In 2023, the PRC is the leader in blockchain projects. Their number exceeds the number of those launched in the US by 10 times. China was the first in the world to develop a state digital currency. In 2021, a law is passed that DCEP is the third form of money, along with cash and non-cash. Mass testing of digital currency in China began in 2022. By July 2023, more than 40 provinces, including Beijing, Shanghai, Guangzhou, had joined the project. The mobile application for settlements is integrated into Huawei phones. The software is supported by major payment systems Alipay and WeChat Pay, through which 90% of electronic transfers in the country take place. The authorities expect the volume of DCEP transactions to reach $300 billion by the end of 2023.

What is digital currency in China

Bitcoin, which emerged in 2009, marked the beginning of a new global market. Cryptocurrencies quickly became popular. The growth of private remittances forced governments to start regulating this area. China took a different path. First, the authorities banned the mining and circulation of digital coins. Then they issued a state-issued cryptocurrency. Digital Currency Electronic Payment (DCEP) is the country’s third form of money. It can be used in the same way as cashless yuan: to pay for purchases, bills, and transfer to individuals. DCEP has these features:

- It is the equivalent of banknotes circulating in the PRC. Citizens can exchange non-cash yuan to digital form and back at a rate of 1 to 1.

- Recognized as a legal tender. In case of theft or fraud, legal action can be taken.

- Micropayments are made anonymously. To send large sums, you need to undergo verification on the platform. For small everyday expenses, it is enough to register a wallet of the most minimal level – only by phone number.

History of creation

China began to develop a national cryptocurrency in 2014. For this purpose, a research institute was created, which was engaged in integrating blockchain technology into the state financial system. However, in 2015, the project was frozen due to the country’s strict regulation of the cryptocurrency industry.

In 2019, Mark Zuckerberg began developing his own digital coin to conduct transaction in chat rooms. The US did not allow China to participate. Therefore, the Chinese authorities decided to resume the project of the national cryptocurrency. Work on the preparation of the internal infrastructure was completed by the summer of 2020. The government began pilot testing of DCEP.

The large-scale launch was planned to take place during the 2022 Olympic Games. At the China International Import Expo in Shanghai in November 2021, the National Bank of China (NBK) demonstrated a device that could convert the world’s 17 major currencies into e-CNY. It required a passport, with a bank account optional. Due to the pandemic, the Chinese government’s plans were thwarted. The launch of the new payment unit took place, but without the participation of foreign partners.

Online and offline retailers and technology companies joined the project. According to the NBK, at the pilot stage, the volume of transactions reached $14 billion, and by the end of 2022, more than 360 million transactions were carried out.

5020 $

bonus untuk pengguna baru!

ByBit menyediakan kondisi yang nyaman dan aman untuk trading mata uang kripto, menawarkan komisi rendah, tingkat likuiditas yang tinggi, dan alat modern untuk analisis pasar. ByBit mendukung trading spot dan leverage, dan membantu trader pemula dan profesional dengan antarmuka yang intuitif dan tutorial.

Dapatkan bonus 100 $

untuk pengguna baru!

Pertukaran kripto terbesar di mana Anda dapat dengan cepat dan aman memulai perjalanan Anda di dunia mata uang kripto. Platform ini menawarkan ratusan aset populer, komisi rendah, dan alat canggih untuk berdagang dan berinvestasi. Pendaftaran yang mudah, kecepatan transaksi yang tinggi, dan perlindungan dana yang dapat diandalkan membuat Binance menjadi pilihan yang tepat bagi para trader dari semua level!

By July 2023, more than 5.6 million stores had added support for the digital yuan. As a result, DCEP became the most widely used CBDC compared to other similar projects. Currently, citizens can pay with any convenient method, but the authorities expect that in time the digital yuan will supplant cash.

Future and impact on key sectors in China

Chinese citizens are actively using mobile payments. According to the NBK, more than 80% of smartphone users pay online. This is the highest rate in the world. The government is working on the widespread adoption of digital currency in China. Already during the pilot launch there was a high demand for the new service among the population.

Over time, it will reduce the profits of financial organizations. However, digital yuan will not be able to completely replace banks. The new form of payment is being introduced in stages. Major technology companies are involved in the project. This partnership will expand the scope of e-CNY in the future.

Working principle

The bitcoin code was used to create the Chinese digital currency. From a technical point of view, these assets are identical. The main difference is the centralization of the new payment instrument. The basics of e-CNY are as follows:

- Only the NBK has the right to issue. The regulator issues DCEP and transmits it to the country’s banks.

- The transaction processing speed is 220,000 TPS. In comparison, Visa has 24-65 thousand.

- Internet is not required for transactions (NFC technology is used).

- Any transaction can be tracked. Only NBK will have full access to information, commercial banks will not be able to get it.

- Chinese users (individuals and companies) can exchange cashless RMB for DCEP at banks.

- No interest will be charged on the account balance.

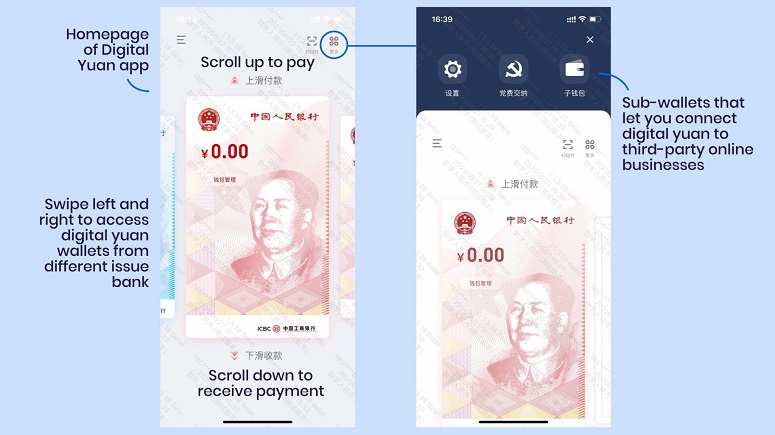

- The mobile application for digital money settlements in China is compatible with popular payment systems. The wallet can also be opened by foreign citizens. It is not necessary to have a bank account in the PRC.

- The wallet has several levels of verification. Chinese residents can register an account by phone number or passport. For significant amounts, confirmation of the source of income will be required.

- The program for paying for purchases and transfers in e-CNY works on iOS and Android. It can be downloaded from the app stores.

- The new payment tool was integrated by Huawei, Alipay, WeChat.

- Payment is instantaneous, no commissions are charged.

Official launch date

In 2021, the pilot project started in 6 cities in China. As part of testing the platform, the authorities opened wallets to individuals, companies and distributed 40 million digital yuan through a lottery. A total of 1.32 million e-money transactions were conducted.

The official launch of the cryptojuan was scheduled for winter 2022. Foreign organizations were expected to participate in testing the new payment form. Most of these plans remained unrealized due to pandemic-related restrictions.

In 2022, only 10 major cities in China managed to connect, but by 2023, 43 provinces are already working with the e-yuan. According to the NBK, the popularity of mobile payments using DCEP has grown by 90% since the launch. In March 2023, a large WeChat network integrated crypto-yuan.

The Chinese authorities expect the volume of transactions to reach $300 million by the beginning of 2024.

Why China’s digital currency was created

More than 600 million Chinese people use cashless money for purchases. The government aims to create a convenient infrastructure to eliminate other forms of payment. According to official sources, the goals of developing the cryptojuan are as follows:

- Reducing transaction costs.

- Making banking services more accessible to residents of remote provinces.

- Combating the misuse of budget money.

- Countering fraud, laundering of funds.

- Increasing the turnover of yuan in the world.

- Strengthening control over transactions of citizens and businesses.

- Expanding the NBK’s ability to conduct monetary policy.

Take the first place as the world’s reserve currency

China has made no secret of its desire to provide the world with a convenient alternative to the dollar for investment and cross-border payments. If the government’s plans to roll out the e-CNY in China and other Asian countries materialize, it will replace the USD as the world’s reserve currency. The NBK will be able to issue large amounts of money. Due to the use of RMB by many central banks, it will not cause significant inflation.

Disconnect from intermediary services

When using traditional financial systems, citizens pay high fees. In some cases, 3 or more banks are required to process a transaction. This leads to an increase in service fees up to 7-10%.

Cryptocurrency transactions are free of charge – directly between customers without intermediaries. This will save trillions of yuan annually on fees.

Move away from the gold standard

There have been media reports about China’s plans to issue CBDC backed by the precious metal. However, the authorities refute this assumption. The country has no plans to return to the gold standard.

What is China’s BSN

In December 2019, the authorities announced the development of a national blockchain infrastructure. The Blockchain Service Network (BSN) is a cross-chain public network that enables startups to deploy and edit dApps cheaply and quickly. The project is based on the FISCO BCOS open source platform. The initiative is being developed by the State Information Center of the People’s Republic of China, China Mobile, China UnionPay, Huobi and other companies.

In 2020, the developers presented the international version of BSN and integrated popular networks – Ethereum, EOS, Nervos, Tezos, NEO and IRISnet. At the launch stage, the blockchain was supported by 100 Chinese nodes, and later the network was expanded.

Back in 2021, the founders promised to launch nodes in Turkey, Uzbekistan and South Korea. The developers also do not rule out entering the US and European markets.

Testing digital money in China

In December 2019, the government announced the readiness of the infrastructure for payments. The transition to digital will be smooth. In the table, you can see the main stages of testing cryptojuan.

| Date | Komentar |

|---|---|

| Establishment of a pilot group in the major cities of Suzhou, Shenzhen, Xin’an and Chengdu. | |

| Authorities distributed DCEP through a lottery. Each of 200 thousand users received 200 crypto-yuan. These could be spent on purchases or transferred to friends. | |

| 28 provinces joined the project. Citizens of Shenzhen were given 10 million digital yuan through the lottery. Popular services joined the test. The NBK opened more than 20 million accounts for private customers and 3.5 million for companies. | |

| The government began the next phase of testing: more cities were added, popular services for food delivery, cab ordering, airline tickets, and streaming resources were connected. Since January 2023, Changshu civil servants have been receiving their salaries in e-CNY. |

How the digital yuan can be used

From 2021, DCEP is recognized as legal tender in China. Users can make transactions such as:

- Transfer funds from a bank account to an e-wallet.

- Pay for purchases, bills, taxes.

- Receive a salary.

- Send transfers to individuals.

- Visitors to China can issue a physical card with a chip through a network of ATMs, replenish the wallet with cash.

At what stage is the launch of DCEP

In 2023, citizens and visitors of 43 provinces in China can use the digital yuan for everyday transactions. Also, the new means of payment is available to large international organizations for fast and convenient cross-border settlements.

The government is expanding the number of localities where crypto-yuan can be used. It is planned to include the entire territory of Asia in the program. In the future, banks will introduce registration on a mobile platform for customers from different countries. It will be possible to open an account by phone number.

At the stage of global adaptation, e-CNY will be traded on international exchanges in pairs with other digital currencies issued by central banks and fiat money.

Infrastructure readiness

In 2023, settlements can be made on a mobile app, via Alipay and WeChat payment systems, and via card without opening an account. Transactions are executed on the Blockchain Service Network, which requires the deployment of a network of validators to maintain. Operators operate in 43 provinces in China and other Asian countries. Users can perform actions such as:

- Register accounts, log into an account and manage a profile.

- Transfer money to individuals and businesses.

- Pay by QR code.

- View transaction histories.

In 2023, work is underway to connect the server infrastructure. This will extend coverage to the entire territory of China, Asian and African countries. Cross-border payments will also be supported in the future.

Partners include Tencent, Bilibili, DiDi Chuxing.

In January 2022, the second phase of CBDC testing began. The government attracted the most popular Chinese services to it. For example, Meituan, the largest food delivery, flower delivery and airline ticketing company, became a partner of the program. In the first quarter of 2023, users paid for more than 690 million orders with cryptojuan. About 17% of Meituan’s shares are owned by Tencent Holding. Bilibili (entertainment content), DiDi Chuxing (ordering cabs, limousines) also joined the project.

Bank of China attracts the most popular services to provide the maximum number of customers with a convenient alternative to the usual payments. In this case, retailers save on commissions, so users are offered discounts.

Payment without Internet connection

E-CNY can be a convenient alternative to cash. You don’t have to be connected to the internet to use DCEP. This makes mobile payments more accessible in remote communities. The infrastructure will work even during natural disasters. At the same time, a digital wallet is much more difficult to hack than to steal banknotes.

Controlled anonymity

To register a wallet, you need to enter passport data (or phone number). Full verification with selfies will be required only for large transfers. For significant spending, the bank has the right to request a source of income. Small everyday expenses can be paid anonymously. It is enough to enter the code from SMS.

Acceptance of DCEP payments in some cities

In Hainan Province, CBDC can be used to pay for subway passes, air travel, train tickets to Suzhou. Online retailer JD.com transfers employees’ salaries in 5 cities.

Testing terminals

Chinese authorities first launched devices to exchange national currencies for crypto-yuan in 2021 in Beijing. By 2023 foreigners were also installed in Hainan province. The self-service machine accepts cash dollars, euros and 18 other currencies. Here’s how the digital ruble works in China today:

- The user receives a physical card with a chip.

- Tops up the balance.

- Funds are converted to yuan at the Central Bank exchange rate and exchanged to e-CNY at a 1-to-1 ratio.

Foreigners use the card to pay wherever e-money is accepted. You can check your balance and see the history of transactions in the machines. The interface supports 8 languages, including Russian.

Appearance of the official name e-CNY.

In 2021, after several years of successful tests of cryptojuan, the government released a detailed technical paper. The White Paper was compiled by a working group of the Digital Currency Electronic Payment project. The guide came out under the title Progress of Research & Development of e-CNY in China. It took root and began to be used further in official sources.

How China is struggling with independent cryptocurrencies

At the end of 2021, the authorities banned settlements using decentralized coins. The law contains such restrictions:

- Extraction, sale, storage of cryptocurrency is recognized as illegal.

- Exchanges and services for monitoring coin rates are prohibited.

- Citizens cannot invest in cryptocurrency mining (even outside of China).

- Mining equipment cannot be sold.

Authorities have banned banks from cooperating with platforms accepting cryptocurrency. Services violating the regulation were blocked. Gradually, there were no platforms left in the country to exchange crypto coins for fiat.

Law enforcement agencies also arrested private miners and confiscated equipment. Higher electricity tariffs were introduced for companies that ignored the ban.

Which banks will open digital wallets

In 2023, it will be possible to register accounts on the CBDC platform in mobile applications of 8 financial institutions, including WeBank and MYbank. In mid-2021, other commercial banks such as Bank of Xi’an, Bank of Hainan, Bank of Shanghai, Bank of Changsha, and Bank of Suzhou also joined the project. They are second-tier financial organizations. This means that their interaction with e-CNY will be limited to certain transactions. For users, account opening, account maintenance and transfers are free of charge.

Whether digital yuan can replace Alipay and WeChat Pay

In the summer of 2023, more than 90% of mobile payments in China take place through popular local apps. After the release of the e-CNY payment app, downloads have surpassed those of social network WeChat.

Alipay and WeChat Pay have integrated settlement into e-CNY. It is planned that users’ balances will gradually shift from cashless to digital.

What other countries are issuing CBDCs

Competition from an actively growing digital market has given rise to the development of government-issued cryptocurrencies. According to the CBDC Tracker, more than 100 countries are working on creating national coins by 2023. Some states are only exploring the opportunities and risks of using a new means of payment, while others have begun implementing CBDC for everyday transactions. The central banks of such countries have launched digital currencies:

- Bahamas – Sand Dollar.

- Nigeria – eNaira.

- Jamaica – JAM-DEX.

- Eastern Caribbean – DCash.

In Russia in 2023, they passed a law on the digital ruble. The Central Bank has started the second stage of testing – on real money. CBDC is also being developed in Canada, Kazakhstan, Japan, the Netherlands and other countries.

Pertanyaan yang Sering Diajukan

📌 Can I use digital currency in China from a PC?

The settlement app needs to be downloaded to your smartphone. Alternatively, you can use Alipay, WeChat cards and interfaces.

💳 What transactions are available to foreigners?

To use e-CNY, you need to be in the province of China where the test is launched. Only small payments can be made. For large transactions, a Chinese citizen passport is required.

📢 Can citizens opt out of using cryptojuan?

The authorities expect the public to appreciate the convenience and security of payments. This will allow the digital yuan to displace banknotes. It is impossible to give up e-CNY, but you can transfer the money into cash and cashless forms.

🔔 Why did China ban cryptocurrencies?

Authorities believe that decentralized assets contribute to the outflow of funds from the country and create competition to e-CNY.

⚡ Are digital yuan transactions safe?

DCEP uses modern security methods to make payments: digital certificates, signatures, encrypted storage (to prevent double spending and unauthorized access to the account).

Apakah ada kesalahan dalam teks? Sorot dengan mouse Anda dan tekan Ctrl + Masukkan

Penulis: Saifedean Ammousseorang pakar ekonomi mata uang kripto.