Bitcoin is often referred to as an investment fraud scheme. This position is based on the fact that the coin’s rate depends on the addition of new buyers. Consequently, its price will decline once fresh investors stop coming to the market and investing in BTC. However, it cannot be argued that cryptocurrency is a pyramid scheme. Criminals capitalize on the volatility of digital assets when devising strategies to defraud investors. Bitcoin itself is hardly a fraudulent scheme.

Blockchain technology

The system on which bitcoin runs is called blockchain. It allows thousands of connected computers and servers to maintain a single, secure and immutable registry.

Thanks to this technology, users can make transactions without the involvement of intermediaries. It is enough to have only a wallet, which is protected by cryptographic methods using public and private keys.

When a cryptocurrency owner creates a transaction, it is broadcast over a network consisting of a large number of computers. The nodes verify the transaction and validate it. The transaction then enters the blockchain and is combined with previous network data to create a registry.

What Bitcoin (BTC) and other cryptocurrency are backed by

In August 2008, someone who introduced himself as Satoshi Nakamoto created bitcoin.org. Two months later, the white paper (the core document) of the Bitcoin network was published. It outlined the principles of a cryptographically secure, trusted, peer-to-peer electronic payment system that was designed to put financial control back in the hands of ordinary people. It was a research project that set the stage for a major technological breakthrough.

5020 $

bonus pour les nouveaux utilisateurs !

ByBit fournit des conditions pratiques et sûres pour l'échange de crypto-monnaies, offre des commissions faibles, un niveau élevé de liquidité et des outils modernes pour l'analyse du marché. Il prend en charge le trading au comptant et avec effet de levier, et aide les traders débutants et professionnels grâce à une interface intuitive et des tutoriels.

Gagnez un bonus de 100 $

pour les nouveaux utilisateurs !

La plus grande bourse de crypto-monnaies où vous pouvez rapidement et en toute sécurité commencer votre voyage dans le monde des crypto-monnaies. La plateforme offre des centaines d'actifs populaires, des commissions faibles et des outils avancés pour le trading et l'investissement. La facilité d'inscription, la rapidité des transactions et la protection fiable des fonds font de Binance un excellent choix pour les traders de tout niveau !

In January 2009, Satoshi published the genesis blockchain (the first in the chain) and 6 days later made the Bitcoin source code publicly available. Shortly thereafter, ownership of the site’s domains was transferred to other people. Since then, the Bitcoin network has been self-sustaining in an ever-changing developer community without Satoshi’s involvement.

Bitcoin is open source, public, transparent and verifiable.

When you consider the collateralization of a major cryptocurrency, bitcoin has no intrinsic value. This is true for most digital assets. Hence, for a coin to become a medium of exchange, user trust is important. It does not matter what it is secured with.

What influences the exchange rate

The creator of Bitcoin never talked about financial gain. Mostly Satoshi Nakamoto wrote about technical aspects, freedom, problems of modern banks. If he mentioned the price of bitcoin, he meant its inflationary or deflationary nature.

When new coins appear in circulation, the money supply increases. However, this situation does not always lead to inflation.

It is important that the volume of BTC in circulation increases at the same rate as the number of people using it. Then the price will remain stable.

If demand grows faster than supply, deflation will occur. Accordingly, the value of BTC will increase. As the number of users increases, the value will increase. This can attract even more participants to the network.

The source code has a limit of 21 million BTC. More bitcoins cannot be issued. Issuance limits keep the main cryptocurrency in short supply and allow it to maintain its price. Bitcoin does not give dividends or other returns, so it is not like a stock. It is more like a commodity that had no price at all for the first 1.5 years.

Legal Features

Cryptocurrency operates on the principle of decentralization. No one owns the Bitcoin network. The blockchain is controlled by users from different countries. Developers improve the software, but they cannot forcibly change the Bitcoin protocol. The blockchain will only function properly if there is general agreement among the network participants. Consequently, users have an incentive to protect that consensus.

Thus, Bitcoin does not have a single controlling organization. However, there are several bottlenecks that can limit the network’s operation:

- The government controls centralized market participants: exchanges, wallets, and fiat exchanges.

- Contrary to popular belief, Bitcoin (and other coins) are not anonymous.

- A public, transparent registry allows everyone to track cryptocurrency transactions, unlike fiat transactions.

What is a cryptocurrency pyramid scheme

On July 23, 2013, the U.S. Securities and Exchange Commission (SEC) accused Bitcoin Savings and Trust founder Trendon Shavers of creating a financial pyramid scheme using bitcoin. He attracted at least 700 thousand BTC investments in his company and promised investors up to 7% weekly income. Shavers’ fund allegedly engaged in bitcoin arbitrage, giving part of the profits to customers. However, cryptocurrency trading was only a legend.

After that, the SEC issued an official document – a warning about the dangers of fraud using digital money. In it, the commission defined the signs of a financial pyramid scheme – a crime in which existing investors are paid profits received from the deposits of new participants. Such a system is also called a “Ponzi scheme” in honor of Charles Ponzi, who defrauded investors with stamp sales in the 1920s.

Scammers create imaginary companies. They lure investors with success stories and pseudo-statistics.

Because of their volatility, cryptoassets make it easier to sell unrealistic profits to an audience that doesn’t understand how the digital currency market actually works.

People who have been burned by fraudulent schemes, identify the concepts of cryptocurrency and financial pyramid. However, this is not the case at all. This is a peer-to-peer payment system that allows you to transfer any amount of digital assets with minimal fees.

Caractéristiques

In its warning, the US Securities and Exchange Commission urged investment market participants to pay attention to some features. They are listed below:

- High returns with little or no risk. Any “guaranteed” investment opportunity the SEC recommends should be viewed with suspicion.

- Stable returns. Investments tend to go up and down over time. Investments that regularly produce positive returns regardless of general market conditions are worth questioning.

- Unlicensed and unregistered companies. Legitimacy is important because it gives investors access to information about the organization’s management, products, services and finances.

- Complex strategies in which the investor does not understand the profit procedure or cannot extract information about it.

- Problems with paperwork. Lack of account statements is a sign that investor funds are not being used for their intended purpose.

- Difficulty accepting payments. Problems with cashing out should be considered a sign of a “Ponzi scheme.”

Why Bitcoin is being equated with pyramid schemes

The financial world is divided between those who believe in Bitcoin as an investment tool and those who mistake BTC for a fraudulent scheme. According to the latter, Bitcoin is a cryptocurrency pyramid scheme. They believe that holders of the coin make money on investors who came to the market later. Economist Nassim Taleb, author of the book “Black Swan”, states that an asset that changes in price by +/-5% per day or 20% per month cannot be a currency. Some fail to see the real utility of a major digital coin, arguing that Bitcoin is a solution in search of a problem that has yet to be found.

The difference between a cryptocurrency and a pyramid scheme

Proponents of the digital asset line point to the ecosystem that has begun to develop since the latter became mainstream. Cryptocurrencies are already accepted by some of the world’s largest financial institutions.

Central banks have taken the first steps to introduce their own digital assets.

All this suggests that bitcoin and other cryptocurrencies cannot be equated with pyramid schemes. In addition, you need to consider the following factors:

- The promise of high or stable investment returns is a common sign of a fraudulent scheme. However, it was stated above that Satoshi never discussed this parameter of BTC. Over time, investors began to predict very high prices for the main cryptocurrency. The project itself did not initially possess these attributes.

- Open source is the opposite of secrecy. Since changing the protocol requires the consent of the majority of network participants, no authority can influence decision-making. Bitcoin does not rely on a website, data center, or corporate structure.

- For the same reason, there are no “paperwork problems” or “difficulties in receiving payments”. The whole point of bitcoin is to be independent of third parties.

Types of pyramid schemes

Bitcoin itself does not fall under the signs of a “Ponzi scheme”, but a large number of fraudulent projects using digital assets are created every day in the world.

Basically, cryptocurrency in a financial pyramid scheme is an old-fashioned scheme “wrapped” in a modern high-tech appearance.

As a rule, scammers attract investments in businesses related to digital assets. They promise high profits at the expense of:

- Shares in l'exploitation minière pools. Mining cryptocurrency – the process of verifying previous transactions in exchange for a reward. Fraudulent coin mining schemes promise investors a percentage of these profits.

- Sales of advertising on marketplaces for crypto projects. The administration promises to share revenues generated from marketing promotion of cryptocurrency funds.

- The growth of the price of utility tokens. For example, for the use of cryptocurrency from wallets, investors are credited with profit. It is issued in the form of a token of the project, the price of which is most often overvalued, but falls strongly before the scam.

- Trading. This is how fictitious cryptocurrency funds operate, which promise to give investors a part of the income received from successful transactions with digital currencies.

The most famous cryptocurrency pyramids

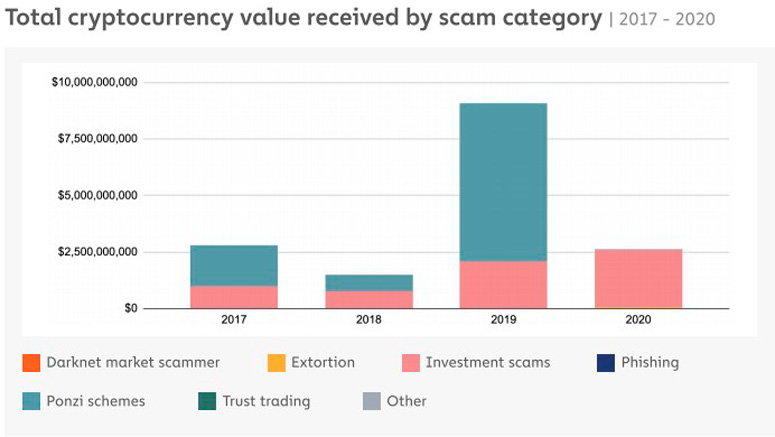

Fraud in the market of digital assets is still a lucrative form of crime. However, according to analytical resource Chainalysis, the damage from cryptocurrency scams has decreased from ~$9 billion in 2019 to less than $2.7 billion in 2020.

| Project | Number of investors | Losses |

|---|---|---|

The largest cryptocurrency pyramid scheme in 2019 was the PlusToken project, which attracted investments worth about $3 billion. Depositors’ losses amounted to more than $2 billion.

BitConnect

This is the largest bitcoin pyramid scheme. In just one year, Bitconnect managed to turn from an unknown ICO into a crypto project worth $2.6 billion.

Scammers offered to invest in Bitconnect Coin, which is beyond the control of the government. Anyone who stored BCC in their wallet could earn interest supposedly in exchange for helping to keep the network secure.

In 2017, Bitconnect announced the launch of its lending platform. It was then that the crypto community, including Ethereum founder Vitalik Buterin, openly accused the project of using a pyramid scheme.

BCC’s maximum price of $432 was recorded on January 7, 2018. Further, the value of the coin mysteriously began to decline. By January 15, 2018, it fell to $290.

The next day, Bitconnect announced that it was shutting down the lending platform, but the exchange would cease operations after only 5 days. BCC fell in price to $25.91. The losses from the token price drop amounted to over 90% in just a few days.

OneCoin

The project was aimed at incompetent users who do not understand digital coins and technologies. The administration used cryptocurrency terminology to appear like market professionals. OneCoin’s popularity grew rapidly thanks to social media. According to the legend, the coin was supposed to become the #1 cryptocurrency, destroying bitcoin.

The platform made money by selling plagiarized educational courses that came along with so-called mining tokens that allowed earning OneCoin. The minimum package offered by the project cost 110 euros, the maximum – 228 thousand euros.

In fact, the mining was fake and the coins were worthless. OneCoin never had a blockchain. Consequently, the project administration could do anything they wanted with the investment, including changing the price of the coin, deleting transactions, or even censoring individuals. Losses from the OneCoin scam amounted to about 4 billion euros. The defrauded depositors were people from 170 countries.

PlusToken

This is a cryptocurrency wallet that guaranteed users high returns for buying their own PLUS tokens. A carefully crafted marketing campaign convinced more than 3 million people (mostly residents of China, Korea and Japan) to invest in the project. The scammers claimed that revenues were generated from exchanges and mining. PlusToken was to be traded on several Chinese exchanges at a price of $350.

The project guaranteed returns of 9 to 18% monthly. However, the story ended differently. Depositors stopped receiving payouts on June 30, 2019. Chinese media reported that the project attracted more than $3 billion in cryptocurrency investments.

The damage of the pyramid in Bitcoin (BTC) amounted to 180 thousand coins.

Also, investors lost 6.4 million ETH, 111 thousand USDT and 53 OMG. The total amount is $2 billion (according to Chainalysis).

How not to become a victim of a financial pyramid scheme

It is possible not to fall for the tricks of scammers. It is necessary to take into account the following features:

- There are no guaranteed risk-free investments.

- Scammers often use vague technical jargon to describe their non-existent opportunities: “high-yield investment program”, “global currency arbitrage”. This language is designed to wow users.

- Acting according to hard-selling methods, the pyramid founders pressure the victim, preventing him or her from evaluating the nature of the investment and making a well-considered decision.

- Scammers try to hide the real nature of their scheme. They do not provide clear and understandable explanations.

- Criminals strive to make the business appear legitimate. They often have impressive job titles, glossy brochures and fictitious websites. They organize meetings in expensive locations in an attempt to inspire confidence.

- If there is any suspicion about the authenticity of the scheme, checking the company status and contact details will help.

- One should always ask simple questions about the organization and scheme of work. If the administration is evasive, it is a worrying sign.

- It makes sense to meet with the company’s management or arrange a phone call. In financial pyramids, the real founders most often do not show their faces. The roles of the managers are played by ordinary actors.

Conclusions

The scheme of any active financial pyramid is simple. It has the following mechanism:

- The fraudster places an advertisement for a non-existent instrument that offers high returns for a short period of time.

- Having received the promised profit from their investments, the first depositors begin to tell family and friends about it. Thus, the scheme gains credibility.

- Since the money is not invested in any investment instruments, there is no real profit for the company. Instead, the first customers are simply paid out of the investments made by the new participants.

- Usually the scammer disappears with the investors’ money, so the system eventually collapses. Subsequent depositors get nothing, losing even their initial capital.

Bitcoin was launched in the most honest way possible. Satoshi Nakamoto first showed others how to do it. Then he started the blockchain himself. Anyone could start mining with him in the early days. Bitcoin has always remained a fully transparent open source project with an organic growth trajectory.

Questions fréquemment posées

🆘 What should a person do if they find themselves a victim of a pyramid scheme?

Stop contact with scammers, try to cash out your deposit and do not invest any more money.

⛔ Will it be possible to return the capital from the closed project?

Since pyramid schemes are illegal companies and do not generate profits, participants are unlikely to be able to return their deposits.

❓ How to realize that a cryptocurrency pyramid scheme will soon stop working?

Investors can not receive payouts, the timeframe for withdrawing funds from platforms increases. The price of the token drops sharply.

❕ Is it possible to become a victim of a financial pyramid twice?

It happens that after a project scam, the administration contacts its investors and informs them that it will help them return the lost money, demanding a reward for this.

❔ Did the PlusToken scam affect the value of Bitcoin?

It cannot be said with certainty that the drop in the price of BTC in 2019 is caused by withdrawals from PlusToken wallets. However, transactions with large amounts have definitely affected bitcoin volatility.

Y a-t-il une erreur dans le texte ? Mettez-la en évidence à l'aide de votre souris et appuyez sur Ctrl + Entrer

Auteur : Saifedean Ammous, expert en économie des crypto-monnaies.