In October 2023, the crypto market is valued at $1.05 trillion. New coins are appearing every day. Governments see them as a threat to the traditional banking system, so they are developing their own assets. According to the Bank for International Settlements (BIS), 86% of the world’s central banks are working on a new digital currency called CBDC. Some countries are already using government crypto-assets, while others are still testing. Mass adoption will take several years. In the article, readers will learn how digital money works, as well as their pros and cons. Right now, making settlements in CBDC is voluntary. But states plan to create a convenient infrastructure that will allow to gradually abandon cash.

What is the digital currency CBDC

In 2008, the emergence of Bitcoin marked the beginning of a new market. Cryptocurrencies quickly gained popularity. Ordinary users and institutionalized people are investing in the coins. The growth of trade turnover stimulates governments to pay attention to this sphere.

The abbreviation CBDC stands for Central Bank Digital Currency. It is a concept of a means of payment – electronic national money.

CBDC can be used in non-cash settlements. For example, you can transfer money to other users and pay for purchases. Digital money is issued by central banks, which guarantee the stability of the exchange rate relative to fiat, regulate circulation and ensure the security of transactions.

Background

Technological advances have led to banknotes being used less frequently. According to Mastercard, in 2023, the share of cashless payments in most countries exceeds 70%, and in the United States, Belgium, France, Canada, Sweden – 90%. This affects the ability of Central Banks to conduct effective monetary policy.

5020 $

bonus untuk pengguna baru!

ByBit menyediakan kondisi yang nyaman dan aman untuk trading mata uang kripto, menawarkan komisi rendah, tingkat likuiditas yang tinggi, dan alat modern untuk analisis pasar. ByBit mendukung trading spot dan leverage, dan membantu trader pemula dan profesional dengan antarmuka yang intuitif dan tutorial.

Dapatkan bonus 100 $

untuk pengguna baru!

Pertukaran kripto terbesar di mana Anda dapat dengan cepat dan aman memulai perjalanan Anda di dunia mata uang kripto. Platform ini menawarkan ratusan aset populer, komisi rendah, dan alat canggih untuk berdagang dan berinvestasi. Pendaftaran yang mudah, kecepatan transaksi yang tinggi, dan perlindungan dana yang dapat diandalkan membuat Binance menjadi pilihan yang tepat bagi para trader dari semua level!

Funds on client accounts do not belong to the Central Bank – they are resources of financial institutions. The Central Bank does not have full control over them and can only partially influence the rate of issue and volume of money.

Also, governments see the growing popularity of cryptocurrency as a threat to financial stability. According to TripleA research, 420 million investors – 8% of the world’s adult population – owned digital coins in May 2023. BitPay, the largest bitcoin payment operator, processes more than $1 billion worth of transactions annually.

Payment for purchases with crypto-coins is prohibited in many countries. But individuals and organizations use digital assets for investments and transfers. This reduces the liquidity of banks.

Characteristics of SBDCs

Digital currencies are being created as a third form of settlement. In the language of the Central Bank, digital assets will be part of the monetary aggregate M0 (which includes cash). Citizens will not be forced to use CBDCs – the method of settlement is self-determined and voluntary. Governments seek to create a convenient means of payment that will eventually replace cash. CBDC digital currencies have these characteristics:

- No credit risk. The CB is responsible for the safety of citizens’ balances.

- Only Central Banks have the right to issue.

- Settlements are carried out on a special platform.

- The user creates only one wallet. In most countries it is necessary to pass KYC, but in China small anonymous payments are allowed.

- At any time it is possible to exchange for non-cash money at a rate of 1 to 1.

- Citizens do not pay for transfers. Companies are charged a small fee of 0.5-1%.

- It is possible to pay for purchases.

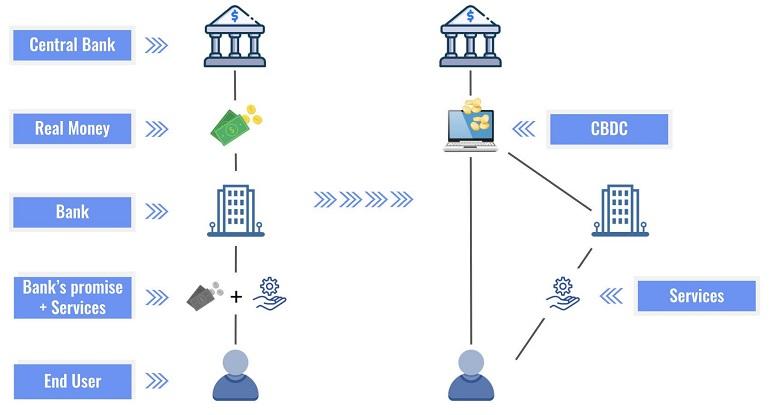

Difference with cash and bank deposit

States guarantee the stability of the SBDS rate. Digital currency is converted into cache and non-cash money at a rate of 1 to 1. The means of payment have differences.

| Parameter | CBDC | Cash | Deposit |

|---|---|---|---|

Comparison with cryptocurrency

Technically, CBDCs, like digital coins, operate on blockchain technology. Therefore, such CB assets share the characteristics of cryptocurrencies – transparency of transactions, the possibility of using smart contracts, and safe, fast and inexpensive transactions. But there are differences:

- Centralization. Bitcoin does not have a single governing body. Decisions require a vote of all participants. The SBDC digital currency is regulated by the CB – additional issuance can be announced, fees can be changed, or transactions can be banned.

- Anonymity. No documents are required to create a non-custodial cryptocurrency wallet. Accounts for SBDCs must be verified. Some countries allow anonymous transactions, but only for small amounts.

Is CBDC a cryptocurrency

Bitcoin and altcoins are coins that have no physical embodiment and no single regulatory center. Despite one technology, CBDC is not a digital asset in the common sense.

Many tokens traded on cryptocurrency exchanges do not meet the requirement of decentralization. Developers find it difficult to ensure high transaction speeds, low fees, security, and a distributed network. Teams are reducing the number of trusted nodes, which leads to the centralization of cryptocurrency. Power is concentrated in the hands of companies and large investors.

Formally, decisions are made by the community, but ordinary users cannot influence the results of votes.

Differences between SBDCs and stablecoins

Stablecoins are cryptocurrencies backed by fiat money. For example, the exchange rate of the most popular stablecoin USDT is pegged to the price of the dollar. Coins are issued only after the appropriate amount of USD is credited to the account. Holders can exchange tokens for real dollars at any time through the Tether Limited website.

SBDCs are not backed by physical assets – the guarantor of their stability is the national Central Bank. If necessary, governments can issue new digital coins and distribute them to users.

For example, in 2021 China distributed 40 million crypto-yuan to citizens to popularize the means of payment.

Risks and challenges of a central bank digital currency

Supporters of CBDC talk about the advantages of the new means of payment – fast and cheap settlements, secure transactions, simple implementation of monetary policy. Opponents draw attention to the risks – threat to privacy, financial freedom and the traditional banking system.

Commercial structures cannot earn on commissions and will be forced to leave the market. After the mass introduction of SBDS, users will start opening accounts and taking loans directly from the Central Bank. The security of settlements will be ensured by smart contracts.

Government token is a convenient target for cyberattacks. When funds are concentrated in one place, a successful hacking attempt can do a lot of damage. Even with modern defenses, governments are not immune to attackers.

In the history of the Fed, there have been more than 50 attacks on the reserve. In 2016, hackers managed to steal $110 million.

Implementation

To create a convenient and secure method, a level of centralization and distribution of functions between the Central Bank and intermediaries must be envisaged. In all SBDS models, central banks are the sole issuer. Only they can issue and burn tokens.

There are 2 mechanisms of CBDC digital currency implementation – wholesale and retail. In the first one, access to the asset is provided only to professional participants, in the second one – to all users. The wholesale model differs little from the traditional model, so the retail mechanism is mainly discussed. The widespread availability of the new payment instrument will cause digital assets to start competing with other financial products – accounts, deposits and cash. This will completely change the current banking system.

Impact on monetary policy

In 2023, no Central Bank is considering charging interest on the balance of SBDS accounts. Therefore, the impact on monetary policy is minimal in the short term. The global financial crisis has shown that interest rates cannot go below zero. Otherwise, investors will withdraw assets into cash.

If the cache is not used, the situation will change – governments will be able to set negative rates. This is possible if similar interest rates are also charged on national tokenized wallets. Cash may only disappear in the long term, as happened with coinage.

Privacy feature

When designing a national token, authorities have to compromise between users’ right to anonymous transactions and the risk to the financial system. Cash is confidential – there are no records of transactions, no need for identity verification. But such funds can be used for criminal purposes. CBDC of most countries cannot be used without KYC.

Anonymity is needed not only by criminals, but also by entrepreneurs and ordinary citizens. The need for privacy contributes to the growing popularity of cryptocurrencies. A compromise may be the “controlled privacy” implemented in China. Citizens are allowed to make small transactions anonymously.

Use of synthetic CBDCs

Governments are discussing public-private partnerships. The Central Bank is only responsible for issuing, controlling and clearing synthetic CBDCs. The choice of technology, monitoring and conducting transactions is done by businesses. So far, this is only a theory. For realization in practice, the launch of several regulated stablecoins is needed. When realized, synthetic stablecoins will compete with the state cryptocurrency.

Pros and cons of SBDS

Banks charge a fee of at least 2-3% of the transaction amount for transfers. Businesses pay for acquiring 5-10% of revenue. The use of digital currency of the Central Bank will save millions of fiat units on a national scale.

SBDS can simplify international settlements. Asian countries (China, Hong Kong, Thailand, UAE) are already working on a joint project mBringe – a single platform for cross-border payments. Central bank digital currencies have both weaknesses and strengths.

| Keuntungan | Kekurangan |

|---|---|

How digital money works

The new means of payment can be settled in the same way as other forms. Central banks are free to give users full management access or allow only intermediaries. Countries are developing several CBDC digital money models and have not yet reached a consensus.

Financial institutions

In the Model FI mechanism, the Central Bank retains the role of issuer of digital currency. Only professional market participants – banks and non-credit organizations – are allowed to use it. They can conduct fast, cheap transactions for their clients and ensure the security of transactions with the help of smart contract technology.

The entire economy

In Model EW, financial institutions and companies have direct access to government tokens. But small businesses cannot interact with the platform without intermediaries. For this, a CBDC digital currency exchange has to be launched for transactions. The infrastructure will be supported by a third party.

Financial institutions and limited access to banks

The Model FI+ mechanism is designed to analyze the benefits and risks of different levels of access. The use of the SBDS is restricted to all banks and companies. In this case, one financial institution acts as a narrow bank, providing liquidity to other participants.

The choice of a bank for this role does not depend on its size and risk profile. Such factors as the amount of funds on the balance sheet, loan portfolio, as well as the actions of clients do not influence.

How to use in practice

Regardless of the inner workings of digital currencies, the process is as simple as possible for citizens. To pay for purchases and transfers, you need to perform the same actions as when using a mobile bank. The general algorithm is as follows:

- Register a wallet through any financial intermediary. Most often it is a bank, in which the citizen acts as a client.

- Replenish the balance from the account of any financial institution. The exchange rate of non-cash money to SBDS is 1 to 1.

- Go to the site of the seller accepting digital currency.

- Scan a QR code with a smartphone camera.

- Confirm the transaction.

CBDC digital currency in Russia can be sent to all wallets registered in the system. The Central Bank does not have the goal of making money on the integration of the digital ruble, so no commission is taken from individuals.

SBDC in Russia

The Central Bank of the Russian Federation presented the draft platform in 2020. At first, the government took the idea without enthusiasm. But in 2022 sanctions forced to look at the concept of the digital ruble from a different angle.

The country uses a hybrid CBDC model – the platform is created using blockchain technology and managed by a central authority. Features of the digital ruble:

- One can register on the platform as an individual or a legal entity. Only one wallet is available.

- One needs to undergo verification through an intermediary. It can be any partner bank.

- Settlements are carried out on behalf of the user on the platform of the Central Bank. The Bank of Russia is responsible for the safety of funds and the correct display of the balance after transactions.

- Investors can send money to other wallets and pay for purchases. Transfers for citizens are free, for companies the commission is no more than 1%.

Start of testing

The Bank of Russia launched the project in 2022. During the year, the developers prepared the infrastructure. For interaction with the digital ruble, a special platform was created. Central Bank programmers used their own solutions and open source software. Partner banks upgraded mobile applications to integrate the program.

At the initial stage, 4 financial institutions joined the project. In 2023, this number increased to 15. In March 2023, a focus group tested wallet replenishment and transfer functions. In the summer of 2023, the State Duma passed a law on the digital ruble. After that, testing on real money began. Private companies will be connected to the project to study the payment for purchases.

Experience of different countries in the application of digital money

In 2017, the Bank of Great Britain convinced the largest countries of the need to implement CBDC. In June 2023, the Atlantic Council of the United States said that research is being conducted in 130 states. Some countries are already using digital currencies, while others are still testing.

Some governments, after studying the issue, decided to abandon the project. For example, Japan began developing a state cryptocurrency in 2020. In 2022, the country conducted 2 stages of testing. But in August 2022, the Bank of Japan (BoJ) announced that it would not issue a digital yen due to low interest in society. More than a third of the country’s population is not ready to abandon cash in favor of other payment methods.

Central banks in the Bahamas, Eastern Caribbean, Nigeria, Jamaica and the Bahamas have implemented CBDC in 2023. A second phase of testing is underway in China and Sweden. Digital currencies are available to the public, but not in all areas. These countries are the least dependent on cash. In Sweden, less than 2% of citizens use such digital currencies, and in China about 10%. Therefore, the transition to SBDS can be made as easy as possible for the population.

Trends and development prospects

According to the Atlantic Council, in 2023, 14 countries are testing a national cryptocurrency and preparing for its mass introduction. Despite the advantages of the new means of payment, there are challenges that hinder rapid integration.

According to ECB President Christine Lagarde, the project will take 5-10 years for mass adoption. The central bank’s cryptocurrency offers a mechanism that is qualitatively different from cash. Therefore, the money of countries that do not want to create digital platforms may depreciate. This will happen if citizens start using another country’s SBDS. Experts predict that the countries that are the first to introduce a new means of payment will claim to make their CBDC global.

Impact on cryptocurrency

Bitcoin was created as an alternative means of payment for users who have stopped trusting the traditional banking system. CBDCs have the advantages of cryptocurrencies except decentralization. Therefore, digital money will be used by customers who need guarantees from the government.

The cryptocurrency industry will continue to evolve and become an alternative for those who require anonymity. Coins will also remain a speculative instrument. The SBDS rate is tied to fiat, so it will not be possible to make money on deviations.

Pertanyaan yang sering diajukan

⚡ On what devices can I launch a wallet for the digital ruble?

The Bank of Russia developed the platform and integrated it into the mobile applications of partners. The software only works on modern smartphones.

📌 How will regulators deal with the potential outflow of liquidity from banks to CBDC wallets?

At the first stage, balance restrictions will be imposed. For example, the Bank of Russia will prohibit deposits of more than 300 thousand rubles per month, and the ECB will limit the account to 3,000 digital euros.

✨ After the implementation of the CBDC, will the income of banks decrease?

Financial organizations will not be able to make money on transfer fees. Governments expect that this will incentivize banks to offer new investment products, which will offset losses in whole or in part.

🔔 How do central banks plan to get citizens interested?

SBDCs will be in demand in countries with a low share of cash payments. Governments believe that providing a convenient means of payment is enough for popularization. To stimulate demand, popular retail chains should be involved in the project. Citizens will choose the new payment method if they are offered a discount.

📢 Why do many citizens oppose the implementation of CBDC?

The main reason is that government cryptocurrencies take away users’ financial privacy and allow governments to control account transactions. In times of crisis, a common way for the poorest to survive is to go into a gray area and receive subsidies from the government. For example, during the pandemic, cash transactions in the US increased by 50%, while bank liquidity increased by only 2%.

Apakah ada kesalahan dalam teks? Sorot dengan mouse Anda dan tekan Ctrl + Masuk.

Penulis: Saifedean Ammousseorang pakar ekonomi mata uang kripto.