Cryptocurrency has become a tool for trading and savings instead of a geek’s pastime. It is not without disadvantages, the main one being volatility. Cryptocurrency is not backed by anything, its value depends only on the users’ faith in the rate increase. Volatility and instability do not allow digital assets to take the place of fiat. Supporters of traditional approaches to investment and trading use familiar tools. Tangible asset-backed coins were created to reduce volatility. Stablecoins in the list of cryptocurrencies take their place. They do not resemble virtual money in the usual sense. Coins are used for different purposes. They attract users who avoid the volatility of cryptocurrencies.

What is stablecoin

The concept of stablecoin consists of two English words. It means “stable coin.” That is, the rate does not depend on standard factors (news background, user confidence, statements of opinion leaders), but is tied to one of the assets: fiat money, other crypto coins or material values (gold, oil, minerals).

How it came into existence

The first virtual currency was created in 2009. It was bitcoin, which was developed by Satoshi Nakamoto (an unknown programmer or group of people). Later, forchette based on it, other coins and gettoni appeared. Since the launch of the first cryptocurrency, people have been arguing about the future of digital assets that can replace fiat money in different cases:

- A means of payment.

- A tool for trading.

- A means of saving or capital accumulation.

Proponents call bitcoin “new gold” and cryptocurrency a complete alternative to fiat. The main argument of opponents of virtual money is volatility. The exchange rate is too dependent on external factors. It is influenced by:

- News background.

- Events in the world.

- Attitudes of states, companies, opinion leaders.

The lack of centralized management excludes manual regulation of the rate, as it happens in fiat money. Cryptocurrency is affected by world economic and political events.

5020 $

bonus per i nuovi utenti!

ByBit offre condizioni comode e sicure per il trading di criptovalute, offre commissioni basse, un alto livello di liquidità e strumenti moderni per l'analisi del mercato. Supporta il trading a pronti e con leva finanziaria e aiuta i trader principianti e professionisti con un'interfaccia intuitiva e tutorial.

Guadagnate un bonus di 100 $

per i nuovi utenti!

Il più grande exchange di criptovalute dove è possibile iniziare in modo rapido e sicuro il proprio viaggio nel mondo delle criptovalute. La piattaforma offre centinaia di asset popolari, commissioni basse e strumenti avanzati per il trading e l'investimento. La facilità di registrazione, l'alta velocità delle transazioni e l'affidabile protezione dei fondi fanno di Binance un'ottima scelta per i trader di qualsiasi livello!

While skeptics doubted virtual money, an ecosystem of exchanges, payment services, decentralized applications, and blockchain platforms emerged. Different ways to reduce the volatility of digital assets were applied.

A stablecoin (stable coin) was developed. It is a symbiosis of virtual and fiat money. Tangible assets, currencies (dollar, euro, yen and others) serve as collateral. There are koins with a link to gold, coins that depend on digital assets.

Why are they needed

The goal of the developers of stablecoins is to reduce the volatility of traditional virtual money. This is achieved by tying the rate of a stable coin to one of the assets with a constant price. When the user wants to keep savings, he chooses secured tokens. Volatile assets are better for trading on the principle of “higher risk – higher profit”.

Fiat currencies since the 70s of the XX century are also not backed by anything. Until 1944 the “gold standard” was used. The rate of each national monetary unit was tied to the precious metal. From 1944 to 1978, the key currency was used – the U.S. dollar, backed by gold. The rate of other monetary units was pegged to the USD. Then all countries abandoned the existing system. Now the currency rate is calculated by a complex formula, it depends on supply and demand. But traditional money is not backed by material values.

Stablecoins use the advantages of gold:

- The exchange rate is stable, tied to the price of a unit of collateral.

- A reliable means of accumulation. No sharp fluctuations in the exchange rate.

Stablecoins have one but significant disadvantage. Unlike bitcoin and other altcoins, there is no decentralization principle.

Stablecoins are managed by the company that issues them. It sets the percentage of security. There is a possibility of manipulation, fraud with assets to support the rate.

Principle of operation

Stablecoins allow all standard operations similar to actions with fiat money. The main functions:

- A means of payment.

- Investment instrument.

- A means of saving or storing assets.

Stablecoin is backed by fiat currency or another crypto asset at a 1:1 ratio. Deviations are allowed, but the rate is maintained as long as the coin exists. Market fluctuations, other factors do not affect the price of the token.

Categories of secured cryptocurrencies:

- Linked to fiat money or tangible assets (oil, gold, silver).

- Backed by other koins.

- Not tied to any asset, the exchange rate is maintained by the issuance of coins. Also called algorithmic.

The value of the koin depends on the currency of the collateral. If the dollar falls, the cryptocurrency tied to it will also become less attractive to investors.

Usage

Stablecoins are used for saving funds. That being said, there are many popular secured coins that help bring the digital world closer to the real world. These assets serve as a universally understood means of price measure.

Large investors can convert savings into virtual money and trade. Stablecoin works in the opposite direction. If a trader has a lot of koins but doesn’t want to withdraw into fiat yet, he or she uses secured assets. They save funds during times of increased market volatility.

The most popular

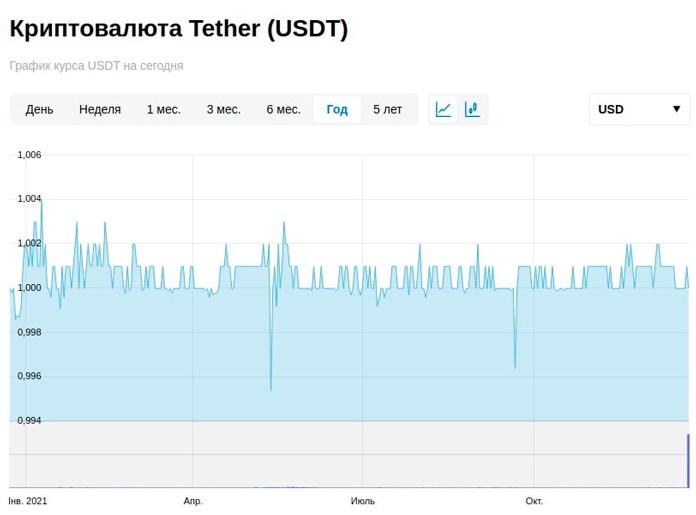

Stablecoins are issued by different companies and organizations. Among secured cryptocurrencies, there are little-known projects and market leaders in terms of capitalizzazione. For example, as of the end of January 2022, Tether (USDT) is ranked 3rd in the CryptoProGuide.com ranking, and USD Coin (USDC) is ranked 6th:

| Cryptocurrency (ticker) | Descrizione |

|---|---|

| True USD (TUSD). | A young project, appeared in 2018. It is backed by the US dollar in the proportion of 1:1 |

| Tether (USDT) | A popular coin, slightly lost its positions. The share of USDT is 65% of all stablecoins. It is backed by the US dollar. Scandalously famous for its lawsuit related to the lack of fiat for 100% backing. |

| USD Coin (USDC). | A stable token from the famous Coinbase and Circle (a fintech startup). It is backed by the U.S. dollar. In terms of capitalization in the top 10 (in January 2022). |

| Gemini USD (GUSD) | Collateralized asset from the exchange of the same name, the US dollar is used as a backing vehicle |

| TerraUSD (UST) | Stable algorithmic koin. The rate of the asset is pegged to the US dollar. At the beginning of 2022, UST was leading among algorithmic options in terms of capitalization. |

| DAI | Decentralized stablecoin, ERC-20 token, backed by Ethereum coins. The development was carried out by the Maker company. Users themselves can create tokens. The rate is controlled by smart contracts, which provide mechanisms for lowering or raising the price to $1. |

| Binance USD (BUSD) | Stablecoin with a peg to the U.S. dollar, created by Binance exchange in cooperation with Paxos, a well-known company in the field of blockchain and digitization of assets. The token has received approval from the New York State Department of Financial Services. The collateral currency is held in U.S. bank accounts. |

There are less popular stable tokens. However, they all serve the same purpose – to create an alternative coin to replace volatile cryptocurrencies.

Varieties

Stablecoins are assets backed by tangible assets, fiat or other coins. Such cryptocurrencies are classified depending on the source of support for the exchange rate. The most numerouscoins with the provision of fiat currency: the US dollar, euro, yen and other money. However, other types of stable crypto coins are also developing.

Fiat-backed

The simplest and most common type of stablecoin. The issuer issues coins usually in a 1:1 ratio to fiat currency. For example, a company has $5 million in assets. For this amount, it issues 5 million coins that can be exchanged for other currencies, sold, or stored.

In simple words, steblecoins backed by fiat money are debt receipts. The owner of the token can present it to the issuer at any time and receive currency in return.

The custodian for fiat collateral is a bank, a depository. Issuing companies hire auditors to check the availability of money, make reports. This is a criterion of reliability for potential users. Recent scandals with Tether, which failed to prove the security of its crypto asset USDT, undermined faith in the reliability of stable coins.

A lot of fiat-backed coins use the US dollar. It is the most popular monetary unit in the world. Many stable coins are linked to cryptocurrency exchanges that initiate the development or issuers (BUSD, GUSD, USDC, USDT and others).

Secured coins are tokenized fiat. The resulting symbiosis has the advantages of two systems: the stability of the exchange rate and the capabilities of the blockchain. Among the popular assets -Tether (USDT), TrueUSD (TUSD) and others.

Backed by cryptocurrency

Backed by other coins. This solves the main problem of fiat-backed tokens – the loss of decentralization. The money is held in banks that are regulated by the financial structures of the country of incorporation.

Cryptocurrency has no single governing body. The main advantage is decentralization. Therefore, steblecoins are issued with coins of popular projects (Bitcoin, Etherium and others).

The problem of high volatility is solved by creating a reserve capital with a multiple of at least 2. This will allow you to keep the rate when the price falls.

To purchase an asset, you need to request the necessary amount and transfer the equivalent into a means of security in the required ratio. Next, the initiator receives a stablecoin into the account. The purchase is carried out through contratti intelligenti.

Advantages of cryptocurrency-backed stablecoins:

- Decentralization, all processes take place on the blockchain.

- No depositary and bank, no risks of influence of government regulators.

- Ease of buying and selling. You can use cryptocurrency exchanges, exchange services.

Disadvantages:

- Volatility of the backing vehicle affects the stablecoin.

- Need a backup reserve in case of a sharp drop in the price of cryptocurrency.

Unsupported

There are stablecoins with no backing. The exchange rate is adjusted through the senorage process. This is a volume control procedure with the help of additional issuance of other supporting coins. If it is necessary to decrease the rate, the developer issues coins, to increase – destroys some of them. That is, a surplus or deficit is created, demand and supply are regulated.

Such stablecoins are also called algorithmic. Smart contracts are used for control. Price stabilization systems work, which are created in advance and included in the protocol.

Algorithmic tokens work based on the blockchain of the cryptocurrency collateral, most often Ethereum. The user transfers coins, which are locked in a smart contract, a stablecoin is created based on it. When the tokens are redeemed, the owner gets their etherium back.

This is a complex format of stablecoins. They are used as part of the DeFi ecosystem.

Advantages of Algorithmic Stablecoins:

- Independence from fiat or digital currencies.

- No collateral reserve is needed, which benefits the issuing company.

The disadvantages of such tokens include:

- Low stability index. The price of the asset depends on the general situation in the market, is subject to the influence of external factors.

- Demand among investors is low, it is necessary to constantly support, conduct an advertising campaign.

Banking

Financial institutions of different levels of ownership at first did not consider cryptocurrency as a threat to their existence. But over time it became clear that blockchain can change many approaches, including in the banking sector. Stablecoins fit perfectly into the philosophy of traditional financial institutions. At the same time, they bring an element of innovation. Standard bureaucratic institutions are slowly embracing the digital world.

While banks are only testing new opportunities, trying to create virtual money. We cannot talk about a separate type of stable coins. These are stablecoins backed by fiat money. For example, JP Morgan has issued a token JPM Coin backed by the US dollar. It is used for international payments, securities settlement. It is a domestic currency for solving current tasks of clients.

In this case, the stablecoin helped the bank to reduce costs and commissions, speed up the procedures for making payments. Blockchain proved to be faster than the traditional SWIFT system, especially in cross-border areas.

JPM Coin is based on its own blockchain. There are solutions from IBM and Stellar. Banks from other countries are also developing their own stablecoins. Not only the US dollar is used for collateral. For example, Sygnum Bank, Coinify (developer) and Digitex Galaxus (retailer) have jointly created the Signum Digital Swiss Franc (DCHF) with a peg to the Swiss franc. The first transaction took place in the summer of 2020.

State-run

Central banks also see digital assets as a threat. They worry about the stability of a financial network based on centralization, a monopoly in the issuance of money with a complex system of exchange rates. Meanwhile, many countries around the world are developing national bank digital currencies (CBDCs):

This virtual money format is remotely similar to fiat-backed stablecoins. Assets are being tested; no nation wants to fall behind in adopting new technologies.

Commodity-backed

Another category of stablecoins is cryptocurrency with support in the form of tangible assets. Gold, silver, oil and other commodities are used. The collateral is stored in one of the verified depositories or banks. The essence of such assets is no different from fiat-backed tokens, only instead of money, other valuables are used.

The user of a commodity-backed token essentially owns the asset, expressed digitally. If desired, tokens can be exchanged for real gold. There are different rules for buying and selling, not always favorable and convenient.

The advantage of such assets is the ability to work with gold, oil and other commodities more easily. Commodity-backed koins are tokenized assets. Some examples with gold backed assets include Tether Gold (XAUT), DGLD, GoldMint, and others.

The best exchanges to buy stablecoins

Almost all cryptocurrency platforms work with secured tokens. You can buy on such exchanges:

- Currency.com.

- CEX.io.

- Binance.

- Coinbase.

- Huobi and others.

A complete list of cryptocurrency exchanges to choose from is prepared by CryptoProGuide.com. It is better to use proven resources with a large turnover, rating and available ways to deposit or withdraw assets.

Perspectives of Stablecoins

The digital world is developing and transforming under the influence of various factors. Stablecoins occupy a special place in the ecosystem of decentralized assets. They serve as a kind of symbiosis between cryptocurrencies and fiat money. They provide fiat input for trading. Allow you to wait out the period of volatility of popular coins and tokens.

Some stablecoins may disappear under the influence of other projects. New developments will appear, including those involving the banking sector, state financial systems of different countries.

There may be a conflict of interest between fiat-backed stablecoins and CBDC, which are essentially similar to each other. At the same time, the latter have support in the form of administrative resources of central banks. CBDCs allow the government to control the financial system and take full advantage of the digital world with high transaction speeds and low fees.

In the fight against cryptocurrency of central banks, algorithmic stablecoins, which are not backed by anything, may come to the fore. Stabilization of the exchange rate is carried out with the help of additional issuance of related coins (for example, Terra for TerraUSD), which is managed by smart contracts.

Advantages and disadvantages

Stablecoins have their pros and cons:

| Advantages | Disadvantages |

|---|---|

| Price stability | Centralization |

| High speed of transactions | Inflation reduces value of collateral |

| Risk insurance | Possibility of government regulation: money is held in banks that operate in the jurisdiction of a particular country |

| Not subject to influence of central banks, despite being linked to fiat currencies | Audits by specialized organizations are obligatory (checking the availability of collateral). |

We can also call low volatility. In this case, the indicator is considered twofold, it looks like an advantage and a disadvantage. It all depends on the goals pursued by the investor. To save money, low volatility is an advantage that everyone uses. For making money on trading – it is a disadvantage. There are no large fluctuations in the exchange rate, you can not count on profits.

Stablecoin increases the popularity of the cryptocurrency market. This type of assets attracts new users who do not trust digital assets of the classic kind too much.

There are scandals associated with some secured coins. They undermine the trust of users and form a negative image of stablecoins.

Domande frequenti

💱 How can I exchange cryptocurrency for gold?

Commodity-backed stablecoins are tokenized tangible assets. If gold is used as collateral, the issuing company must exchange the coins for the precious metal according to predetermined rules.

💵 How do I know if a company has a collateral currency?

To increase credibility, the issuer engages an auditor to verify. The results are put on display.

❗ What is a “cryptoruble”?

The MCR token exists under this name. The cryptocurrency is created on the Ethereum blockchain in the decentralized system MonolithosDAO, pegged to the Russian ruble in a 1:1 ratio. It has no relation to the national money of the Russian Federation.

😱 What happens if the cryptocurrency collateral in stablecoin collapses?

Usually several times more funds are reserved. The fall in the exchange rate is governed by the reserve of the collateral token. If there is a catastrophic loss of value, the stablecoin will cease to exist.

❔ Does the stablecoin cryptocurrency have centralized management?

Assets that are issued backed by fiat money or tangible assets are regulated by the issuing company. From this perspective, it is a cryptocurrency with centralized governance.

C'è un errore nel testo? Evidenziatelo con il mouse e premete Ctrl + Entrare

Autore: Saifedean Ammous, esperto di economia delle criptovalute.