Digital assets are different from fiat money. While the latter is backed by government control, cryptocurrencies are protected only by encryption and a blockchain system that records transactions. Due to the fact that digital assets are poorly regulated by governments, attackers have many opportunities to defraud investors. Bitcoin scams are becoming common. Therefore, it is important for investors to follow security measures when dealing.

Popular Bitcoin fraud schemes

As the value of Bitcoin continues to reach new peaks, the number of malicious schemes increases daily. People who dream of making significant profits from investing in BTC often regret their choice after losing money.

Despite the news and warnings, attackers still manage to deceive users. Criminals find new schemes of cryptocurrency fraud.

Fake exchanges and scam exchanges

Fake trading platforms deceive victims by posing as legitimate venues. Fraudulent exchanges often lure users with advertisements, phone calls or emails promising high returns on investment.

Criminals develop sites with adaptive design, provide information about attendance, trading volumes. Victims are even offered to set up two-factor authentication (2FA). After the user deposits funds into their account balance, exchanges refuse to withdraw digital assets or block the client altogether.

Felhőbányászat

Creators of mobile applications deceive people into thinking that they will profit from mining new coins. Users are convinced to rent equipment and pay for additional services and upgrades.

5020 $

bónusz az új felhasználóknak!

A ByBit kényelmes és biztonságos feltételeket biztosít a kriptopénz kereskedéshez, alacsony jutalékokat, magas szintű likviditást és modern eszközöket kínál a piacelemzéshez. Támogatja az azonnali és a tőkeáttételes kereskedést, és intuitív felülettel és oktatóanyagokkal segíti a kezdőket és a profi kereskedőket.

Keress 100 $ bónuszt

új felhasználóknak!

A legnagyobb kriptotőzsde, ahol gyorsan és biztonságosan elindulhat a kriptovaluták világában. A platform több száz népszerű eszközt, alacsony jutalékokat és fejlett eszközöket kínál a kereskedéshez és befektetéshez. Az egyszerű regisztráció, a tranzakciók nagy sebessége és a pénzeszközök megbízható védelme teszi a Binance-t nagyszerű választássá bármilyen szintű kereskedők számára!

These programs display a fake minimum account balance to induce the victim to invest more. In doing so, criminals take the money users spend on apps and upgrades without providing the promised services.

Phishing

Such attacks are aimed at obtaining information related to online wallets or accounts on exchanges. Fraudsters are interested in cryptocurrency vault private keys or account passwords.

Digital money phishing is similar to standard social media schemes of criminals. Token and coin holders are sent an email on behalf of an exchange or wallet. It asks them to enter information about a private key. Or the fraudsters redirect the user to a specially created fake website, where the owner of cryptoassets specifies his credentials. Having obtained this information, hackers steal coins from real accounts or wallets.

Ransomware viruses

Viruses don’t just steal personal information. They are capable of blocking access to the system. The user, trying to regain control of the wallet, transfers money to the scammers.

One of the malicious applications for stealing cryptoassets works by searching the clipboard for patterns corresponding to Bitcoin address identifiers. The virus then substitutes a new code in place of the wallet number.

The user makes the transaction. But the money goes to the fraudster’s Bitcoin wallet. To protect yourself from malicious applications, you need to use an antivirus, as well as a firewall.

Skype and e-wallet

The criminal is engaged in the sale of BTC. The transaction is conducted through an e-wallet. To make sure that the user has money, the fraudster insists that the person shows the phone screen with the balance via Skype. Then the criminal convinces to form a voucher. This is a special code that entitles the owner to receive money. The attacker activates this certificate in his account, taking the buyer’s funds.

Cryptocurrency wallet clones

One of the problems with vaults for digital assets is the risk of hacking. But some thieves don’t even hijack access to cryptocurrency wallets. Instead, they sell fake programs (vaults) online or in mobile app stores. Criminals have full access to these wallets. Therefore, they can embezzle whatever is stored in them.

The scam that affected Bitcoin Gold coin holders in 2017 is a good example. First, the criminal convinced customers to promote his website to store the token, and then stole more than $3 million in bitcoins and about $200 thousand in other cryptocurrencies.

To keep coins from falling to fraudsters, you need to use well-known and reliable wallet services.

Investment schemes

In BTC investment scams, criminals create fake websites for mining or launching a new cryptocurrency. They use many ways to attract victims. Sometimes scammers pose as investors themselves, who share tips online. Other times, they send out emails on behalf of experts, offering their victims a boost in income.

Fake investments in digital assets can also be advertised through social media. Sometimes scammers will hack into the accounts of celebrities or friends to gain the trust of their victims.

Regardless of how the scam begins, it all happens the same way. Investment sites promise huge profits and use fake reviews to make it look real.

Sometimes they offer multiple levels to invest with greater returns as the deposit increases. Victims invest their money. In return, the attackers periodically send out fake reports to show users how their investments are growing.

But as soon as the victim tries to withdraw their funds, they find that the money is gone. Sometimes the site demands to pay a commission for withdrawing the investment without giving anything in return.

Fraud involving exchangers

Two users contact the attacker: a bitcoin seller and a person who wants to buy these BTC. The exchanger requires prepayment to the card, but provides not his account, but the details of a third party.

The bitcoin buyer transfers the funds and expects the cryptocurrency from the attacker. However, as a result, the BTC seller receives the transfer, the fraudster receives the bitcoins. And the person who wanted to purchase the coins is left with nothing.

In 99% of cases, users who exchange BTC do not know that the money they receive from a third party. But the deceived buyer writes a statement to the police on the person who owns the card to which he transferred the amount. In such a situation, it is easier for the attacker to avoid punishment, as it is difficult for law enforcers to identify the data of the criminal.

Fake giveaways

Scammers create fake accounts of celebrities or famous cryptoinvestors, offering help to beginners. The mailings state that if the user sends them digital assets, they will add some of their funds to help the beginner multiply their investment.

In reality, any money the victim gives just goes into the pockets of the scammers. According to the Federal Trade Commission (FTC), attackers posing as Ilon Musk swindled more than $2 million in cryptocurrency from investors in one six-month period.

ICO

Initial public offerings of tokens and coins attract investors with high profits. But some ICOs are fraudulent schemes. In such a case, the announcement of the initial token and coin offering uses fake biographies of team members and technical documents copied from other already existing projects.

Investing in an ICO is always risky. Because it is impossible to predict how the new coin will work. But some projects are initially aimed at committing cryptocurrency fraud.

There are two types of ICO crimes:

- Completely fake currency. Criminals create something that looks like a new altcoin and manipulate its price on exchanges. They then simply take investors’ money, causing the exchange rate to crash.

- Scammers spoof a real cryptocurrency that has a real ICO. They create a similar website or social media profile and use phishing emails to lure investors. Visitors think it’s a chance to get their hands on a new cryptocurrency as soon as possible. But in reality, they are sending their money directly to the criminals.

The best way to avoid such scams is to carefully study information about ICOs before investing.

Pyramids

Cryptocurrency investments can also be used as a vehicle for a traditional Ponzi scheme, where money from new followers is paid out to previously joined customers.

Purported investments in emerging cryptocurrency markets have been the basis for many pyramid schemes. Not all investors understand the principles of tokens and coins correctly. This helps to cover up the fictitiousness of the scheme.

BTC donations

Users allegedly receive cryptocurrency for participating in a mutual aid fund. Everyone who joins the organization is supposed to accept donations from all its members. But before you need to send a certain amount of assets (for example, 0.001 bitcoins) to other donors. In the end, the scammers get BTC, and the victims of this scheme lose money.

Funds

Many companies manage investors’ capital, including buying cryptocurrency on their behalf. Instead of investing in real digital assets, fraudulent funds misappropriate clients’ money and use it for personal purposes.

Blackmail

Another popular method is sending threatening emails. In their messages, scammers claim that they have evidence that the user has visited adult websites or other illegal online resources, and promise to disclose this information if the victim does not send cryptocurrency to the criminal. Such cases constitute extortion. They should be reported to law enforcement.

What threatens in Russia for fraud c Bitcoin

For the misappropriation of other people’s property in the Russian Federation, there is liability under article 159 of the Criminal Code. Attackers face punishment up to imprisonment. However, at the moment, the regulation of the sphere of cryptocurrencies in Russia is imperfect. This allows fraudsters to remain unpunished.

Transactions in the blockchain can be traced. Even if fraudsters manage to trick investors and get their cryptocurrency, there is a chance that cashing out will be prevented by trading platforms. Many exchanges and exchanges use tools that help track the origin of assets and verify their purity.

How to protect yourself from fraud

Before investing money, you should check all the information about the company that created the investment offer. Search online for the name of the organization and the name of the cryptocurrency using words like “review,” “scam,” or “complaint.” See what other people are saying. In addition, there are characteristic signs of a scam:

- Attackers promise that you can make a lot of money in a short time and achieve financial freedom.

- Scammers offer large payouts with guaranteed returns.

- Criminals promise profits without effort or investment.

- Scammers make loud claims without details and explanations.

All of these are scams. Even if there are celebrity testimonials, they are easy to fake. No one can guarantee a fixed income. In addition, competent investors should always understand how their investments work and where the money goes. Online statements and user reviews can help identify companies and people to avoid.

Necessary legislative solutions for protection

The U.S. Securities and Exchange Commission classifies cryptocurrency as an asset, investing in which is similar to investing in a business.

The U.S. Internal Revenue Service (IRS) equates tokens and coins with any other property. This makes it possible to get returns on cryptocurrency investments. And through its Criminal Investigation Division, the IRS can uncover money laundering scams, even if the perpetrators used digital assets.

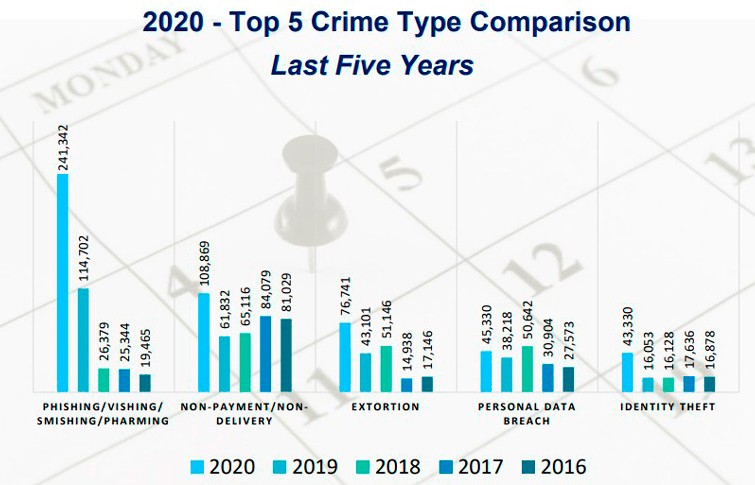

In May 2000, the U.S. created the Center for Internet Crime Complaint Intake in the United States. Since its launch, nearly 5.7 million letters have been received. These appeals concern online fraud affecting users from different countries.

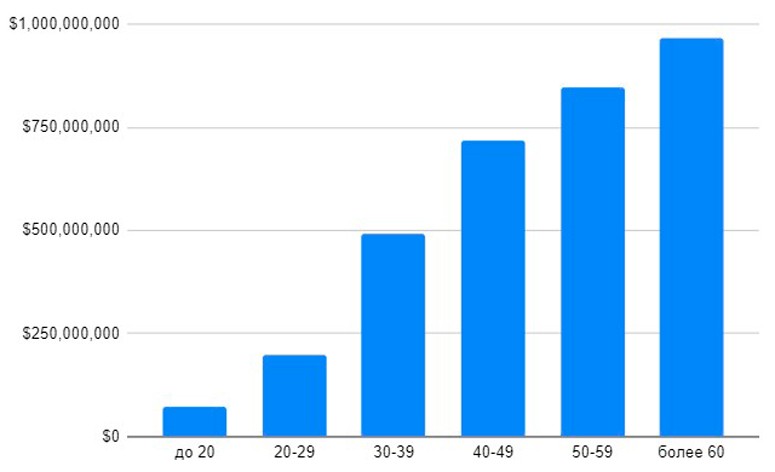

| Év | Number of victims, thousand | Amount of losses, billion |

|---|---|---|

| 2015 | 288 | $1,1 |

| 2016 | 298,7 | $1,5 |

| 2017 | 301,6 | $1,4 |

| 2018 | 351,9 | $2,7 |

| 2019 | 467,3 | $3,5 |

| 2021 | 791,8 | $4,2 |

Russia has not fully legalized token circulation, despite the fact that the law “On Digital Financial Assets and Digital Currency” came into force on January 1, 2021. It is prohibited to use coins in the Russian Federation to pay for goods and services. But it is allowed to be used as an investment object. Because of this, it is impossible to fully regulate the market at the state level.

Criminal prosecution of fraudsters for illegal operations with cryptocurrencies is also practically not carried out. Only after the status of digital assets is established at the legislative level, Russia will be able to protect the rights of its citizens from cryptocurrency thieves.

Tips and advice on how to protect yourself from fraud

Not all ways to defraud crypto investors are considered new. Criminals adapt old techniques to convince users to pay them. To protect your capital from scammers, you should follow elementary network security practices:

- Install an antivirus program.

- Hide your internet connection.

- Create only complex passwords.

- Store assets on reliable (cold) wallets.

It is also important to pay attention to the warning signs of cryptocurrency scams:

- Promises of huge returns. In real investments, high returns are associated with high risk.

- Offers of free money. This is guaranteed to be a scam.

- Lack of description of the transaction. Cryptocurrency investment scams often gloss over the details of how the investment works. Real advisors, on the other hand, are usually eager to explain how they can help clients get their money.

Gyakran ismételt kérdések

⛔ Can I get back bitcoins sent to scammers?

No, the way blockchain technology works does not allow you to undo transactions.

😱 What was the biggest cryptoaffair?

The BitConnect project misappropriated $2 billion received from investors from all over the world.

👛 Can a bitcoin wallet be tracked?

While blockchain records are open to public view, there is no system that identifies the specific owner of an address. Law enforcement can track the wallet owner through a money trail, but it’s not easy.

✅ Can the Bitcoin network be trusted?

Yes, Bitcoin provides a very high level of security when used correctly.

👮 Can the police track bitcoins?

Law enforcement agencies have access to the same features that regular users have. It is possible to trace the transfer path of cryptocurrency, but criminals often manage to cover their tracks.

Rossz szöveg? Jelölje ki az egérrel, és nyomja meg a Ctrl + Írja be a címet.

Szerző: Saifedean Ammous, a kriptovaluta közgazdaságtan szakértője.