This type of earning attracts professionals and beginners because it is positioned as the safest. It is not necessary to predict market movements, deeply understand fundamental and technical analysis. The scheme is as simple as possible – you need to find a bundle (rate difference) and exchange coins. Transactions are performed in circles until the disappearance of efficiency. In the article – about what is arbitrage on Binance. Readers will learn where to look for bundles manually and how to automate the process.

What is cryptocurrency arbitrage on Binance

The main principle of successful trading in any market is “buy cheap, sell expensive”. Cryptocurrency arbitrage works the same way. You need to find 2 exchanges with a difference in price for a particular coin. Then you should buy the asset at a low rate on one platform, transfer it to the second and sell it more expensive.

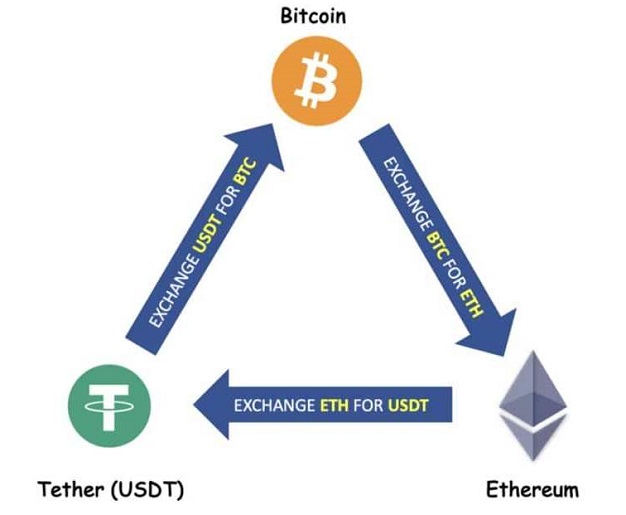

Another way is intra-exchange cryptocurrency arbitrage on Binance. The trader finds on the platform 2 coins with a price difference relative to the dollar exchange rate. After that, it is necessary to buy digital currency, exchange it for the second asset, then – for USD. The standard profit is up to 2%. On Binance, this method is not common – due to the high liquidity there are few bundles, they quickly disappear. Arbitrage of digital assets has such features:

- Low risk. Users do not need to forecast the market. Only the price difference matters.

- Speed. The cryptocurrency market is highly volatile, so transactions must be made quickly. Traders often use robots.

- Large volumes. Because of the low income in one transaction (up to 2%) arbitrageurs enter the entire deposit or a significant part of it.

How much you can earn

The rules of trading in the cryptocurrency market are changing very quickly. Until 2022, you could start arbitrage with 50 thousand rubles and earn up to 20% per day. In 2023, you need a minimum of $10 thousand, 3-5% of the deposit per day is considered a good income.

Profit can be increased if you find profitable bundles with a small spread. But for this purpose you will need to use special software and be online almost 24/7. Market volatility often increases at night or on weekends after the news.

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

Varieties of arbitrage bundles

To make a profit, a trader makes a chain of transactions. At the initial point he exchanges fiat, USDT or other coins, and at the final point he receives the same digital currency in larger quantities. Such a circle is called a bundle. Simple ones consist of one step, complex ones consist of several, and on different exchanges. There are several popular schemes.

| Bundle | Commentary |

|---|---|

| A trader is looking for platforms where he can buy an asset cheaply and sell it more expensively | |

| The arbitrageur earns on the rate discorrelation relative to the underlying digital currency. The transaction involves 3 coins on one exchange. | |

| You need to conduct 3 or more transactions on different platforms | |

| The trader is looking for trading opportunities when exchanging popular coins for fiat. It can be withdrawal to rubles by different methods or buying for USD (other national currencies) by one method and selling for RUB by another. | |

| Rates on local exchanges (for example, Turkey, Kazakhstan) sometimes differ from global ones by 3-5% or more. Traders with access to the closed market profit from this. |

To make profitable transactions, arbitrageurs should monitor various exchanges.

How you can earn on arbitrage on Binance

In such trading, speed is important. Therefore, you need to:

- Register and set up accounts on the platforms on which you plan to trade.

- Deposit on crypto exchanges in different digital currencies.

- Use software to automatically search for bundles.

During the transfer of cryptocurrency between exchanges, the rate can change. Therefore, you should choose assets with high bandwidth in networks or open transactions simultaneously – for example, buy bitcoin for USDT on one platform and sell on another. This will require deposits on both accounts. This tactic helps to close trades quickly, but reduces profits because the trader cannot use the entire balance.

Intra-exchange arbitrage

This strategy does not require transferring assets between platforms, so traders can save on CEX commissions and service fees. The arbitrageur’s task is to find 2 scoring assets relative to the underlying asset (usually USDT, USD or BTC). The scheme is as follows:

- Compare the prices of two cryptocurrencies with each other (cross rates) – for example, ETH/ADA, TRX/BNB.

- Calculate the value in fiat or stablecoins.

- Choose the moment when the cross rate will increase, and the price of assets in USD, USDT will not change.

Traders pay only the exchange commission (0.1-0.2%). In case of large turnovers, the fees can be reduced. Transactions take place inside the platform, so there is no need to spend time on the transfer. This allows for more transactions per day. The disadvantage of traffic arbitrage inside Binance is the limitations on the part of the service. Robots constantly analyze the scattered assets and quickly eliminate trading inefficiencies. Therefore, this approach on highly liquid platforms gives a small profit.

Inter-exchange

This is the most popular type of arbitrage. Traders look for 2 crypto exchanges with different rates for one coin. You can earn more on low-liquid assets. The scheme is as follows:

- Load Binance and 10-20 other exchanges (more often DEX) into the screener program.

- If the rate deviates by 5% or more, buy a coin on DEX.

- Transfer the cryptocurrency to Binance.

- Sell at the market price.

It is necessary to act quickly, so chains of transactions are conducted with the help of bots. Traders control the process – they are at the terminals or set up remote access. In case of failures it is necessary to stop trading quickly.

Multicurrency

The method combines internal and interexchange trading. Here the trader is looking for the discorrelation of two coins relative to the underlying asset not on one platform, but on different ones. The order of actions on the example of a bundle with Tron:

- Buy TRX for BTC on Binance.

- Transfer the asset to another exchange.

- Exchange TRX for USDT.

In this strategy, it is necessary to take into account transfer fees, possible spreads and trading fees. A good result is considered if there is a profit of 0.2% per round after costs.

Arbitrage on exchange deposit

The scheme is suitable for platforms where bundles on specific assets often occur. The user pre-funds the balance on both crypto exchanges in the desired digital currencies. This allows you to open transactions at the same time, without losing time on the transfer. The algorithm is as follows:

- Select coins (for example, ETH and USDT) and exchanges.

- Refill the balances on the exchanges in the ratio 50/50.

- Find a bundle and execute 2 transactions simultaneously.

- Balance the assets so that the 50/50 ratio is reached again.

- Reinvest or withdraw profits.

Work with spot and futures markets

You can also make money on arbitrage on Binance on the deviation of the rate of one contract relative to the others due to local or general peak volatility. Movements on futures are sharper due to high margins. They are characterized by price squeezes below/above the level held on the spot.

Experienced traders can also make money on the difference between the prices of contracts (weekly, monthly, quarterly, open-ended). But you need to be prepared that there will be no signal for a long time (days or weeks).

Explanation of P2P arbitrage

Peer-to-peer services are used for quick withdrawal of cryptocurrencies to fiat and back. Transactions are conducted between clients without intermediaries, so the commissions are small (1%). P2P service acts as a guarantor of the honesty of counterparties – cryptocurrency is blocked for the duration of transactions. In case of problems, investors can appeal to arbitration. It is necessary to provide proof of transfer, then the money will be returned.

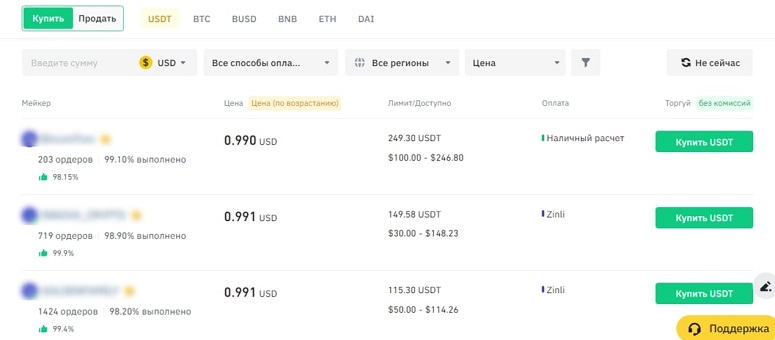

On P2P you can choose the method of settlement – bank cards, EPS, money transfer systems. Cryptocurrency exchange rates differ depending on the payment method. The difference can reach 1-2% and more. This is what speculators make money on.

There are internal and inter-exchange P2P arbitrage. In the first case, the user finds a bundle – for example, buys bitcoin for $29 thousand on Binance P2P and sells it for 2.94 million rubles ($30 thousand). In the second – buys USDT from the EPS for 97 RUB and withdraws to the card at a rate of ₽100. General scheme of work:

- Find a bundle with the help of software or manually. You need the difference between buying cryptocurrency and withdrawal in fiat at least 2%. You also need to take into account the commissions of payment systems.

- Buy digital currency on the platform.

- Transfer money to Binance P2P.

- Create an ad and wait for the response of the counterparty.

- Perform the exchange.

- Repeat the operation from point 2 until the inefficiency disappears.

Risks

In 2023, governments tightened regulation of the cryptosphere. In the Russian Federation, banks automatically consider transactions with digital assets suspicious. If the card receives many small amounts per day or large turnovers are noted, but there are no household settlements, payment for purchases, it can be blocked. The owner will have to prove non-involvement in money laundering and terrorist financing.

There are also trading risks – rates can change quickly, and users will not have time to sell cryptocurrency at a favorable price. There is a possibility that the service will increase commissions or update the working conditions. In addition, you need to take into account the risks of hacking and account blocking on the exchange.

What you will need for cryptocurrency arbitrage

To get started, you need a minimum deposit of $10 thousand. The trader will need to open accounts and pass verification on the platforms on which you plan to trade. Necessary tools:

- Digital wallet. You need a multi-currency non-custodial service to connect to DEX.

- Bank card. It’s worth opening multiple accounts. Banks can block accounts with frequent transactions and high turnover. In addition, on P2P withdrawal rates to cards differ. Therefore, it is better to have accounts in all popular banks.

- Software (scanners, bots). Manual search for bundles takes a lot of time. Robots will speed up the entry into positions.

Special software for arbitrage

In 2023, more than 90% of trading transactions are made by robots. Manual users cannot compete with algorithms. Beginners often use free software to gain experience. But as volumes grow, more feature-rich programs will be required.

Scanners

These programs track rates on platforms and show bundles. Most scanners are paid (Day Trading School, P2P.Army) or with limited functionality (SpreadScan). On average, developers charge $100 for a monthly subscription. You can set up receiving signals in Telegram chat.

Tools for comparing rates

In addition to scanners, you can use free programs that show quotes for coins on different services. Directly the bundles are not displayed, but it is not difficult to find them. Instructions:

- Select a cryptocurrency or fiat.

- Sort the list of exchanges.

- Select services with specific parameters.

Using programs and services to track quotes, you can effectively control the market and increase flexibility in financial markets.

Bots

In arbitrage trading on Binance, the speed of opening and exiting trades is important. Therefore, traders use algorithms. You can connect robots to Binance that will play the role of scanners – look for bundles within the exchange and open trades (Triangular Arbitrage, Cryptohopper, Bitsgap).

Another way is to analyze the market with a special program (DEX Screener, TradingView – tabs “Products”, “Screener”) and use bots only to create orders or control the operation.

How to find bindings

First, one or several programs for tracking quotes should be installed. Next, the following courses of action are possible:

- When using paid screeners, you only need to choose the most profitable from the received signals and create an order.

- When manually searching, you will need to open pairs with frequently occurring forks in different windows. When a trading opportunity appears, you need to calculate the volume and enter the transaction.

There are other ways to get signals – chats, forums, blogs. But they are less effective. Working schemes are rarely posted in the public domain.

When many users learn about the opportunity, it stops bringing money. Therefore, in free access is information about the bundles that have ceased to bring profit or give a small income.

Chats in social networks

Administrators monitor the market situation and post signals. Chats with real bundles usually work by subscription. In free ones there are educational articles and advertisements (trades on old signals) with an offer to buy participation. Chats can be used by beginners, but the profitability will not be high. Trading inefficiency is seen by many users at once, so it quickly disappears.

Thematic forums

Bloggers share information on which crypto exchanges are less spread, commissions, on which digital pairs are more often found working cases. But you can’t find ready-made bundles for making money. While the post is being prepared, the trading opportunity will already be exhausted.

P2P exchanges

Bundles with a high spread occur when exchanging to fiat. You can search for them manually or add exchanges to the screener. The search algorithm is as follows:

- Make a list of P2Ps.

- Select available digital currencies – necessarily liquid.

- Compare prices on the platforms.

- Discard options with no earning opportunities.

- Calculate the total commission per round.

- Calculate the final yield for the remaining options.

At first, it will take a long time to calculate. It is likely that in the process, the deal will already lose relevance. But over time, users will learn to work faster.

Examples of bundles

Ready-made cases with high profitability (4-6%) are not placed on the Internet. Traders can post bundles effective in the past or low-yielding forks. For example, such arbitrage was profitable in the summer of 2022:

- Buy UZS (Uzbek soms) from a Tinkoff ruble card on P2P.

- Exchange UZS for USDT.

- Sell Tether for rubles.

The scheme brought up to 5% per round. With a deposit of 100 thousand rubles, you could earn 5-25 thousand rubles per day. Other bundles are found on the Internet. But you need to be careful about forks that use unreliable platforms. It is safer to search on your own.

Frequently Asked Questions

📢 Why do I need to consider the availability of replenishment in arbitrage?

The best opportunities occur during peak volatility. If the exchange rate for a coin is very different on one exchange, the administration may close the withdrawal/refill. Therefore, the first transaction should be made on a small volume, so as not to hang with a large sum.

📌 Why is Binance popular among arbitrageurs?

To sell cryptocurrency, traders choose liquid platforms with low spreads and commissions, a large number of available coins and a good reputation. Binance is the largest exchange that fulfills all the criteria.

🔥 How to set up a robot for automated arbitrage?

Not every beginner will be able to do it the first time. You need to undergo basic training and set the default settings. Then you can adjust them and monitor the profitability of trading. If you can’t make a profit, it is better to order customization from the developers.

⚡ What is better – to use paid screeners or programs for comparing courses in free access?

The second method is suitable for beginners who do not have extra money. But it takes more time. Screeners can find bundles in milliseconds.

✨ What is the funding rate?

It is a mechanism in the futures market to bring the contract price to the spot. Every 8 hours, traders who stand against the trend are credited with a profit. Users who open reverse trades receive a loss. The funding rate changes once per period. To engage in cryptocurrency arbitrage on Binance, you need to understand the market well. To earn money, you need to simultaneously open a transaction on the spot (on the trend) and a reverse position on the futures. This will also allow you to get away from the risk of rate changes. Both deals are closed at the same time.

Error in the text? Highlight it with your mouse and press Ctrl + Enter.

Author: Saifedean Ammous, an expert in cryptocurrency economics.