The hype for digital coins has led to the formation of organizations that profit from transactions with the capital of individuals. As of fall 2021, there are over 800 investment firms. Experts believe that for newcomers to the industry who don’t want to learn, the opportunity to invest in bitcoin in a cryptocurrency fund is a chance to multiply income. According to analysts, the growth potential of the sector is great.

What is a cryptocurrency fund

These are analyst firms that manage funds invested in them by individuals. The aim is to earn earnings from the commission on the profits of depositors.

Employees are interested in their clients’ earnings because they are reflected in the firm’s results.

Principle of operation

Digital currency investment firms can be compared to exchange-traded funds that are tied to a specific industry or market sector. Only they work with crypto assets. Predominantly, organizations focus on Bitcoin and other liquid digital coins with growth potential.

Profits in the virtual sector depend on changes in quotes. Investors are often frightened by the volatility and instability of the exchange rate, as well as its dependence on the main cryptocurrency BTC. Large funds usually have a stock of cash to be able to manage positions. This is how the impact on asset price growth happens. Cryptocurrency investment funds then close the positions and users get a share of the profits.

5020 $

bonus per i nuovi utenti!

ByBit offre condizioni comode e sicure per il trading di criptovalute, offre commissioni basse, un alto livello di liquidità e strumenti moderni per l'analisi del mercato. Supporta il trading a pronti e con leva finanziaria e aiuta i trader principianti e professionisti con un'interfaccia intuitiva e tutorial.

Guadagnate un bonus di 100 $

per i nuovi utenti!

Il più grande exchange di criptovalute dove è possibile iniziare in modo rapido e sicuro il proprio viaggio nel mondo delle criptovalute. La piattaforma offre centinaia di asset popolari, commissioni basse e strumenti avanzati per il trading e l'investimento. La facilità di registrazione, l'alta velocità delle transazioni e l'affidabile protezione dei fondi fanno di Binance un'ottima scelta per i trader di qualsiasi livello!

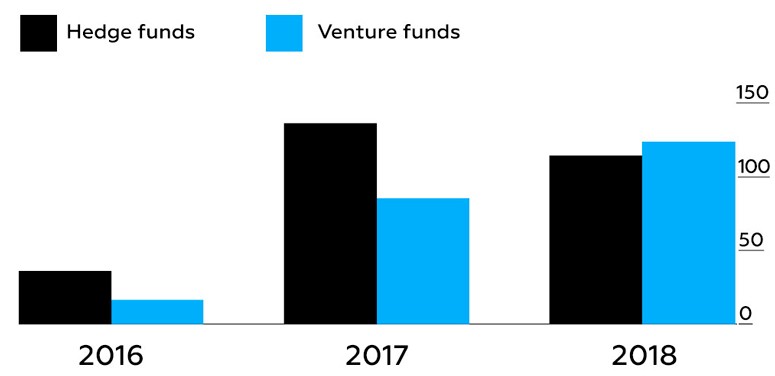

There are 3 types of funds that differ in the principles of operation. The characteristics are listed in the table:

| Venture capital | Invest in projects that are just starting to develop. This is a long term investment, but it can potentially bring users returns of hundreds and even thousands of percent. |

| Hedge Funds | Invest in startups with potential growth prospects. Pay attention to the current status of the project and the promises of the developers. Investments are designed for a short term (1-2 years). |

| Mutual funds | Provide users with the opportunity to buy a share of a company. |

Over 95% of portfolios include bitcoin and 67% include etherium (as of October 2021).

Any investment in cryptocurrencies carries risks.

Legal framework for activity

Most jurisdictions do not define the status of cryptocurrencies. Some countries are loyal to digital money – they allow trading, estrazione mineraria, purchase of goods. Others act aggressively. For example, China, which in September 2021 completely banned all operations with cryptocurrency on its territory.

The legal status of companies is not officially recognized. Until regulating legislation appears, there is a high risk of investing in a fraudulent organization. Licensing of crypto funds is being considered by regulators.

Development of the fund market and its future

The audit firm PWC in its study estimated the growth of the direction. Between 2018 and 2019, the total value of assets managed by firms has doubled. The return on investment is approximately 30%. The figure is much higher than that of traditional investment organizations. Such results are due to the volatility of digital assets.

The cryptocurrency organization industry is a good promising field. With the advent of regulation, investment companies will definitely develop.

Varieties of funds

Before choosing an investment object, the user needs to understand their types. They differ in terms of strategies. Such approaches affect the potential income and risks. In total, 5 types are distinguished:

- Fundamental.

- Quantum.

- Opportunistic.

- Venture.

- Smart beta.

After reading the features of the companies representing cryptocurrency in the stock market, the user understands which one is better to consider for investment.

Fundamental

The task of experts is to isolate the asset from the general “noise”, based on its value. The approach relies on methods of fundamental analysis, using various parameters (from the assessment of prospects to the work of the development team). There are 2 strategies:

- Long. The firm acquires assets that are undervalued and holds them until the value rises to the projected value.

- Shorting and longing. In addition to buying undervalued coins, the fund takes short positions on assets that are likely to lose value.

Quantum

Its job is to identify potentially profitable assets based on complex mathematical analysis. There are three operating principles:

- Directional strategy. Profits are linked to investments when the market moves in a specific direction. Experts use data that is not available to traders. An example is massive movements of BTC between users’ wallets and exchanges. This can indicate that the price will soon fall. Machine algorithms are used to make calculations.

- Arbitrage strategy. Profits are made from selling the same crypto asset on different platforms. For example, on a regulated platform, the price of the asset is higher than on an exchange that is not as developed.

- Volatility trading. Traditional earnings due to the mechanism of options. Such strategies allow you to profit from the transaction regardless of the dynamics of quotes. The asset brings income both when the rate falls and when it grows.

Opportunistic

Companies use new tools in the cryptocurrency industry. Examples of such mechanisms:

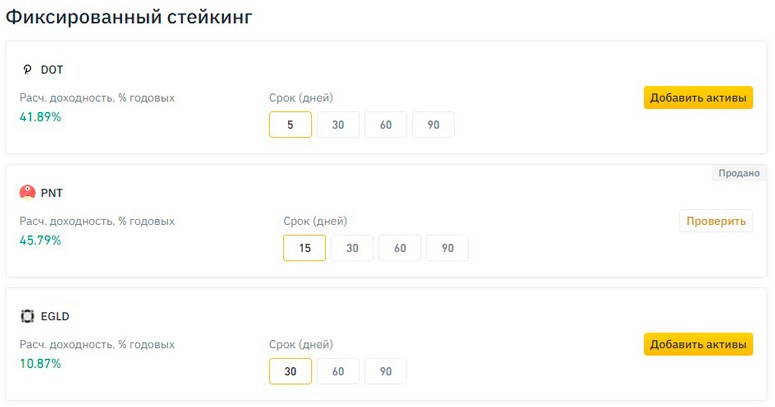

- Staking, mining. The fund can make bets, independently mine coins and receive income in the digital currency of the network. Polkadot, EOS, Cosmos projects have this possibility. Quotes on assets periodically increase sharply.

- Prestito. Crypto-loans are available on special platforms that allow you to lend assets. Lending is done at high rates (up to 8% per annum). Also, if you borrow crypto assets, you can provide a larger volume for trading.

Venture Capitalists

These companies are similar to traditional investment organizations. The firms invest in popular instruments:

- Trading platforms.

- Exchange services.

- Payment systems.

The main object of investment is shares of companies, not crypto-assets themselves.

Among venture capital firms, a hold strategy is popular. Then the digital asset is acquired for a long term in the hope of growth.

Smart beta

The company’s task is to invest in indices (composite indices) that correlate with the crypto market. Such firms do not engage in trading. The method includes 2 types of indices:

- Active. To generate income, the ratio of coins is constantly redistributed.

- Passive. The weight of assets in the portfolio is centered on a certain share and does not change.

Best Cryptocurrency Funds

Most of the companies managing billions of dollars are venture capital firms. Quant organizations perform better and have higher returns. That said, those that work on an arbitrage strategy have $10 million or more at their disposal. Notable crypto funds include:

- Andreessen Horowitz. A venture capital firm that works with investments from individuals.

- Bitcoin Investments Trust. A private company that has been investing in bitcoin since the dawn of digital currencies.

- Flint Capital. A venture capital organization that funds progressive technology projects.

- Blockchain Capital. An American company that invests in well-known blockchain projects.

- Satoshi Fund. An organization that allows beginners to invest in digital coins.

How to choose

To find a good company that is safe to entrust funds to, you need to get maximum information about it:

- The reputation of the organization. You can find comments from other users on websites. If there are no reviews – this is a bad sign.

- Historical profitability. Analyze the results of work for previous periods.

- The terms of the contract, the cost of services, the size of commissions. Before investing in the fund, it is necessary to understand exactly what scheme the organization works under. The user needs to know all the conditions completely.

- Location and legality. It is important to understand in which jurisdiction the firm is registered, and study the laws on digital assets that are in force in the country.

- The prominence of the experts and founders. Reputation of analysts is an important issue when choosing a company. There are few renowned experts in the digital currencies industry. However, if the names of analysts are associated with negative events – it is better to refrain from investing.

These are the main parameters by which investment organizations can be evaluated. Users need to approach the choice responsibly.

Investment strategies

Understand in advance how cryptocurrency will behave in the future – it is impossible. Simultaneously, one coin can grow, another – fall. Therefore, investors are advised to diversify their portfolio. This popular strategy allows you to amortize market volatility. There is an opinion that it is better to make a portfolio like this:

- Bitcoin and etherium – 40%.

- Stablecoins – 30%.

- NFT – 15%.

- Altcoins – 15%.

Rules to follow when choosing assets:

- The portfolio is compiled based on the risk level ratio. Instruments should be balanced.

- Reallocate coins based on market volatility.

- Follow the outlined strategy and do not make decisions without analyzing.

- Invest funds in the amount that is not terrible to lose if the profitability goes down.

- Analyze the market and projects independently. Be critical to the opinion of other users and experts.

Domande frequenti

🏛 Which organization should I choose for investment?

Companies should meet the user’s strategy.

❓ Is there an SEC-approved bitcoin ETF?

As of Fall 2021, several entities are being considered by the regulator. There are 2 ETFs freely traded on the market – Purpose Bitcoin and Evolve Bitcoin.

💸 Which cryptocurrency to invest in?

It is better to create a balanced diversified portfolio of different assets.

📊 What risks should be considered?

An important factor is the volatility of the digital coin market.

⛔ Do investment companies guarantee returns?

The performance can be anything. Organizations do not give any guarantees.

C'è un errore nel testo? Evidenziatelo con il mouse e premete Ctrl + Entrare.

Autore: Saifedean Ammous, esperto di economia delle criptovalute.