There are many platforms where you can convert some assets into others. In 2023, you can sell and buy coins on exchanges, P2P services, exchangers and Telegram bots. The platforms differ in functionality and capabilities. For example, cryptocurrency exchangers work similarly to ground points, allowing you to quickly buy digital currency for fiat money. The choice of service should be treated responsibly.

Differences between cryptocurrency exchangers and exchanges

There are two main ways to convert digital money. Users turn to cryptocurrency exchangers and exchanges. There are a number of differences between them:

- Registration and verification. Cryptocurrency exchanges must be licensed in the countries where they operate. Registration and detailed customer data is a requirement of regulatory bodies. Exchanges do not necessarily need to create a personal account and go through the personal data verification procedure. Usually only details, email address, sometimes full name are required.

- Formation of fees. Conversion platforms take the rate of popular crypto exchanges. A markup is added to it. This is an additional payment that pays for the services of the service. On average, commissions are 1-5%, depending on the volume and direction.

- Reserve. Crypto exchanges have a limited number of coins for purchase.

- Coin selection. Exchange services usually offer only popular assets.

- Support technique. On a crypto exchange, you have to wait a few days for a response from the support team. Most exchangers have 24/7 tech support. Even if a user needs help at night, operators will consider the appeal.

- Fiabilité. Almost all crypto exchangers work without a license and do not provide data on the legal entity. The exchange in this respect looks more reliable.

Types of cryptocurrency exchangers

Conversion platforms differ from each other. Distinguish 2 types depending on how they accept payments:

- Offline platforms. Such services sell digital currency for cash. Such platforms are few, they mainly work only in large cities.

- Online platforms. They are used to buy cryptocurrency from bank accounts and electronic payment systems. This is the most common type of exchange offices.

The second, in turn, are divided by the way applications are processed. There are three types:

- Manual. All actions are performed by the operator.

- Semi-automatic. The client sends an application through a special form on the site, transactions are processed by employees.

- Automatic. In this mode, everything is done by the system.

How crypto exchanges work

Such platforms offer the most suitable environment for users who are just starting to work with cryptocurrency markets. The exchange process is as follows:

5020 $

bonus pour les nouveaux utilisateurs !

ByBit fournit des conditions pratiques et sûres pour l'échange de crypto-monnaies, offre des commissions faibles, un niveau élevé de liquidité et des outils modernes pour l'analyse du marché. Il prend en charge le trading au comptant et avec effet de levier, et aide les traders débutants et professionnels grâce à une interface intuitive et des tutoriels.

Gagnez un bonus de 100 $

pour les nouveaux utilisateurs !

La plus grande bourse de crypto-monnaies où vous pouvez rapidement et en toute sécurité commencer votre voyage dans le monde des crypto-monnaies. La plateforme offre des centaines d'actifs populaires, des commissions faibles et des outils avancés pour le trading et l'investissement. La facilité d'inscription, la rapidité des transactions et la protection fiable des fonds font de Binance un excellent choix pour les traders de tout niveau !

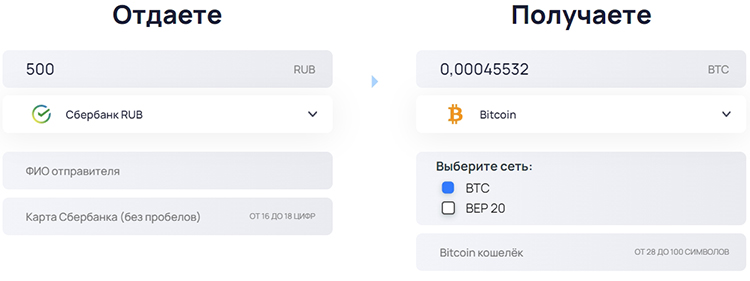

- Select the assets of interest.

- Enter the requested details: the number of the card from which the transfer will be made, the address of the wallet for crediting cryptocurrency.

- Specify the amount of the transaction.

- Go to payment. From this moment, a countdown is launched, during which you need to send money.

- Pay the application by transferring fiat or coins using the issued details.

- Wait for a reciprocal transaction.

Different payment methods are supported: bank cards, EPS and others.

Some sites allow you to make transactions with cash. This procedure may include additional steps. For example, identity identification and bank card verification.

P2P services

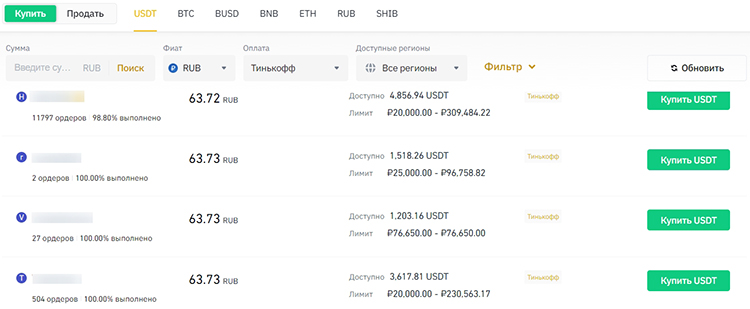

On peer-to-peer platforms, crypto market participants trade with each other directly. Exchanges take place on an escrow basis. The buyer of digital currency deposits funds into the seller’s bank account. His cryptocurrency balance is frozen until the transfer takes place. After the transaction takes place, the platform sends the locked tokens to the buyer’s account.

There are a lot of scammers in P2P services. They can send fake transfer checks. You should check the incoming payment in the online bank.

Unlike centralized exchanges, where you need to go through KYC to process an order, P2P platforms allow you to send and receive coins without asking for identity verification. Other advantages and disadvantages are presented in the table.

| Pour | Points faibles |

|---|---|

| Payment Methods. There are several avenues when trading on a P2P platform, from banks and EPSs to gift cards. | Liability. Platforms leave users responsible for regulating transactions. This includes finding a buyer or seller, agreeing to the transaction, sending cryptocurrency, and verifying payment. |

| Trade chat. It is possible to communicate with the counterparty before the exchange procedure. This allows you to clarify requirements, discuss details. | Associated risks. This point follows from the previous one. With this type of trade, the client may encounter fraud. The counterparty sometimes does not make the transfer, but marks the transaction completed. The other party sends its funds on trust, without verifying the incoming payment. |

| Escrow account. The system ensures that digital assets are protected. When the actors consent to the transaction, the coins are blocked. They will be unlocked and sent to the buyer only after the payment is made. | Transaction time. Transfers sometimes take 30-40 minutes. |

Many exchanges provide a built-in P2P service. Such a service is offered by Binance, Bybit, OKX and others. Users withdraw money to cards and e-wallets.

Instant automatic exchangers

Online cryptocurrency conversion services provide an easy and fast way to buy or sell coins. The platforms offer Bitcoin and popular altcoins. Cards and payment systems can be used in transactions.

The principle of work of exchangers is as follows: the client creates a request on the site and pays for the application, and the system does the rest. On average, in automatic mode, the transfer takes 5-10 minutes.

Infrequent delays occur due to network load or failure of the payment system. It is worth noting the advantages and disadvantages of such platforms. Read more in the table.

| Pour | Points faibles |

|---|---|

| Confidentiality. Verification is not required for transactions. | Fees. Commissions are charged by the service itself. In some exchange offices they are quite impressive. |

| No internal wallet. Instant exchangers do not store clients’ funds on the site. There is no risk for asset theft, even if the site is subject to hacking. | Sécurité. Almost all exchangers do not have registration and license. |

| Intuitive interface. A beginner can easily cope with the creation of an application. |

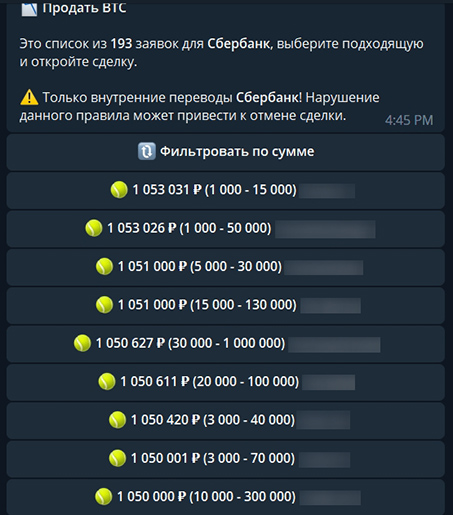

Telegram bots

Many services provide services in messenger. There are dozens of Telegram-bots in which buy and sell cryptocurrency. They are based on P2P exchange or developed with a tie to a specific conversion platform.

In Telegram, cryptocurrency exchangers work around the clock. Such platforms are easy to use. It is enough to follow the instructions in the program. The advantages and disadvantages of services are reflected in the table.

| Pour | Points faibles |

|---|---|

| User-friendly interface | Risk of falling for fraudsters |

| Favorable exchange rate and low fees | Small selection of coins, usually only popular tokens are available |

| You can see the rating of a potential counterparty and statistics on transactions | |

| Minimum exchange amount starts from a few hundred rubles | |

| Large selection of destinations |

How to properly exchange cryptocurrency

There are many platforms available for converting digital currencies. When choosing them, you need to take into account such factors:

- Fees. Exchange offices charge different commissions. In some they are fixed and transparent, in others they are hidden.

- Year of establishment and reputation. It is worth using sites that have been operating for several years. Through reviews you can learn about the quality of services and be confident in the safety of money.

- Reserve. It is important that the crypto exchange had a sufficient number of coins available for sale/buy. It is better to choose sites with a reserve of at least $100 thousand.

- Presence on popular aggregator sites. It is worth checking whether the platform is represented in monitoring.

- Feedback. It will not be superfluous to write to tech support before the deal. Specialists should not only respond quickly to requests, but also be interested in solving the problem.

- User agreement. This document is mandatory to read. It is important to know for what reasons the transfer can be canceled or blocked. It is also necessary to study the refund policy.

Protection from scammers

There are a lot of scams in the digital currency market. To save your money, you can follow these rules:

- Use aggregator sites, study reviews. This allows you to filter out honest services from disguised fraudulent schemes.

- Follow links only from official sources. Fraudsters often copy the sites of popular exchangers.

- Find out what fees are charged by the site. Hidden fees can make the transfer unfavorable. It is important to check the exchange rate offered by the service against the market rate.

- Do not send sensitive data through unsecured sites. A secure site starts with https.

- If it is P2P, you need to log into your bank account or wallet to confirm that the transfer has been received. Under no circumstances should you send cryptocurrency relying on the proof of a transaction partner.

- Double-check the details entered. There is software that changes the wallet address during the transfer.

Conclusions

Finding an exchange is a complicated process. Before using the site, you need to study the rating, commissions, supported currencies, withdrawal options. To choose the right service, monitoring sites are used.

Questions fréquemment posées

✅ What payment methods do P2P-bots have?

They offer banks, EPS, international transfers, gift cards, cash at ATMs, phone top-ups.

❓ Do all exchangers support fiat?

No, some conversion sites only offer cryptocurrency exchange.

💵 What is the minimum conversion amount in a P2P service?

It depends on the specific offer. There are some buyers who offer small limits.

🕑 How long does it take to exchange coins?

The speed is affected by the network load. Usually the waiting time is 5-30 minutes.

✋ What is the safest way to convert?

It is impossible to accurately answer this question. It is necessary to study the rating and customer reviews before using the services of the site.

Une erreur dans le texte ? Mettez-la en évidence à l'aide de votre souris et appuyez sur Ctrl + Entrer.

Auteur : Saifedean Ammous, expert en économie des crypto-monnaies.