manufacturers start to significantly reduce prices.

At the beginning of 2023, the price of bitcoin began to rise and continues to strengthen over the last 6 months. Against the backdrop of falling hardware costs, this has allowed ASIC mining to return to positive profitability. There are 4 factors to consider when assessing the profitability of crypto mining:

- Price of the devices

- Hardware hash rate

- Electricity cost

- The exchange rate of the crypto coin being mined.

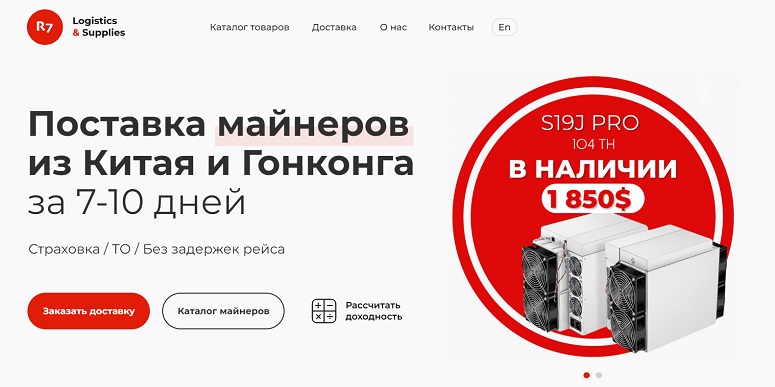

Specialized intermediaries (for example, the company R7Miner) help with the selection of equipment. You can also use the mining calculators on the seller’s website.

For calculations in this material, online services WhatToMine or MinerStat were used. The estimation was made taking into account that the cost of 1 kWh of electricity is 4.3 RUB. It is important to realize that tariffs dynamically differ depending on the region where the equipment is located.

R7Miner provides consultations on selecting the most efficient location and placement in the data center. The company also has a function to start mining without the buyer’s participation.

5020 $

新規ユーザーへの特典!

ByBitは暗号通貨取引に便利で安全な条件を提供し、低い手数料、高い流動性、市場分析のための最新ツールを提供します。スポット取引とレバレッジ取引をサポートし、直感的なインターフェースとチュートリアルで初心者からプロのトレーダーまでサポートします。

100 $ボーナスを獲得

新規ユーザー向け

暗号通貨の世界で迅速かつ安全にあなたの旅を開始することができます最大の暗号取引所。このプラットフォームは、何百もの人気資産、低い手数料、取引と投資のための高度なツールを提供しています。簡単な登録、高速取引、信頼性の高い資金保護により、Binanceはあらゆるレベルのトレーダーにとって素晴らしい選択肢となっています!

You can select a miner with regard to price, performance and payback on your own or with the help of the project staff. The following models of ASIC devices are selected for comparison.

| 名称 | Crypto mining algorithm | Hash rate (depends on the configuration) | Power consumption, W |

|---|---|---|---|

Mining with SHA-256 algorithm

Bitcoin mining is ranked #1 in the world. The SHA-256 hashing algorithm, which is the basis of the Bitcoin network, requires a lot of hardware performance. The capacity of the models already exceeds more than 100 TH/s. They are produced by several companies. The most popular are considered to be the Antminer and WhatsMiner series. In addition to the difference in cost, there are also significant differences within the lines.

著者 サイフェデ・アムス暗号通貨経済学の専門家。