Digital coins were created to be the antithesis of national money. But there are many similarities between the two. Fiat and cryptocurrency do not differ much in application. They can be used as mediums of exchange and payment, invested and transferred. Both types of currency depend on economic factors and are not backed by physical commodities. Before crypto coins become the new money, there must be a global change in the economy, acceptance of the assets by the public, and recognition of this fact by governments.

What is fiat in simple words

Fiat translates from Latin as “let it be.” When applied to money, it should be understood as follows: paper currencies only have value because they are backed by governments. Fiat money is not backed by physical commodities (gold or silver), but is issued and established by the government as legal tender. Most modern paper currencies fall into this category, including dollars, euros, rubles, pounds, and others. The value of traditional money is determined by the public’s trust in the issuer, the ratio of supply and demand, and the stability of a country’s government and central bank. Unlike commodity coins (gold or silver), fiat has no intrinsic value. It is essentially a promise by a government to accept currency in exchange for a product or service. Therefore, governments seek to manage the money supply responsibly and protect banknotes from counterfeiting.

Evolution of Money

At first, coins were created from precious metals. But demand outstripped supply. Gold, silver, and copper were in short supply, so people had to switch from coins to banknotes. China was the first to issue fiat currency. The development of business in rich provinces led to a shortage of metal coins. In 1000 AD, the inhabitants of the Celestial Empire already used credit tickets and accepted paper as a means of payment. But the transition to banknotes did not happen immediately. At first, the issue of private notes, secured by the money reserve, was established. Gradually paper money entered into circulation, and the government of China began to issue national banknotes. In Russian principalities in 1370-1380 years only began minting of own coins. But for calculations and large purchases still used silver ingots. Later, a unified monetary system appeared, and then the monetary reform of Peter the Great was carried out. In the process of reorganization, there was a transition to machine minting of coins. Only in 1770 in Russia appeared the first assignations. They replaced heavy metal coins and facilitated the transportation of money. At the same time, a ban was introduced on the export of banknotes abroad and on the return import.

What determines the value

The value of fiat money depends on the state of the country’s economy and the peculiarities of governance. In states embroiled in war or experiencing political instability, national currencies are weakened and commodities are expensive. Although the face value of banknotes is determined by the state, they receive value because citizens believe in their legitimacy and accept them as a means of payment. Manufacturers of goods and service providers are obliged to work with fiat, which strengthens the confidence of users in its value.

The most popular fiat currencies

The issuance of banknotes is handled by central banks. The popularity of the national monetary unit determines the stability of the exchange rate against other world currencies and liquidity. In 2021, the market leaders remain:

5020 $

bonus for new users!

ByBit provides convenient and safe conditions for cryptocurrency trading, offers low commissions, high level of liquidity and modern tools for market analysis. It supports spot and leveraged trading, and helps beginners and professional traders with an intuitive interface and tutorials.

Earn a 100 $ bonus

for new users!

The largest crypto exchange where you can quickly and safely start your journey in the world of cryptocurrencies. The platform offers hundreds of popular assets, low commissions and advanced tools for trading and investing. Easy registration, high speed of transactions and reliable protection of funds make Binance a great choice for traders of any level!

- TheUS dollar is legal tender in 50 states. Until 1971, it could be freely exchanged for gold. The dollar is considered the world’s main reserve currency and is used for most financial transactions in the global market.

- Euro is the official currency of 19 EU countries. The issuer of the asset is the European Central Bank. There are denominations of 5, 10, 20, 50, 100, 200, 500 EUR in circulation.

- Japanese yen is a common investment asset. It is bought by central banks of other countries, large financial organizations and investment funds.

- Pound sterling – currency of the United Kingdom of Great Britain and Northern Ireland. GBP was considered the main reserve currency from XVIII to XX centuries, but after the liquidation of the gold standard it gave the palm of primacy to the US dollar.

- Swiss Franc – considered traditionally a defensive asset because it remains stable or strengthens against others during periods of market volatility.

The main function of the world’s reserve currency is to build up a nation’s foreign exchange fund. In most countries, the government decides how to use the accumulated money. But they spend them very rarely, so as not to collapse the rate of their own monetary unit.

| Currency | Price in October 2021 (satoshi) | Capitalization in October 2021 (BTC) | Circulating supply |

|---|---|---|---|

| Chinese yuan (CNY) | 255 | 599 063 556 | CNY 234.28 trillion |

| US dollar (USD) | 1 645 | 349 129 953 | 21.215 trillion USD |

| Euro (EUR) | 1 908 | 269 795 918 | 14.134 trillion EUR |

| Japanese Yen (JPI) | 14 | 218 499 513 | 1.518 trillion JPY |

| Pound Sterling (GBP) | 2 261 | 76 622 918 | 3.387 trillion GBP. |

Electronic fiat money

To facilitate transactions, financial organizations can store funds in digital databases. The value of electronic money is backed by a fiat equivalent. This is a perpetual obligation of the issuer, digitally expressed and redeemable at the time of presentation in banknotes. Electronic fiat is divided by the way it is used:

- Payment certificates of a certain denomination – stored in encrypted form and signed with the issuer’s electronic signature. In settlements, checks are transferred from one participant in the system to another.

- Entries in the user’s account – the exact analog of cashless transactions. Settlements are made by debiting a certain number of monetary units from one account and crediting them to another within the payment system.

Electronic money is circulated through the Internet, POS-terminals and other devices. They can be stored, invested, used to pay for goods and extend credit. Unlike non-cash fiat, electronic fiat exists only within the issuer’s payment system and cannot be transferred to other platforms in an unchanged form.

.

Currency problems

National money is susceptible to depreciation. Inflation comes as a result of uncontrolled printing of banknotes and a rapid increase in fiat money. Only governments can influence the situation by regulating prices and reducing the availability of currency. When a government tries to cover a budget deficit, a financial crisis arises due to a shortage of cash. The problem is exacerbated by sharp changes in the value of financial instruments. Serious contradictions between risks and rewards in this sector can cause difficulties in the entire banking system. Credit institutions have to conduct risky transactions from the balance sheet used by the payment system. Governments are partially helping to solve the problem. This leads banks to pursue even riskier policies and increase rates, knowing that possible losses will be recovered.

Differences between fiat and cryptocurrency

Paper money and digital coins combine the possibilities of exchange, investment, gift, and bequest. However, fiat and crypto have many differences. They are regulated differently, differ in volatility, dependence on inflation, and amount of currency. In transactions with crypto coins, you can maintain complete anonymity. Transactions with traditional assets require confirmation of the user’s identity.

Centralization

Traditional assets are issued and controlled by states. The regulator determines the conditions for working with fiat: the size of commissions, the possibility of conversion and others. Cryptocurrency in its majority does not have a controlling body. Users independently mine coins and spend them. The rate of assets depends on the demand for them and is volatile due to the lack of a regulator.

Inflation

The volume of issuance of bitcoin and other crypto coins is known in advance. Digital assets are issued in limited quantities just like real estate or stocks. Therefore, cryptocurrency investments can be used as methods to hedge against inflation risks. Analysts compare tokens to gold, the price of which increases over time. The issuance of paper money is not limited. Central banks regularly issue new bills. At the same time, the purchasing power of the currency falls.

Volatility

The cryptocurrency market is young and unstable. High volatility of coins attracts investors, but for beginners it can be disastrous. To make money from trading coins, you need special knowledge and skills that come with experience. For cryptocurrency, sharp rate hikes are normal. The price of a coin can fall and recover within one day. Traders should take into account the risks and exercise caution in transactions. Actions with digital assets involve a high probability of both loss and success. The volatility of tokens is also affected by external factors, uncertainty of future price, the probability of hacking, actions of large investors, positive and negative news. Fiat can be volatile due to periodic recessions and the regularity of the business cycle. Central banks balance the value of fiat bills by controlling the total money supply, interest rates, and liquidity.

Collateralization

Fiat currency and cryptocurrency are not backed by anything. Contrary to popular belief, national money is not backed by the gold reserves of nations or gross domestic product (GDP). But the fiat exchange rate depends on the actions of the government and its economic policies. Digital coins have no single issuer and no consumer protection. The only exceptions are stablecoins (Tether, DAI, TrueUSD), which are linked to fiat currency exchange rates. In 2021, Russia is still finalizing the legal framework for cryptoassets. However, it is already clear that lenders will lend against bitcoins. So far, digital coins are regarded as a “general purpose intangible asset”, but in the future circumstances may change this categorization.

Availability of tangible counterparts

Fiat can be withdrawn from an ATM or bank teller machine. In contrast, crypto has no physical manifestation. The value of a digital coin is determined by the information stored in it. For any data placed on electronic media, a certain number of bitcoins can be assigned, which with their help will receive identification.

Retrievability

If a bank customer makes a mistake in the details of the payee, the transaction can be canceled. This does not work with cryptocurrencies. Digital transactions are irreversible. They cannot be changed or canceled. If the transaction has been made and the money has been transferred, it will not be possible to return it.

Anonymity

When working with fiat money, it is impossible to maintain confidentiality. Even a simple purchase using a bank card is recorded in the database. In cash payments, the parties themselves are witnesses to the transaction. Anonymity is considered a strong point of digital currencies. This view is partly wrong. In 2021, the intelligence services of many states can track transactions and establish the identity of the payer.

Security

Fiat money and cryptocurrency have different degrees of protection. Fraudsters have long ago learned how to hack into the security systems of banks. Physical wallets can simply be stolen. Blockchain technology reduces the risk of hacking to 0.01%, but does not provide a hundred percent guarantee of asset protection. Customers’ money can be stolen from private e-wallets or exchanges.

Commissions

Confirming transactions in the blockchain requires some effort. The work of the network is supported by miners and validators, who receive payment in the form of a percentage of transaction amounts. The size of the commission depends on the workload of the blockchain. In some cases, the fees may exceed the cost of the transfer. Processing payments out of queue is charged additionally, so urgent transactions cost more. The banking system has fees for all types of transactions. For example, the fee for cash withdrawals from credit cards reaches 5% of the amount. The commission for money transfers is usually 1%. In the case of early repayment of the loan, additional interest is not charged.

Convenience

Paper money is a familiar means of payment. Fiat can be used to pay for purchases in cash, with the help of bank cards and electronic systems. But to open an account, you need to go to the bank, draw up documents, pay costs. It is more convenient to store assets in cryptocurrencies. To create a digital wallet, it is enough to go to the website and fill out the registration form. In Western countries, the number of objects where you can pay with coins is constantly growing. Bitcoin, Ethereum and other cryptocurrencies are accepted:

- Business centers.

- Stores of famous brands.

- Fast food restaurants.

- Car dealerships.

- Real estate agencies.

- Cabs.

In Russia, crypto coins cannot be used as a means of payment, but can be bought, sold, transferred, invested and bequeathed.

Popularity

Any state has national money. Banknotes are the main means of payment in the world. Even to pay with crypto coins for some goods, they need to be converted into fiat. However, more and more people realize the value of koins and want to use them for settlements. There is also a desire in the work of large companies to understand the new industry, determine how effective it is and apply it to business development.

Cryptocurrency vs. fiat currency

Major investors and entrepreneurs (Jack Dorsey, Steve Wozniak) express hope that in the next decade bitcoin will be recognized by the global community as a means of payment. Some analysts claim that the asset can replace national currencies. For example, Liu Yihua from the Taihe Institute is convinced that in the coming years there will be global changes in the financial sphere, which will allow society to abandon cash. However, for this to happen, the first cryptocurrency still has to solve many problems related to the speed of transactions, scaling and high volatility.

Advantages and disadvantages

In 2021, cryptocurrency cannot exist without fiat. Both means of payment complement each other. Large digital platforms are opening regular accounts to expand trading opportunities. For example, fiat on the cryptocurrency exchange Binance is represented by more than 50 monetary units, including the dollar, euro, ruble, pounds sterling, yen and others.

Fiat Currency

Paper money is predictable, has less volatility, and is used in the real economy. Other pros of banknotes include:

- Ease of storage and movement.

- Control by central banks.

- Ubiquitous use.

- Returnability of erroneous payments.

Minuses of fiat:

- Exposure to hacker attacks.

- Inflation.

- Lack of anonymity.

Unattached to tangible assets makes banknotes directly dependent on government regulation and fiscal policy. Irresponsible government actions lead to inflation and devaluation of national currencies.

Cryptocurrencies

Digital coins can be transferred from one wallet to another using only a smartphone or computer. Other pros of cryptocurrency:

- Decentralization.

- Transparency of transactions.

- Immunity to inflation.

Blockchain eliminates intermediation in transactions, so commissions for crypto transactions are much lower than bank commissions.

- Minuses of digital coins:

- High volatility.

- Risk of losing access to the wallet.

- Inability to cancel a transaction.

- Uncertain legal status.

Coin can lose value and become worthless if users switch to another type of digital asset.

Frequently Asked Questions

💵 On which exchanges can I deposit and withdraw money with fiat?

Such features are available on Binance, Huobi, Exmo and other major platforms.

❓ How are cryptocurrency transactions recorded?

The data is recorded on the blockchain. Confirmed transactions cannot be changed or excluded from the register.

❕ Where can I buy digital coins for rubles?

On exchanges, P2P platforms, in exchangers and cryptomats.

✅ What is the difference between “hot” and “cold” wallets?

The first requires a permanent connection to the Internet to work. In the second case, a standalone device is used.

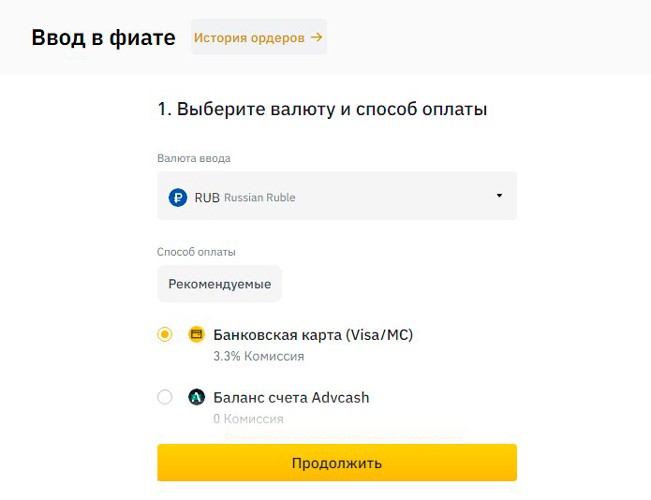

💰 How to deposit fiat on Binance?

Via bank cards and electronic payment systems.

Error in the text? Highlight it with your mouse and press Ctrl + Enter