The main difference between cryptocurrency and fiat is its complete independence. It is beyond the control of the government, and the transaction does not need intermediaries in the form of banks. The number of users in the network is constantly growing. This leads to an increase in the popularity of decentralized financial transactions. The number of token and coin holders is growing. Explain what bitcoin is for dummies in simple words, it is necessary to help beginners get used to the cryptocurrency market. Without this knowledge, beginners risk losing money.

The principle of Bitcoin for Dummies

The first cryptocurrency is based on blockchain technology. This is a decentralized public open registry, which stores information about all the assets of the network and their changes. Data protection is provided by means of cryptography and distribution of copies of the blockchain among participants. Private keys are used to confirm the sending of funds between wallets. This is proof that the transaction is approved by the owner.

More about BTC mining

The processing power of computers connected to the network (nodes) is used to process transactions and create new blocks. This is called cryptocurrency mining (mining).

Participants are rewarded for solving cryptographic problems. Computers are engaged in the enumeration of millions of combinations in the form of determining a special value(hash). Thanks to this, transactions are verified.

In the Bitcoin algorithm, there is an increase in the complexity of calculations depending on the intensity of mining. The higher it is, the more difficult it becomes to mine blocks. At the beginning of the emergence of cryptocurrencies, information about mining was available only to enthusiasts who understood digital technologies. Then many communities appeared, where everything about bitcoin was told in simple language for beginners. Then the power of the network grew, and the chances of miners to get rewards decreased a lot. Then communities were invented to combine efforts in this direction, which were called pools. Users connect their resources into a common network. The digital money received by the pool is divided in proportion to the power of each participant’s equipment.

Mining is carried out on:

5020 $

bonus per i nuovi utenti!

ByBit offre condizioni comode e sicure per il trading di criptovalute, offre commissioni basse, un alto livello di liquidità e strumenti moderni per l'analisi del mercato. Supporta il trading a pronti e con leva finanziaria e aiuta i trader principianti e professionisti con un'interfaccia intuitiva e tutorial.

Guadagnate un bonus di 100 $

per i nuovi utenti!

Il più grande exchange di criptovalute dove è possibile iniziare in modo rapido e sicuro il proprio viaggio nel mondo delle criptovalute. La piattaforma offre centinaia di asset popolari, commissioni basse e strumenti avanzati per il trading e l'investimento. La facilità di registrazione, l'alta velocità delle transazioni e l'affidabile protezione dei fondi fanno di Binance un'ottima scelta per i trader di qualsiasi livello!

- Video cards.

- Processors.

- Asic devices (special chips designed to solve cryptographic tasks).

Another difference in the Bitcoin network is the reduction of the reward for mining. This is called “halving” (halving). Reducing the payout for a mined block by 50% happens regularly, every 4 years.

Benefits of Bitcoin transactions

Bitcoin is based on blockchain technology. It is a distributed data registry with information about financial transfers. Blockchain technology has certain advantages.

Irreversibility

Once a transaction is created, when a block of new information is generated, the transfer data cannot be canceled or destroyed. They are included in the ledger chain and a copy is sent to the network nodes. The blockchain is an open ledger where any movement of assets can be tracked.

Anonymity

Registering a bitcoin wallet does not require confirmation of identity. All transactions take place with a high level of confidentiality. But Bitcoin cannot be considered a completely anonymous network. Recently, many online services have switched to a customer verification system (KYC). This is due to emerging laws on the regulation of the cryptocurrency market. By identifying the owner of a wallet, it is possible to trace all transactions sent from it through blockchain browser sites.

Security

Cryptographic tools for recording information in blocks provide high security and availability of data. Each new segment of the chain contains a part of the previous one. This continuity makes it impossible to change or delete information.

However, with control of 51% of the network’s capacity, it becomes possible to make any entries in the chain. If attackers start controlling the majority of nodes, all coins will be directed to hackers’ wallets. In large projects like bitcoin, such an attack is almost impossible. To do so, huge computing power must be created or captured. Small or just emerging crypto projects are much more susceptible to hacking.

Freedom

Data transfer in a blockchain network takes place without the involvement of a central server. This allows any user to connect. Communication between wallets is also decentralized based on peer to peer (P2P) technology. Independence from states or regulatory bodies makes free movement of cryptocurrency possible.

Bitcoin uses

Digital money is used in the same way as traditional fiat money. They can be used to invest, buy goods, make transfers and protect capital against inflation.

Choosing a wallet for storage

Many applications and devices for working with digital money have appeared. All wallets can be divided into 5 main types.

| Type | Advantages | Disadvantages |

|---|---|---|

| Online | No need to download an installation file. | Vulnerability of the servers where customer information resides. |

| Mobile applications | Always at your fingertips. | Risk of data interception over Wi-Fi. |

| Paper bitcoin wallets | Resistance to hacker attacks. Storing information without access to the network. | Probability of destruction or loss. You have to manually enter a key or scan a QR code to transfer coins. |

| Bitcoin-client for PC | Funds are stored under the full control of the owner. | It is necessary to download an installation file. Some desktop clients store the entire history of transactions in the blockchain. In this case, the file volume can exceed 100 GB. |

| USB devices | Security against hacking is provided by key encryption. | High price. |

Creating a wallet

There are many types of cryptocurrency storage. It can be difficult for beginners to choose the optimal one. For beginners, online wallets are recommended. Including the storage of assets on the deposit of crypto exchanges is suitable.

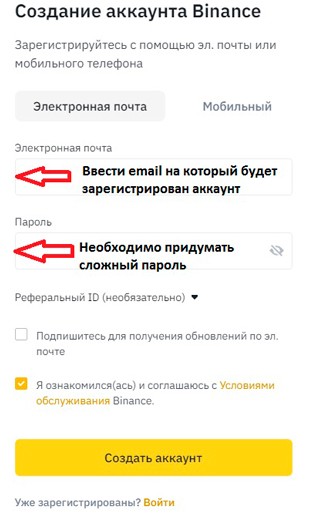

Below is a step-by-step instruction for creating a bitcoin wallet on the Binance website. This platform is attractive with a good reputation. To open an account and deposit cryptocurrency, you need to perform such actions:

- Click the “Registration” button on the main page of the site.

- Write your email and come up with a password.

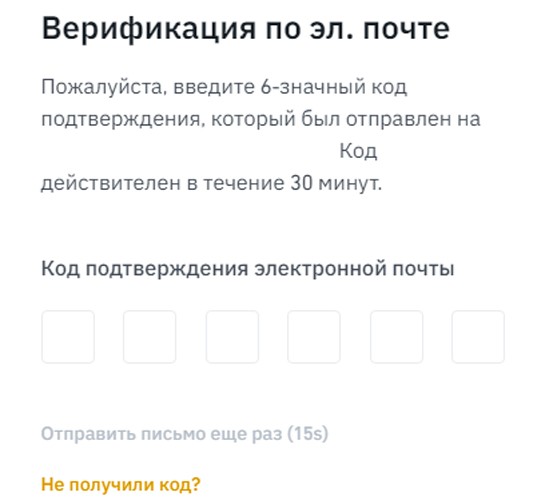

- Enter the code from an e-mail or a message in your cell phone.

Registration through a browser is the easiest way to start a digital wallet. But it should be remembered that such platforms are vulnerable to attacks by hackers. In this case, users will lose money.

Replenishment and withdrawal of funds

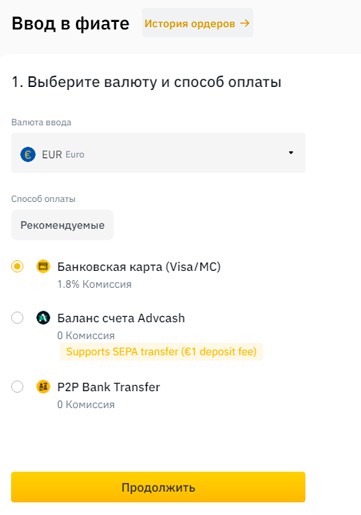

The easiest way to purchase coins is to use the services of the exchange. From the proposed payment methods on the platform choose the one that is convenient for the client. Important criteria: minimum commissions, speed of execution.

Exchange of fiat money for Bitcoin

Cryptocurrency is becoming popular due to the increase in the number of sites where you can use it to buy goods. There are 3 main ways to get digital assets:

- Exchange services.

- Crypto exchanges.

- Private intermediaries.

Exchanger

Instruction on Bitcoin from scratch cryptocurrency exchange using the example of the service (Telegram platform) Chatex:

- Download the Telegram application (messenger on which the platform runs) via Google Play or App Store and create an account in it.

- Go to the chatbot.

- Make up a login.

- Create a new ad in the “Exchange” section. Select the “buy/sell” type.

- Specify the method of payment in fiat money.

- Select the rate – the transaction will take place at this rate. Specify the source of quotes (exchange, which will give the estimated current price).

- Specify the terms of fulfillment of obligations to avoid disputes.

- Confirm the order by pressing the “Create” button.

Exchange

On cryptoplatforms, many payment methods are available when withdrawing or buying digital currency. It is convenient to engage in trading on such sites. In addition to the usual trading of cryptoassets, on the exchange you can:

- Buy tokens and coins with leverage (borrowed money).

- Invest in staking, lending and other investment instruments.

- Earn from affiliate (referral) programs.

Real meeting

It is difficult to find a reliable private intermediary online. For a safe transaction, it is better to meet the seller in person. There are special sites and forums where you can agree on this. Sending coins is done at the time of transferring cash to the seller.

Transferring money to another address

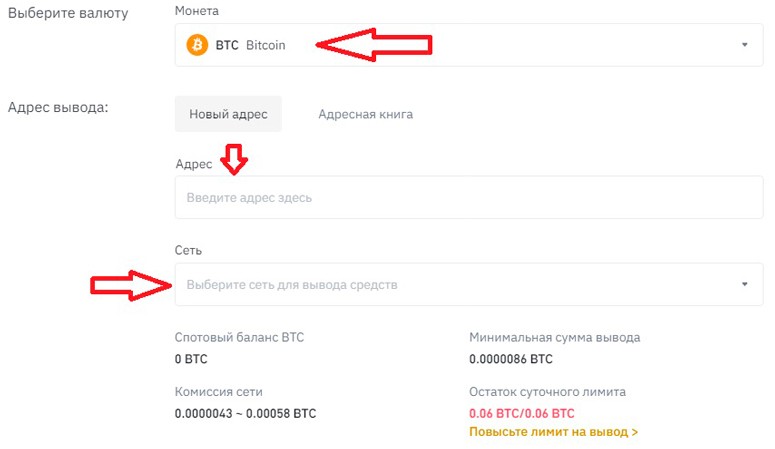

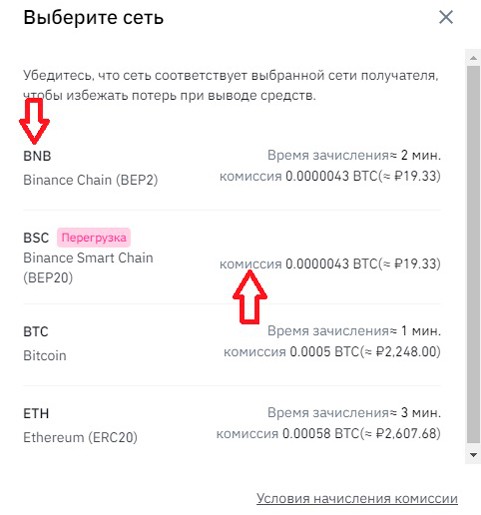

Transactions with a large commission have a high priority and are the first to be processed by the mining nodes. In the instructions, where to start learning bitcoin, usually in the first place put the mastering of simple operations with a cryptocurrency wallet. You need to:

- Select a transaction currency.

- Fill in the address and select the recipient network.

- Enter the amount including the commission fee.

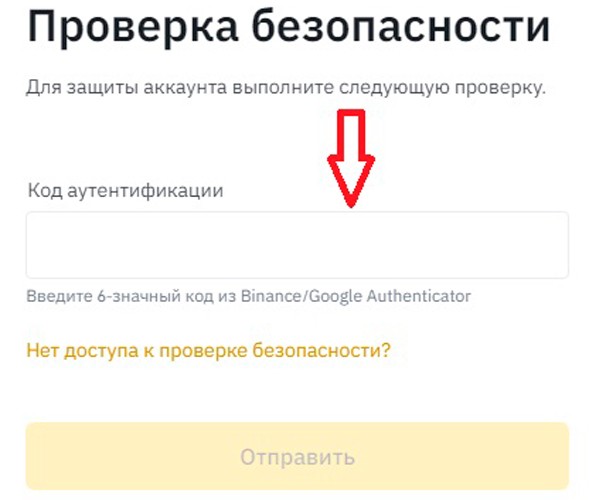

- Confirm the payment using two-factor authentication.

How to sell bitcoins

If the user decides to exchange cryptocurrency for fiat money, you can choose the following methods:

- Sell on the exchange and withdraw to a payment card.

- Through an online exchanger.

- Convert to cash when meeting with an intermediary.

Cryptocurrency trading

Digital assets are becoming an increasingly attractive medium among traders. The market is very volatile and alternates between sharp periods of rise and fall.

There are several strategies to capitalize on it. Short-term selling and buying (speculation) requires a deep understanding of the market and skills in working with assets.

In this case, it is most convenient to store capital on trading platforms to save on commissions when moving money. In addition, exchanges offer leverage for transactions.

Margin trading is a way of making transactions with cryptocurrency using borrowed funds. This allows you to buy assets not only with your personal money, but also with funds provided by the platform. This type of trading increases the results of trading. You will be able to get more profit from successful trades, but the risks will also increase.

Long-term investments – investing in cryptocurrency and keeping it for a long period of time in anticipation of growth in the value of the asset.

Bitcoin network transaction fees

Thanks to the interest for transfers, the decentralized system is maintained and the miners who ensure its functioning are encouraged. Many wallets now allow you to charge a payment fee. The size of the commission does not depend on the amount of the transaction. When the network is heavily loaded, transfers with a high fee will be processed first. Due to the growth of the exchange rate against the dollar, it becomes unprofitable to send small amounts. The fee may be higher than the transfer itself. You can find out its actual size using online calculators (Bitcoinfees).

Legal side of the issue

In Russia, Federal Law No. 259-F3 “On Digital Financial Assets, Digital Currency” has been in effect since January 1, 2021. The maximum amount of cryptocurrency purchase is set at the level of 600 thousand rubles per year. The sale is subject to personal income tax (13%). You can store and send bitcoins, but you cannot accept payment for goods and services in them.

In the Republic of Belarus, Decree No. 8 has been in effect since 2017, legalizing the circulation of digital coins in the country. Trading and investment operations with cryptocurrency are allowed.

The Parliament of Ukraine in 2021 adopted the draft law No. 3637 “On virtual assets”. The President vetoed this decision.

Thus, cryptocurrency is not legalized in all countries, but the process of regulating digital money has been initiated by many states.

Security Memo

The issue of protection against cryptocurrency theft is becoming more and more urgent with the growing popularity and increasing value of digital assets. The first rule is not to keep your savings in one place. Having gained access to the wallet, attackers will withdraw all the funds. It is necessary to study articles about the functioning of digital money to better understand what information is susceptible to theft.

Protect your PC and phone

There is a lot of important data stored on the hard disk. It is extremely undesirable that the keys to access the wallet fall into the wrong hands. Therefore, protecting information on PC and phone is an important security aspect for any user.

To reduce the risk of device hacking, these recommendations will help.

| Computer | Use licensed programs. Malicious code is often embedded in hacked versions. |

| Install an antivirus and configure a firewall. | |

| Automatically update the system. The development team releases updates that protect against hacking. | |

| Make regular key backups. | |

| Phone | Prohibit automatic connection to open Wi-Fi networks. |

| Use the data encryption feature. This will protect you in case your phone is stolen or lost. |

Scammers’ techniques

Offering to invest in cryptocurrency by transferring money to an unknown wallet or company account is a popular scheme to deceive gullible people. This can seriously ruin the acquaintance with bitcoin for a beginner.

However, even experienced users fall into the networks of attackers:

- Phishing sites. Copies of real projects, where data (keys) are immediately stolen. Or malware is downloaded to the victim’s computer.

- Fake applications. Look almost like the real thing with minor changes. May contain viruses.

- Crypto pyramid schemes. Promise high returns without risk. The first investors manage to get their money back and even earn money. All subsequent investors lose capital.

Long-term prospects of bitcoin

Bitcoin, the largest cryptocurrency by market value, reached a price peak of $66 thousand in October 2021. This happened after transactions with the first Bitcoin-ETF (exchange traded fund) began in the United States. Digital currencies offer efficient solutions for financial systems. Prospects for investing on a legal basis are emerging. Bitcoin is gaining popularity as a tool for inflation protection. The availability of articles, videos that tell everything about BTC and cryptocurrency for beginners attracts new market participants.

Frequently asked questions

❓ What is proof of work?

The principle of transaction verification on the Bitcoin network. Miners solve cryptographic problems. The higher the computing power they use, the greater the chance of generating a new block.

🔼 Why is the complexity of bitcoin mining increasing?

It happens if the total power of the network has increased and it took less time to find the last 2016 blocks than the previous ones. The increase in complexity is necessary so that the cryptocurrency does not accelerate its issuance.

💰 Do I have to pay tax on bitcoin sales?

According to the laws of the Russian Federation, trading operations with digital assets are subject to personal income tax at a rate of 13%.

❔ How do Bitcoin-ETFs work?

These are investment funds that sell equity stakes similar to stocks. Dealing with ETFs allows investors to legally invest in bitcoins without owning the cryptocurrency.

❗ How much BTC will be mined in total?

A limit of 21 million coins is set programmatically.

Is there an error in the text? Highlight it with your mouse and press Ctrl + Enter

Author: Saifedean Ammous, an expert in cryptocurrency economics.