The large number of instruments on the exchange can be confusing for new users at first. The most difficult thing to understand is the additional transaction fees that the service charges. From this material, readers will learn what trading commissions on Binance are, their size and important features. The figures are current as of October 2023.

General information about commissions on Binance

On the Binance exchange, service fees are charged in one form or another for each financial transaction. Given that the instruments are different, some commissions are calculated as a fixed percentage, while other fees depend on additional conditions.

At what point the fee is charged

Most fees are calculated as a percentage. Cases in which the exchange withholds a portion of the money:

- Fees for transfers and turnover of fiat currencies. A fee is always deducted when sending assets from the exchange. Sometimes you also have to pay a percentage for depositing funds into your account. The amount of fees depends on the type of asset. Also, when withdrawing cryptocurrencies, the choice of blockchain network, and therefore external transaction costs, is involved in the formation of additional fees.

- Trading commissions. These include spot transactions, margin borrowing, peer-to-peer (P2P) exchanges and the execution of derivatives transactions. Each type has its own subtleties, but the commonality is that the service portion tends to depend on the size of the transaction.

- Additional services. Fees are withheld if an exchange user applies internal tools to generate passive income – for example, Binance Launchpad, Simple Earn and others.

- Funding and funding of futures contracts. This is a unique interest rate that came to the crypto economy from traditional stock exchanges. In this case, it does not apply to Binance revenue. The fees in the form of funding rate are paid by traders among themselves.

The structure of fees on the Binance exchange is much more complex than described in the main groups. Therefore, it is necessary to understand the principles of charging fees and interests. The data specified in the material are current as of October 2023. The size of commissions and tariffs may dynamically change over time.

Fees on Binance

Service fees play an important role in the world of finance and investment. They make up the internal liquidity of an exchange. On the one hand, it is needed to keep the service running. On the other hand, the exchange uses part of the income received in financial operations. For example, Binance invests liquidity to issue in the form of loans. This is money that users can borrow in the form of margin when trading on the spot or futures market.

The more complex the financial instrument, the more fees are involved in its mechanics. Therefore, new clients are recommended to trade on the spot market. There are minimal commissions involved in its operation. When trading derivatives for the first time, the situation is more complicated and requires a separate study.

5020 $

bónusz az új felhasználóknak!

A ByBit kényelmes és biztonságos feltételeket biztosít a kriptopénz kereskedéshez, alacsony jutalékokat, magas szintű likviditást és modern eszközöket kínál a piacelemzéshez. Támogatja az azonnali és a tőkeáttételes kereskedést, és intuitív felülettel és oktatóanyagokkal segíti a kezdőket és a profi kereskedőket.

Keress 100 $ bónuszt

új felhasználóknak!

A legnagyobb kriptotőzsde, ahol gyorsan és biztonságosan elindulhat a kriptovaluták világában. A platform több száz népszerű eszközt, alacsony jutalékokat és fejlett eszközöket kínál a kereskedéshez és befektetéshez. Az egyszerű regisztráció, a tranzakciók nagy sebessége és a pénzeszközök megbízható védelme teszi a Binance-t nagyszerű választássá bármilyen szintű kereskedők számára!

Cost analysis is part of a trader’s strategy and an important element that significantly affects the final income.

Commissions accompany every monetary transaction. Therefore, it is worth paying attention to the following actions.

When depositing money

To trade on Binance, you need to deposit funds into the account. This is done in traditional currencies or cryptoassets. There are 2 nuances when depositing fiat:

- For depositing money from bank cards in most cases, you do not need to pay anything.

- Replenishment of the exchange balance from the account of payment systems can be both free and accompanied by a commission. Its presence and size depend on the agreement between Binance and the third-party service.

For example, for Russians in October 2023, the transfer with bank cards is not available. However, you can enter rubles from the account of 2 payment systems – Payeer and Advcash. In this case, Binance does not withhold money, but payment services take 0.5% of the transfer amount.

Cryptocurrency deposit also depends on 2 parties – the exchange and the blockchain network. Binance also does not charge money for replenishment with digital assets. However, you have to pay a fee for a transaction in the network.

The lowest cost of transaction fees for depositing cryptocurrencies on Binance is through BNB Smart Chain and Tron. In both cases, they will be less than $1 (from 10 to 70 rubles).

When transacting with cryptocurrencies, the basic principles should be taken into account. They apply to both the replenishment and withdrawal of tokens and coins. Features of operations:

- Transaction fees are held in cryptocurrencies.

- Digital assets can be withdrawn from the Binance exchange using different networks – for example, through BNB Smart Chain (BSC), Ethereum, Tron and others.

- Costs are paid in the native cryptocurrencies of the selected blockchain.

- The fees vary from network to network.

- Cryptocurrency withdrawal fees are fixed and do not depend on the amount of assets in the transfer.

For example, sending 1, 10 or 1 thousand USDT through the BSC network will cost the same in each case – 0.29 USDT, or approximately 28 rubles. If it is necessary to withdraw the same stablecoin in any volume via the Ethereum blockchain, the costs will be 3.21 USDT, or about 314 rubles.

It should also be taken into account that the size of transaction fees in the blockchain may increase from time to time due to network congestion and a large volume of transactions at one time.

When withdrawing funds

You can send money from the exchange both in the form of cryptocurrencies and in fiat, including for Russians. Features of the withdrawal of rubles from Binance:

- You can not send money to bank cards.

- You can withdraw to the accounts of payment systems. 2 services are available.

- Sending to Advcash is free, to Payeer – with a 1% commission.

For transactions with other national currencies, bank transfers and transfers to the balances of payment systems are available. The list of services and the amount of fees should be specified for each asset individually. This information can be found in the “Commission rate” subsection (tab “Deposit/Withdrawal”).

For a transaction with cryptocurrencies, it is always necessary to pay network fees. This is mandatory for recording data in the blockchain.

Standard amount per transaction

After making a deposit, you can use the money in trading and investments. Fees are also deducted for these transactions. Data can change, so you need to check the relevance on the exchange’s website. The amount of commission on Binance per transaction in October 2023 is shown in the table.

For spot trading

This type of trading is the least risky. In it, traders perform selling and buying using their deposit. Therefore, the risk of losing only personal funds remains.

Spot transactions are transactions in which the buyer immediately receives the asset after payment.

For each successful financial action, the exchange takes 0.1%. Commissions on Binance for a transaction on the spot market are withheld from the received asset. For example, in the ETH/USDT pair it looks as follows:

- If you need to buy Ethereum with payment in stablecoin, the costs are formed in ETH.

- If you deposit ether and need to sell it for USDT, the fees are calculated in Stablecoin.

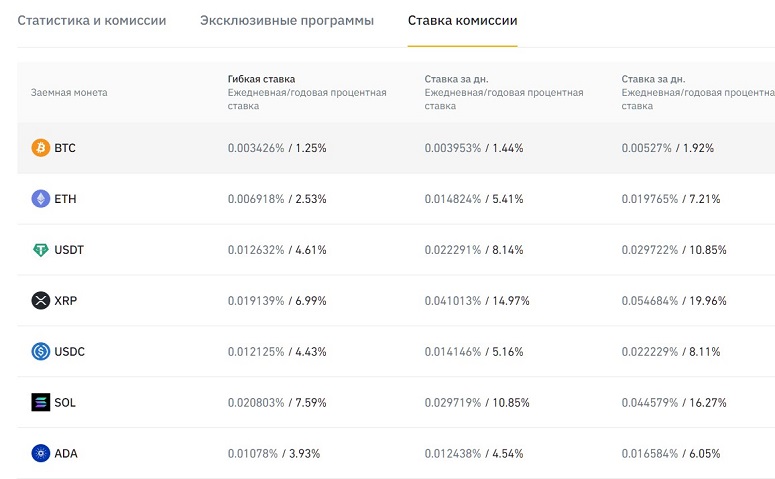

Also, spot transactions can be performed using borrowed funds. In financial terminology, the borrowed capital has its own name – margin. Loans are taken not for a long period of time, as in the traditional economy, but to fulfill the transaction. The money is returned to the exchange automatically after the order is closed. To take advantage of margin, you need to take into account several features:

- Part of the user’s own deposit is held as collateral (security).

- The exchange takes a share from 0.01 to 0.3% for obtaining leverage (leverage).

- The rate of commission for the use of margin in the spot is accrued daily. Individual conditions are developed for each crypto asset.

- If the transaction is unsuccessful, the exchange forcibly sells the assets at the market price and returns the borrowed funds.

- In case of automatic liquidation, the trader loses his part of the deposit blocked as collateral.

As a result, commissions on Binance on a spot with leverage must be paid twice – for the purchase (or sale) operation and separately for leverage. In addition, you need to remember about possible expenses due to the loss of collateral.

On futures

Fees in derivatives trading are more complicated. Features of futures commissions:

- Similar to spot trading, any transaction with contracts is accompanied by fees based on the volume of assets in the transaction.

- The formation uses the total amount of money in the transaction, taking into account the borrowed capital. In other words, the exchange takes a percentage per transaction of the full amount.

- Fees are deducted both for opening a position and for completing the transaction in the amount from 0.02 to 0.04%.

For example, a user invests his deposit of $100 and borrows $200 from the exchange. As a result, the deal is concluded at $300 and closed at $350. Detailed calculations of commission costs are in the table.

| Paraméter | Érték | |

|---|---|---|

If we draw an analogy with a spot, opening a position is the first order to buy assets. To earn money, you need to sell cryptocurrency profitably. To do this, you will need to place the second order. In futures, the same action occurs during the closing of the position. The transaction is a kind of double intention, first to purchase an asset, then to promise to sell it in the future.

The size of the commission for trading on Binance can vary. This is due to the rate at which the purchase or sale is made.

If the transaction takes place at the limit price, the commission is lower (0.02%). If the transaction is made at the market rate, the fees are higher (0.04%).

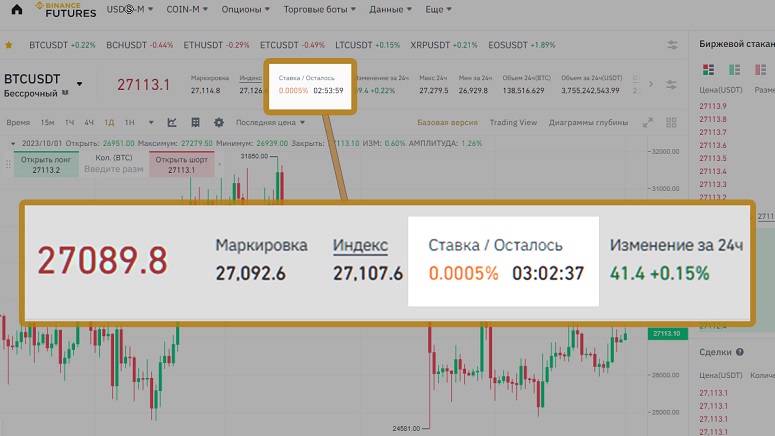

Funding

If a trader opens a futures position, a daily funding rate may be held. Its second name is fundings. The main subtleties:

- On Binance, the funding rate is charged once every 8 hours. Most other exchanges use the same time interval as a basis.

- The size of the rate changes dynamically and is fixed in a positive or negative form.

- Withholding is calculated as a percentage in relation to the entire volume of the position.

- When the value is positive, longs pay shorts. This means that traders with upside trades transfer the reward to users who are trying to capitalize on price declines.

- When the funding rate is negative, shorts pay longs.

Positive and negative rates are a way to show the distribution of power on the trading floor. If the longists are paying, it means the market is going against them and the price is falling. If the funding rate is withheld from shortists, the price strengthens and rises.

Funding is used to keep the price of a futures contract closer to the price of the underlying asset. You need to remember that the funding rate can also affect the ultimate profitability.

Therefore, it is recommended that you study and understand how this mechanism works in detail before trading futures.

Liquidation of positions

The exchange lends traders their funds. In futures contracts, users make deposits by predicting both price increases and decreases. If expectations do not come true, the transaction turns out to be unprofitable, including for the exchange.

To avoid losses, Binance forcibly sells the assets in the transaction. This is called liquidation. Simply put, it occurs when a trader has lost the amount he or she was holding at the beginning of the trade.

The exchange deducts a percentage for liquidation. It depends on the size of the position and is equal to the maintenance margin rate. Tariffs and commissions on Binance are in the table below.

| Position size | Maintenance margin rate, % |

|---|---|

It should be taken into account that in case of liquidation the trading commission for closing the transaction is also withheld. Operations with futures belong to professional types of trading. Part of the complexity is due to the intricacies of fees for different elements of the transaction.

P2P transactions

Peer-to-Peer on Binance is a kind of bulletin board for selling private holders’ assets. You can exchange both digital funds for rubles and other national currencies, as well as perform the transaction in the opposite direction.

In September 2023, Binance banned the creation of P2P transactions with rubles.

Nevertheless, peer-to-peer exchange is available for residents of Kazakhstan, Belarus and Ukraine.

Features of accrual:

- In this section, only ad creators pay the interest to the exchange.

- The size of the commission ranges from 0 to 0.35%. The indicator depends on the selected cryptocurrency in the trading bundle.

- Buyers who responded to the ad do not need to pay costs.

On Binance, P2P traders can become merchants. This will require completing a list of tasks, including completing a set number of trades.

Merchant status entitles you to trading discounts ranging from 20 to 50%.

Other commissions

The exchange charges fees in other areas as well. For example, there are costs for the following transactions:

- NFT sales and purchases – 0.9% of the trading turnover.

- Options transactions – 0.03% of the transaction volume.

- Swap-farming programs – from 0.105% of the deposit size. The coefficient is equal to blockchain exchange fees with deduction of rebate commission.

Commission difference for makers and takers

There are 2 definitions in the trading segment. Makers (translated as “makers”) sell assets at their price and are willing to wait for a buyer. In turn, time-delayed bids are called limit bids. Takers (“doers”) are traders who agree to the offered price (market or market price) and buy back already placed assets.

This terminology is used in any manifestation of the market. Makers and takers can be found in spot trading, futures and the P2P sector.

The definitions are most often used for charging commissions. Important features:

- On Binance, makers pay a smaller percentage to the exchange when trading futures – 0.2%. The fee charged to takers is 0.4%.

- For spot transactions, the costs for both groups are the same – 0.01%.

- On the P2P market, takers do not pay anything to the exchange, but makers are charged a commission of 0.35%.

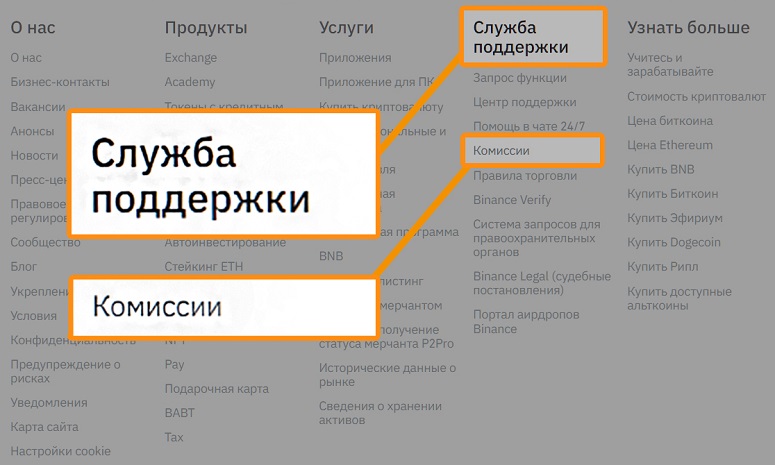

Where to see the current rates on the Binance website

All the terms of charging fees should be clearly described. On the Binance exchange, a full-fledged section “Commissions” has been created. It can be found at the bottom of the site in the “Support Service” block.

Where the information about the paid commission is located

All information about financial transactions can be found in the account. The paid fees for deposits and withdrawals from the account balance can be found in the wallet (section “Transaction histories”).

Data on trading fees are located on the “Orders” page. In this section you can get detailed information about each financial transaction.

Whether you can get a discount on fees

It is not possible to reduce the amount of top-up fees on the exchange. However, there are several ways to get a discount on trading fees on Binance. You can do this if you:

- Using BNB (Binance Coin) to pay fees.

- Participate in the referral program.

- Upgrade to a VIP level account.

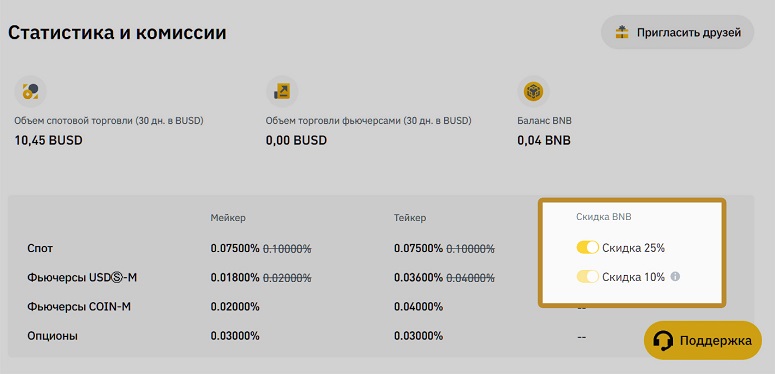

BNB

To take advantage of the discount, you need to keep a Binance Coin deposit in your wallet. You will also need to activate the toggles on the “Commissions” page.

Trading fees will then be held in BNB (Binance’s native cryptocurrency). Possible cost reduction:

- In spot, the percentage of deductions to the exchange will drop to 0.075% (by 25%).

- When executing futures trades, fees will be reduced by 10% for both takers (0.036% total) and makers (0.018%).

Participate in the referral program

Binance pays bonuses for inviting new members to the exchange. The promotional offers consist of 2 parts:

- It is possible to get a part of the trading commissions of the invited user.

- Cashback (rebate) on the amount of paid fees from their transactions is available.

You can find the invitation link or short ID of your account in the “Referral Program” section. In the “View activity history and overview” tab, detailed information about the actions performed by the joined users and accruals is available.

Program for VIP-clients

Depending on the activity on the exchange and trading volume, you can change the status of your account. After registration all traders get the level of “Regular User”.

If at the end of the month the spot turnover exceeded $1 million (for futures – more than $15 million), the status can be changed to VIP-1. It is also necessary to fulfill a mandatory condition – to make a deposit to the account in the amount of 25 BNB (about 529 thousand rubles).

Special promotions on the site

Binance regularly holds promotional campaigns and bonus programs for its users. For example, the exchange can launch a promotion to give away free tokens or provide temporary discounts on certain pairs of cryptocurrencies. In this way, Binance simulates traders to trade assets that have recently appeared on the exchange.

News about current promotional campaigns are published in the company’s blog section and official social media accounts.

Can there be zero commission

It is possible to pay no trading fees on Binance. As a rule, such promotions are held temporarily and as part of support for new crypto projects. You can also get rewards for completing daily challenges in the “Bonus Center” section. For example, a coupon or voucher will partially or fully cover the trading fees paid.

Comparing trading fees on Binance with other exchanges

Most of the exchange’s fees are at the same level as competing platforms. The commissions of different services are shown in the table below.

Gyakran ismételt kérdések

📌 What is hedging mode?

It is the ability to open trades with futures both up and down.

📢 Can the timing of funding rate accrual change?

Yes. This can happen against the background of a sharp increase in the volatility of the cryptocurrency price.

🔔 Do I have to pay a fee for copytrading?

Yes. The fee in this case consists of interest for trading, as well as deductions to the trader whose trades are repeated.

✨ What are the minimum limits for placing orders?

In the spot market, orders can be opened from $10 and futures trades from $30.

⚡ What percentage is deducted as a fee for auto-investment?

The cost of using this tool is 0.2% of the deposit amount.

Hiba van a szövegben? Jelölje ki az egérrel, és nyomja meg a Ctrl + Írja be a címet.

Szerző: Saifedean Ammous, a kriptovaluta közgazdaságtan szakértője.