When bitcoin appeared, many expected that the new digital coin would become a “safe haven” for investors, unaffected by external factors. In the first years of its existence, the correlation of cryptocurrencies with stocks, commodities and monetary assets was weak or non-existent. But that has changed in the last few years. In 2024, analysts are talking about a pronounced correlation of digital coins with other types of assets and use this correlation to form profitable investment portfolios.

What is the correlation of cryptocurrencies

To create a balanced portfolio of digital coins, an investor needs to select assets that are weakly correlated with each other. Then the fall of one koin will be compensated by the growth of another.

The correlation of cryptocurrencies means that their rates move in the same or opposite directions during a certain period.

Coefficients can range from -1 to +1 (measured in %):

- A one indicates that the coins are moving in sync and reacting to the same factors in the same way.

- A zero value indicates that there is no correlation.

- A negative value indicates that currency prices are moving in opposite directions.

Almost all digital assets have a positive correlation. In other words, the value of a cryptocurrency depends on the BTC exchange rate. But the strength of this relationship is not the same. Many repeat the movements of bitcoin, others are less dependent on the first cryptocurrency.

5020 $

新規ユーザーへの特典!

ByBitは暗号通貨取引に便利で安全な条件を提供し、低い手数料、高い流動性、市場分析のための最新ツールを提供します。スポット取引とレバレッジ取引をサポートし、直感的なインターフェースとチュートリアルで初心者からプロのトレーダーまでサポートします。

100 $ボーナスを獲得

新規ユーザー向け

暗号通貨の世界で迅速かつ安全にあなたの旅を開始することができます最大の暗号取引所。このプラットフォームは、何百もの人気資産、低い手数料、取引と投資のための高度なツールを提供しています。簡単な登録、高速取引、信頼性の高い資金保護により、Binanceはあらゆるレベルのトレーダーにとって素晴らしい選択肢となっています!

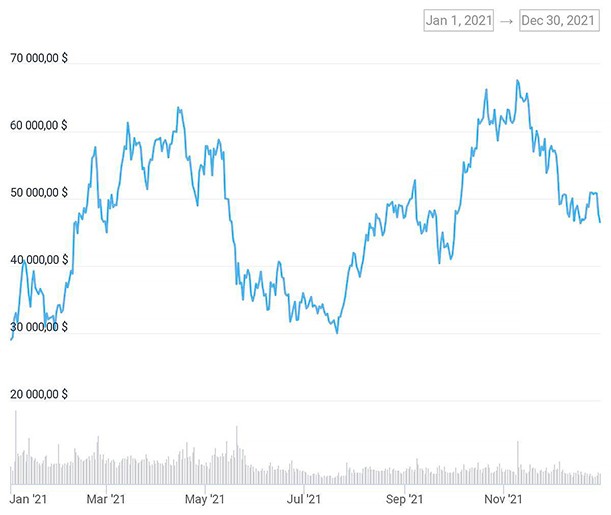

In 2021, ETH (+0.98%) showed the greatest synchronization with BTC. In November, ETH simultaneously with BTC updated the historical maximum at $4.8 thousand (Bitcoin reached $69 thousand).

The correlation with LTC is also at a high level (+75%). XRP is less dependent on the behavior of the flagship (+66%). Positive correlation is especially pronounced when the BTC exchange rate falls. The correction in the price of the base cryptocurrency by 10-15% causes altcoins to collapse by 20-30%. The correlation with the strengthening of bitcoin’s position is weaker.

Reasons for the positive correlation of cryptocurrencies

Before 2018, analysts often talked about the multidirectional price movements of bitcoin and altcoins. But after the deep market decline, the situation changed. BTC began to grow again, proving its stability and confirming its status as a leader. Altcoins follow the flagship, but do not repeat its movement literally. The fall in the prices of alternative coins is deeper, and the growth is lower. Therefore, in case of sharp collapses, their value recovers more slowly. The growth of digital gold often outpaces the rest of the market.

Experts name several reasons for this relationship between altcoins and bitcoin:

- Digital currencies react to all external factors in the same way, but with different degrees of perception.

- Major players view BTC as a protective asset during periods of turmoil in traditional markets.

- Many investors perceive cryptocoins as a single array of digital assets.

Single influencing factors

It is not uncommon for major movements in the crypto market to occur in connection with high-profile information occasions. Coin prices rise on the background of positive events and fall when bad news appears.

The greatest resonance is caused:

- Unpredictable events. The hacking of major exchanges, blocking the accounts of industry actors in social networks can sow panic among investors and collapse cryptocurrency rates. When the Chinese operator Weibo blocked the profile of TRON founder Justin Sun in December 2019, the coin fell by 6% (from $0.01410 to $0.01330). A few hours later, the rate recovered and rose above the previous values (to $0.01420).

- Opinion leaders’ statements. In December 2021, DOGE rose in price by more than 20% within an hour after Ilon Musk (head of Tesla) tweeted that the company would start selling merch for this coin.

- Political Decisions. In May 2021, Liu He, head of China’s State Council, announced stricter measures against cryptocurrency 採掘 and trading. The market reacted with a sharp decline in the BTC rate by 8% (from $41 thousand to $37 thousand).

- Actions of exchanges. Large trading platforms regularly hold contests with certain coins, which causes a short-term rise in their prices. Currency rates also grow after being added to exchanges. In September 2021, GALA rose 600% (from $0.02 to $0.14) in just 6 days of listing on Binance.

- New product launches. Cryptocurrencies appreciate best on the back of news about the development of projects and their application in real life. In 2020, WAVES rose in value by more than 100% in 3 weeks after the announcement of a joint project with Rosseti in the field of electricity consumption metering using blockchain.

Digital gold

In 2024, analysts often say that investors have begun to see bitcoin as a tool to protect capital during volatile times in traditional markets. But big players have been investing in Bitcoin for a long time.

According to Legg Mason Value Trust fund manager Bill Miller, the first cryptocurrency entered the market as a reaction to the 2008 economic crisis and became the only instrument independent of government control and dubious manipulation.

The volume of investments in digital gold grows when investors see the danger of a slowdown in the global economy. This is evidence of bitcoin’s inverse correlation with traditional markets.

Growing investor interest in cryptocurrencies

In May 2022, the market capitalization of digital coins is $1.3 trillion. Bitcoin’s share is 41.4%. In 2021, the main market asset has updated historical records 11 times, which attracted the attention of large investors.

MSCI analysts estimate that by 2022, 52 companies with a total capital of $7.1 trillion have invested in digital currencies or related instruments. They include Tesla, MicroStrategy, Coinbase, Soros Fund Management, BlackRock and others.

The interest of institutional investors in digital assets is not only due to the opportunity to insure capital against rising inflation. According to Soros Fund Management CEO Daun Fitzpatrick, cryptocurrencies have already become mainstream. Large funds realize that they could lose clients if they don’t invest in Bitcoin.

How to calculate the correlation coefficient

It is important for an investor to balance a portfolio so that in the event of major market shocks, the potential returns outweigh the risks. Various methods are used to determine the correlation of cryptocurrencies:

- Mathematical formulas – operate with the average values of indicators in pairs and coefficients of standard deviations.

- Software tools (Python) – allow you to calculate the degree of interaction of selected pairs and analyze indicator-guides for trading on exchanges.

- Online calculators (iCorrelation Table) – serve to quickly calculate the correlation within cryptocurrency pairs and with other assets.

The correlation coefficient of digital coins is at the heart of pair trading. The technology is easy to use, but for accurate results, it is necessary to include the exchange commission in the equation and take into account the news factor.

Correlation of cryptocurrencies with other assets:

| Pearson correlation coefficient (%) | Nature of correlation |

|---|---|

In 2021, most analysts note the connection of the main digital coin with the traditional financial market and gold. But the correlation between the sectors cannot be called stable. Cryptocurrencies are a new asset class, and it is not yet possible to establish predictable patterns of their behavior relative to others.

Precious metals

Analysts, investors and regulators have long argued about the status of BTC in the global market. As a result, the cryptocurrency was equated to a commodity. Many already perceive it as a digital version of gold. Bitcoin’s correlation with the precious metal intensified in 2019. In 2021, the dependency ratio is 0.91%. This indicates an almost direct connection between the assets.

The key correlation indicators of bitcoin and gold in 2019-2021 are presented in the table.

| Period | Event | BTC behavior | GOLD behavior | Estimated correlation |

|---|---|---|---|---|

| May-June 2019 | Intensification of the US-China trade standoff | Rapid growth (from $5.26k to $13.85k) | Rising and reaching a 6-year high ($1.42k) | Sustained positive |

| August 2019 | Introduction of new trade duties between the US and China | Correction, recovery and price increase from $10k to $12k. | The asset rose in price to $1.50k. | Positive |

| Beginning of 2020 | COVID-19 pandemic, escalation of the US-Iran conflict | Recovery and growth of the rate to $10.40 th. | Another renewal of the high to $1.69k. | Sustained positive |

| October-November 2021 | Launch of the first bitcoin-ETF in the U.S. | Growth and renewal of the historical high at $69k. | Price rises to $1.80k | Positive |

Fiat currencies

The market of traditional finance has not shown a significant correlation with digital coins for a long time, although some experts have noted the connection in trading pairs since 2013.

In 2022, fiat and virtual currencies are in a statistically confirmed inverse interaction. When the dollar falls, bitcoin rises, the reverse is also true. If fiat money depreciates, BTC remains deflationary.

Over time, the value of a major cryptocurrency increases and the quantity is limited. The fewer coins available for mining, the more efficient and reliable a tool for capital preservation and multiplication it becomes.

Stock market

Statistical data shows a significant positive correlation between the graphs of changes in the price of BTC and the S&P 500 index (an exchange-traded fund consisting of shares of the largest companies in the United States). The stable correlation has been observed since the beginning of 2020 and is especially noticeable during the period of intensive growth of the sectors. However, experts do not consider it as a confirmed regularity and consider it more of a coincidence that reflects the general sentiment in the stock and cryptocurrency markets.

In the first quarter of 2022, the correlation between BTC and the S&P 500 turned negative. By April, bitcoin had lost about 20% from its peak values.

Oil

A positive correlation between “black” and digital gold has been observed since 2014. Then analysts for the first time noted a synchronized fall in the rates of oil and bitcoin. The first asset for the year lost 54% of its value, the second – 44%.

In 2017, oil rose by 22%, Bitcoin rose in price 20 times. In November 2018, the price of BRENT futures on the London ICE exchange fell to $59 per barrel. At the same time, the BTC exchange rate fell from $5.60 thousand to $3.57 thousand. In 2024, the correlation between the assets remains consistently positive.

結論

The clear positive correlation of cryptocurrencies is pronounced within the industry. The reference point is Bitcoin, and the other coins are oriented on it. In 2022, BTC maintains a strong correlation with precious metals (Gold), becoming in fact a full digital analog of gold and a significant deflationary asset. Positive correlation is observed with oil, negative – with fiat currencies. The close interaction indicates capital flows between traditional and cryptocurrency markets.

よくある質問

💡 Can I use the correlation coefficient as a basis for building a trading strategy?

Evaluating the interaction of a digital currency with other assets is essential for building an investment portfolio. In trading, the correlation coefficient works in conjunction with other technical and fundamental analysis tools.

✅ Which coins does BTC correlate more strongly with?

Currencies from the top ten by capitalization (ETH, BNB, DOT and others) have a stable positive correlation with the main crypto coin.

📆 What does the positive or negative correlation between traditional and digital assets depend on?

The behavior of markets is determined by the same factors: political and economic events, interest of major players.

🧰 What tools are available to calculate the correlation coefficient?

You can use formulas, special programs and calculators.

❓ Which coins do not depend on the BTC rate?

Digital currency rates move independently, behind which there are in-demand projects: SOL, ADA, MATIC and others.

テキストに間違いはありませんか?マウスでハイライトして Ctrl + 入る。

著者 サイフェデ・アムス暗号通貨経済学の専門家。