There are more than 7,800 cryptocurrencies in the world. They exist within decentralized distributed networks – chains of blocks with transaction information. Data is stored on users’ computers – nodes. The network is powered by devices connected to it. Cryptocurrencies have value and are a tool for trading. You can earn on the blockchain in different ways: trading, l'exploitation minière, lending. Each method of generating income has pros and cons.

Features of blockchain technology

Technical progress is a continuous chain of inventions. The distributed registry refers to the same discoveries. Technology is developing, every year new projects arise, previous developments are improved.

Blockchain is a way of transferring information. Data in the network is recorded in the form of a distributed ledger. No intermediaries, regulators are needed to exchange information between nodes. It is possible to perform many actions, for example:

- Transfer money.

- Formalize contracts and agreements.

- Transfer personal data.

- Fix property rights.

- Transfer information about goods.

The system develops and supports itself using the power of the participants’ computers. The technology is based on cryptographic encryption of data. Each block of the chain is linked to the previous one. Therefore, having one computer with a complete node, it is possible to restore the network. It is difficult to hack a distributed chain. For this, attackers need to access most of the nodes at the same time.

The prospect of making money from the technology

Blockchain reliably stores information and works without server participation. Thanks to these qualities, projects based on a distributed decentralized network are actively developing.

5020 $

bonus pour les nouveaux utilisateurs !

ByBit fournit des conditions pratiques et sûres pour l'échange de crypto-monnaies, offre des commissions faibles, un niveau élevé de liquidité et des outils modernes pour l'analyse du marché. Il prend en charge le trading au comptant et avec effet de levier, et aide les traders débutants et professionnels grâce à une interface intuitive et des tutoriels.

Gagnez un bonus de 100 $

pour les nouveaux utilisateurs !

La plus grande bourse de crypto-monnaies où vous pouvez rapidement et en toute sécurité commencer votre voyage dans le monde des crypto-monnaies. La plateforme offre des centaines d'actifs populaires, des commissions faibles et des outils avancés pour le trading et l'investissement. La facilité d'inscription, la rapidité des transactions et la protection fiable des fonds font de Binance un excellent choix pour les traders de tout niveau !

Among the promising areas are:

- Economics, finance, banking. A distributed registry protects information. The advantage of blockchain application in the financial sphere includes the reduction of maintenance and audit costs.

- Payment systems. The technology enables secure transfer of funds.

- Insurance.

- Medicine and education.

- Logistics.

- Investments, contrats intelligents.

Earning prospects are growing as new technologies emerge. There are options for generating income through trading on cryptocurrency exchanges and long-term investing. New trends are developing:

- Initial Coin Offerings (ICOs).

- Tokenized assets.

- Implementation of distributed ledger in offline companies.

How to make money on blockchain

Decentralized networks can bring income to both beginners with small capital and large companies. The first way to earn money is mining. The extraction of new coins in the first years after the emergence of cryptocurrencies was performed on personal computers. Miners solved mathematical problems, confirming transactions. Such a method needed productive equipment. Over time, the market came under the control of large ASIC-farms (block mining devices). The miners were out of business. In addition, pools appeared, behind which there are large companies with resources, sources of cheap electricity. But besides mining, there are other ways to make money on the blockchain.

Investments and trading

Competent trading on a cryptocurrency exchange provides a constant income. The principle is to buy coins cheaper, sell them more expensive. The best cryptocurrency exchanges provide:

- A large selection of pairs for trading.

- Interface for in-depth market analysis.

- Professional support service.

- Cryptocurrency storage on the exchange wallet.

- Margin trading with leverage (the service is not available on all platforms, increases the trader’s capital, but increases risks).

Cryptocurrency exchanges with a demo account will be interesting for beginners. On it you can learn to trade without the risk of losing money. Trading is suitable only for people with strong nerves and analytical skills. Here you can not make mistakes, otherwise you will have to forget about the profit.

To work on the exchanges, minimal knowledge of economics and finance is mandatory. You need to understand the strategies that are used in trading. Trading on the blockchain is difficult because of the high volatility of cryptocurrencies. Factors that affect the price of coins:

- Attitudes towards digital assets in a particular country.

- Statements of famous people.

- News.

- Political and economic situations.

- Values and prospects of the project.

To simplify analysis and trading, algorithmic trading methods are used. Trading robots make decisions faster than a human. They are not subject to emotions. Some robots are based on neural network technology and are capable of self-learning. These are professional tools for making money on cryptocurrency.

To start trading, it is better to choose the largest exchanges in terms of trading volume and the list of available services.

An alternative to trading for beginners is long-term investing. This method involves buying and holding a coin against the expectation of an increase in the rate. This method has less potential, but there are no requirements for trading knowledge. Usually investors buy cryptocurrency at the time of a decline in the rate.

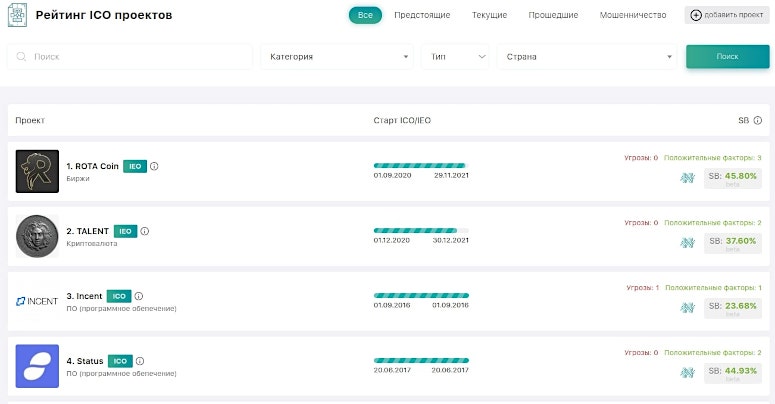

Participation in ICO

Initial coin offering is a type of crowdfunding (public collection of money) based on distributed ledger technology. ICO is held to raise funds for the development of the project, providing jetons in return. Cryptocurrency or fiat money can be invested.

Participation in an ICO allows investors to earn money. To do this, you can:

- Resell the issued tokens, provided that the project develops and becomes profitable.

- Wait for the company to develop and receive services with an advantage. In this case, the tokens are used as service tokens for working on the project.

Participation in an ICO is the support of startups. The investor invests in the future of the project.

ICO is based on trust. No one guarantees the development of the project in the future. It happens that startups close down without realizing their ideas. You can fall for scammers who collect money for a fake project.

To minimize the risks, you should study the whitepaper (technical document of the project) and the identity of the founders of the company that comes out with the initial coin offering. Since there are a lot of new startups on the market, you should choose only useful ones that offer interesting financial solutions.

Creating applications

Blockchain has properties that are in demand in different spheres of activity. IT specialists can earn money by creating applications. Programmers’ services will be of interest to companies that implement:

- Storing data in a distributed network. The advantages of this method are security, distribution of data to all network participants, and the impossibility of deleting information.

- Streaming services. Organization of payments to right holders, authors, commissions to the company-provider of services in automatic mode, without delays and human participation.

- Voting system based on a distributed register. This is a promising direction, which excludes fraud in elections. The results of such voting cannot be falsified.

- Electronic document management system. Decentralized networks automate operations in data exchange.

Such applications in the portfolio of developers increase the attractiveness for customers.

Technology implementation in companies

Corporate interest in distributed ledger technology (DLT) has been around for a long time. Companies, banks, insurance funds use or implement tools based on decentralized networks. Some buy off-the-shelf products, while others develop them themselves.

In the fall of 2021, 65 of the world’s 100 largest public companies use DLT, and another 16 are conducting research.

Statistics on distributed ledger technologies:

| DLT | Companies |

|---|---|

| Hyperledger Fabric (26%) | Microsoft, Google, Toyota, Visa, Amazon |

| Ethereum (18%) | PayPal, Nvidia, Amazon, Coca-Cola, Shell |

| Quorum (11%) | Microsoft, J.P.Morgan |

| C-RDA (8%) | SAP, Goldman Sachs |

There are other DLTs with a share of less than 2-3% of the total. Many companies use distributed ledger for investment, advertising, efficient document management, logistics, other purposes.

Experts believe that small firms will also move to decentralized solutions. This gives specialists a chance to earn money by creating applications. But this method is not suitable for everyone. To earn on the blockchain, you need to have knowledge in the field of distributed networks.

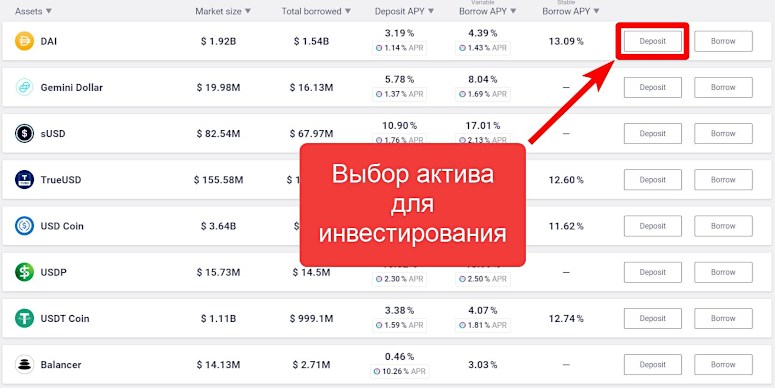

Prêts

Decentralized finance is a promising area of blockchain technology. This area includes lending – giving money to another person for a fee, interest.

In the real world, such services are provided by banks and microfinance organizations. This is especially relevant in times of economic downturn.

Decentralized lending works on the basis of smart contracts. The terms of the contract are recorded in the register, and the system monitors the fulfillment in automatic mode. Advantages of decentralized lending:

- There is no intermediary.

- Easier processing.

- The loan is cheaper, there is no intermediary’s commission.

There is a risk of not getting the money back. In case of bank, the defaulter is charged a penalty and may be liable in court. In DeFi lending, the borrower provides excessive collateral. The collateral should be more than the loan amount. If the rate of the contributed assets falls during the period of the loan agreement, the collateral needs to be increased.

It is favorable for the borrower to take the loan despite the large collateral. Main reasons:

- Need money, but there is no point in selling coins as their rate is increasing.

- Need to increase leverage in trading.

- Servicing the loan is cheaper than commission expenses when selling cryptocurrency.

Scheme of work for the lender:

- Choosing a platform – for example, MakerDAO, Compound.

- Depositing funds as collateral, locking them into a smart contract. Some DeFi protocols involve transferring these assets to the platform itself. In return, the user receives tokens from the Liguidity Pool platform. They can be exchanged for cryptocurrency or fiat money, withdrawn, invested in other projects. The borrower’s blocked funds are temporarily unavailable. But at any time they can be received back in exchange for liquidity tokens.

Such earnings on Blockchain technology makes sense if you have a large amount of free funds.

The market of digital assets is developing, you can earn on the interest of traders and investors in tokens and coins. Popular resources for working with cryptocurrency are exchanges and exchange services. You can create a platform and earn income from users who pay for the services of deposit, withdrawal, trading on the platform. To do this, you need to:

- Choose a direction for work.

- Analyze the market, identify competitors.

- Choose the principle of creation – independent development or the use of an existing product.

- Solve financial and legal issues – decide on a country for registration with loyal legislation, obtain a license, open a bank account.

Each stage is important, because to launch the exchange you need to invest significant capital. The platform must have free funds. Any error in the code, legal registration can lead to loss of investment.

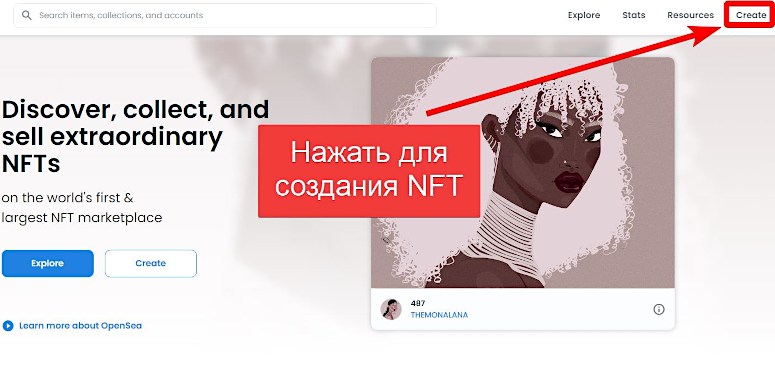

Registration of copyright or legal rights

Blockchain allows you to protect intellectual property. Non-interchangeable tokens are used for this purpose. By linking an NFT to a copyrighted item, data on any changes to the owner or copyright holder will be available to everyone.

Non-mutualizable tokens have been evolving since 2017. Anyone can buy or sell NFTs. There are different platforms for this purpose:

- Rarible.

- SuperRare.

- OpenSea.

- The Sandbox (the platform sells Land tokens – virtual plots of land in Decentrlaland).

On these platforms it is possible to create non-interchangeable tokens. For example, on OpenSea you can make an NFT from a picture, music, video. Then it can be displayed on the site and sold.

You can create a token not only from music or video. The following assets are suitable for this purpose:

- Virtual real estate.

- Game artifacts.

- Messages.

- Pictures.

- Poems.

Some tokens are little more than memes that sell because of popularity. However, the technology is applicable to any object in terms of copyright enforcement. A tokenized object can be tracked on the blockchain. It is difficult to steal. NFT rights owners can receive remuneration (royalties) for their use.

Banking industry

Blockchain is relevant for different areas. Banking is not an exception. The problems of existing financial institutions are centralized management, inefficient document flow, and high service fees. Blockchain allows:

- Protect the data of customers and the bank itself.

- Optimize document flow.

- Reduce transaction fees and increase transaction speed.

- Optimize legal costs through the use of smart contracts.

There are great prospects in changing the principles of storing customers’ personal data and information exchange between banks. The current system is imperfect, errors and losses are possible. Blockchain will provide market participants with access to information on clients and credit history.

It is difficult to make money on blockchain in already existing financial companies. This is a conservative sphere. But there is a prospect of new financial products.

Cloud storage

When processing large amounts of information, many problems arise. It is necessary not just to accumulate data, but also to provide access to it to interested parties, to update it. Centralized storage systems have these disadvantages:

- Poor security against hacking.

- Problems with reliability.

- The possibility of confidential user information being used by third parties.

Blockchain allows you to get rid of the problems of centralized cloud storage. In this case, the data is not placed on the owners’ servers, but on the personal computers of network users, who rent the storage capacity. There are already startups in this direction:

Companies are intermediaries between users who rent out storage capacity and the owners of the information.

The problem with using blockchain to store information is the limited block volume. Large files will have to be shared. In addition, data from the network cannot be destroyed. Therefore, a decentralized distributed network is used to record the terms of a transaction and to monitor the fulfillment of obligations.

Blockchain training

The development of new technologies requires knowledge, skills from the employees of companies and organizations. Blockchain is not yet part of the training program, but people far from cryptocurrency need knowledge.

Banks and companies hold seminars and courses. If you have knowledge, competence in this area, you can earn money by teaching people.

Pros and cons of blockchain

The distributed ledger technology has advantages and disadvantages. Pros of blockchain:

| Avantages | Comments |

|---|---|

| Decentralization | The network is not managed by anyone but the community. |

| Fiabilité | Blockchain cannot be stopped. |

| Sécurité | Cryptographic methods are used to encrypt data. |

| Immutability | You can’t undo a transaction, rewrite information. This advantage can bring losses. If the sender made a mistake in the details, it is impossible to return the money. |

| Speed | Transactions are made instantly (depends on the technology of the project). |

| Low cost of transactions | Compared to the commissions of banks and other institutions, transfers are cheaper. |

In some networks, such as Bitcoin, the confirmation of transactions is very long. You have to pay higher fees for increased processing speed.

Other disadvantages:

- The blockchain is secure. But if hackers gain control over 51% of computing power, they can double-spend coins, stop transaction confirmation, and take other actions against network users.

- Low interoperability of blockchain-based products and centralized applications (relevant for businesses).

- Scalability issues – limited block size in some networks, congestion, confirmation delays.

Future of blockchain technology

The adoption of distributed ledgers has been slow for a number of reasons:

- The conservative attitude of professionals towards anything new.

- Lack of skills among employees to work with decentralized applications.

- Users’ distrust of incomprehensible technologies.

But despite the problems, blockchain has a future. Distributed registries solve important problems. We should expect their implementation in finance, medicine, logistics, and other sectors of the economy.

Résumé

There are many ways to make money on blockchain. It allows you to earn income not only in traditional ways – mining, investing and trading. In 2021, there is a whole system of decentralized finance in the world. Some sectors (cloud technologies) are still underdeveloped. The market needs specialists in digital assets, decentralized distributed systems.

Questions fréquemment posées

🗂 What is blockchain?

It is a database where information is stored in distributed networks.

💰 What does it mean to make money on blockchain?

Generating income by using technology. Some ways require investment, others require only knowledge.

🙄 Are cryptocurrency and blockchain the same thing?

No, the former is a special case of the latter. Blockchain is a chain of blocks of information. Cryptocurrency is an example of a distributed ledger for financial transactions.

💵 Why buy tokenized images?

Non-fungible tokens are unique. Creating NFTs for artwork allows for better copyright control.

❓ What is DeFi?

Decentralized finance is a system of tools and services based on the blockchain system. It is an alternative to traditional banking, credit and other services.

Y a-t-il une erreur dans le texte ? Mettez-la en évidence à l'aide de votre souris et appuyez sur Ctrl + Entrer.

Auteur : Saifedean Ammous, expert en économie des crypto-monnaies.