Theoretically and legally, digital assets are not money, which fulfills 3 functions: a medium of exchange, a unit of account and a means of saving. Not many goods and services are valued in cryptocurrencies. Digital assets are not universally accepted as a unit of account and means of payment. While many cryptocurrency payment apps have been created, none of these methods have become a mainstay for everyday transactions. The exception is financial transactions in the criminal world. Apart from the non-acceptance of digital assets as units of account, there are other problems with cryptocurrencies. The issues of legalization, insurance, stability of coins and tokenek are raised in the global community.

The main problems of cryptocurrencies

A lot of information is published daily about the benefits of blockchain and digital assets. However, cryptocurrencies have drawbacks that cause many conservative investors to call them a bubble. It is important to identify and understand the problems that may prevent mass adoption of new technologies.

Instability

Price volatility due to the lack of intrinsic value is a major problem with cryptocurrencies. Because of the volatility, Warren Buffett calls the digital asset ecosystem a bubble.

Price volatility is a serious problem that is solved by tying the value of cryptocurrency to tangible and intangible assets. The flaw is partially addressed by the creation of stablecoins, where market participants back the coins and tokens with fiat currencies, gold, diamonds and energy resources. The widespread adoption of backed digital assets increases consumer confidence in cryptocurrencies and reduces volatility.

Lack of legislative framework

Prices for digital assets are quoted in US dollars (or other fiat currencies). Thus, cryptocurrencies are no different from commodities. To be legally considered money, digital assets must be recognized under the laws of a country as a monetary unit. This legal tender status allows market participants to fulfill their obligations to creditors.

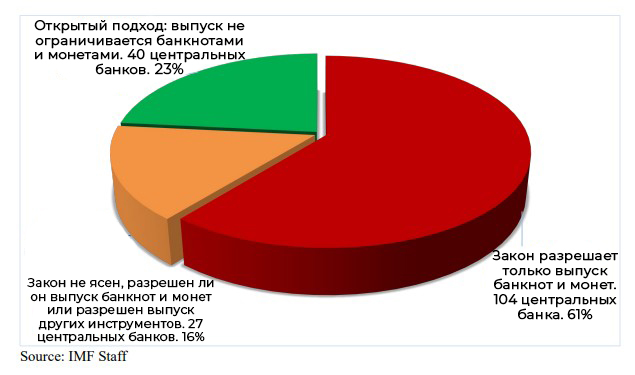

A study by the International Monetary Fund found that ~80% of the world’s central banks are prevented or restricted from issuing crypto-assets under existing laws. In 2020, China passed a law authorizing the central bank to issue virtual units of account. However, the world’s first official digital asset DCEP is not a cryptocurrency.

5020 $

bónusz az új felhasználóknak!

A ByBit kényelmes és biztonságos feltételeket biztosít a kriptopénz kereskedéshez, alacsony jutalékokat, magas szintű likviditást és modern eszközöket kínál a piacelemzéshez. Támogatja az azonnali és a tőkeáttételes kereskedést, és intuitív felülettel és oktatóanyagokkal segíti a kezdőket és a profi kereskedőket.

Keress 100 $ bónuszt

új felhasználóknak!

A legnagyobb kriptotőzsde, ahol gyorsan és biztonságosan elindulhat a kriptovaluták világában. A platform több száz népszerű eszközt, alacsony jutalékokat és fejlett eszközöket kínál a kereskedéshez és befektetéshez. Az egyszerű regisztráció, a tranzakciók nagy sebessége és a pénzeszközök megbízható védelme teszi a Binance-t nagyszerű választássá bármilyen szintű kereskedők számára!

Legal tender status is given to units of account that are easily used by people in ordinary life. To handle coins and tokens, a digital infrastructure is needed, including computers, smartphones, and the internet. This condition makes it impossible to turn koins and tokens into full-fledged money.

The risk of investing in cryptocurrency will remain high until governments legislate the technology. Other problems with digital assets are logistical in nature. For example, changing protocols is a necessary process that can be time-consuming and disrupt the established flow of transactions.

Loss of access to the wallet

Another problem with cryptocurrencies. Bitcoin users have lost about 20% of all existing coins. Unlike fiat currency, which can potentially be recovered, the lost units will not be put back into circulation. The reason lies in the structure of cryptocurrencies and their security. While the loss of 20% of bitcoins will not have a significant impact on the market, the capitals of individual investors could be at risk.

Crypto investors usually store their coins and tokens in digital wallets protected by special algorithms and accessible only through a private key. No one can take possession of the assets. This is usually a good thing. But if the wallet owner loses his private key, the funds will forever remain inaccessible.

This security flaw in cryptocurrencies has spawned an entire industry of bitcoin hunters who help investors recover lost BTC. Hackers typically charge a commission of 5-40% of the recovered funds and use a variety of tools to aid in their investigation. Hunters examine the hardware or even resort to testing different key combinations.

There is no guarantee of a refund

People are always making mistakes: writing down numbers incorrectly, failing to save important information. Some errors are detected immediately, while others are not. If a cryptocurrency user enters an incorrect wallet address during the exchange, he is guaranteed to lose his funds.

Digital assets do not have a central regulatory body, but operate in distributed systems on blockchain technology. The problem with cryptocurrencies is that no one will give the investor guarantees of compensation for losses in case of errors in transactions with digital assets.

Malware and hacker attacks

Cryptocurrencies are prone to security breaches. Hackers break into exchanges, empty wallets, and infect computers with malware that steals digital assets. Since transactions are conducted online, attackers misappropriate users’ funds through phishing and viruses. To protect purchased cryptocurrency from theft, investors should be confident in their security system and the counterparty whose services they use.

Software needs to be updated regularly. There are very few ways to recover lost coins and tokens. If a user’s wallet keys are stolen, the thief can impersonate the original account holder. He will gain access to the funds just like the user. Once the bitcoins are transferred out of the account and the transaction has been recorded on the blockchain, the investor will lose his money forever.

Cryptocurrency exchanges shutting down

Digital assets rely heavily on unregulated companies that are often susceptible to hacking. Any exchange deals with financial transactions, so it must maintain security as well as comply with KYC (customer verification) and AML (anti-money laundering) regulations. Cryptocurrency trading platforms are not responsible for volatility and other market risks. However, exchanges do have their own specifics:

- Data loss. There is always a risk that servers will fail, information may be irretrievably lost. Data leakage is also possible when stored in cloud services.

- Loss of user funds. A serious risk for any coin and token exchange is hacking or unauthorized access to traders’ capital. It is possible to lose money as a result of a system error.

- Infrastructure failure. The number of clients is growing, and the system is not ready for such loads. As a result, there are failures, problems with withdrawal and trading, vulnerabilities that create the risk of theft or loss of money. There are user security issues, increased risks of hacking, long-term failure of the exchange and serious reputational losses.

- Inability to meet regulatory requirements. Regulatory restrictions, as well as non-compliance with AML and KYC terms and conditions, can lead to site blocking and problems with fiat currency exchanges.

Exchanges that encounter such situations are more likely to subsequently shut down and users lose their funds.

Technical problems

The risks associated with digital assets are becoming increasingly apparent alongside their potential benefits, which emphasizes the need to properly understand the technical challenges.

Peer-to-peer interactions during virtual currency trading are governed by specific protocols. If there is disagreement over consensus rules, this could lead to the separation of cryptocurrency. For example, in 2016, two versions of the Efirium currency appeared: Ethereum and Ethereum Classic. Although both projects were originally a single blockchain, they are traded differently. This is called a villa. In most cases, forks create confusion and technical difficulties. This is a serious problem with cryptocurrencies.

Protocol vulnerabilities

The biggest challenge faced by digital currency is the lack of proof that users didn’t spend the same money twice. Traditional financial systems solve this problem by adding a superstructure of banks and other institutions. They account for each payment and ensure that funds are not spent twice. Bitcoin was the first digital currency to offer an alternative solution that didn’t require a third-party intermediary. This was done through a decentralized network of nodes that follow the same protocol to achieve consensus and store transactional data. In order to spend bitcoins or any other coins and tokens twice, the user must either gain control of a significant portion of the network or find a way to simulate that the transaction has been validated. Among the popular hacks in the world of blockchain technology, the following are technically performed:

Means that attackers gain control of 51% of all nodes in the blockchain, allowing them to control the network by taking advantage of a majority-based consensus protocol. Attackers can spend cryptocurrency twice and cancel transactions.

Such schemes only apply to coins and tokens based on the Proof-of-Work consensus algorithm, such as Bitcoin and its derivatives. The more concentrated a part of the network is in the same hands, the higher the risk.

Hackers quickly send coins to the seller and into their wallet: one right after the other. If an attacker controls a node, they can reject the first transaction, prioritize the second transaction, and pass this action to other nodes for confirmation, tricking users.

Aimed at merchants who do not wait for transaction confirmation before sending an item. For this hack, attackers must run their own node. They include transactions between their wallets in new blocks that they create themselves. The deceived merchant, without seeing this, ships the ordered goods. The new blocks are then released into the network. Transactions against these blockchain items have a higher priority and therefore only they are recorded on the chain.

Was invented long before blockchain technology. Creates a threat to any online system where a single device can try to control the network with multiple identities. In blockchain, an attacker can run multiple nodes and outmaneuver legitimate participants in the network. In fact, Sybil is a clone of the 51% attack.

To prevent hacking, blockchains implement various consensus algorithms. Proof of work or ownership shares increase the cost of misconduct and make it disadvantageous for attackers.

Unreliable ICOs

In 2017, investing in blockchain and cryptocurrency related projects has become very popular. This type of fundraising is called Initial Coin Offering (ICO). Projects have started to easily raise large amounts of investment with nothing more than an internet connection. In 2017, more than $1.7 billion was raised through ICOs. There were few successful projects and many investors lost their money. The cryptocurrency market is still unregulated, there are no risk assessment mechanisms and there is no guarantee of return on investment other than the honest word of the people who came up with the project.

Just because someone has an idea doesn’t mean it’s good and feasible. There is no guarantee that the final product will make a profit, or that the project creator won’t spend the money on himself. He or she may simply abscond with the money, knowing that it is virtually impossible to trace the recipient in the cryptocurrency market.

Fraud

Since the introduction of cryptocurrencies to the market, their value has proven to be unstable. The potential for very high returns on a new type of asset attracts fraudsters. This poses risks to coin and token holders. Beginner investors are more susceptible to situations with fraudsters than professionals.

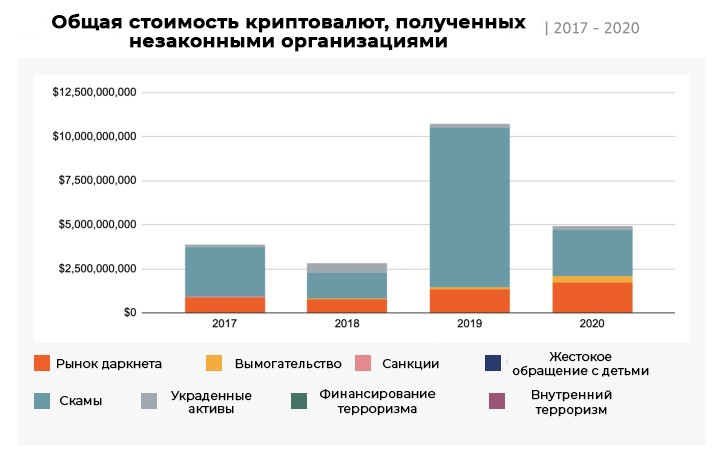

In addition, cryptocurrency is unregulated, so it is easier for criminals to exploit it than traditional regulated bank accounts and other authorized investment schemes. The combination of these factors has led to an increase in cryptoasset fraud.

Attackers typically target individuals rather than companies. Victims are chosen at random. They are usually incentivized to make investments by promising high returns. Often, however, the scammers take the investors’ money and disappear.

In other cases, people hand over funds for a crypto asset and either lose control over it or don’t realize what they bought at all. Scammers create a fictitious cryptocurrency exchange and sell people digital money, claiming that its price will increase as the trading platform grows. When the holder tries to withdraw assets from the exchange, they find that they cannot access the funds. Therefore, anyone planning to invest in cryptocurrency should only use well-known platforms that can be easily verified by conducting a simple internet research.

The possibility of a digital currency market crash

Proponents of bitcoin say that it is an investment opportunity. However, there is a cash flow associated with the financial asset. Coins and tokens generally have no source of income or practical application. Speculation is their raison d’être. Coin and token prices are subject to sudden and random movement and can be managed. This raises another problem: savings.

For an asset to serve as a means of capital accumulation, it must be liquid, applicable, and have a stable value. Cryptocurrencies have none of these characteristics.

Bitcoin trading suffers from illiquidity and manipulation due to the existence of whales (wallets containing large quantities of BTC coins).

At the end of 2020, the top 100 Bitcoin addresses accounted for 13% of the total number of bitcoins, with the identities of most owners unknown. Thus, all it takes is a few whale wallets to manipulate the market, causing dramatic price fluctuations. The volatility has made cryptoassets a risky instrument to save.

There is a possibility that the prices of coins and tokens will eventually collapse. This could be caused by a shift in monetary policy or after regulations are passed.

Recommendations for asset holders

The following measures can help avoid problems:

| What to check | Action |

|---|---|

| Address | Carefully check all characters of the recipient’s account number, the amount sent, and the fee before sending. |

| Messages from users | Do not click on unknown links. |

| Pénztárca | Write down a mnemonic phrase that will allow you to regain access to funds. Use hardware wallets to store assets. |

| Beruházások | Keep cool and make informed decisions when investing, do not panic or rush into things. |

| Portfolio | Remember that crypto investments are very risky. Do not invest more than you can lose at any moment. Diversify your investments. |

| Biztonság | Run high quality anti-virus protection to secure the devices that are used to access crypto wallets and trade on exchanges. |

Összefoglaló

For all the possible obstacles to mass adoption, cryptocurrencies (and blockchain technology) will evolve. They offer many of the benefits consumers are looking for in the current system of finance: decentralization, transparency, and flexibility.

But some problems of the cryptocurrency market remain unresolved. These primarily concern price stability, investment security and the fight against digital fraud.

Gyakran ismételt kérdések

❌ What happens if a bitcoin transaction fails?

When nodes reject a transaction, the funds sent by the user are returned to their wallet address.

🤨 Why is bitcoin a high risk?

It is an asset that is not backed by anything. A rise in quotes can be replaced by a decline.

🤑 Can cryptocurrency make an ordinary person a millionaire?

Due to volatility, the value of tokens and koins changes very quickly. If you find successful market entry points, you can make high profits. But there are risks of losing capital due to falling quotes.

🛡 Which coin is the safest?

Bitcoin is the most famous crypto asset. The coin influences the market, it is safer than most altcoins.

🤔 Which cryptocurrency exchanges can be trusted?

Trading platforms that are at the top of the lists, which have positive reputation and reviews.

Hiba a szövegben? Jelölje ki az egérrel, és nyomja meg a Ctrl + Írja be a címet.

Szerző: Saifedean Ammous, a kriptovaluta közgazdaságtan szakértője.