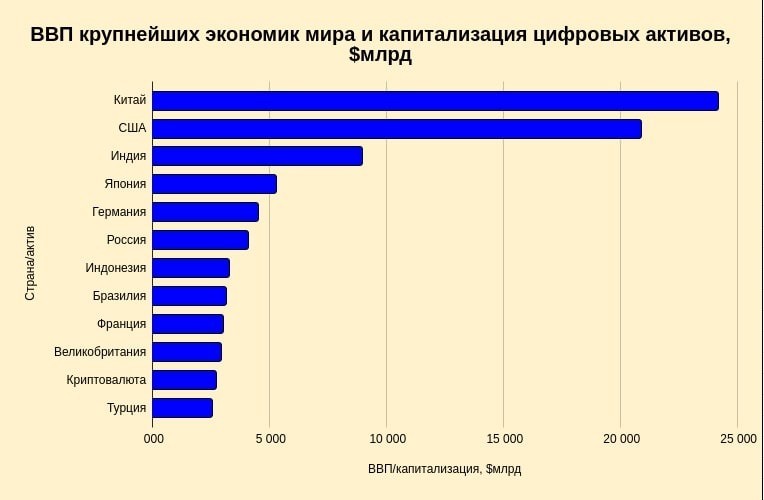

Capitalization best shows the significance of the digital world. The volume of virtual money is $2.58 trillion (at the end of November 2021). This is an amount on a par with the budgets of the largest countries. At the same time, the digital world is heterogeneous. There are coins that serve as objects for investment, trading. There are many scam projects, fraudulent developments. However, no one disputes the relevance of cryptocurrency, because the digital world has become part of the real world. They influence each other, develop together. Bitcoin and altcoins are prophesied to be an alternative to fiat money, and blockchain – to the traditional financial system.

Relevance of cryptocurrency in 2024

In 2017, during the first boom on virtual assets, they were considered financial pyramids. A few years later, attitudes have changed. In 2024, bitcoin and altcoins are serious tools for trading, investment. Blockchain-based projects are changing people’s attitude towards digital money. This is noticeable in the development of non- fungible tokenek(NFT). Celebrities are releasing music, writing paintings, creating videos and digitizing them. Tokenization of art objects makes it possible to secure copyrights, confirm ownership.

Capitalization

Price is one of the main criteria. Capitalization shows how much all the project’s koins are worth. It is calculated using the formula:

Capitalization = asset price X number of coins issued (mined).

The market value of the project shows how much money is needed to buy all the securities at once. For example, Tesla’s capitalization is $900 billion at a price of $900 per share and their total number of 1 billion. This is how much money a potential investor needs if he wants to buy out the world’s most expensive car company now, provided that the holders of the securities agree to sell.

The market capitalization of koins is calculated in a similar way. For example, for bitcoin, this figure looks like this:

5020 $

bónusz az új felhasználóknak!

A ByBit kényelmes és biztonságos feltételeket biztosít a kriptopénz kereskedéshez, alacsony jutalékokat, magas szintű likviditást és modern eszközöket kínál a piacelemzéshez. Támogatja az azonnali és a tőkeáttételes kereskedést, és intuitív felülettel és oktatóanyagokkal segíti a kezdőket és a profi kereskedőket.

Keress 100 $ bónuszt

új felhasználóknak!

A legnagyobb kriptotőzsde, ahol gyorsan és biztonságosan elindulhat a kriptovaluták világában. A platform több száz népszerű eszközt, alacsony jutalékokat és fejlett eszközöket kínál a kereskedéshez és befektetéshez. Az egyszerű regisztráció, a tranzakciók nagy sebessége és a pénzeszközök megbízható védelme teszi a Binance-t nagyszerű választássá bármilyen szintű kereskedők számára!

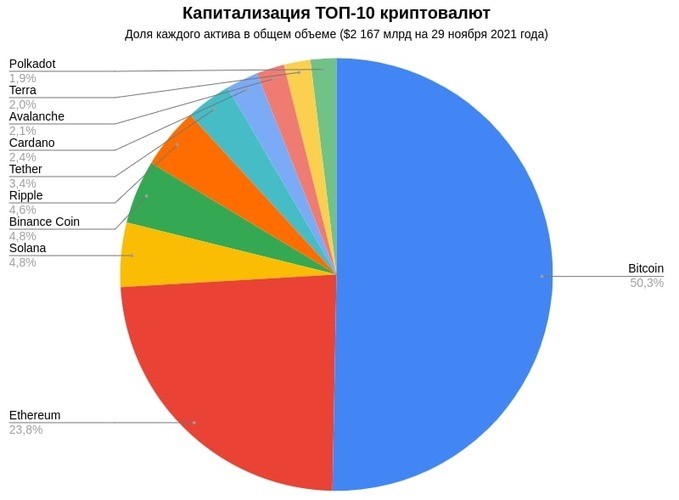

$54,400 X 18.95 million BTC = $1.03 trillion.

The first value is the current bitcoin price at the end of November 2021. Accordingly, 18.95 million BTC is the total number of mined coins as of that date. Bitcoin’s capitalization is more than $1 trillion dollars. This is almost 2 times the volume of the next asset – etherium.

The record value of capitalization was in early November 2021 and exceeded $3 trillion.

The rates of major crypto assets reached the maximum values. Later, there was a correction, and the level of capitalization decreased (is $2.71 trillion as of November 29, 2021).

Capitalization shows that digital assets are a force to be reckoned with. As Bank of America stated, “the cryptocurrency market is too big to ignore.”

Scopes

Crypto-assets include 2 concepts: coins and tokens. Their difference lies in the blockchain. Coins are based on their own distributed network, tokens are realized on someone else’s. The purpose is also different. Cryptocurrency is a means of payment. Different methods are used for issuance:

Tokens do not always act as a means of payment. The emission is performed one-time at the start of the project. A token serves as a financial instrument and provides information security for the blockchain.

Cryptocurrency serves other purposes:

- It acts as a trading instrument for trading.

- Serves as an investment object.

- Serves as a means of payment.

Not all cryptoassets are equally popular among investors and traders. The relevance of bitcoin and a number of altcoins is proven by time. It is enough to look at the exchange rate, trading volume on exchanges and capitalization.

Private investors, companies and funds use cryptocurrency to save their savings. For example, MicroStrategy keeps some money in bitcoin, has more than 100,000 BTC (November 2021). Tesla and other investors are doing the same.

The scope of tokenization is broader. As of 2020, NFT is a popular direction. Tokenization of assets, their digitization provide copyright protection.

Decentralized finance (DeFi) is a huge area of application of digital assets. It includes lending services, deposits. Tokens ensure the functioning of these systems.

Convenience

Virtual money is different from traditional payment units. The convenience consists of the following:

- Decentralization – there are no governing and controlling bodies.

- Security – cryptographic encryption methods are used.

- Anonymity – no one controls transactions, does not ask questions about the origin of assets. At the same time, information about transactions is recorded in the blockchain.

- High speed of transactions (depends on the features of the distributed network).

- Convenience of settlements – there are no intermediaries.

However, some advantages can be considered disadvantages. For example, the absence of regulatory authorities makes virtual currency convenient for illegal transactions.

The irreversibility of the transaction can lead to the loss of coins, for example, in the case of an erroneous address. It cannot be canceled physically, it is inherent in the nature of the blockchain.

Private keys and seed phrase are used to access a cryptocurrency wallet. If you lose them, the money will be blocked forever. The mnemonic phrase or private key cannot be recovered.

Stability

First of all, the rate of cryptocurrency depends on the trust of users. Coins are not tied to tangible assets (except for stablecoins), their value is affected by various factors:

- News background. Any significant world events can shake or raise the price. For example, a new strain of coronavirus was identified, and the rate went down.

- Actions of official authorities of states in relation to virtual currency. For example, after the Chinese government banned any operations, mining, bitcoin and altcoin rates fell.

- Statements of famous people about digital assets. This list includes businessmen, politicians, celebrities. Popular and charismatic opinion leaders (Ilon Musk and others) are influential.

- Economic events.

The problem is the volatility of cryptocurrencies. Short-term investments can ruin investors. It is recommended to buy virtual money to save capital for the long term, as well as to diversify the portfolio.

Recognition by states

The attitude to digital assets of the authorities of different countries differs. El Salvador was the first among all states to accept bitcoin as an official currency on a par with the US dollar. China banned any transactions: mining, buying, owning. Some countries recognize digital assets, but consider them a commodity. Others fully legalize koins, defining the status as a means of payment.

The table lists the countries in which coins are legally recognized.

| Állam | Jellemzők |

|---|---|

| Japan | Cryptocurrency has been authorized since 2016, it is considered a means of payment. |

| Germany | Issuing, mining, owning and trading are not prohibited in the country. In 2017, Germany recognized cryptocurrency as a financial instrument. |

| Switzerland | It is possible to pay with coins for various services. |

| Singapore | Loyal legislation is in place, which attracts startups from all over the world. Cryptoassets are considered a good or service. |

| El Salvador | Bitcoin has been recognized as an official means of payment since 2021. |

| Estonia | The country has progressive legislation that attracts different cryptocurrency services under Estonian jurisdiction. Digital assets are used as alternative means of payment. |

| Belarus | Since 2017, coins and tokens have been fully legalized in the country. They can be stored, exchanged, bought and sold. |

In addition, in a number of countries (USA, Canada, Australia, Slovenia, Malta and others) digital money is partially legalized.

Relevance of cryptocurrency mining

Mining coins of projects based on the algorithm of proof-of-work(PoW), in 2021, has turned into a serious business. Users without large investments will not be able to earn by mining. This is done by large pools and companies that have access to cheap electricity, resources to buy equipment. Cloud services for mining coins are gaining popularity.

Factors that affect the relevance of mining:

- The complexity of mining – hashrate growth.

- Prospects for increasing the capitalization of projects – limited issuance limits the opportunities for miners.

- Cost of equipment.

- Electricity consumption – regions with low price of this important resource are prioritized.

- Plans of project managers and communities for further development of networks (transition to Ethereum 2.0 and so on).

A kriptopénz jövője

The digital world has already achieved serious indicators. It is reckoned with, it is discussed, including at the legislative level. Large companies, including financial companies, invest savings, see coins as an effective investment tool. People earn fortunes on bitcoin and altcoins.

In the future, the relevance of cryptocurrencies will be higher, they will be able to exist on par with fiat money. A number of countries will accept virtual assets as an official means of payment. However, there will be no full-fledged replacement of fiat money with digital money. The state financial system is too complex a mechanism to entrust it to a decentralized network.

The main problem with cryptocurrencies is the ambiguous approach of governments to recognition. Until all countries make a unified decision, it is difficult to talk about relevance.

Eredmények

Cryptocurrency remains an investment instrument, a means for saving capital. Due to the high volatility of coins, you can earn on trading. To do this, you need to apply trading strategies, analyze the market, use different tools.

The digital world is much wider. Smart contracts, decentralized finance, non-mutualizable tokens ensure the development of the ecosystem.

Gyakran ismételt kérdések

🔎 What are the prospects for the NFT market?

Digitization of tangible assets. Tokenization is possible with different objects: music, texts, videos and others. NFTs are relevant in the gaming industry as well.

❓ Why create new digital assets if there are already more than 7000 of them?

Developers of new projects count on profit, quick popularization. In addition, there are scammers who cheat investors, collect money and fold.

📝 Should I sell coins when the exchange rate drops?

The decision is up to the investor. If the investment is for the long term, it is not worth selling. In the future, the rate may rise. In any case, a comprehensive approach and the use of analytical information are necessary.

📗 Why do some countries allow cryptocurrency and others prohibit it?

The position of the state depends on various factors. Cryptocurrency is difficult to control, and its use for illegal operations is possible. Therefore, many states decide to ban virtual money rather than develop special legislation and establish strict control over the digital market.

📈 The exchange rate of stablecoins does not change, they are tied to other assets, right?

Stablecoins are a symbiosis of fiat money and virtual currencies. The price is tied to material values: dollars, euros, gold, natural resources and so on. Stablecoins have less volatility and serve as a kind of buffer.

Hiba van a szövegben? Jelölje ki az egérrel, és nyomja meg a Ctrl + Írja be a címet.

Szerző: Saifedean Ammous, a kriptovaluta közgazdaságtan szakértője.