The Central Bank has been working on the creation of a new means of payment since 2020. In August 2023, the law on the digital ruble came into force. Testing of operations on real settlements has already been launched, but it will take another 5-10 years before mass implementation. Citizens will be able to pay for purchases, receive benefits and salaries in new money. In the article we will tell about the pros and cons of the digital ruble for the population. Spoiler – each coin can be traced, so security will increase. However, it will be easier for the Central Bank to control the income of citizens.

What is a digital ruble

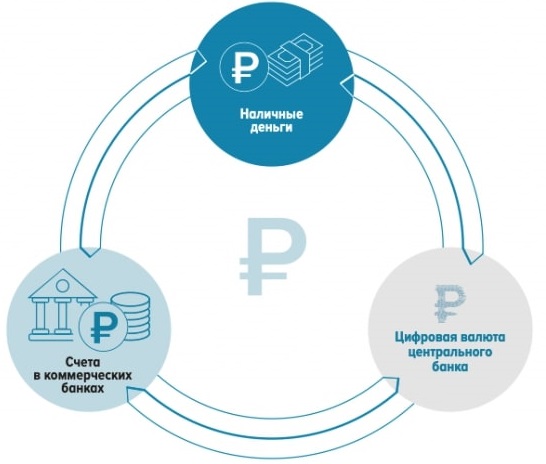

The digital ruble is an alternative means of payment along with non-cash and cash banknotes. It exists from August 1, 2023. The Central Bank says that it will not force the population to use the digital ruble. Citizens can independently choose a convenient way of settlements.

The regulator’s goal is to provide Russians with a safe and cheap means for transfers and payment for purchases. It is expected that there will be a high demand for CBDC. The Central Bank relies on statistics: since 2017, the share of cash in settlements has decreased from 45% to 25%, while the share of non-cash has increased from 42% to 75%. Basically, the circulation of money is the responsibility of commercial institutions, and the influence of the Central Bank is falling. It is planned that the situation will change with the introduction of the new form of the ruble. The Russian CBDC has such peculiarities:

- Transfers for individuals are free. Companies pay a small commission (up to 1%).

- It is possible to pay for purchases. To do this, it is necessary to scan a QR code with a mobile application.

- To use it, you need a smartphone with internet. Later, a service for offline payments will be connected.

- No interest is charged for storage. When paying in a new currency, there will be no cashback. To get access to the platform, you need to be a client of a partner bank. The Central Bank is responsible for the safety of funds. The revocation of the license of a commercial organization will not affect the balance.

- You can create only one wallet. A lost password can be easily recovered.

Why use it

Cryptocurrencies have been gaining popularity since 2017. Institutional investors are entering the market. In 2023, the daily volume of cryptocurrency transactions in the Russian Federation is estimated at 10 billion rubles.

The overflow of monetary volume into private unregulated assets creates risks for the state’s financial system. The Bank of Russia cannot influence the issuance and circulation of digital coins, and thus control inflation. This weakens the exchange rate of the national unit. Therefore, citizens are offered an alternative under the control of the Central Bank.

CBDC will expand the possibilities of money volume management for the regulator. According to the assurances of the Central Bank, CBDC will be useful to the population and businesses. Citizens will get:

5020 $

bonus per i nuovi utenti!

ByBit offre condizioni comode e sicure per il trading di criptovalute, offre commissioni basse, un alto livello di liquidità e strumenti moderni per l'analisi del mercato. Supporta il trading a pronti e con leva finanziaria e aiuta i trader principianti e professionisti con un'interfaccia intuitiva e tutorial.

Guadagnate un bonus di 100 $

per i nuovi utenti!

Il più grande exchange di criptovalute dove è possibile iniziare in modo rapido e sicuro il proprio viaggio nel mondo delle criptovalute. La piattaforma offre centinaia di asset popolari, commissioni basse e strumenti avanzati per il trading e l'investimento. La facilità di registrazione, l'alta velocità delle transazioni e l'affidabile protezione dei fondi fanno di Binance un'ottima scelta per i trader di qualsiasi livello!

- Instant transfers to anywhere. Bank transactions take up to 10 business days, and sometimes a payment can get “lost”. With digital currency this is excluded, money is transferred instantly. In case of an error, each coin can be traced.

- Discounts when paying for goods. With traditional payment systems, retailers charge commissions of up to 15%. With the digital ruble, the fees will be reduced to 0.5-1%. Therefore, sellers will be able to offer a discount.

- Secure transactions. Businesses will be able to use smart contracts. Buyers’ money will be blocked in escrow accounts until conditions are met. If the parties break the agreements, the funds are unfrozen.

- A single account that is independent of commercial organizations. Funds are safe as long as the Central Bank is functioning.

When will it be introduced in Russia

In August 2023, a federal law came into force, which creates a legal field for the introduction of a third payment form. Focus group testing of the advantages and disadvantages of digital currency has been underway since April. Since August, participants have been able to conduct real-money transactions. However, mass implementation will take at least 5 years. The project needs to be finalized and tested. One successful hacker attack on the Central Bank’s server could cause significant damage to the state’s financial system.

How it will work

According to preliminary calculations, the use of the digital rouble to pay allowances and salaries to state employees will save billions of rubles a year. Citizens will be able to choose the method of payment. However, the Central Bank believes that the population will appreciate the convenience of the new money. Calculations in CBDC practically do not differ from the usual payments in a mobile bank. The algorithm is as follows:

- Create an account in the partner’s online bank.

- Transfer banknotes to a digital wallet. The conversion rate is 1 to 1.

- Send digital rubles to another user or pay for the purchase. In the second case, you need to scan the QR code on the store’s website.

Where and how to buy

Digital currency will not be traded on official platforms (Moscow Exchange and SPB Exchange). It is possible to replenish the e-wallet only from the bank account of organizations connected to the program.

In August 2023, the platform can be accessed via mobile applications of 15 banks (Tinkoff, SberBank, VTB and others). The number of partners is expected to increase soon.

Pros of digital currency

The Central Bank claims that the population will not feel the changes. Operations are maximally simplified, transfers do not differ from sending non-cash money. Users who do not want to engage the digital currency or do not have smartphones, can pay as before.

The Central Bank expects high demand for CBDC among the working population due to the absence of commissions, security of storage and convenience of payment. The table summarizes the main advantages of the digital rouble for citizens and entrepreneurs.

| Population | Business |

|---|---|

| Security of payments. | Additional way of settlements with counterparties. |

| Possibility of offline settlements. | Reduction of costs for bank services in settlements. |

| The Central Bank is responsible for the safety of money. Liquidation of banks will not affect the wallet balance. | Expansion of the payment acceptance system. |

| Tokenization. Each ruble has a number, you can trace its history. | You can offer discounts. This will increase the turnover. |

| Login to the account via mobile banking. | The security of transactions is ensured by smart contracts. |

| Payment for purchases by QR code. There are no commissions for transactions. You can buy goods at a discount. |

Minuses of the digital ruble

A number of experts are cautious about the integration of a new means of payment. In the traditional system, it is difficult to control money flows. Citizens’ accounts receive funds from different sources. It is impossible to determine which units of currency were spent on purchases. Digital money is numbered, so it is possible to trace each token.

According to analysts, this will hit the least protected citizens who receive “gray” wages and state benefits. There are also other disadvantages of the digital ruble for individuals. Experts fear that the government may only allow targeted spending. Then citizens will not be able to use the money for other needs. The centralized storage of CBDC also inspires fears. A successful attack on the CBDC server could cause major damage.

Development of digital money in Russia

In 2020, the Central Bank of the Russian Federation published a report on the prospects of CBDC integration. After that, the development of the technological base began. At the end of 2021, the regulator presented a prototype of a platform for processing transactions. The project was created by the best Russian programmers. Open source software and the latest cybersecurity technologies were used.

In 2022, VTB, PSB and then other commercial institutions joined the program. Leading Russian banks worked on mobile app compatibility with the CBDC platform.

In April 2023, a focus group of clients of partner organizations was set up to test and evaluate the pros and cons of digital money. Participants practiced wallet top-up transactions, transfers to regular users and companies.

The Digital Ruble Law opened the door for launching the second phase of real money testing. 30 retail outlets will be connected to the project to test the work of the QR code payment service.

Differences of the digital ruble from cryptocurrency and cash

From the technical point of view CBDC does not differ from digital coins. It is based on blockchain technology – transactions are recorded in chains of blocks that cannot be rewritten or forged. The decision to change the Bitcoin code is made by the community in a vote, while CBDC can modernize the Central Bank alone. The Bank of Russia has been given this authority:

- Additional issuance.

- Determining fees on the network.

- Blocking coins in the wallet.

Blockchain is an open system. Any user can view transactions: it is enough to enter the wallet address or transaction number. Only the account holder and the CBDC have access to the history of transactions with CBDC. The information is protected by the law on banking secrecy. To pay for purchases you will need a modern smartphone and internet access.

After preliminary testing is completed, development of the service for offline payments will begin. The option is an analog of cash. Users will be able to withdraw funds from the wallet for spending in places where there is no internet.

Is it possible to steal electronic money

The software for the digitalrouble platform was created by employees of the Central Bank. Programmers used Russian technologies and open source software, so the sanctions did not affect the development of the service. The specialists prioritized security. The Central Bank assures – the risk of an attack on the server is low due to the cost of the event and small chances of success.

However, the user can transfer money to fraudsters or pass the password. In this case, law enforcement agencies will easily calculate the attackers, since each ruble is numbered.

Domande frequenti

📢 Why is no interest charged for CBDC storage?

This is a function of commercial financial institutions. The Central Bank has no plans to change the traditional banking system, so the digital rouble was not added as an investment option. It can only be used for transfers.

⚡ Who can create a wallet for a digital rouble?

A customer of any partner bank is eligible to register an account on the CB platform. Income and credit history do not matter. The main condition is Russian citizenship.

💳 Is it possible to withdraw cash from an e-wallet?

There is no direct function. First you need to send money to a card or bank account. Then you can withdraw funds at an ATM.

🔔 Which bank to contact in case of problems?

Financial organizations are not responsible for the work of the platform. You need to write to the chat or call the Central Bank’s hotline.

📌 Can virtual RUB be transferred abroad?

So far, only settlements between Russian citizens are planned. Cross-border transactions are possible if partners use a compatible platform.

C'è un errore nel testo? Evidenziatelo con il mouse e premete Ctrl + Entrare

Autore: Saifedean Ammous, esperto di economia delle criptovalute.