At the end of November 2021, there are more than 7 thousand coins and tokens. But there are 2 main cryptocurrencies in this market – Bitcoin and Ethereum. BTC and ETH coins are characterized by their own features. It is useful for users of virtual money to know the differences of Bitcoin and Ethereum. They will help novice investors to better understand these cryptocurrencies.

The main differences between Bitcoin and Ethereum

The developers of Bitcoin and Ethereum initially put different ideas into their digital projects. The bitcoin coin network is a payment system that was created in 2009 after the global financial crisis of 2007-2008. The main objective of Bitcoin is to solve the main shortcomings of fiat currency:

- Centralization.

- Market inflation.

- Lack of anonymity.

Ethereum is a platform for developing decentralized cryptocurrency applications based on digital blockchain technology. Ethereum was created in 2015 by Vitalik Buterin.

Issuance

In 2021, both networks apply the Proof-of-Work(PoW) algorithm. It allows users to come to a common decision – consensus (one viewpoint on the blockchain). Proof-of-Work provides cryptocurrency networks with protection against errors in the operation of nodes (nodes) in digital asset systems.

Bitcoin and Ethereum miners need computer hardware to work in Bitcoin and Ethereum coin blockchains. They use it to solve complex tasks in cryptocurrency networks – calculating the hash (data identifier) of digital transactions and blocks of the system. For their work, miners are rewarded – new coins. They are created by the system and are part of the cryptocurrency financial market.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

In 2022, Vitalik Buterin will combine Ethereum 1.0 and 2.0 networks. In the new blockchain, nodes will work according to the Proof-of-Stake (PoS) algorithm – proof-of-ownership. With it, it is not the amount of computing power that matters, but the number of frozen ETH coins in the Etherium system (the base for staking). The main tasks of nodes will be to verify and validate Ethereum transactions. In the cryptocurrency community, such nodes are called validators.

However, BTC and ETH digital assets have differences in issuing new coins. For example, Bitcoin’s issue is limited to 21 million bitcoins. Ethereum has a revolutionary network. It is this project that is considered to be the first that did not limit the issue of cryptocurrency. There can be any number of ethereum in the system – even 500 million or more.

Another difference between Bitcoin and Ethereum is different algorithms for reducing the number of coins issued. In the Bitcoin cryptocurrency system it is called halving, while in the Etherium network it is called reduction. Both of these processes reduce the number of coins that miners receive as a reward for working on the blockchain. But they are very different:

- Halving. Automatically done once every 4 years without developers. Reduces the reward by 50%. Halving will be done until the amount of remuneration for miners’ work is 0.

- Reduction. Produced by developers at different times when needed. The amount of reward reduction is often between 30% and 45%. But a larger reduction is also possible.

Technology

At the heart of the Efirium blockchain is the ability to quickly create smart contracts. They are a small code in the Solidity programming language (invented specifically for the Ethereum cryptocurrency system). With its help, the user can set the terms of a digital contract. If they are met, then a certain ETH transaction is made automatically.

Smart contracts are based on mathematical operations, and their program code executes them. With their help, Vitalik Buterin has created a new digital economy.

Bitcoin blockchain is only a decentralized payment system. It is convenient to store digital assets and conduct cryptocurrency transactions because Bitcoin has low fees. The Bitcoin blockchain is powered by the BTC coin, which is the unit of payment. There are no other core technologies in the network.

Mining and commissions

To understand whether Efirium or Bitcoin is more promising, you also need to consider the systems in terms of cryptocurrency mining. In 2021, there are few differences, as the mining of both digital assets is carried out using the Proof-of-Work algorithm:

- ETH cryptocurrency is mined more with video cards. The network of this coin allows miners to effectively utilize them to work on the blockchain.

- The digital asset BTC is mined more with ASICs, which are computer hardware that is specifically customized to compute in the cryptocurrency system. In 2021, video cards have a low efficiency for bitcoin mining due to the high complexity of the network. The figure reflects the total amount of computation required to create 1 block.

However, in 2022, after the merger of Etherium versions 1.0 and 2.0, the way of mining will change in the system. It will only be possible to mine ETH cryptocurrency assets in the new blockchain using the PoS algorithm. Nodes will no longer use high computing power to work in the system.

The main income of nodes operating on the chain with the PoS algorithm consists not of rewards for creating blocks, but of commissions paid by network participants for confirming their cryptocurrency transactions.

Bitcoin and Ethereum also differ in the principles of fee formation. The former’s transaction fees are paid in the cryptocurrency BTC. The user automatically sends to miners a certain number of satoshis (there are 100 million of them in 1 bitcoin) for 1 byte of processed transfer data. The total commission is formed depending on the weight of the Bitcoin transaction information and the load on the cryptocurrency network. The latter indicator affects the price of processing 1 B of data in satoshi.

For the transfer of ethereum, the user pays with gas. When he creates an Ethereum transaction, he automatically buys Gas for Gwei (there are 1 billion Gwei in 1 ETH). The price of Gas varies with the load on the blockchain. For a normal transfer of ETH coins between wallets, miners will need to pay up to 21k Gas.

Use as payment for goods and services

Bitcoin and Ethereum projects differ in ideas. Bitcoin was originally created as a payment system. Its main task is to support fast cryptocurrency transfers with low fees. However, in 2021, the bandwidth of the Bitcoin system (4 transactions per second) is not enough for a large number of users. At low network utilization, it takes about 60 minutes to fully process transfers. However, the load on the Bitcoin blockchain is often high, and a Bitcoin transaction can wait up to 3 days for confirmation from the miners.

In 2021, the throughput of the Etherium system is 20 transfers per second. Despite the fact that the commission in this cryptocurrency network is higher than in Bitcoin, many people use the Ethereum blockchain for transactions. Some are willing to pay more for processing speed.

ETH coin blockchain miners confirm etherium transactions in an average of 6 minutes – 10 times faster than Bitcoin.

Scaling

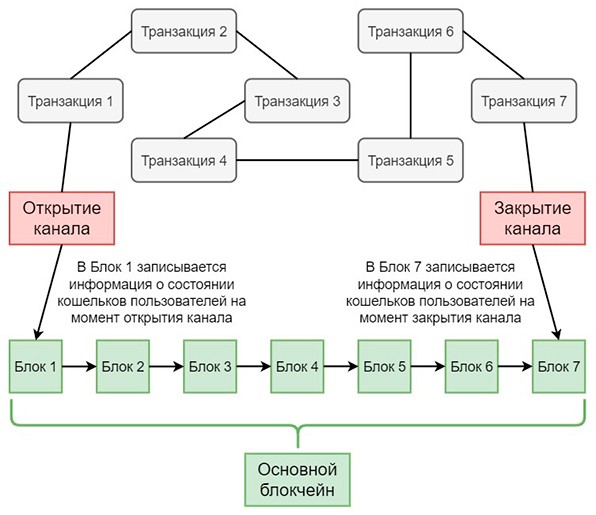

Increasing the number of transactions processed per second is one of the main challenges for both digital systems. To increase this figure in Bitcoin, the team behind the Bitcoin Core cryptocurrency program released the Lightning Network (LN) in 2015. This is a second-level payment protocol (running on top of the main blockchain) that allows fast BTC transactions through a direct channel with low fees. Data on such transactions are not recorded in the public chain.

Any participant of the cryptocurrency network has the right to create a channel through a wallet that supports the Lightning Network function. As long as it is open, it can be used by an unlimited number of people. LN technology allows hundreds of Bitcoin transactions to be quickly conducted within a single channel. But there will only be 2 records in the main blockchain:

- Channel Creation. The main Bitcoin blockchain enters the account information of the second level participants before Bitcoin transactions take place.

- Closing the channel. The last information about the digital assets in the accounts of second-level users after cryptocurrency bitcoin transactions are entered into the main BTC coin blockchain.

To increase the number of ETH transactions per second in the Etherium system, developers came up with a similar solution – Rollup. But still Bitcoin and Ethereum differ in the way of increasing this network metric:

- In Rollup cryptocurrency technology, the second level is called a sidecar. But the term sidechain is more commonly used in the community.

- Rollup channel users’ digital funds are stored in the main chain. Because of this, the main network requires proof of state (data about cryptocurrency assets on the wallets of sidechain participants) from the nodes of the sidechain layer.

- Ethereum transfers within the second layer channel are constantly “rolled up” into a single ETH transaction. It is this transaction that is recorded in the main blockchain. This happens when the system requests proof of state (on average, 1 time per 20 minutes).

Read also

Security

In cryptocurrency networks, there is a concept of 51% attack. It means that by gathering more than 50% of the total computing power in one system, an attacker gains the ability to modify the blockchain at will.

In terms of resistance to the 51% attack, the Bitcoin cryptocurrency network is significantly better than Etherium. As of November 25, 2021, the number of calculations per second in the BTC coin system is 203 thousand times higher than in the blockchain of the digital asset ETH. Because of this, it is more profitable for an attacker to attack Ethereum than Bitcoin.

Impact on the environment

Ilon Musk on May 13, 2021 announced the end of accepting bitcoin cryptocurrency as payment for Tesla cars. He argued his decision with the bad impact of BTC coin mining on the environment.

In 2021, Bitcoin and Ethereum use the Proof-of-Work algorithm, which requires a lot of computing power from nodes. It takes a lot of electricity to run the miners. Fossil fuels are burned, which creates millions of tons of emissions.

However, in 2022, the cryptocurrency community expects the Efirium network to switch to the PoS algorithm. It does not require a lot of processing power from the nodes. This algorithm will reduce the bad environmental impact of mining new ETH coins.

The impact of events on the value of coins

To understand whether Bitcoin or Ethereum is more profitable requires analyzing the impact of news on the market prices of these coins. There is also a correlation between the value of BTC and ETH cryptocurrencies.

News has a strong impact on digital assets. Bitcoin is more susceptible to events as it is the first successful and main cryptocurrency in the virtual money financial market. Also, many analysts often take the BTC digital asset rate and its possible changes into consideration when researching coins and tokens.

Efirium is also highly influenced by news. However, this cryptocurrency does not have an inverse relationship with the price of bitcoin. The value of the ETH coin is declining for its own reasons. Quotes of the digital asset Bitcoin, on the other hand, can remain in the same place or even grow.

By the end of 2021, the dependence of the etherium rate on the market value of Bitcoin was decreasing. This blockchain has become more independent. In the community of digital asset marketers even began to say that etherium can overtake bitcoin in capitalization and become the No. 1 coin.

What is the best cryptocurrency to invest in?

Ethereum and Bitcoin projects work in different directions. It would be wrong to compare them from a technical point of view. However, traders still ask the question: it is better to buy BTC or ETH. To get the answer, it is worth considering these digital projects in terms of the main growth prospects. They are presented in the table below.

| Bitcoin | Etherium |

|---|---|

| Stabilization of the market rate jumps of the BTC cryptocurrency. Because of this, the interest of investors in traditional financial markets to preserve capital in bitcoins is increasing. | Merger of Ethereum 1.0 and 2.0 systems in 2022. This event will change the Ethereum network and significantly increase the number of ETH transactions processed per second in the new blockchain. |

| Bitcoin-ETF trading approval in 2021. Funds for trading BTC futures were created at the end of October. | Ethereum-ETF to appear in 2021. The Chicago Mercantile Exchange has authorized trading in ETH cryptocurrency futures contracts. |

| Increase in the number of institutional bitcoin traders. Investment funds and large companies began investing in the BTC cryptocurrency. | Application of PoS algorithm in Ethereum 2.0 blockchain. In 2021, this consensus mechanism is attracting more and more users of digital assets. |

Which cryptocurrency is better to mine

At the end of 2021, buying computer hardware to mine ETH coins does not make sense. This is due to the imminent transition of the Ethereum blockchain from the Proof-of-Work algorithm to the Proof-of-Stake mechanism. After this event, the purchased equipment will not be needed, because high computing power is not important for PoS.

In 2022, miners will have to sell their equipment and invest in staking. There is another option – switching to mining another cryptocurrency, since video cards can be used to work in many blockchains.

From this point of view, Bitcoin is better suited for mining in 2022. Users of the Bitcoin network can safely buy new equipment, since the PoW algorithm change is not expected.

Summary

Bitcoin and Ethereum are the 2 main coins in the financial cryptocurrency market. The developers of these digital projects were initially guided by different ideas, so it would be wrong to compare their prospects on a technical level.

If we talk about the differences, Efirium is based on smart contract technology. With its help, Vitalik Buterin developed a new generation of virtual economy. Bitcoin, on the other hand, is just a payment system for convenient storage and use of BTC cryptocurrency. It was created in 2009 to solve the main shortcomings of fiat.

In some points, Ethereum is better than Bitcoin. The superiority of Ethereum over Bitcoin will be felt even more after the merger of versions 1.0 and 2.0. But in 2021, Bitcoin remains the top cryptocurrency in the digital asset financial market.

Frequently Asked Questions

❓ How will Ethereum 2.0 solve the network scaling problem?

In 2022, developers will use sharding – dividing the main blockchain into “shards”. They will connect to the main network and transfer information between them if needed. The developers plan to increase the network capacity to 100 thousand ETH transactions per second.

✅ Will Ethereum become the No. 1 cryptocurrency?

A part of Ethereum users really think so. However, Bitcoin also has prerequisites for a big growth in 2022, so it is impossible to confidently say so.

❗ What is Beacon Chain?

It is the name of the central blockchain in the Ethereum 2.0 network to which the shards are connected. This cryptocurrency chain is already operational in 2021.

💡 When did the Beacon Chain network launch?

The new system started operating on December 1, 2020. On this day, the first block of the cryptocurrency chain was created.

🔑 Proof-of-Stake will increase the security of Etherium?

In 2022, thanks to the PoS algorithm, the Ethereum network will become more resistant to the 51% attack. To pull it off, an attacker would have to buy more than 50% of the ETH coins in circulation.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.