The digital economy has created a new system for generating income. On the one hand, the DeFi sector adapts traditional ways of trading that appeared on stock exchanges, on the other hand, it is technically complex organized due to blockchain technology. The material explains that decentralized finance in simple words is digital money, and points out the ways in which you can earn money. Readers will learn about the technology, its application, strengths and problems of this cryptocurrency.

What is decentralized finance in simple words

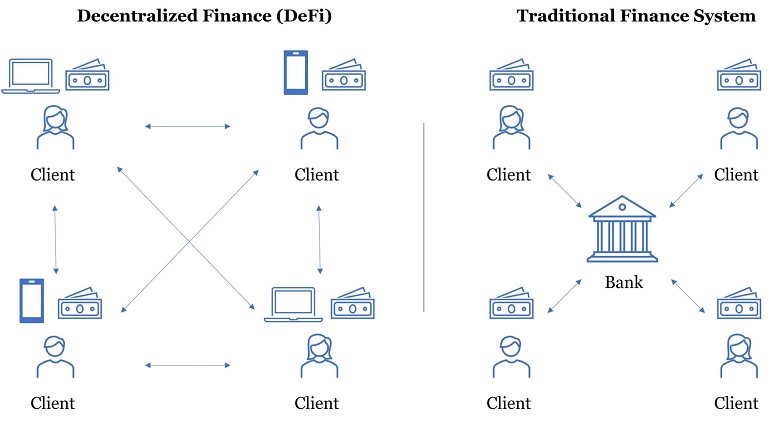

In ordinary life, in order to take a loan, you need to go to the bank. Employees of the institution will verify the identity of the client using his passport, check the financial solvency and make a decision on issuing a loan. The bank conducts control, and the possibility of refusal gives it the role of a manager, that is, a centralized authority. The Binance exchange or other platforms where an account is required to be created can block the user’s profile. The ability to impose such sanctions characterizes digital platforms as centralized services.

The same thing is happening at a higher level. A country’s monetary system and a government with legislative functions are centralized authorities. In a DeFi system, however, transactions are performed outside the control of the government or other large institutions.

Instead, decentralized finance is built on blockchain technology. Its structure gives each participant in the network the right to execute transactions and control their authenticity.

In blockchain, digital money and data are stored on different computers called nodes. All participants have access to the same information. In a general sense, cryptocurrencies are decentralized finance. The term is translated from English, in which it sounds like Decentralized Finance, but the acronym DeFi is more commonly used. By 2023, it has taken on a broader meaning. Decentralized finance includes several blockchain manifestations:

5020 $

bonus untuk pengguna baru!

ByBit menyediakan kondisi yang nyaman dan aman untuk trading mata uang kripto, menawarkan komisi rendah, tingkat likuiditas yang tinggi, dan alat modern untuk analisis pasar. ByBit mendukung trading spot dan leverage, dan membantu trader pemula dan profesional dengan antarmuka yang intuitif dan tutorial.

Dapatkan bonus 100 $

untuk pengguna baru!

Pertukaran kripto terbesar di mana Anda dapat dengan cepat dan aman memulai perjalanan Anda di dunia mata uang kripto. Platform ini menawarkan ratusan aset populer, komisi rendah, dan alat canggih untuk berdagang dan berinvestasi. Pendaftaran yang mudah, kecepatan transaksi yang tinggi, dan perlindungan dana yang dapat diandalkan membuat Binance menjadi pilihan yang tepat bagi para trader dari semua level!

- Cryptocurrencies.

- Decentralized exchanges (DEX) and applications (dApps).

- Loans.

- Stacking.

- Liquidity transactions and other financial products.

What all of the above have in common is that DeFi tools are provided via smart contracts on blockchain networks. The concept of distributed data storage provides security as there is no single point of vulnerability. This means that the segment is difficult to attack or control.

Cryptocurrencies such as Bitcoin or Ethereum are examples of decentralized financial systems – the interconnection of a native asset with marketplaces for its circulation, storage wallets and investors.

Users send and receive money without intermediaries or tax authorities. This gives everyone in the network freedom and full control over digital assets.

Reasons for popularity

Decentralized finance helps all users participate in the economic system, regardless of traditional restrictions. For example, accessing digital money and blockchain tools does not require registering a bank account, providing salary documents or credit history. This is called inclusion. It is made up of several factors:

- Financial freedom. Users have full control over their personal crypto assets without intermediaries in the form of banks

- Accessibility. You only need the internet to use DeFi. Being tied to a location or having a certain residency is unimportant.

- Innovation. At first, the action of the first DeFi instruments was identical to the procedures taking place in the fiat system. However, the evolution of the direction has led to the creation of opportunities that are unique to the digital economy – for example, the emergence of synthetic cryptoassets.

- Anonymity. Thanks to blockchain protocols and encryption, users conduct transactions without revealing personal information.

- Transparency and security. Transactions are recorded in a public and immutable registry. This increases user trust and helps avoid fraud.

Protocols

To give users access to DeFi, developers create websites and apps. Functions and special conditions in them are formalized in the form of program code and prescribed in a single architecture – blockchain protocols. Users only need to create or link a wallet in the crypto-network, after which DeFi features become available automatically. Functions of decentralized finance – in the table.

| Option | Service |

|---|---|

Linking to smart contracts

In order for a blockchain network to start the automatic execution of a given algorithm, a special function is used. It is called a smart contract. In fact, it is a script to confirm a transaction.

For the transaction to be recorded in the network, a number of prescribed conditions must be met. The algorithm automatically checks for correctness. The structure of decentralized finance consists of linking smart contracts to the blockchain.

Keuntungan

DeFi’s strengths go beyond accessibility and inclusion. Blockchain technology makes transactions in crypto networks fast and open to public evaluation. It is also possible to exclude intermediate intermediaries from mutual settlements and fully automate the process. Equally important, decentralized finance creates a foundation for new developers to develop financial protocols.

Transparency and accessibility

In automated scenarios, all rules and conditions are pre-defined and open for public viewing. Anyone can check the work of the DeFi protocol and evaluate its correctness and reliability.

The data about the previously performed transactions in the cryptocurrency chain cannot be changed imperceptibly. The slightest attempt to make edits will break the connection, and participants can find the place where the manipulation took place. The system ensures its security and invariance.

Smart contracts guarantee transparency, accessibility and automation of financial transactions.

Speed

Smart contracts and blockchain have another advantage. Financial transactions in the traditional economy can take days or weeks – for example, for international transfers and multi-step transactions. Smart contracts in DeFi are much faster and are completed almost instantly.

Size of fees

Traditional financial services and transactions can come with high fees. DeFi makes it possible to significantly reduce transaction costs. Users make transfers between each other and without the involvement of intermediaries. The size of commissions is reduced to a minimum.

Autonomy

Cryptotransfers do not need third parties, assets are transferred from one wallet to another with the help of a software algorithm. The protocol autonomously executes the conditions and checks for correctness.

Compatibility with existing applications

Data openness is not only characteristic of transaction records. The program code of projects and protocols is also stored publicly – for example, on repository sites such as GitHub. Technical text is used by other developers to build new, more complex blockchain products on its foundation. Additional tools that extend the functionality of existing protocols are also being deployed. Decentralized finance is flexibly adapting to the needs of users and businesses.

DeFi challenges

Decentralized finance is a promising area of economics. However, it also has weaknesses. For example, the sector has the same scalability-related weaknesses as blockchain. Networks like Ethereum are limited in bandwidth.

Software engineers are ensuring that the number of blockchain transactions increases in different ways. Some are creating sidechains – networks with faster proof-of-concept mechanisms – to help existing ones, while others are developing entirely new chains.

Low bandwidth slows down transfers and raises fees. This is exactly what is happening in the case of Ethereum. Another weakness is the lack of regulation. DeFi, like the entire blockchain, is outside the sphere of influence of traditional regulatory bodies. Therefore, users are left defenseless against fraudsters.

Decentralized finance has other drawbacks:

- Technological vulnerability. Despite the lack of a centralized control point, the operation is based on the action of the protocol. It can be attacked by cyber criminals. Therefore, there remains the risk of hacker attacks that will lead to loss of funds.

- Complexity. To novice digital marketers, the DeFi segment seems difficult and incomprehensible. Understanding the principles of smart contracts and other instruments requires time and experience.

- High volatility. Like trading other cryptocurrencies, the prices of DeFi assets can fluctuate. This leads to loss of funds in case of unpredictable market fluctuations.

- Lack of liquidity. Little-known or new DeFi projects face a lack of trading volume. This makes it difficult to withdraw funds or sell assets quickly.

Examples of decentralized finance use cases

DeFi protocols provide a variety of features and functions. Types and examples of decentralized finance:

- Lending. Users deposit their digital assets as collateral and gain access to borrowed funds.

- Banking. These include stablecoins, derivatives, deposits, and an insurance system.

- Access to trading. Protocols can be used to exchange digital assets on decentralized exchanges (DEX). Users get full control over their funds and conduct transactions directly from their wallets, and without registering an account.

- Staking. Users invest crypto funds in liquidity pools to earn interest or rewards.

- Investments. For example, the Yearn.Finance protocol automatically redirects users’ funds to the most profitable liquidity pools so that asset owners get more income.

- Application development and other uses.

Lending and borrowing

Such DeFi services lend users the assets of other investors for temporary management. Decentralized finance includes 2 types of borrowing transactions:

- Lending. This is a procedure in which the user leaves crypto assets as collateral to get a larger amount. Funds that belong to other participants are transferred from the liquidity fund locked in the smart contract.

- Pinjaman. The process is similar to lending, but the investor can get a deposit without collateral.

In both cases, the user borrows funds in the smart contract and agrees to repay them later. Interest is charged for lending. If the participant fails to return the loan, the contract can sell the user’s collateral and return the money to the borrower. Everything happens automatically and without the involvement of intermediaries.

DeFi lending allows you to borrow and lend money quickly and earn money on loans.

Banking services

Smart contracts and protocols help to realize familiar operations from the segment of the traditional economy in the form of an algorithm. In the system of decentralized finance distinguish:

- Stablecoins tied to assets.

- Derivatives.

- Insurance.

- Deposits.

Asset-linked stablecoins

Cryptocurrencies are characterized by high volatility. In other words, their prices can fluctuate and change a lot in a short period of time. Stablecoins are pegged to real assets – for example, the U.S. fiat dollar or other stabilization mechanisms. This allows them to maintain their value at a 1:1 ratio. In trading, the fixed equivalent works as a means to preserve profits and avoid drawdowns amid cryptocurrency price changes.

In the DeFi environment, the stable value of stablecoins underpins borrowing transactions, derivative products and the operation of DEX exchanges. This helps mitigate risk and improve stability within the decentralized finance ecosystem.

Stablecoins simplify the transition between the crypto world and the traditional financial system. Users convert their deposits to preserve value (e.g. into USDT) and withdraw them into fiat when needed.

Derivatives

The main idea of such transactions is to allow users to trade or profit not from the sale of an asset, but due to the change in its value. Such transactions are related to professional trading and generate high returns.

In the DeFi segment, derivative trading is available to all users. However, it requires spot trading skills and studying the principles of liquidity. Derivatives include:

- Futures (futures).

- Options (options).

- Perpetual swaps.

- Credit default swaps (CDS).

- Index-based derivatives.

- Synthetic assets.

- Collateralized debt obligations (CDO).

Insurance

The DeFi segment also provides participants with mechanisms to protect their assets against various risks. Algorithms are provided by blockchain pools (funds). DeFi insurers’ payouts can compensate for losses that occur due to vulnerability of smart contracts, hacker attacks, market fluctuations and other unexpected events. The basic principles of DeFi insurance:

- Pooling. In blockchain finance, users deposit their funds into shared decentralized pools. A pool with a collective deposit helps reimburse participants who experience unexpected events.

- Use of smart contracts. Insurance blockchain funds are also governed by terms and conditions automatically prescribed in a software script.

- Customized insurance parameters. Each pool sets its own terms and conditions (e.g., expiration date, premium and maximum reimbursement amount).

- Collateral. Some pools require participants to provide a guarantee to cover losses. This becomes collateral. Collecting collateral increases confidence in the fund and reduces risks for insurers.

The work of pools, as well as all DeFi tools, is performed by a program algorithm. Blockchain helps to verify the security and transparency of operations.

Contributions

In decentralized finance, users deposit their funds into money protocols to earn interest. It is analogous to traditional bank deposits but adapted in the DeFi environment of blockchain. The procedure consists of 4 steps:

- Selecting a protocol. Services offer rates of different sizes depending on how long the funds are held and the level of security.

- Placing liquidity. The participant deposits funds into a pool of the selected cryptocurrency or stablecoin. The deposit can be made in any amount, depending on the minimum and maximum restrictions of the protocol.

- Income generation. After depositing funds, the assets start working in the DeFi system and generate income in the form of interest or rewards for participation.

- Withdrawal of funds. The user withdraws his money and income at any time convenient for him. Some protocols limit the lock-in period, other services allow participants to determine the deposit period themselves.

Decentralized trading platforms

On DEX exchanges, users manage exchange transactions using smart contracts and personal wallets. This provides complete control and security. On the other hand, CEX platforms offer higher liquidity and convenience.

However, users will have to trust the exchange as one has to hand over funds to its management. The choice between DEX and CEX depends on the preferences of the participants.

Staking

When assets are not involved in trading, passive income from locking in a deposit is available to users. This procedure is called steaking. It involves the following steps:

- The participant selects the amount of cryptocurrency to be blocked in the protocol.

- Then it is required to send the assets to the protocol’s smart contract for a certain period of time or until a list of conditions is met.

- During the blockchain, the digital coins are leveraged for network and transaction security.

- Once the steaking is complete (or conditions are met), the user gets his deposit back. For this, he is rewarded in the form of new tokens or commissions deducted when transactions are recorded on the blockchain.

Investasi

In addition to lending, participation in liquidity pools and staking, it is possible to earn money by using other DeFi solutions. One of the most popular is DeFi services to raise funding for new crypto projects (Initial Coin Offering, ICO).

In a decentralized environment, investors buy tokens of promising startups using their assets – for example, Ethereum (ETH) or Stablecoins. The acquisition takes place automatically in a smart contract and protocol.

In the future, the price of the native token of the project can grow significantly and bring good profits. However, the risks of participating in the ICO in DeFi service remain. The project may not achieve development and turn out to be unprofitable. Therefore, you should conduct a fundamental analysis of the development before making a financial decision.

Application development

To create DeFi products, new smart contracts are invented or existing protocols are used. In the latter case, an update extends the capabilities of an existing service or makes it more convenient. Developers design or update user interfaces and test program code.

Other applications

DeFi services can be used to obtain mortgage loans. Users also participate in voting for blockchain updates within the decentralized community (DAO).

The decentralized finance space has created its own unique product – synthetic assets. These can be obtained by blockchaining other cryptocurrency assets. A synthetic asset mimics the price and movement of a real token. Such products are used to diversify a portfolio, hedge risks or participate in markets that were previously inaccessible due to restrictions or high entry barriers.

In addition to the tools of the traditional financial system, DeFi also includes services of an entertainment nature – gaming, sports-related, and even in the form of lotteries. The gaming segment is called GameFi. In this segment, you can spend time playing computer games and receive income in native tokens of the cryptoproject. Sports DeFi applications belong to the SportFi sphere. Users who use them are motivated to be physically active – for example, daily walking or running. As a reward, one can receive payments in cryptocurrencies.

In the DeFi world, there are various decentralized lotteries that offer participants the opportunity to play, receiving tokens or other digital assets. Such services are also based on blockchain smart contracts, making them transparent and secure.

DeFi is a dynamic ecosystem of financial instruments that actively evolves depending on what phenomena characterize the current demand. By 2023, new forms of investment and entertainment services remain on trend.

Examples of services

One of the most reliable DeFi platforms is considered to be MakerDAO. It is a protocol on the Ethereum network that provides loans in native stablecoin with a peg to the US dollar – DAI. For lending, you need to make a cryptocurrency deposit in ETH.

Equally popular is the Compound service. The protocol is also focused on lending transactions. Users deposit assets in a smart contract to receive interest on deposits or to borrow. Rates are dynamically generated based on internal supply and demand.

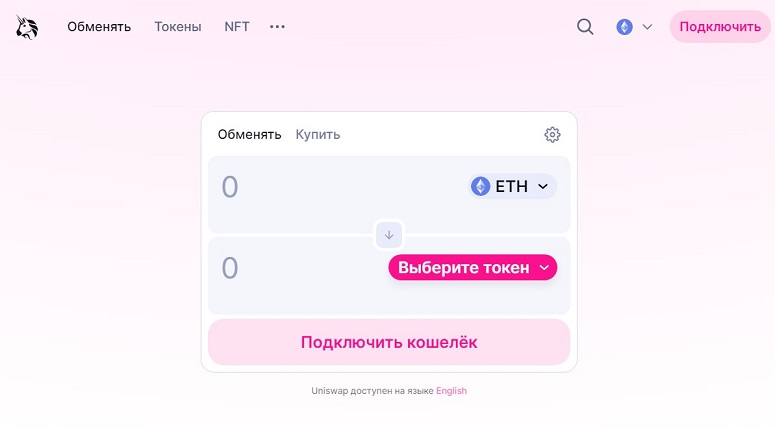

One of the first DEX exchanges was Uniswap. It is a decentralized trading platform on the Ethereum blockchain. On it, users exchange tokens without registering a profile, keeping personal data secret. Uniswap collects deposits from liquidity providers into pools. Users can create such a fund in any asset pair on the Ethereum blockchain.

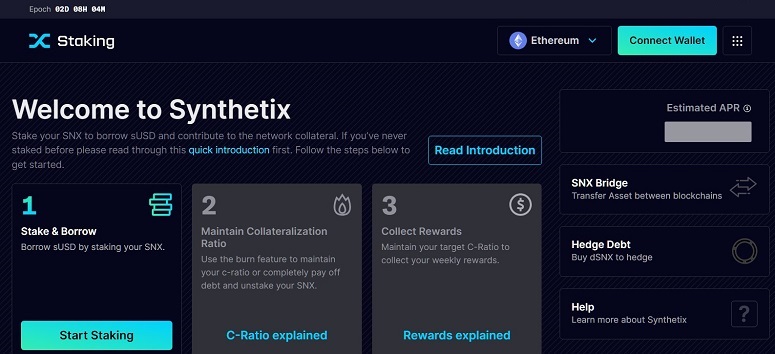

Synthetix.Exchange is a decentralized exchange and platform for creating synthetic finance. This form of tokenization is linked to the value of real assets or indices (gold, stocks or cryptocurrencies). Users can trade synthetic tokens on the platform or deposit them as collateral for loans. The service has no native stable digital currency, but synthetic versions of fiat are available. The sUSD asset mimics the value of the U.S. dollar, while sEUR mimics the value of the euro.

The TokenSets platform helps investors automatically create token portfolios. Several asset management strategies are available for selection. Portfolios are automatically reallocated according to market conditions and the holder’s goals.

In the entertainment sector, PoolTogether’s lossless lottery is best known. Users deposit stablecoins into a DeFi pool. One participant picks up the prize pool once a week. Notably, after the lottery ends, all investors get their deposits back.

Blockchains for DeFi

The decentralized finance segment needs a popular and fast network. It allows you to operate large amounts of liquidity and perform many transactions simultaneously. The most popular blockchains for deploying DeFi services in 2023 are considered:

These are just a few examples of blockchains that are being used in the DeFi environment. In the last year, decentralized finance has become integrated into the Bitcoin network. Previously, the concept of smart contracts was not available there. However, with their emergence, teams of developers began to work on creating analogs of popular DeFi services in the new blockchain space.

Pertanyaan yang sering diajukan

📌 What other DeFi lotteries exist?

In addition to PoolTogether, raffle platforms include the YieldWars, FarmHero, and FireLotto services.

✨ Farming is part of decentralized finance? What is its principle?

Yes, this tool also belongs to DeFi. The principle of farming is for the user to blockchain their cryptocurrency assets in order to get additional tokens or interest for participating in liquidity.

⚡ What is asset lending?

It is the placement of assets so that other users can borrow them. This form is available in centralized financial systems.

🔥 What is the essence of liquid mining?

It is the blockchain of a couple of assets. This is how services replenish the liquidity of 2 cryptocurrencies. The income is also paid in a pair of tokens.

🔔 DeFi protocols can only be deployed on a single network?

No. There are multi-chain services. Broadly speaking, Polygon blockchain refers to an ecosystem for deploying DeFi protocols across different networks, but helps them to easily interoperate with each other.

Apakah ada kesalahan dalam teks? Sorot dengan mouse Anda dan tekan Ctrl + Masukkan

Penulis: Saifedean Ammousseorang pakar ekonomi mata uang kripto.