In 2023, there are many investment instruments in the cryptocurrency market. Among them, for example, derivatives (derivative contracts tied to underlying assets). Leveraged token (financial leverage) can also be included in the list of additional instruments. In 2023, they started gaining popularity. Such tokens mean cryptocurrency instruments, transactions with which are carried out with a fixed trading leverage. With pronounced trends in the market of digital assets, they are able to bring large profits.

Features of leveraged tokens

The main characteristic feature of short and long altcoins is the binding to the underlying assets. In this case, they are the corresponding futures (also a type of derivatives).

For example, the underlying asset of BTCUP on the Binance cryptocurrency exchange is the perpetual BTC contract on the Binance Futures platform.

The daily fee for leveraged token management on Binance is 0.01%.

Also, leveraged crypto assets have 5 other features:

- Spot market trading. Short and long altcoins are tied to derivatives. However, such assets are traded on the spot market along with traditional cryptocurrencies.

- Calculation of quotes using a special formula. It looks like this: the value of the underlying asset + (price change * coefficient). The second variable in parentheses determines the amount of leverage to decrease or increase the quotes of the digital currency at market fluctuations. It works like this: the coefficient of the crypto asset ETHBEAR (short type positions) is -3. When the price of traditional ETH decreases by $100, ETHBEAR quotes will increase by $300.

- High losses and gains. Losses and gains from derivatives trading increase due to the leverage ratios set.

- Free issue. Any cryptocurrency company or platform for trading virtual assets can issue and bind tokens to futures contracts of interest.

- The ability to generate income even when the price falls. Short tokens are used to capitalize on selected digital assets during a decline in their quotes. They are usually denoted by the suffix DOWN or BEAR.

Because of the listed features, short and long altcoins are considered a profitable trading instrument. For example, they allow traders to receive increased profits even with a downtrend in the cryptocurrency market.

5020 $

bonus untuk pengguna baru!

ByBit menyediakan kondisi yang nyaman dan aman untuk trading mata uang kripto, menawarkan komisi rendah, tingkat likuiditas yang tinggi, dan alat modern untuk analisis pasar. ByBit mendukung trading spot dan leverage, dan membantu trader pemula dan profesional dengan antarmuka yang intuitif dan tutorial.

Dapatkan bonus 100 $

untuk pengguna baru!

Pertukaran kripto terbesar di mana Anda dapat dengan cepat dan aman memulai perjalanan Anda di dunia mata uang kripto. Platform ini menawarkan ratusan aset populer, komisi rendah, dan alat canggih untuk berdagang dan berinvestasi. Pendaftaran yang mudah, kecepatan transaksi yang tinggi, dan perlindungan dana yang dapat diandalkan membuat Binance menjadi pilihan yang tepat bagi para trader dari semua level!

Difference between leveraged tokens in margin and futures trading

Perpetual contracts are a type of derivatives. More specifically, such transactions are a special type of futures (Futures). They have no expiration (execution) date. Also, open-ended contracts are based on major price indices.

Leveraged token trading and futures trading have 3 main differences. They are presented in the table below.

| Difference | Deskripsi singkat |

|---|---|

| Changes in token quotes are always larger than with Futures | Short and long altcoins fluctuations are more pronounced than in contracts. According to some information, token holders earn more than futures investors. For example, when buyers of contracts earn 270% of the initial amount for a conditional period, the income of investors in leveraged altcoins for the same time is 400%. |

| With stable trends, tokens bring higher profits than conventional futures | Example: a conditional investor invests $10,000 each in the ETHUSD contract and the long crypto asset ETHBULL. In one week, the price of traditional Ethereum increases by 25%. In this case, the profit from the contract will be about 75.7%, and from the long crypto asset – about 101%. The net return in dollars would be $7570 and $10,080, respectively. |

| Exchanges often fail to liquidate even heavily losing token positions due to rebalancing | This term refers to restoring the original shares of cryptoassets in an investment portfolio by buying/selling new coins. Issuers make rebalances at set periods or forced rebalances when prices drop by 11% on average. They also shift liquidation points each time shares rebalance. Because of this, issuers almost never forcibly close investors’ positions. |

Principle of trading

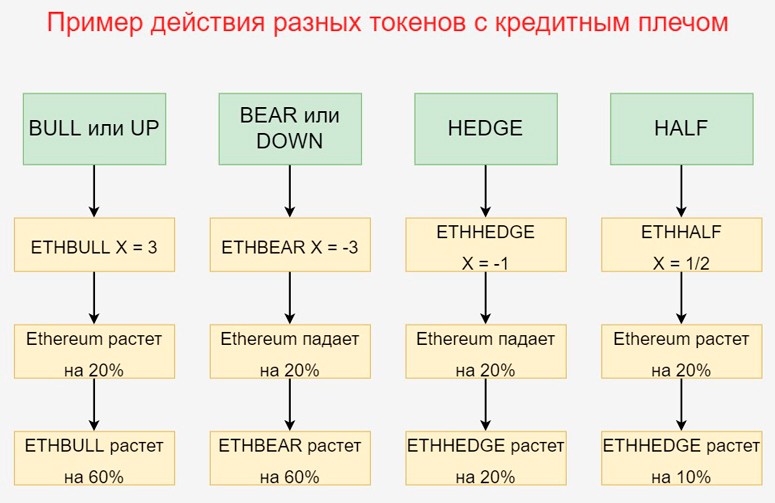

First, you need to understand the types of leveraged altcoins. There are only four of them:

- BULL or UP. This type is called a long position. It allows traders to receive increased profit from the direct growth of quotes of cryptoassets. Usually the coefficient (X) for BULL/UP is between 2 and 4.

- BEAR or DOWN. This type is called a short position. It allows you to make money when prices are falling. Usually the coefficient for BEAR/DOWN is -2 to -4.

- HEDGE. This type is used for hedging risks (leveling losses). The coefficient for HEDGE can be 1 or -1 depending on the current trend. Buy such crypto-tokens only when X = -1, that is, when the prices of the underlying instruments decrease.

- HALF. This type allows you to minimize risks. The coefficient for HALF is always equal to 1/X, where X = 2. This type reduces not only losses, but also income.

You should choose the type of altcoin depending on your current goal and the market situation. Otherwise, you can accidentally acquire an unsuitable position and lose part of your capital or profit.

You can buy cryptotokens with leverage using 3 methods:

- Through an exchange. Cryptocurrency trading platforms offer customers easy access to the spot market. This is where short and long tokens are traded en masse.

- Via deposit. Part of the platforms offer clients a method of direct exchange of savings directly to the altcoins in question. With this method, users make deposits and request the issuance of cryptocurrencies of interest. Exchanges issue them and give them to investors.

- Through conversion. The FTX platform offers the exchange of any available assets in the account at once to tokens with leverage.

It is worth considering that investing in such assets should be done with caution. By purchasing a leveraged token, a trader can significantly increase his profit. However, there are risks.

Leveraged coins are not suitable for beginners.

When it is worth trading

Investing in leveraged altcoins is possible in 2 cases:

- The trend of cryptocurrency market movement is maintained for a long time (from 2-3 days). Digital exchanges reinvest the profits generated in the process of periodic rebalancing. This provides more profit in case of long-term trends.

- The investor follows a conservative trading strategy. The main fear of investors while using leverage is liquidation. However, for short and long altcoins, forced liquidation is almost impossible. For example, for liquidation at X = 3 the quotations of the underlying instrument must collapse by 33% in a day, and at X = 2 – by 50%.

Penulis: Saifedean Ammousseorang pakar ekonomi mata uang kripto.