By the end of spring 2022, the digital asset market has expanded greatly. Many new projects, promising concepts and already working technologies have appeared. As of May 24, 2022, there are dozens of popular cryptocurrency networks with native coins, as well as thousands of virtual jetons. The list of the latter includes WBTC. This cryptocurrency belongs to the category of Wrapped Tokens. Such virtual assets began to appear in 2019.

What are wrapped tokens: the history of creation

The idea of developing Wrapped cryptocurrencies belongs to a consortium of 3 institutions:

- Kyber Network. A digital project with a blockchain of the same name and a native KNC coin.

- BitGo Inc. An institutional platform for digital asset management.

- Republic Protocol. A cryptocurrency project with a decentralized platform for over-the-counter trading.

The consortium first published the white paper on January 24, 2019. The white paper includes a description of Wrapped-token technology and has a lot of other information about this type of cryptoasset.

The English word Wrapped translates into Russian as “wrapped”. But in relation to cryptocurrencies, the term means “tokenized”.

The English-language term Wrapped was deliberately chosen by the consortium. The technology developed by the consortium involves “wrapping” the native coin of a third-party blockchain into the digital protocol of another network. Technically, this process is called “tokenization”. The creator of Wrapped cryptocurrency can choose any standard – for example, ERC-20 (Ethereum virtual chain).

5020 $

bonus pour les nouveaux utilisateurs !

ByBit fournit des conditions pratiques et sûres pour l'échange de crypto-monnaies, offre des commissions faibles, un niveau élevé de liquidité et des outils modernes pour l'analyse du marché. Il prend en charge le trading au comptant et avec effet de levier, et aide les traders débutants et professionnels grâce à une interface intuitive et des tutoriels.

Gagnez un bonus de 100 $

pour les nouveaux utilisateurs !

La plus grande bourse de crypto-monnaies où vous pouvez rapidement et en toute sécurité commencer votre voyage dans le monde des crypto-monnaies. La plateforme offre des centaines d'actifs populaires, des commissions faibles et des outils avancés pour le trading et l'investissement. La facilité d'inscription, la rapidité des transactions et la protection fiable des fonds font de Binance un excellent choix pour les traders de tout niveau !

Wrapped coins are virtual assets transferred from one blockchain to another. But this approach requires Wrapped token prices to be linked to native cryptocurrency rates. This avoids discrepancies in market quotes. The pegging is done by securing the wrapped crypto coins as stablecoins.

Tokenized assets are backed by custodians. They store selected tangible assets as a sum of wrapped crypto-tokens. For example, for every WBTC, there is always 1 BTC from a custodial fund created by the developer.

A custodian can be:

- Merchant (the company providing the Wrapped token).

- Smart Contract.

- A multi-signature cryptocurrency wallet.

- A decentralized autonomous organization (DAO, or DAO).

Why Wrapped tokens are needed

By May 24, 2022, the decentralized finance(DeFi) market has become very popular. The development of this cryptocurrency sector has been greatly helped by the so-called “blockchain bridges” – software solutions for interconnectivity. They allow to transfer tokens and information from one isolated digital chain to another.

But as of May 24, 2022, not all blockchains are connected by bridges. Wrapped tokens solve this problem and increase the number of uses for crypto coins.

Wrapped digital tokens expand the uses of coins and allow them to be used on other popular networks. For example, Ethereum can be used in the BNB Smart Chain (BSC).

The most popular Wrapped Token

This is the WBTC. This wrapped crypto token is the first of its kind. It was released into free circulation by the consortium at the end of January 2019. The launch took place in the cryptocurrency network Etherium on the ERC-20 protocol. At that time, members of the Bitcoin blockchain were able to freely use a portion of dApps from Ethereum using WBTC.

As of May 24, 2022, WBTC is accepted by the following platforms:

As of May 24, 2022, WBTC has a capitalisation de $7.96 billion. The circulating supply of the crypto asset is 274.5k WBTC. The token is backed by the same amount of BTC.

Wrapped cryptocurrencies in the Ethereum network

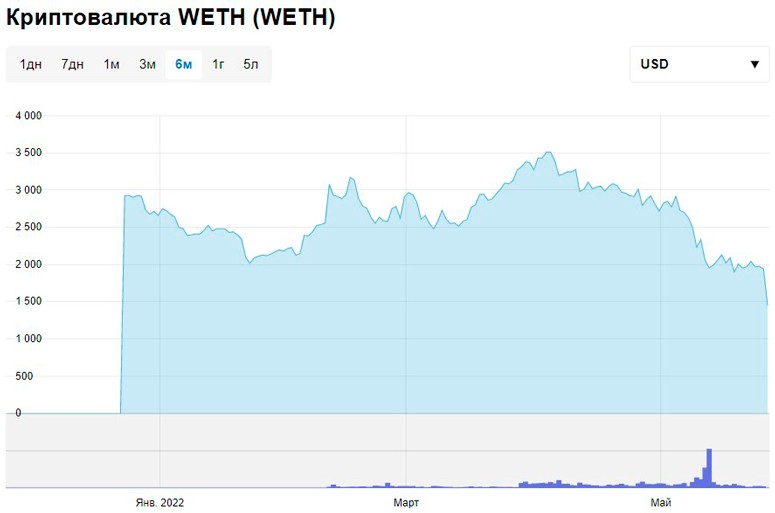

The main Wrapped token in the Ethereum blockchain is WETH, or Wrapped Ether. This cryptocurrency is the first wrapped etherium. As of May 27, 2022, the exact creation date remains unknown. WETH is released into market circulation by Radar Relay Inc.

After its creation, ETH became the prototype for etherium tokens. This means that the Ethereum coin was released before the ERC-20 cryptocurrency protocol. For this reason, ETH does not conform to its own blockchain standard.

As of May 27, 2022, some of the decentralized applications on the Etherium virtual blockchain only support ERC-20 protocol crypto-tokens. That said, dApps need standardization. As a result, regular Ethereum is not suitable when using many decentralized applications. WETH solves the Ethereum problem and standardizes dApps.

The Wrapped Ether custodial is a smart contract from Radar Relay Corporation. The main merchant is the company itself.

As of May 27, 2022, WETH has a market capitalization of $2.05 billion. Circulating supply is equal to approximately 1.15 million WETH. Average daily trading volume is $2.3 billion.

WBTC and some of the other Wrapped cryptocurrencies also work on the Efirium network. They increase the interoperability of native blockchain coins.

Wrapped tokens in the BSC

The BNB Smart Chain digital blockchain has Wrapped Tokens too. They are supported by Binance Bridge, a blockchain bridge from the developers of the Binance virtual ecosystem. It allows converting coins into wrapped crypto-tokens of the BEP-20 standard.

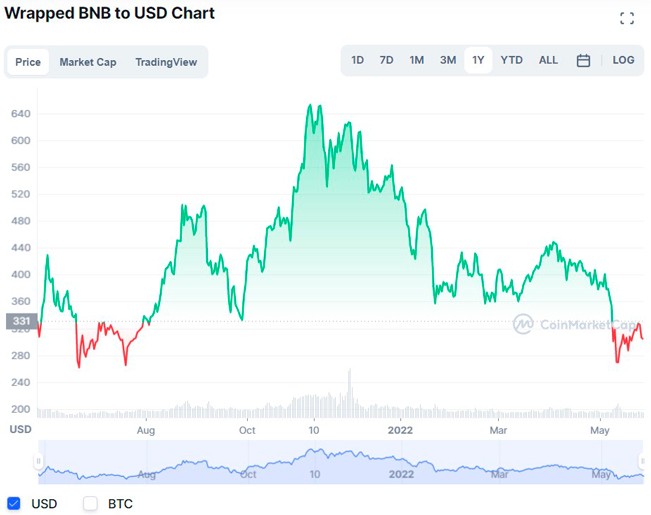

WBNB is the most popular Wrapped Token on the BSC network. It is released into circulation at the end of 2020. The cryptotoken was created by the developers of Binance.

The regular BNB has a similar problem to ETH – inconsistency with the digital protocol of the blockchain used. Because of this, the WBNB was released. It also standardizes dApps on the BSC chain.

The custodian of WBNB is a smart contract from the creators of Binance. The main merchant is the ecosystem. Also, WBNB issuance is facilitated by the Pancake Swap cryptocurrency project.

As of May 27, 2022, the market capitalization of WBNB is equal to $1.55 billion. 5.18 million WBNB were issued in total. The wrapped crypto-token is backed by the same number of BNB.

There is also a Binance Chain (BC) with the BEP-2 protocol. This crypto network also has wrapped tokens. The coins are converted (“wrapped”) through the Binance Bridge. Once exchanged, they become cryptotokens and get new tickers on the BC network. For example, a regular WIN becomes a WINB of the BEP-2 standard.

The most popular Wrapped Token in BC is BTCB. This is the first wrapped cryptocurrency in the blockchain under consideration. The BTCB digital asset was created on June 18, 2019 using the BEP-2 protocol. The token is issued by the Binance team.

The custodian and main merchant of BTCB is the cryptocurrency company Binance. The corporation stores regular BTC on a backup bitcoin address. No other merchant is known to exist.

As of May 27, 2022, the capitalization of BTCB is equal to $3.04 billion. There are 105.2 thousand BTCB in free market circulation. A similar amount of collateral (in BTC) is stored at the reserve address of the developer company.

Advantages and disadvantages of wrapped tokens

The pros and cons of Wrapped cryptocurrencies are listed in the table below.

| Avantages | Disadvantages |

|---|---|

| Freedom to use blockchains. For example, it is possible to apply BTC coins in the Ethereum network. | User funds are at the disposal of custodians. As of May 27, 2022, the technology does not allow transactions without trustees. |

| Increased liquidity and capital efficiency of centralized and decentralized exchanges | Expensive token creation. The high price is due to the need for 100% Wrapped cryptocurrencies. |

| Reduced transaction time and lower fees. Wrapped crypto-tokens allow for fast and cheap blockchains. | Occurrence of slippage. Slippages are caused by the unpopularity and low liquidity of many wrapped cryptocurrencies. |

Résumé

The idea for Wrapped tokens comes from a cryptocurrency consortium of Kyber Network, BitGo Inc. and Republic Protocol. The project group told the public about the developed technology on January 24, 2019. A few days later, the consortium issued the ERC-20 standard WBTC, the first wrapped token in the history of the digital asset market.

The issuance and maintenance of Wrapped Tokens involves:

- Merchants

- Custodians.

As of May 27, 2022, popular wrapped crypto tokens are:

Questions fréquemment posées

❓ How do I wrap or unwrap a cryptocurrency?

Some centralized and decentralized trading platforms and blockchain bridges allow you to do this.

✅ What are Wrapped tokens for?

They allow users to transfer cryptocurrency and data from one blockchain to another.

❕ What networks use Wrapped tokens?

They are mostly needed in blockchains with decentralized applications. Using wrapped cryptocurrencies in other virtual chains is almost pointless.

💰 Can I invest in Wrapped tokens?

No one prohibits investing savings in them. This is because the prices of such crypto-tokens are linked to the exchange rates of the underlying assets.

❔ What Wrapped tokens does the consortium have?

A total of 3 wrapped cryptocurrencies have been issued by the project group: WBTC on Ethereum, WBTC on Tron and WETH on Tron.

Y a-t-il une erreur dans le texte ? Mettez-la en évidence à l'aide de votre souris et appuyez sur Ctrl + Entrer

Auteur : Saifedean Ammous, expert en économie des crypto-monnaies.